Table of Contents

Overview

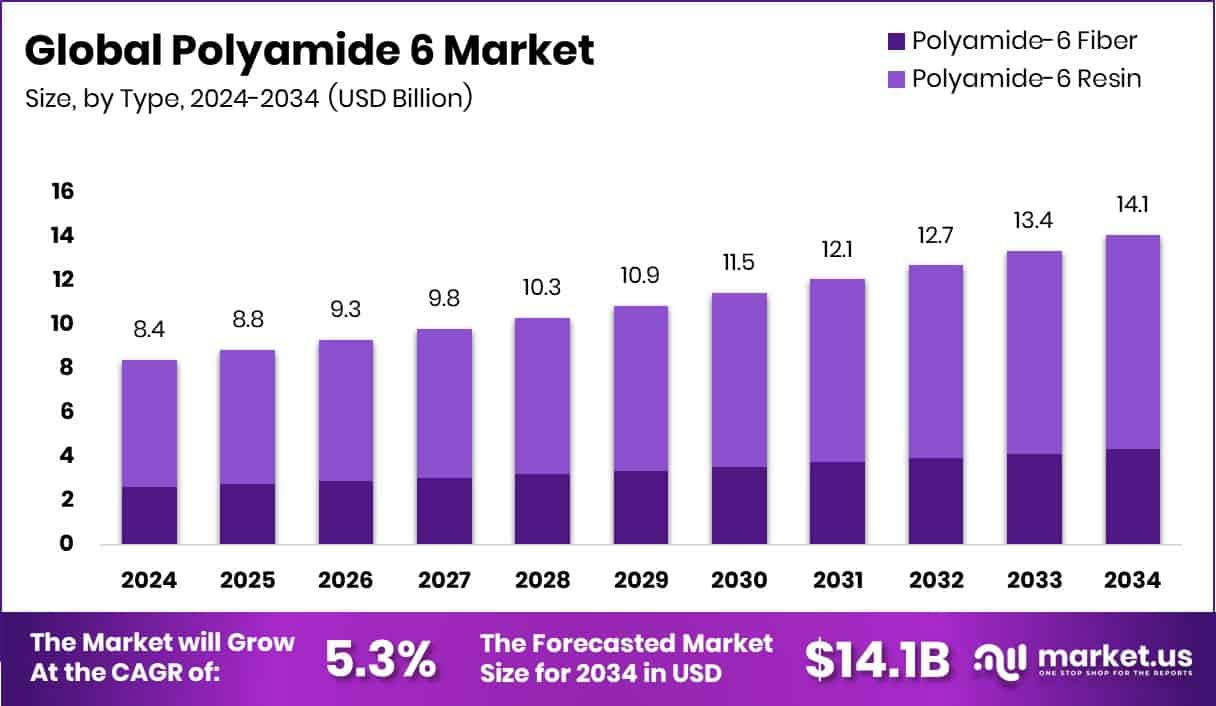

New York, NY – October 14, 2025 – The global Polyamide 6 market is set for robust growth, projected to reach USD 14.1 billion by 2034 from USD 8.4 billion in 2024, at a CAGR of 5.3%. Asia-Pacific dominates with a 45.2% share, supported by expanding automotive and industrial manufacturing bases.

Polyamide 6, produced via the ring-opening polymerization of caprolactam, offers exceptional tensile strength, durability, and thermal stability. These qualities make it indispensable in automotive, textile, packaging, and electrical applications. Rising demand for lightweight vehicle components, high-strength fibers, and engineering plastics continues to propel market expansion.

Additionally, sustainability trends are fostering wider adoption of recyclable and bio-based PA6 in textiles and packaging. The growing use of Polyamide 6 in 3D printing, renewable energy components, and sustainable fibers further underscores its relevance in modern manufacturing ecosystems.

Favorable industrial investments, innovation in circular polymer technologies, and government emphasis on reducing carbon emissions position Polyamide 6 as a critical material in the transition toward sustainable, high-performance products worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-polyamide-6-market/request-sample/

Key Takeaways

- The Global Polyamide 6 Market is expected to be worth around USD 14.1 billion by 2034, up from USD 8.4 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, Polyamide-6 Resin dominated the Polyamide 6 Market, capturing a strong 69.4% share.

- Granules held a notable 43.6% share in the Polyamide 6 Market during 2024, driving industrial consumption.

- The automotive sector led the Polyamide 6 Market in 2024, accounting for 38.2% market share.

- The Asia-Pacific recorded an estimated market value of USD 3.7 billion overall.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160992

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 8.4 Billion |

| Forecast Revenue (2034) | USD 14.1 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Polyamide-6 Fiber, Polyamide-6 Resin), By Form (Granules, Powder, Films, Sheets), By End-use (Automotive, Aerospace, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Others) |

| Competitive Landscape | LANXESS, Mitsubishi Chemical, SABIC, NYCOA, Elementis, DSM, BASF, Kraton Corporation, DuPont, Ascend Performance Materials, Solvay |

Key Market Segments

By Type Analysis

In 2024, Polyamide-6 Resin dominated the By Type segment of the global Polyamide 6 Market with a 69.4% share. Its leadership stems from broad adoption in automotive components, packaging films, and textile fibers, driven by its high tensile strength, durability, and chemical resistance. The resin’s excellent molding ability and cost efficiency make it indispensable in engineering plastics and industrial applications.

