Table of Contents

Overview

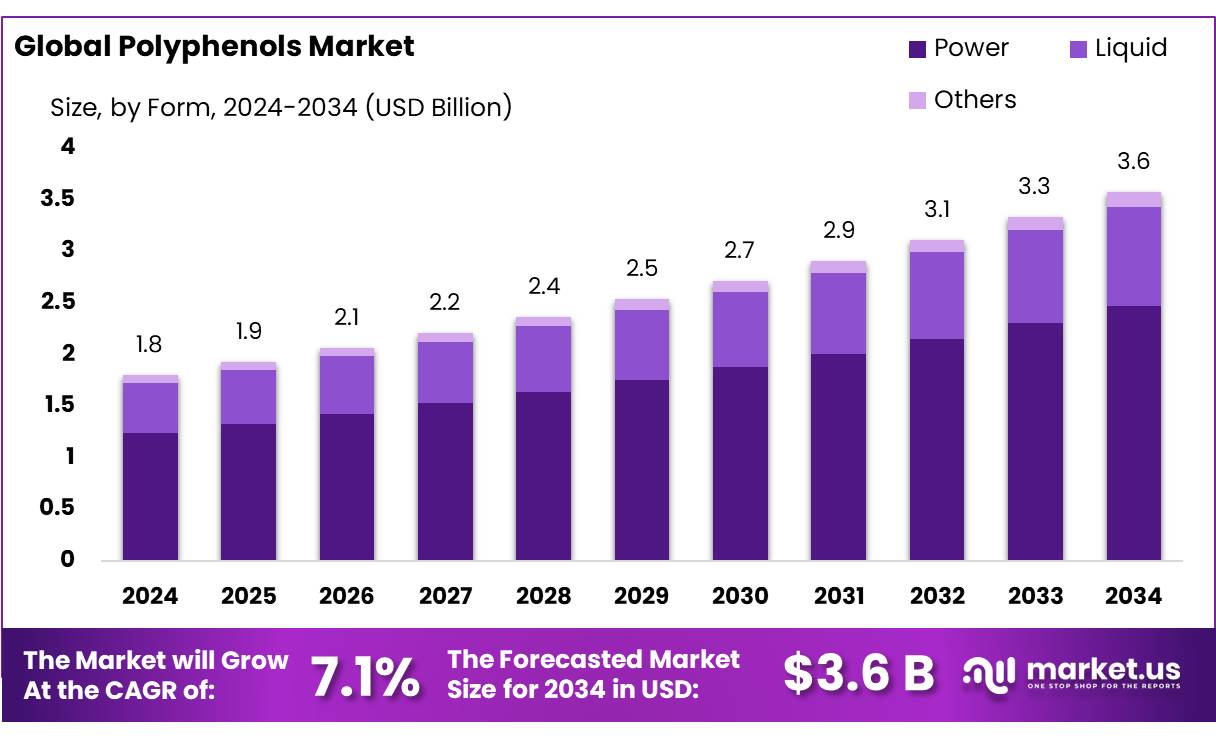

New York, NY – August 01, 2025 – The Global Polyphenols Market is projected to grow from USD 1.8 billion in 2024 to USD 3.6 billion by 2034, achieving a CAGR of 7.1% during the 2025–2034 forecast period. In 2024, the Asia-Pacific (APAC) region led the market, accounting for a 42.8% share and generating USD 0.7 billion in revenue.

Polyphenol concentrates, highly purified plant-derived compounds, are increasingly vital in functional foods, nutraceuticals, beverages, and cosmetics. These antioxidant-rich extracts, including flavonoids, tannins, phenolic acids, lignans, and stilbenes, are designed for enhanced bioavailability and efficacy. Their agricultural sources, such as grape seeds, green tea, berries, and citrus, emphasize the importance of traceable and sustainable sourcing.

The Global production of industrial-grade polyphenols reached approximately 16,380 tons. By the end of 2024, production is expected to double to 33,880 tons, with a market value of USD 1.33 billion. In the U.S. and Europe, functional beverages account for 44% of industrial use, followed by functional foods at 33%. In India, the Ministry of Food Processing Projects forecasts the food processing sector to reach USD 535 billion, driving polyphenol extraction and application.

