Table of Contents

Overview

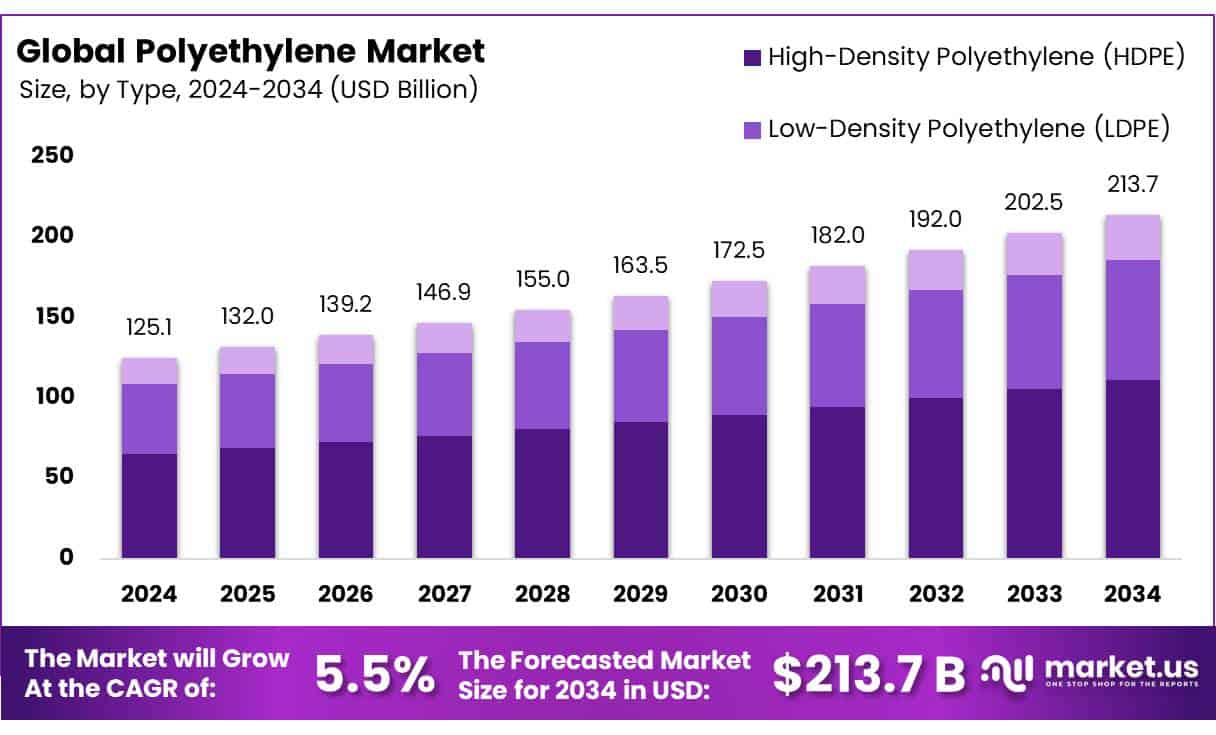

New York, NY – May 09, 2025 – The global Polyethylene Market is set for steady growth, driven by rising demand across packaging, construction, and consumer goods. In 2024, the market was valued at USD 125.1 billion and is projected to reach USD 213.7 billion by 2034, expanding at a 5.5% CAGR.

High-Density Polyethylene (HDPE) commanded a 52.4% share of the polyethylene market in 2024, driven by its extensive use in packaging, construction, and consumer goods. Virgin polyethylene dominated the market in 2024 with an 83.3% share, favored for its superior quality and consistency in demanding applications like food packaging, medical products, and automotive parts.

Extrusion molding led polyethylene processing methods in 2024, holding a 38.4% share. Its efficiency in producing pipes, films, and sheets for packaging, construction, and agriculture drives its prominence. The packaging sector led polyethylene end-use in 2024 with a 44.3% share, driven by the material’s versatility in producing food wraps, shopping bags, rigid containers, and industrial packaging.

US Tariff Impact on Polyethylene Market

North American polyethylene and polypropylene market players are preparing for shifts in trade flows in response to US President Trump’s proposed 25% tariffs on non-energy Canadian imports. US tariffs on Canadian imports, if applied specifically to the resin, would impact flows for about 17% of the PE produced between the two countries.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/polyethylene-market/request-sample/

The US and Canada combined have a total of 30.206 million mt/year of PE capacity, 4.77 million mt/year of which is in Canada; Celanese, Dow Chemical, ExxonMobil, and Nova Chemicals have Canadian production sites. Canada is also home to North America’s only integrated PP producer. Inter Pipeline’s Heartland Petrochemical Complex has 525,000 mt/year of PP production and a propane dehydrogenation unit with a capacity of 535,000 mt/year

Key Takeaways

- The Global Polyethylene Market is projected to grow from USD 125.1 billion in 2024 to USD 213.7 billion by 2034, at a CAGR of 5.5%.