Increasing demand for lightweight and high-performance materials in modern manufacturing has reinforced its strong market presence. With industries focusing on durability, design flexibility, and sustainability, Polyamide-6 Resin continues to play a crucial role in advancing innovation and maintaining market dominance throughout 2024.

By Form Analysis

In 2024, Granules led the By Form segment of the global Polyamide 6 Market, securing a 43.6% share. Their dominance is driven by versatility, easy processability, and suitability for injection molding, extrusion, and compounding. Manufacturers widely prefer Polyamide 6 granules for automotive parts, industrial components, and packaging materials due to their consistent quality, mechanical strength, and production efficiency.

Additionally, their recyclability and compatibility with additives allow for enhanced customization and sustainable material development. The extensive use of Polyamide 6 granules in engineering plastics and consumer goods manufacturing underscores their crucial role in modern industrial applications, reinforcing their market leadership throughout 2024.

By End-use Analysis

In 2024, the automotive sector dominated the end-use segment of the global Polyamide 6 Market, capturing a 38.2% share. This dominance stems from the growing need for lightweight, durable, and heat-resistant materials in vehicle manufacturing. Polyamide 6 is extensively utilized for producing engine covers, air intake manifolds, and fuel system components, offering superior mechanical strength and dimensional stability.

The global shift toward fuel-efficient and electric vehicles has accelerated its adoption, as reducing vehicle weight improves energy efficiency and performance. Ongoing advancements in polymer engineering and a stronger focus on sustainable automotive production have further solidified Polyamide 6’s leadership within the automotive market throughout 2024.

Regional Analysis

In 2024, Asia-Pacific dominated the global Polyamide 6 Market, holding a 45.20% share valued at USD 3.7 billion. This leadership stems from rapid industrialization, expanding automotive production, and strong textile and packaging sectors across China, India, Japan, and South Korea. The region’s push for lightweight, high-performance materials and sustainable manufacturing policies continues to reinforce its market strength.

North America ranked second, benefiting from the rising adoption of Polyamide 6 in automotive and electrical applications, supported by polymer technology advancements. Europe maintained consistent growth, driven by its emphasis on recyclability and environmental sustainability.

Meanwhile, Latin America and the Middle East & Africa showed emerging potential, with growth fueled by construction, automotive, and packaging industries. Though their shares remain modest, increasing infrastructure investment and industrial diversification are expected to boost regional demand in the years ahead.

Top Use Cases

- Automotive under-hood parts: PA6 is used for engine covers, air intake manifolds, and fuel system parts in cars because it can withstand heat, chemicals, and vibration, while being lighter than metal.

- Electrical connectors & enclosures: Because PA6 is a good electrical insulator and resists heat, it’s used for plugs, sockets, connector housings, and circuit enclosures in consumer electronics and appliances.

- Textile fibers & apparel: PA6 is spun into fibers for clothing, hosiery, carpets, and sportswear. It’s valued for its strength, flexibility, abrasion resistance, and ability to take dyes.

- 3D printed structural parts: PA6 powders or filaments are used in additive manufacturing (like SLS or selective laser sintering) to build functional parts, prototypes, or small batches with good mechanical performance.

- Wear pads, bearings, and bushings in machinery: PA6 is used in sliding, rotating, or contact parts (like bushings and wear pads) because it has low friction and good durability under load.

- Recycled textile-to-textile application: PA6 is being recycled from waste fabrics into new polymer (e.g, “loopamid®”) for use in garments again—closing the loop in textile manufacturing.

Recent Developments

- In May 2025, MGC signed an MOU with TRE Holdings to explore making green methanol from woody biomass and waste. This can feed into sustainable polymer chains (methanol is a feedstock for many chemical intermediates).

- In October 2024, LANXESS agreed to divest its Urethane Systems business (a polymer / plastics-adjacent division) to Japan’s UBE Corporation, for an enterprise value of €460 million, with proceeds around €500 million.

- In May 2024, SABIC displayed new plastics and circular solutions (under its TRUCIRCLE™ and BLUEHERO™ programs) at NPE2024, highlighting materials that serve multiple industries, including automotive, electronics, and packaging.

- In April 2024, NYCOA introduced NXTamid L, a long-chain nylon (polyamide) designed to replace PA11/PA12 in some uses. It’s plasticiser-free, offers higher service temperature, better dimensional stability, and some grades include >50% bio-based content.

Conclusion

The Polyamide 6 market continues to evolve with strong momentum across automotive, packaging, textile, and electrical sectors. Its balance of strength, flexibility, and chemical resistance makes it a preferred engineering material for both traditional and modern applications. Growing focus on lightweight design, sustainability, and recyclability is expanding its use in eco-friendly products and advanced manufacturing.

Continuous innovations in bio-based and recycled PA6 grades, combined with increasing industrial automation and demand for durable components, are driving steady development. The market’s future lies in material efficiency, circular production, and high-performance solutions tailored for emerging global industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)