The USDA’s 2018 flavonoid database, cataloging polyphenol content in over 500 foods, notes high concentrations like 11.95 mg/100 g of eryodictyol (hesperetin) in orange juice. The USDA’s ORAC research further highlights spinach and blueberries as top natural antioxidant sources, supporting formulation, compliance, and substantiation in functional food and supplement markets.

In Europe, the European Food Safety Authority (EFSA) mandates 5 mg hydroxytyrosol per 20 g of olive oil for approved blood lipid protection claims. EU-funded research into advanced extraction methods, such as enzymatic hydrolysis and supercritical CO2, enhances yield and purity. In the U.S., the FDA’s updated “healthy” nutrient-content labeling rules, aligned with Department of Health and Human Services standards and set for implementation, will facilitate market access for polyphenol-fortified foods and supplements.

Key Takeaways

- The Global Polyphenols Market is expected to grow from USD 1.8 billion in 2024 to USD 3.6 billion by 2034, with a steady 7.1% CAGR.

- Powder held a dominant market position, capturing more than a 58.3% share in the global polyphenols market by form.

- Fruits held a dominant market position, capturing more than a 62.4% share in the global polyphenols market.

- Functional Foods held a dominant market position, capturing more than a 38.2% share in the global polyphenols market.

- Asia-Pacific (APAC) emerged as the dominant region in the global polyphenols market, capturing approximately 42.8% of the total market share, with an estimated market value of USD 0.7 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-polyphenols-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.8 Billion |

| Forecast Revenue (2034) | USD 3.6 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Form (Liquid, Powder, Others), By Source (Fruits, Vegetables, Cocoa, Others), By Application (Functional Foods, Beverages, Dietary Supplements, Animal Feed, Cosmetics and Personal Care, Others) |

| Competitive Landscape | Ajinomoto Co. Inc., Archer Daniels Midland (ADM), Barry Callebaut, Biolink Group (Polyphenols AS), Botaniex, Inc., Cargill, Incorporated, Diana Foods, DSM-Firmenich, GRAP’SUD, HERZA Schokolade GmbH and Co. KG, Indena S.p.A., International Flavors and Fragrances, Kemin Industries, Inc., Lallemand, Layn Natural Ingredients, SGS SA (NutraSource, Inc), Vidya Pvt. Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152735

Key Market Segments

By Form Analysis

In 2024, the powder form dominated the global polyphenols market, accounting for 58.3% of the market share. Its popularity stems from its extended shelf life, ease of storage, and versatility across industries like dietary supplements, functional foods, beverages, and cosmetics. Powdered polyphenols offer manufacturers flexibility in formulation, enabling seamless integration with other ingredients.

In 2025, demand for powder-based polyphenol concentrates grew further, fueled by the shift toward natural, plant-based ingredients. Their ability to retain bioactive compounds during processing, combined with antioxidant and anti-inflammatory properties, makes them ideal for clean-label, health-focused products, driving global consumer demand.

By Source Analysis

Fruits held a commanding 62.4% share of the global polyphenols market by source in 2024, driven by their naturally high polyphenol content in grapes, apples, berries, and citrus. Consumer trust in fruit-based sources for purity and nutritional value has boosted their use in dietary supplements, functional beverages, and health foods.

In 2025, fruit-derived polyphenols maintained strong demand, supported by the rise in plant-based nutrition and clean-label trends. Grape seed and apple skin extracts, by-products of food production, are cost-effective and sustainable, enhancing their appeal in the food and beverage industry for antioxidant benefits and shelf-life extension.

By Application Analysis

Functional foods led the global polyphenols market by application in 2024, capturing a 38.2% share. Growing consumer demand for health-enhanced foods, beyond basic nutrition, drives this segment. Polyphenols, known for their antioxidant, anti-inflammatory, and immune-supporting properties, are widely used in fortified cereals, dairy alternatives, snacks, and bakery products.

