Table of Contents

Overview

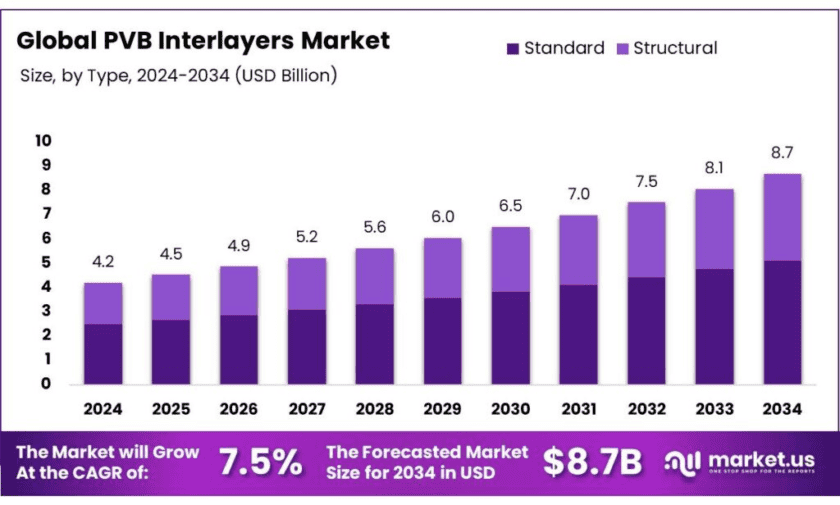

New York, NY – Oct 31, 2025 – The global Polyvinyl Butyral (PVB) Interlayers Market is projected to reach USD 8.7 billion by 2034, growing from USD 4.2 billion in 2024 at a CAGR of 7.5% between 2025 and 2034. In 2024, the Asia Pacific region dominated the market, capturing over 41.3% share, which corresponds to around USD 1.7 billion in revenue.

PVB interlayers are thin, transparent plastic films used to laminate glass, providing essential functions such as safety, security, sound insulation, UV protection, and impact resistance. Produced by blending PVB resin with plasticizers and additives, these films adhere strongly to glass and maintain flexibility and clarity. Their cost-effectiveness and superior performance make them the preferred choice for automotive windshields and architectural laminated glass in both residential and commercial applications.

The automotive industry continues to be the largest consumer of PVB interlayers, driven by the need for laminated safety glass in windshields and panoramic sunroofs. However, in recent years, demand has expanded significantly in the construction sector, where energy-efficient and aesthetic glass façades have gained popularity. Modern building projects increasingly use laminated glass for thermal insulation, noise reduction, and enhanced durability, boosting consumption of PVB films across Asia, Europe, and North America.

Additionally, as industries move toward sustainability and circular economy models, recycled PVB films are emerging as a new growth avenue. Companies are focusing on recovering interlayer films from end-of-life windshields to produce recycled-grade PVB, aligning with global green-building initiatives and regulatory pushes toward waste reduction. Despite these advantages, a key restraint is the hygroscopic nature of PVB—its tendency to absorb moisture—which can affect processing and bonding quality if not properly controlled.

Key Takeaways

- The global PVB interlayers market was valued at USD 4.2 billion in 2024.

- The global PVB interlayers market is projected to grow at a CAGR of 7.5% and is estimated to reach USD 8.7 billion by 2034.

- Based on the forms of PVB interlayers, sheets & rolls dominated the market in 2024, comprising about 74.6% share of the total global market.

- Based on the types of PVB interlayers, standard interlayers were at the forefront of the market in 2024, accounting for 58.9% share of the total global market.

- Among the end uses of PVB interlayers, the automotive & transportation dominated the market in 2024, accounting for around 52.3% of the market share.

- Asia Pacific was the largest market for PVB interlayers in 2024, accounting for around 41.3% of the total global consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/pvb-interlayers-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.2 Bn |

| Forecast Revenue (2034) | USD 8.7 Bn |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Form (Sheets & Rolls, Films, Others), By Type (Standard, Structural), By End-Use (Automotive & Transportation, Building & Construction, Consumer Electronics, Industrials, Others) |

| Competitive Landscape | Eastman Chemical Company, Everlam, Genau Manufacturing Company LLP (GMC LLP), Guangzhou Aojisi New Material, Huakai Plastic (Chongqing), Jinjing (Group), KB PVB, Kuraray, Saint-Gobain, Sekisui Chemical, Chang Chun Group, Other Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160978

Key Market Segments

Form Analysis: Sheets & Rolls PVB Interlayers Lead the Market with 74.6% Share in 2024

In 2024, sheets and rolls were the dominant form in the global PVB interlayers market, accounting for a 74.6% share. These formats are preferred over films because of their ease of handling, uniform thickness, and suitability for large-scale lamination in both automotive and architectural applications. Sheets and rolls provide precise control during the lamination of large glass panels, ensuring consistent adhesion and optical clarity. In contrast, PVB films require more careful handling to prevent wrinkles or uneven layering, which increases processing complexity.

