Table of Contents

Overview

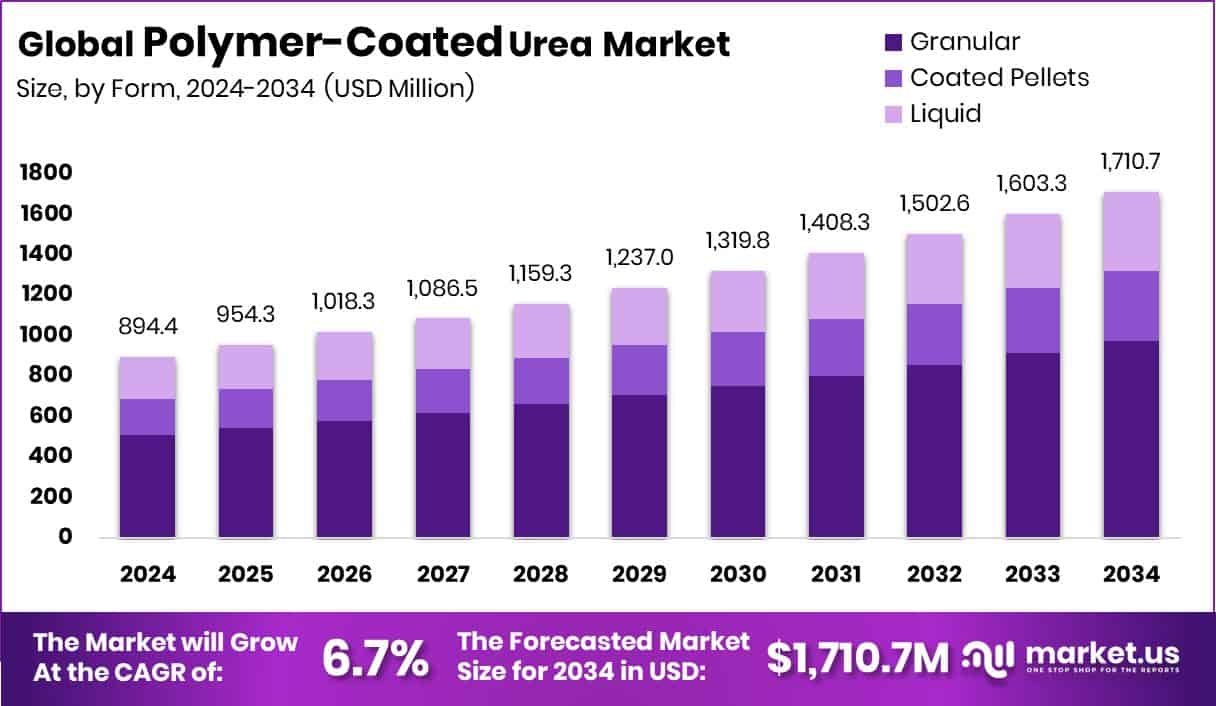

New York, NY – Nov 03, 2025 – The global Polymer-Coated Urea (PCU) market is projected to reach USD 1,710.7 million by 2034, growing from USD 894.4 million in 2024 at a 6.7% CAGR (2025–2034). North America leads with a 46.8% share, valued at USD 418.3 million.

PCU, a slow-release fertilizer with a polymer layer controlling nitrogen release, enhances soil nutrient efficiency and reduces leaching and volatilization losses. The market’s expansion is driven by the push for sustainable agriculture and efficient fertilizers amid population growth expected to exceed 9 billion by 2050. PCU aligns with precision farming goals by improving nitrogen use efficiency and lowering environmental impacts. Governments and industries are backing innovations to reduce fertilizer-related emissions.

Notably, USD 1.3 million has been allocated toward improving urea production and cutting CO₂ emissions, fostering sustainable fertilizer technologies. Additionally, Perdaman’s USD 6 billion Pilbara Urea Project, now under construction, is set to become one of the largest global urea production facilities. These initiatives illustrate how ongoing funding, industrial investments, and sustainability policies are reinforcing the long-term growth potential of the polymer-coated urea market, positioning it as a cornerstone of modern eco-efficient farming practices.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-polymer-coated-urea-market/request-sample/

Key Takeaways

- The Global Polymer-Coated Urea Market is expected to be worth around USD 1,710.7 million by 2034, up from USD 894.4 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Polymer-Coated Urea Market, the granular form leads with 57.1% preference among users.

- By type, slow-release polymer-coated urea secures 45.8%, highlighting efficiency in controlled nutrient delivery.

- Agriculture dominates applications of polymer-coated urea, holding a 56.9% share due to rising crop demands.

- Crop production remains the largest end-use sector, accounting for 62.3% of the polymer-coated urea market.

- The Polymer-Coated Urea Market in North America accounted for USD 418.3 Mn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159634

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 894.4 Million |

| Forecast Revenue (2034) | USD 1,710.7 Million |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Form (Granular, Coated Pellets, Liquid), By Type (Slow Release, Controlled Release, Water Soluble, Immediate Release), By Application (Agriculture, Horticulture, Fertilizer, Others), By End Use (Crop Production, Landscaping, Turf Management, Others) |

| Competitive Landscape | Agrium, BASF SE, COMPO EXPERT GmbH, Haifa Group, BASF, AdvanSix, Yara International, Arkema, Nufarm, Nutrien, ICL Group, Mosaic Company |

Key Market Segments

By Form Analysis

In 2024, the granular form dominated the By Form segment of the Polymer-Coated Urea Market, holding a 57.1% share. Its widespread use is attributed to easy application, stable storage, and compatibility with diverse crops and soil types. Farmers increasingly favor granular polymer-coated urea for its uniform field distribution and controlled nitrogen release, which enhances crop yield while minimizing nutrient losses.

