Table of Contents

Overview

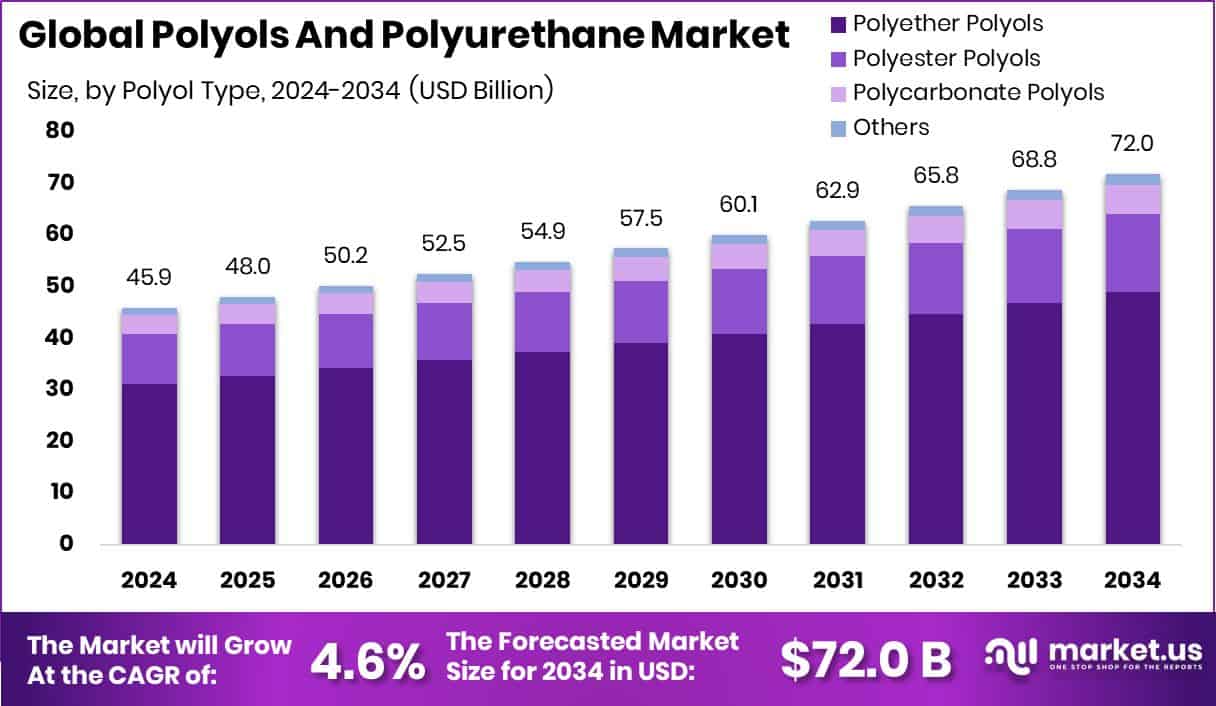

New York, NY – Aug 07, 2025 – The global polyols and polyurethane market is projected to reach approximately USD 72.0 billion by 2034, rising from USD 45.9 billion in 2024, at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2034. North America significantly contributed to this growth with a valuation of USD 19.5 billion, largely driven by the strong demand for insulation and foam products. Polyols, which are organic compounds with multiple hydroxyl groups, serve as critical components in the production of polyurethane. These are generally sourced from petroleum based or renewable materials and are available in two major types: polyether and polyester polyols. Polyurethane is synthesized by reacting polyols with diisocyanates and is available in a variety of forms such as rigid and flexible foams, coatings, adhesives, and elastomers.

The market for polyols and polyurethane is broad, spanning the production, trade, and application of these materials across multiple industries. Major areas of application include construction, automotive, and consumer goods, where polyurethane enhances insulation, reduces product weight, and improves durability. The market ecosystem comprises raw material suppliers, manufacturers, processors, and end users. A key growth factor is the increasing adoption of polyurethane based insulation, especially rigid foams, in residential and commercial construction, fueled by tightening energy efficiency regulations.

In addition to construction, the automotive sector has emerged as a major consumer of polyurethane due to its lightweight and resilient properties, which align with the industry’s goals for fuel efficiency and electric vehicle performance. The rise in urbanization and growing consumer spending on long lasting goods such as mattresses, furniture, and footwear have also boosted market demand. Moreover, the shift toward electric vehicles and the emphasis on lightweight materials for better performance and energy efficiency have led to greater use of polyurethane in automotive interiors, seating, and trim applications.