Type Analysis: Standard PVB Interlayers Accounted for 58.9% Market Share in 2024

The standard PVB interlayer type dominated the global market in 2024 with a 58.9% share. These interlayers are more widely used than structural variants because they offer a cost-effective and reliable solution for providing impact resistance and safety, meeting essential performance needs in automotive and architectural glass applications. Standard grades adhere to baseline regulatory standards, making them suitable for mass-market use and high-volume production.

End-Use Analysis: Automotive & Transportation Segment Held 52.3% Share in 2024

The automotive and transportation sector emerged as the leading end-use segment in 2024, capturing a 52.3% share of the total PVB interlayers market. The dominance of this segment stems from the widespread use of laminated glass in vehicle windshields and windows to enhance passenger safety, visibility, and impact resistance. PVB interlayers absorb energy during collisions and prevent glass shattering, aligning with strict automotive safety regulations across major economies.

List of Segments

By Form

- Sheets & Rolls

- Films

- Others

By Type

- Standard

- Structural

- Acoustic

- Solar-Control

- Colored & Tinted

- UV-Resistant

- Others

By End-Use

- Automotive & Transportation

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Others

- Commercial Vehicles

- Light Duty

- Heavy Duty

- Others

- Passenger Cars

- Building & Construction

- Consumer Electronics

- Industrials

- Others

Regional Analysis

Asia Pacific Emerges as the Leading Market for PVB Interlayers

In 2024, the Asia Pacific region dominated the global PVB interlayers market, generating approximately USD 1.7 billion in revenue and accounting for an estimated 41.3% share of the total market. This leadership is supported by rapid urbanization, robust automotive manufacturing, and rising infrastructure investments across key economies such as China, India, Japan, and South Korea. The growing demand for laminated safety glass in both construction and automotive applications has positioned the region at the forefront of global consumption.

China, in particular, remains the world’s largest automobile producer, manufacturing over 30 million vehicles in 2023, most of which incorporate PVB-laminated windshields to comply with stringent safety regulations. Meanwhile, the region’s construction sector is undergoing a structural transformation, with major metropolitan areas witnessing a surge in high-rise buildings, smart cities, and sustainable infrastructure projects.

These developments have accelerated the adoption of energy-efficient and sound-insulated glazing solutions, where PVB interlayers are essential for enhancing durability, UV resistance, and impact protection. The synergy between the booming automotive sector and modern construction trends firmly establishes Asia Pacific as the largest and fastest-growing hub for PVB interlayers worldwide.

Top Use Cases

Automotive safety glazing (windshields, panoramic roofs): PVB-laminated glass is mandated or specified for windshields in major markets, anchoring steady demand. In the U.S., FMVSS 205 sets performance and marking requirements for automotive glazing used in specified locations (including windscreens). Europe’s UNECE R43 likewise governs laminated windscreen glazing. This regulatory backbone scales with production: global motor-vehicle output reached ~93–94 million units in 2023, and China alone produced ~30.16 million vehicles, the highest worldwide—each vehicle typically using a PVB-laminated windshield.

Architectural façades & acoustic/UV performance glazing: In buildings, PVB delivers impact safety plus comfort features. Acoustic PVB interlayers can lift sound reduction of a typical laminated lite to ~34–37 dB (vs. ~30–33 dB using thickness alone), improving indoor quietness without heavy glass. UV-screening PVB blocks ~99% of UV (conventional PVB up to 380 nm; specialty grades like Saflex UV up to 400 nm), helping protect interiors and exhibits. Building codes (e.g., IBC 2406) identify hazardous locations where safety glazing is required, a common role for laminated glass with PVB.

Hurricane/impact-resistant openings in high-wind zones: In cyclone-prone regions (e.g., Florida HVHZ), fenestration must pass large-missile and cyclic-pressure tests. A widely cited criterion is impact by a 9-lb (4.1 kg) 2×4 projectile at 50 ft/s, followed by ~9,000 pressure cycles—a regime where PVB interlayers help maintain glass integrity and post-break safe retention. These requirements flow from Miami-Dade TAS 201/202/203 and related ASTM tests, driving use of laminated PVB constructions in coastal projects.