This form’s practicality makes it especially suitable for large-scale agricultural operations, promoting efficient and sustainable fertilizer management. The granular segment’s strong position underscores its critical role in improving nitrogen efficiency and driving the overall structure of the polymer-coated urea market.

By Type Analysis

In 2024, the Slow Release type dominated the By Type segment of the Polymer-Coated Urea Market, capturing a 45.8% share. This dominance stems from the growing shift toward slow-release fertilizers that provide a consistent nitrogen supply while minimizing nutrient losses. Their controlled release mechanism helps reduce application frequency, lowering labor and operational costs for farmers.

Additionally, these fertilizers promote sustainable agriculture by mitigating leaching and greenhouse gas emissions. The segment’s strong share highlights the market’s increasing focus on efficiency and resource optimization, especially in regions prioritizing higher productivity with environmental responsibility.

As a result, slow-release formulations have become a standard for reliable and effective fertilizer performance, reinforcing their pivotal role in modern, eco-friendly farming practices.

By Application Analysis

In 2024, the Agriculture segment led the Polymer-Coated Urea Market by Application, commanding a 56.9% share. This leadership underscores the essential role of polymer-coated urea in improving crop yields and optimizing nutrient efficiency in modern farming. Through slow and controlled nitrogen release, it enhances productivity, minimizes fertilizer losses, and supports long-term soil health. The segment’s strong share reflects the growing adoption of sustainable and cost-effective fertilizer solutions among farmers.

By balancing high performance with environmental responsibility, agriculture remains the largest consumer of polymer-coated urea, demonstrating its importance in advancing sustainable nutrient management and shaping the overall market structure.

By End Use Analysis

In 2024, the Crop Production segment dominated the By End Use category of the Polymer-Coated Urea Market, securing a 62.3% share. This strong position reflects the increasing dependence of crop producers on polymer-coated urea to enhance yield efficiency and improve nitrogen utilization. The fertilizer’s controlled-release properties ensure a steady nutrient supply throughout crop growth cycles, making it ideal for large-scale farming operations.

By reducing nutrient loss and improving soil performance, it supports both economic efficiency and environmental sustainability. The segment’s dominance highlights polymer-coated urea’s crucial role in advancing precision agriculture and sustaining high crop productivity, reinforcing its status as a key input in global crop management practices.

Regional Analysis

In 2024, North America dominated the Polymer-Coated Urea Market, holding a 46.8% share valued at USD 418.3 million. This leadership stems from advanced farming systems, high adoption of sustainable fertilizers, and greater awareness of controlled-release technologies.

Europe maintained steady growth, supported by environmental regulations and efforts to cut nitrogen losses. The Asia Pacific region shows immense potential, driven by its large agricultural base and rising food demand.

In contrast, the Middle East & Africa are gradually adopting polymer-coated urea to boost crop yields in arid conditions, while Latin America benefits from extensive crop production, particularly in major farming nations. Together, these regions form a dynamic global landscape; however, North America’s dominance reflects its market maturity and investment strength, setting the pace for global fertilizer innovation and regional expansion.

Top Use Cases

- Improving nitrogen use efficiency in wheat: When PCU was used in wheat as a twice-split application combined with regular urea, the nitrogen use efficiency (NUE) increased by about 16.95% on average while reducing nitrogen input by ~20%, without sacrificing yield.

- Enhancing maize yield with biodegradable coated urea: In a maize pot experiment with biodegradable polymer coatings, yields increased by 26.7% to 33.5% compared to uncoated urea.

- Reducing greenhouse-gas-nitrogen losses in turfgrass: In turfgrass trials, PCU cut ammonia (NH₃) emissions by 41-49% and nitrous-oxide (N₂O) emissions by 45-73% compared with normal urea.

- Controlling nitrogen release in different soils: A study found that PCU, when band-applied (placed in a narrow zone) at 150 kg N/ha, released nitrogen more steadily than standard urea, though soil type mattered.

- Matching crop nitrogen demand in rice: Using PCU as a single basal application in rice improved recovery of ¹⁵N tracer and reduced nitrogen loss via ammonia volatilization, compared to traditional urea splits.

- Tailoring release periods for vegetable crops (tomatoes): In tomato production, different thicknesses of polymer coating on urea (short vs. long release) were tested to align nutrient release with crop needs, improving efficiency in sandy soils.

Recent Developments

- In June 2025, BASF collaborated with Yunnan Yuntianhua Agricultural Material Chain Co., Ltd. to successfully verify and register a product called Limus, which is described as an innovative solution that “reduces urea application rate, improves efficiency and crop yield while significantly decreasing nitrogen loss to the environment.”

- In February 2025, Haifa Group opened a new blending facility in Uberlândia, Minas Gerais, Brazil, specifically for its Multicote controlled-release fertilizer products. The facility is capable of producing “dozens of tons” daily, tailoring Multicote formulations to local soil and crop needs for Brazil’s large agricultural market.

- In September 2024, AdvanSix was awarded a United States Department of Agriculture (USDA) grant to expand granular ammonium sulfate production by approximately 200,000 tons.

Conclusion

The Polymer-Coated Urea market is steadily evolving as agriculture moves toward more sustainable and efficient nutrient management solutions. Its ability to release nitrogen slowly aligns with global efforts to reduce fertilizer waste and environmental impact. Farmers are increasingly adopting these fertilizers to enhance productivity and soil health while minimizing pollution.

Continued innovation in coating materials and eco-friendly formulations is expanding its use across diverse crops and climates. With growing support from governments and industries promoting responsible farming practices, polymer-coated urea is becoming a key component in modern precision agriculture, supporting both higher yields and long-term environmental sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)