- High-Density Polyethylene (HDPE) dominates with a 52.4% market share, driven by its use in packaging, construction, and consumer goods.

- Extrusion molding leads processing methods with a 38.4% share, favored for producing pipes, films, and sheets.

- The Packaging Industry holds a 44.3% share of polyethylene demand, valued for its versatility and cost-effectiveness.

- The Asia-Pacific region commands a 54.3% market share, worth USD 67.9 billion in 2024, fueled by industrialization and urbanization.

Analyst Viewpoint

The global polyethylene market, crucial to the plastics sector, offers a complex mix of investment opportunities and risks, driven by shifting consumer preferences, technological advancements, and stricter regulations. Investors can capitalize on growth in bio-based polyethylene, fueled by demand for sustainable packaging, as consumers increasingly favor eco-friendly options.

Innovations like metallocene catalysts enhance LLDPE performance, creating high-margin opportunities, especially in Asia-Pacific, which commands 54% of the market. However, volatile crude oil prices, a primary feedstock, threaten profitability due to price swings. Plastic waste reduction goals push recycling efforts, potentially increasing compliance costs.

Regulations, such as the EU’s single-use plastic ban, spur innovation, while emerging markets in Africa and Latin America offer growth potential despite looser regulations and infrastructure challenges. Investors must navigate these factors, weighing high-growth prospects against regulatory and raw material risks.

Report Scope

| Market Value (2024) | USD 125.1 Billion |

| Forecast Revenue (2034) | USD 213.7 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE)), By Source (Virgin, Recycled), By Processing Method (Extrusion Molding, Injection Molding, Blow Molding, Rotational Molding, Calendering, Others), By End-Use (Packaging, Automotive, Building and Construction, Consumer Goods, Healthcare, Electrical and Electronics, Agriculture, Others) |

| Competitive Landscape | LyondellBasell Industries Holdings B.V., Covestro AG, SABIC, Dow, Exxon Mobil Corporation, LG Chem, SCG Chemicals Co., Ltd., Evonik Industries AG, PTT Global Chemical Public Company Limited, INEOS, Braskem, Formosa Plastics, Mitsubishi Chemical Corporation, NOVA Chemicals Corporate, Sinopec, TotalEnergies, Chevron Phillips Chemical Company LLC, Westlake Chemical, DSM |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=112744

Key Market Segments

By Type

- High-Density Polyethylene (HDPE) commanded a 52.4% share of the polyethylene market in 2024, driven by its extensive use in packaging, construction, and consumer goods. Its durability, chemical resistance, and recyclability make it ideal for bottles, pipes, and industrial containers. Growing demand for sustainable packaging and infrastructure development supports HDPE’s continued dominance. Environmental concerns further boost its appeal, as manufacturers prioritize recyclable materials. HDPE’s versatility and cost-effectiveness solidify its position as the preferred polyethylene type.

By Source

- Virgin polyethylene dominated the market in 2024 with an 83.3% share, favored for its superior quality and consistency in demanding applications like food packaging, medical products, and automotive parts. Its reliability in meeting stringent industry standards, particularly in healthcare and electronics, ensures strong demand. Despite sustainability trends promoting recycled alternatives, virgin polyethylene remains essential for applications requiring high purity and strength. With stable supply chains, it will likely continue as the primary choice for bulk production.

By Processing Method

- Extrusion molding led polyethylene processing methods in 2024, holding a 38.4% share. Its efficiency in producing pipes, films, and sheets for packaging, construction, and agriculture drives its prominence. The method’s cost-effectiveness and suitability for large-scale production make it a manufacturer’s favorite. Rising demand for plastic films in food packaging and irrigation pipes in agriculture reinforces its dominance. Extrusion molding’s adaptability to various polyethylene grades ensures its continued leadership in high-volume, quality-focused production.

By End-Use

- The packaging sector led polyethylene end-use in 2024 with a 44.3% share, driven by the material’s versatility in producing food wraps, shopping bags, rigid containers, and industrial packaging. Its lightweight, durable, and cost-effective properties make it indispensable for food & beverage, e-commerce, and consumer goods industries. While sustainability pushes for alternative materials, polyethylene’s unmatched performance and affordability maintain its dominance. With no viable substitutes offering the same balance of properties, polyethylene will remain critical to packaging applications.

