Table of Contents

Overview

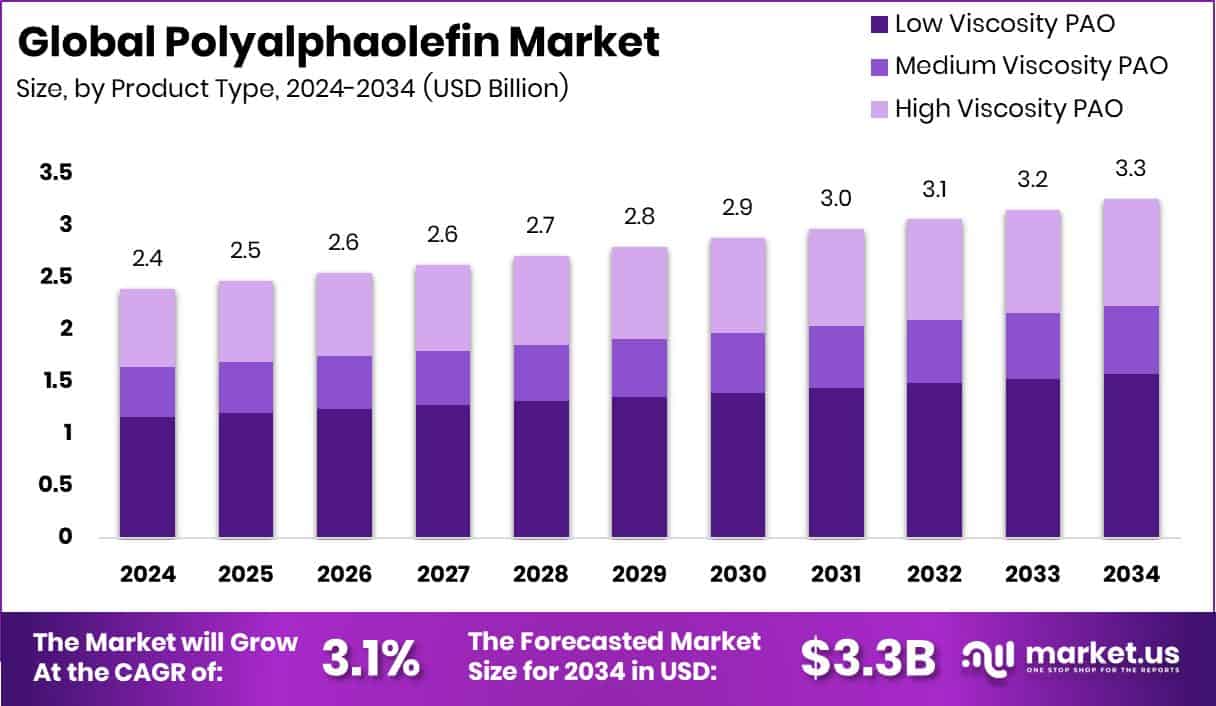

New York, NY – October 16, 2025 – The global Polyalphaolefin (PAO) market is projected to reach USD 3.3 billion by 2034, rising from USD 2.4 billion in 2024, growing at a CAGR of 3.1% (2025–2034). The Asia Pacific region dominates with 48.9% market share, supported by strong automotive and industrial lubricant demand.

PAO, a synthetic hydrocarbon made by polymerizing alpha-olefin monomers, is valued for its high viscosity stability, low volatility, and resistance to oxidation and heat, making it essential for modern engines, turbines, compressors, and hydraulic systems.

Market expansion is largely driven by fuel efficiency and low-emission initiatives that encourage synthetic lubricant adoption, particularly in the automotive and manufacturing sectors. Industrialization in emerging economies continues to strengthen demand, though petrochemical feedstock volatility and production costs act as limiting factors.