Key Takeaways

- The global polyols and polyurethane market is projected to grow from USD 45.9 billion in 2024 to approximately USD 72.0 billion by 2034, registering a CAGR of 4.6% during the forecast period (2025–2034).

- Within this market, polyether polyols dominated with a 68.1% share, highlighting their widespread use in polyurethane production.

- Polyurethane Foam (PUF) led among product types, accounting for a substantial 71.2% of the total market.

- Flexible foam applications made up 38.9% of global polyurethane usage, emphasizing their significance in various end-use sectors.

- The construction sector emerged as the top end user, contributing 34.7% to the overall market demand for polyols and polyurethane.

- North America stood out as a key regional market, with a valuation reaching approximately USD 19.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/polyols-and-polyurethane-market/free-sample/

Report Scope

| Market Value (2024) | USD 45.9 Billion |

| Forecast Revenue (2034) | USD 72.0 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Polyol Type (Polyether Polyols, Polyester Polyols, Polycarbonate Polyols, Others), By Polyurethane Type (TPU (Thermoplastic Polyurethane), PUR (Polyurethane Resin), PUF (Polyurethane Foam), Others), By Application (Flexible Foam, Rigid Foam, Coating and Adhesives, Elastomers, Others), By End-Use (Construction, Automotive, Furniture, Appliances, Packaging, Others) |

| Competitive Landscape | Mitsubishi Chemical, Dow, Evonik, LyondellBasell, Huntsman, Mitsui Chemicals, Covestro, INEOS, Toray Industries, BASF, Momentive Performance Materials, DIC Corporation, Wanhua Chemical, Sumitomo Chemical |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153338

Key Market Segments

1. By Polyol Type Analysis

- In 2024, polyether polyols led the polyol type segment, capturing a dominant 68.1% market share in the global polyols and polyurethane market. This strong position stems from their extensive use in producing flexible foams, which are widely applied in furniture, bedding, automotive seating, and packaging. Their popularity is further supported by key benefits such as superior hydrolytic stability, low volatility, and cost effective processing. Polyether polyols are preferred by manufacturers due to their ease of use, broad compatibility with various isocyanates, and adaptability for both rigid and flexible formulations. Their resilience, durability, and resistance to moisture have positioned them as an essential ingredient across a range of consumer and industrial applications.

2. By Polyurethane Type Analysis

- Polyurethane Foam (PUF) was the leading product type in the polyurethane segment in 2024, holding a strong 71.2% market share. Its dominance is attributed to its broad applicability across industries such as construction, automotive, furniture, and consumer goods, where its lightweight nature, thermal insulation, and cushioning properties offer significant advantages. PUF’s flexibility to be used in both rigid and flexible forms makes it highly adaptable to diverse application needs. In the construction industry, it plays a critical role in thermal insulation, while in furniture and bedding, it enhances comfort and longevity.

3. By Application Analysis

- Flexible foam emerged as the leading application area within the polyols and polyurethane market in 2024, accounting for 38.9% of the total share. This segment is primarily driven by its extensive use in products focused on comfort, such as mattresses, sofas, cushions, and car seats, where softness, resilience, and durability are essential. The high share also mirrors a global increase in consumer demand for ergonomic and long lasting home and automotive furnishings. Flexible foam’s ability to absorb impact and its lightweight nature make it ideal for packaging and interior vehicle parts, enhancing safety and usability.

4. By End-Use Analysis

- In 2024, the construction industry led the end use segment of the polyols and polyurethane market with a 34.7% share. This leadership is driven by the increasing integration of polyurethane materials into construction solutions, especially for thermal insulation, coatings, adhesives, and sealants, which are essential for modern, energy efficient buildings. The growth of this segment is supported by rising infrastructure development and urbanization in both emerging and developed regions. As global building codes emphasize energy conservation, polyurethane based materials have gained prominence for their performance in reducing energy costs and enhancing building comfort.

Regional Analysis

- In 2024, North America emerged as the leading region in the global polyols and polyurethane market, accounting for 42.7% of the total market share, with a valuation of USD 19.5 billion. This strong performance is largely driven by the widespread use of polyurethane products in construction, automotive, and consumer goods sectors. The region’s focus on infrastructure development and adherence to strict energy efficiency standards has significantly boosted the demand for polyurethane based insulation materials, especially in the United States and Canada.

- Europe maintained consistent market growth, supported by a growing emphasis on sustainability and eco friendly manufacturing practices. The region’s push for energy efficient buildings and the development of lightweight automotive components has fostered steady demand for polyurethane materials. In Asia Pacific, rapid industrialization and ongoing urban development particularly in China and India have led to increased consumption of polyurethane in sectors like construction, furniture, and transportation.