Regional Analysis

The Asia-Pacific (APAC) region solidified its leadership in the global polyethylene market in 2024, capturing a 54.3% share, valued at approximately USD 67.9 billion. This commanding position is fueled by rapid industrialization, urbanization, and growth in key sectors like packaging, construction, automotive, and electronics. China drives this dominance with its vast manufacturing base and major infrastructure projects, such as the Belt and Road Initiative, which significantly boost polyethylene demand in construction and related industries.

India also plays a pivotal role, with surging polyethylene use driven by its expanding packaging sector and increased industrial automation. Over the past decade, India’s packaging consumption has doubled, spurred by a growing middle class and a shift toward packaged foods. APAC’s market strength stems from its adaptability to evolving trends, robust infrastructure investments, and ability to meet diverse industry needs. With ongoing economic growth and strategic initiatives, the region is set to maintain its global polyethylene market leadership.

Top Use Cases

- Packaging Solutions: Polyethylene’s durability and flexibility make it ideal for producing plastic bags, films, and containers. Market research helps identify consumer preferences for sustainable packaging, guiding companies to develop eco-friendly polyethylene options that meet rising demand in food, beverage, and e-commerce sectors while ensuring cost-effectiveness.

- Construction Applications: Polyethylene is used in pipes, insulation, and vapor barriers due to its chemical resistance and strength. Research analyzes demand in infrastructure projects, helping firms target high-growth regions like Asia-Pacific and optimize production for construction needs, balancing cost and durability.

- Automotive Components: Polyethylene’s lightweight and impact-resistant properties are perfect for car parts like fuel tanks and interiors. Market research tracks trends in electric vehicle production, enabling manufacturers to supply polyethylene for lightweight components that improve fuel efficiency and meet industry standards.

- Agricultural Uses: Polyethylene films are vital for irrigation pipes and greenhouse covers. Research identifies demand in farming regions, helping companies develop UV-resistant and recyclable polyethylene products to support sustainable agriculture while addressing environmental concerns and regulatory shifts.

- Medical Packaging: Polyethylene’s sterilizability and chemical resistance suit medical packaging, like saline bottles. Market research explores healthcare sector needs, guiding firms to produce high-purity polyethylene for safe, reliable packaging that meets strict safety regulations and supports growing medical demands.

Recent Developments

LyondellBasell Industries Holdings B.V.

- LyondellBasell recently launched CirculenRecover, a recycled polyethylene made through advanced sorting processes, supporting circular economy goals. The company also expanded its high-density polyethylene (HDPE) capacity in Germany to meet rising demand in the packaging and automotive sectors.

Covestro AG

- Covestro has been focusing on bio-based polyethylene derived from renewable raw materials. The company introduced a new CO₂-based polyol technology, reducing fossil fuel reliance in plastic production. Covestro also partnered with Neste to develop chemically recycled plastics, enhancing sustainability in packaging and textiles.

SABIC

- SABIC unveiled TRUCIRCLE, a portfolio of circular polyethylene solutions, including chemically recycled and renewable polymers. The company also expanded its PE production in Saudi Arabia, targeting global packaging and healthcare markets. SABIC collaborated with Plastic Energy to convert plastic waste into high-quality polymers.

Dow

- Dow introduced REVOLOOP, a new recycled polyethylene resin for flexible packaging, reducing plastic waste. The company also invested in net-zero carbon emissions polyethylene plants in Canada. Dow partnered with Mura Technology to scale up advanced plastic recycling using hydrothermal technology.

Exxon Mobil Corporation

- ExxonMobil expanded its Exxtend technology for advanced recycling of polyethylene waste into virgin-quality plastic. The company also started operations at its new PE unit in Beaumont, Texas, increasing production capacity. ExxonMobil is collaborating with Plastic Energy to build large-scale plastic recycling facilities.

Conclusion

The Polyethylene market is poised for strong growth, driven by rising demand in packaging, construction, and consumer goods. Fueled by urbanization, e-commerce growth, and the need for lightweight, cost-effective plastics. Sustainability is a key trend, with companies investing in recycled and bio-based polyethylene to meet environmental regulations. Emerging markets, particularly in Asia-Pacific, will lead demand, while innovations in recycling technologies create new opportunities. Overall, the polyethylene industry remains dynamic, offering significant potential for manufacturers and investors in the coming decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)