Political and financial influences also shape the landscape—for example, Big Oil spent $445 million in the last U.S. election cycle to lobby Congress, while HSBC raised $47 billion for oil and gas firms despite net-zero pledges. Additionally, Saudi Arabia’s $1 trillion capex plan, of which only a quarter targets oil, signals gradual capital diversion toward cleaner energy. This creates opportunities for bio-based and eco-engineered PAO innovations, aligning lubricant development with global sustainability funding trends.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-polyalphaolefin-market/request-sample/

Key Takeaways

- The Global Polyalphaolefin Market is expected to be worth around USD 3.3 billion by 2034, up from USD 2.4 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034.

- In 2024, the polyalphaolefin market saw low-viscosity PAO dominate with a 48.6% share.

- The Homopolymers segment accounted for 42.9% of the Polyalphaolefin Market in 2024.

- Automotive lubricants held the largest 65.3% share of the polyalphaolefin market in 2024.

- The Asia Pacific market was valued at around USD 1.1 billion during the same year.\

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161322

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.4 Billion |

| Forecast Revenue (2034) | USD 3.3 Billion |

| CAGR (2025-2034) | 3.1% |

| Segments Covered | By Product Type (Low Viscosity PAO, Medium Viscosity PAO, High Viscosity PAO), By Grade (Homopolymers, Copolymers, Terpolymers, Others), By End-use (Automotive Lubricants, Industrial Lubricants, Aerospace Lubricants, Others) |

| Competitive Landscape | Exxon Mobil Corporation, INEOS, Chevron Phillips Chemical Company LLC, Dowpol Corporation, LANXESS, NACO Corporation, Total Energies |

Key Market Segments

By Product Type Analysis

In 2024, Low Viscosity Polyalphaolefin (PAO) dominated the By Product Type segment of the global market, securing a 48.6% share. This leadership stems from its extensive use in automotive and industrial lubricants, valued for maintaining smooth flow and stable performance at low temperatures. Its superior lubricating properties contribute to improved fuel efficiency and reduced equipment wear under fluctuating operating conditions.

Low viscosity PAOs are essential in blending high-performance synthetic engine oils, transmission fluids, and greases, offering thermal stability and enabling extended drain intervals that lower maintenance costs. Their strong compatibility with modern additive systems further reinforces their role in meeting efficiency and sustainability goals.

Supported by ongoing demand from automotive OEMs and industrial machinery manufacturers, the segment is expected to retain its dominance through 2025, reflecting the global shift toward energy-efficient lubricants designed for next-generation vehicles and advanced industrial systems.

By Grade Analysis

In 2024, Homopolymers dominated the By Grade segment of the global Polyalphaolefin (PAO) Market, capturing a 42.9% share. Their leadership reflects broad adoption in lubricant formulations requiring uniform molecular structure and high oxidative stability.

Homopolymer-based PAOs offer a consistent viscosity index, strong film strength, and reliable performance even under extreme temperature conditions, making them essential for automotive engines, transmission systems, and industrial machinery. Their uniform chain structure enhances lubricant efficiency, ensuring smoother mechanical operations and longer service intervals.

Additionally, their cost-effectiveness and proven reliability have strengthened their appeal among lubricant manufacturers seeking balanced performance and durability. With rising demand for high-performance synthetic oils across automotive and heavy-duty industries, homopolymers are expected to retain their market leadership through 2025, driven by their technical consistency, energy-saving benefits, and adaptability to modern engine and equipment requirements.

By End-use Analysis

In 2024, Automotive Lubricants led the by-end-use segment of the Polyalphaolefin (PAO) Market, commanding a 65.3% share. This dominance highlights the widespread use of PAO-based synthetic oils in modern engines that demand superior thermal stability, reduced friction, and better fuel efficiency.

PAO formulations are favored for their consistent performance across temperature extremes, making them indispensable in both passenger and commercial vehicles. Their longer drain intervals and strong oxidation resistance help lower maintenance costs while extending engine life and reliability. As automotive technology continues advancing toward stricter efficiency and emission standards,

PAO-based lubricants remain vital for premium engine and transmission oils. Backed by the growing adoption of high-performance and electric vehicles, the segment is set to maintain its strong position through 2025, reflecting the ongoing global shift toward cleaner, more durable, and energy-efficient lubricant solutions in the automotive industry.