By 2025, polyphenol use in functional foods continued to expand, propelled by heightened awareness of preventive health and lifestyle-related conditions. Consumers seeking natural solutions for heart health, digestion, and energy have spurred manufacturers to incorporate fruit- and plant-based polyphenol extracts, aligning with the clean-label movement.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region dominated the global polyphenols market, holding a 42.8% share with a market value of USD 0.7 billion. This leadership is driven by robust demand for functional foods, widespread use of traditional herbal medicine, and a strong nutraceutical and cosmetic manufacturing base in countries like China, Japan, India, and South Korea.

Polyphenols from green tea, grapes, and medicinal plants are prevalent in beverages, supplements, and skincare. Key growth factors include rising health awareness and dietary shifts toward plant-based antioxidants. In China, the China Food and Drug Administration (CFDA) reported a 16% surge in demand for functional food ingredients like polyphenols in 2023, particularly in urban areas.

Japan’s Ministry of Health noted increased imports of polyphenol-rich cocoa and berries for cognitive and cardiovascular health products. In India, the Ayush Ministry’s support for polyphenol-enriched herbal formulations, alongside large-scale production of green tea and turmeric, bolsters domestic and export markets. With investments in food technology, government-backed R&D, and clean-label trends, APAC is poised to sustain its market dominance.

Top Use Cases

- Functional Foods: Polyphenols are added to foods like cereals and snacks to boost health benefits. Their antioxidant properties help fight diseases, making them popular in products targeting heart health and immunity, appealing to health-conscious consumers seeking natural ingredients.

- Dietary Supplements: Polyphenols are used in capsules and powders to support overall wellness. They help reduce inflammation and improve heart health, attracting people who want easy ways to include antioxidants in their daily routines.

- Beverages: Polyphenols enhance drinks like teas and juices with health benefits. They improve gut health and provide antioxidants, making functional beverages popular among consumers looking for tasty, health-boosting options.

- Cosmetics: Polyphenols are used in skincare products for their anti-aging properties. They protect skin from damage and reduce wrinkles, appealing to consumers who prefer natural ingredients in creams and serums.

- Pharmaceuticals: Polyphenols are explored in medicines to prevent diseases like diabetes and cancer. Their anti-inflammatory effects support drug development, targeting patients seeking natural treatment options.

Recent Developments

1. Ajinomoto Co. Inc.

- Ajinomoto has been researching polyphenols for their health benefits, particularly in functional foods and supplements. Their recent focus includes developing polyphenol-rich ingredients derived from fermented sources to enhance antioxidant properties. They are collaborating with research institutions to explore polyphenols’ role in metabolic health.

2. Archer Daniels Midland (ADM)

- ADM has expanded its polyphenol portfolio with new plant-based extracts, including those from berries and tea, for use in nutraceuticals and beverages. Their recent innovation includes a water-soluble polyphenol formulation for better bioavailability in functional drinks.

3. Barry Callebaut

- Barry Callebaut has been leveraging cocoa polyphenols for their heart health benefits. Their recent “Acticoa” cocoa powder retains high polyphenol levels due to a proprietary processing method. They are also researching polyphenol-rich chocolate for cognitive health applications.

4. Biolink Group (Polyphenols AS)

- Biolink Group specializes in high-purity polyphenol extracts, particularly from apples and grapes. Their recent development includes a patented extraction technology to enhance polyphenol yield for pharmaceutical and nutraceutical applications. They are also studying polyphenols for anti-inflammatory effects.

5. Botaniex, Inc.

- Botaniex focuses on sustainable polyphenol extraction from botanicals like pomegranate and olive. Their recent advancement includes a novel CO₂ extraction method for higher polyphenol purity, targeting the supplement and cosmetic industries. They also emphasize organic and non-GMO sourcing.

Conclusion

Polyphenols are gaining traction in multiple industries due to their health-boosting properties. From functional foods and supplements to cosmetics and pharmaceuticals, their antioxidant and anti-inflammatory benefits meet growing consumer demand for natural, wellness-focused products. As awareness of their versatility rises, the polyphenol market is poised for strong growth, driven by innovation and health-conscious trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)