- Other regions also showed encouraging signs of growth. The Middle East and Africa presented emerging opportunities, particularly due to rising construction activity and the need for effective insulation solutions in hot climates. Latin America experienced gradual market expansion, with growing polyurethane applications in packaging, footwear, and household goods. While regional trends vary, North America continues to lead in global revenue contribution, driven by its mature industrial base, regulatory alignment, and strong demand across multiple sectors.

Top Use Cases

- Flexible Seating & Bedding: Flexible polyurethane foam (PUF) cushions mattresses, sofas, automotive seats, and pillows. It delivers comfort through elasticity, shock absorption and durability. Polyether polyols enable resilient cushioning and lightweight structures. This use case thrives on rising consumer demand for ergonomic, long lasting products in furniture, bedding and automotive interiors.

- Thermal & Acoustic Insulation: Rigid polyurethane foam is widely used in building insulation, refrigerator panels, HVAC ductwork and sound absorption systems. It provides excellent thermal resistance and moisture sealing, helping achieve energy efficiency standards. Polyols and isocyanates combine to create durable, closed cell structures ideal for commercial, residential, and industrial insulation applications.

- Automotive Interiors & Lightweight Components: Polyurethane materials are used in dashboards, door trims, seating, headliners and vibration dampers. Polyether polyols support lightweight, fuel‑efficient designs that enhance passenger comfort and reduce vehicle weight. Their sound‑dampening and durability features make them essential for automotive OEMs focused on performance, safety and sustainability trends.

- Coatings, Adhesives, Sealants & Elastomers (CASE): Polyols enable a broad range of specialty polyurethane products including durable coatings, glue like adhesives, airtight sealants, and flexible elastomer parts. These materials offer chemical resistance, weatherability, flexibility and mechanical strength. They serve industries from electronics and construction to footwear and industrial equipment.

- Protective Packaging & Sports Gear Applications: Polyurethane foams cushion sensitive items during shipping and form protective layers in sports equipment. Their shock‑absorbing, moldable and lightweight nature helps protect electronics, athletic padding, and footwear. Polyols enable tailored foam densities for customized resilience and protection in packaging and gear manufacturing.

Recent Developments

1. Mitsubishi Chemical

- Mitsubishi Chemical Group (MCG) recently introduced two sustainability driven innovations: first, its plant based polyol BioPTMG, now used in bio‑synthetic leather products (e.g. bags and small items) by Kahei Co. and sold via the “tonto” brand starting October 2024. Bio PTMG boasts biomass content and performance comparable to petroleum derived PTMG. Second, in October 2024, MCG launched new high‑biomass grades (80%+) of its BENEBiOL polycarbonate diols, offering stain resistance, flexibility, and quality for polyurethane resins in coatings and synthetic leathers.

2. Dow

- Dow has advanced both sustainability initiatives and capacity rationalization in its polyols business. In December 2024, it began manufacturing VORANOL WK5750, a next gen polyether polyol at its Freeport plant designed for hypersoft flexible foams in mattresses and furniture. Earlier, Dow announced it would shut down its San Lorenzo, Argentina polyether polyol plant in October 2024 due to global oversupply and low utilization. Furthermore, Dow is undertaking a strategic review of its European polyurethane assets including MDI and polyol units with an eye toward potential divestment, expected to complete in 2025.

3. Evonik

- Evonik continues to push sustainable innovations in polyurethanes. At PU China 2024, it unveiled TEGOSTAB surfactants based on renewable feedstocks and ISCC PLUS supply chains, and its TEGO RISE software, helping reduce scrap and improve foam quality by simulating production parameters. In April 2024, at UTECH Europe, Evonik further showcased renewable based additive solutions and announced that its global amines platform now runs on green electricity. In May 2025, it announced that all remaining PU additive production would shift to renewable electricity, and also introduced a bio‑based VERSALINK resin grade with renewable carbon for durable PU components.

Conclusion

The global polyols and polyurethane market is experiencing steady growth, driven by expanding applications across construction, automotive, furniture, and consumer goods industries. With demand expected to reach USD 72.0 billion by 2034, sustainability and innovation remain key growth enablers. Companies like Mitsubishi Chemical and Evonik are investing in bio-based polyols and green energy solutions, while Dow is pushing recycling technologies and high-performance materials. Polyurethane’s adaptability through flexible foams, rigid insulation, and specialty elastomers ensures it remains crucial for lightweight, energy efficient, and durable products. As regulatory standards tighten and environmental awareness rises, the market is moving swiftly toward renewable feedstocks and circular manufacturing models.