Mobility comfort & EV refinement (quiet cabins, big glass): Automakers use acoustic PVB to lower interior sound levels, valuable for EVs where road/wind noise dominates. Tests on vehicles with S-LEC™ acoustic PVB show up to ~3 dB better sound pressure (≈3.7% articulation-index gain) versus standard laminated glass—perceived as a meaningful comfort upgrade—supporting adoption in windshields, sidelites, and panoramic roofs.

Circular economy: recycled PVB from end-of-life windshields: End-of-life regulations are pushing recovery of laminated glass and PVB. The EU ELV regime targets ≥85% reuse/recycling and ≥95% reuse/recovery by weight per vehicle, encouraging systems that extract and purify PVB for reuse. Industrial recyclers (e.g., Shark Solutions) already convert post-consumer windshields and architectural laminated glass into recycled PVB and derivatives, cutting landfill and claiming CO₂ savings as part of sustainability programs. Technical pathways for high-purity recycled PVB are documented in patents and studies, reinforcing a viable secondary feedstock for interlayers and other uses.

Recent Developments

Saint‑Gobain: In 2023, Saint-Gobain emphasised laminated glass solutions using polyvinyl butyral (PVB) interlayers such as the Saflex™ and Vanceva™ systems, offering improved safety, acoustic insulation and UV protection. While the company does not disclose PVB-specific volumes for 2023, its technical guide highlights that PVB interlayers are the “more commonly used” variant in laminated safety glass.

Sekisui Chemical Co., Ltd.: In July 2024 the company announced an investment of approx. ¥8 billion to expand its PVB interlayer film production line in Thailand, targeting capacity for an additional 7 million vehicle-equivalent glazing units per year. The expansion underscores Sekisui’s strength in its S-LEC™ PVB interlayer films, serving both automotive windshields and architectural laminated glass.

Genau Manufacturing Company LLP: Based in Sonipat, Haryana, India, Genau is the first domestic manufacturer of PVB interlayer films for laminated glass, catering to both automotive and architectural segments. According to their site, as of 2024, Unit 1 delivers approximately 182 tons/month of 0.76 mm PVB film while Unit 2 produces about 364 tons/month, reinforcing their capacity strength in the Indian market.

Guangzhou Aojisi New Material Co., Ltd.: Founded in 2002 in Guangzhou, China, Aojisi specialises in PVB interlayer films with product thicknesses ranging from 0.38 mm to 1.14 mm and maximum widths of 2.6 m, catering to laminated safety glass for architectural, automotive and specialised uses.

Huakai Plastic (Chongqing) Co., Ltd.: In 2023, Huakai Plastic emphasized its PVB interlayer film business, including a high-temperature PVB grade with heat resistance up to 140 °C, boosting its appeal for solar-module and laminated glass sectors. The firm’s film offerings range across colored and ultra-clear grades for architectural and automotive laminated glass, positioning it as a rising player in China’s PVB interlayer supply chain.

Jinjing Group Co., Ltd.: In 2023, Jinjing expanded its laminated glass portfolio featuring PVB interlayer films, supplying safety glazing solutions for automotive roofs, skylights and façades. Their product line emphasises structural performance, acoustic reduction and solar-control glazing, underpinned by strong film bonding and toughness—key in laminated glass using thin PVB interlayers.

KB PVB: For 2023 the company reported operational capacity of approximately 20,000 tons/year of PVB resin and about 20 million m²/year of PVB film across its seven production lines. KB PVB emphasises full-scale production of PVB interlayers for laminated safety glass and notes that its “3 plants and 7 lines” structure supports its film output.

Kuraray Co., Ltd.: In the fiscal year ending March 2024, Kuraray reaffirmed its PVB resin and film business as part of its “Resins & Films” segment and cited capacity expansion in Germany increasing PVB resin annual output to 39,000 tons after a 10,000-ton uplift. The company highlights that its PVB interlayers are used for automotive windshields and architectural laminated glass, placing emphasis on high-clarity and durability credentials.

Conclusion

In conclusion, the global market for Polyvinyl Butyral (PVB) interlayers is on a strong growth path, supported by rising demand in automotive safety glazing and architectural laminated glass. Key growth drivers include stricter safety and glazing regulations worldwide and increased use of laminated glass in buildings and vehicles. Going forward, companies that focus on high-performance, lower-thickness, sustainable PVB products will be best positioned to capture the value in this evolving market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)