Regional Analysis

In 2024, the Asia Pacific region dominated the global Polyalphaolefin (PAO) Market, capturing a 48.9% share valued at around USD 1.1 billion. This strong position stems from rapid industrial growth, a robust automotive manufacturing base, and increasing demand for high-performance synthetic lubricants across China, Japan, India, and South Korea. The region’s emphasis on fuel efficiency and longer engine life continues to drive the adoption of PAO-based formulations in both automotive and industrial sectors.

North America also holds a significant share, supported by technological innovation and well-developed industrial infrastructure, while Europe’s growth is fueled by strict emission regulations that encourage premium lubricant use.

In contrast, Latin America and the Middle East & Africa are emerging markets, gradually expanding their consumption of synthetic base oils due to growing transportation networks and industrial development, collectively contributing to the global expansion of PAO applications through 2025.

Top Use Cases

- Automotive engine oils and transmission fluids: PAO is widely used as the base oil in synthetic engine and transmission lubricants because it stays stable at high temperatures, reduces friction, and flows smoothly in cold starts. Its performance helps engines run cleaner, last longer, and require less frequent oil changes.

- Gear and bearing lubricants in machinery: Because PAO has a consistent molecular structure and excellent film strength, it’s chosen for gear oils and bearing lubricants in industrial machines. It protects moving parts under heavy loads and resists oxidation under stress.

- Cable installation and fiber-optic lubrication: During fiber-optic cable pulls (installation), PAO is used to lubricate the cable sheath. Its non-toxicity, stability, and smooth flow protect delicate fibers from damage when pulled through conduits or over long runs.

- High-viscosity industrial greases: For heavy-duty operations (e.g., bearings in heavy machinery), PAO is thickened into greases that sustain lubrication under shock, extreme heat, and heavy loads. Its thermal stability is critical for long life.

- Hydraulic and turbine fluids: PAO is used in hydraulic systems and turbines because it resists breakdown from heat, maintains viscosity across wide temperature ranges, and ensures reliable fluid power and rotation under demanding conditions.

- Compressor oils in gas processing: In screw or reciprocating compressors (e.g. in natural gas plants), PAO-based oils act as lubricant, coolant, sealant, and help reduce carbon deposits. This use improves compressor lifespan and reduces maintenance needs.

Recent Developments

- In August 2025, CPChem announced that it had doubled its low-viscosity PAO capacity in Beringen, Belgium, raising output to 120,000 metric tons per year, making it the largest decene-based LV PAO facility in Europe.

- In August 2025, ExxonMobil announced changes to its Baytown, Texas, complex to produce new types of petrochemicals. While not exclusively for PAO, Baytown is a major R&D and production hub for its polymer and synthetic materials business, which includes polyolefins.

- In April 2024, INEOS promoted Durasyn® PAOs for use in single-phase immersion cooling (e.g., cooling electronics, data centers). Their PAO fluids offer high thermal stability, non-flammability, and zero global warming potential. This shows INEOS pushing PAO into new thermal-management fields.

- In April 2025, TotalEnergies Marketing Canada announced it would shift from mineral oils to synthetic-technology motor oils (which often incorporate synthetic base stocks like PAO) for both light vehicles and heavy-duty engines.

- In 2025, LANXESS announced it’s showcasing its product portfolio (including novel developments) at K 2025 (a major plastics/chemical trade fair) in Düsseldorf. Though the press release emphasizes additives, pigments, and polymers, it could hint at future synthetic fluid or lubricant advances.

Conclusion

The Polyalphaolefin (PAO) market continues to evolve as industries move toward high-performance and sustainable lubrication solutions. PAOs are now integral to modern engines, turbines, and industrial systems because of their superior stability, low volatility, and long service life. The shift toward cleaner mobility, energy efficiency, and reduced maintenance costs keeps driving interest in synthetic base oils.

At the same time, new developments in bio-based and metallocene PAOs are expanding eco-friendly alternatives. Companies are investing in innovation and production efficiency to meet growing demand across automotive, aerospace, and manufacturing sectors. The market’s future lies in balancing performance with sustainability goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)