Table of Contents

Overview

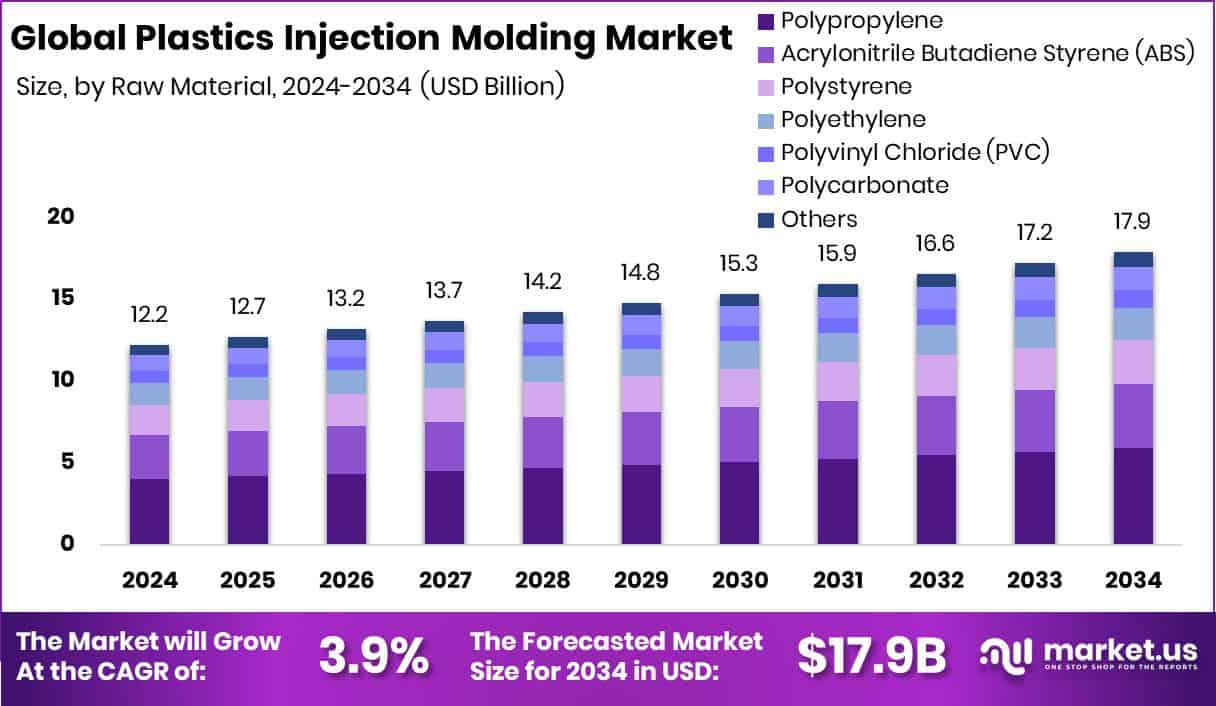

New York, NY – Nov 27, 2025 – The global plastics injection molding market is on a steady growth path, projected to reach around USD 17.9 billion by 2034, rising from USD 12.2 billion in 2024, with a 3.9% CAGR from 2025 to 2034. Asia-Pacific leads with a 36.8% share, valued at USD 4.4 billion, reflecting strong and sustained regional demand.

Plastic injection molding is a high-volume manufacturing process that produces accurate and complex plastic components by injecting molten polymers into metal molds. Its ability to deliver consistent quality, fast cycle times, and compatibility with materials such as polypropylene, ABS, nylon, and engineering plastics makes it essential across automotive, electronics, medical, and packaging industries.

Market expansion is closely linked to automotive lightweighting, rising medical disposable usage, electronics miniaturization, and the need for durable yet cost-effective packaging. Automation, advanced molding machines, and recyclable polymers are improving productivity and design flexibility, while sustainability efforts are reshaping supply chains.

Strong upstream support is also driving growth. A USD 2 billion polypropylene production and terminal project in Türkiye, expected to add USD 300 million annually to national trade, is improving raw material stability. In addition, REC’s ₹4,785 crore financing for a refinery project in Rajasthan highlights continued investment in polymer infrastructure.

Future opportunities center on recycling and circular materials. Initiatives such as The Recycling Partnership’s USD 35 million polypropylene recycling program, including USD 2 million to expand PP recovery facilities, are opening new avenues for recycled and sustainable injection-molded products.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-plastics-injection-molding-market/request-sample/

Key Takeaways

- The Global Plastics Injection Molding Market is expected to be worth around USD 17.9 billion by 2034, up from USD 12.2 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Polypropylene held 33.7% in the Plastics Injection Molding Market, driven by versatility and lightweight performance.

- Packaging accounted for 28.9% in the Plastics Injection Molding Market, supported by hygiene needs and global consumption growth.

- The Asia-Pacific touched USD 4.4 Bn, showing strong manufacturing and industrial expansion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=166059

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 12.2 Billion |

| Forecast Revenue (2034) | USD 17.9 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Raw Material (Polypropylene, Acrylonitrile Butadiene Styrene (ABS), Polystyrene, Polyethylene, Polyvinyl Chloride (PVC), Polycarbonate, Others), By Application (Packaging, Building and Construction, Consumer Goods, Electronics, Automotive and Transportation, Healthcare, Others) |

| Competitive Landscape | ALPLA, Amcor PLC, AptarGroup Inc. (CSP Technologies), BERICAP, Berry Global Inc., EVCO Plastics, HTI Plastics, IAC Group, Magna International, Quantum Plastics, Silgan Holdings Inc |

Key Market Segments

By Raw Material Analysis

In 2024, polypropylene dominated the By Raw Material segment of the Plastics Injection Molding Market with a 33.7% market share, driven by its strong balance of performance and affordability. Its versatility allows usage across both rigid and flexible molded products, making it reliable for high-volume production.

The material is widely used in automotive interior trims, everyday consumer items, storage containers, caps and closures, appliance housings, thin-wall packaging, and medical components. Easy processing, moisture resistance, and stable mechanical strength support consistent quality in applications where durability and cost control are critical.

Polypropylene demand is further supported by ongoing capacity additions and recycling initiatives aimed at improving material availability and circular usage. These investments help manufacturers maintain steady production levels while protecting margins and meeting sustainability goals. As a result, polypropylene continues to be a preferred raw material for injection molders seeking efficiency, scalability, and long-term cost advantages.

By Application Analysis

In 2024, packaging led the By Application segment of the Plastics Injection Molding Market, capturing a 28.9% share, supported by strong demand from food, beverage, personal care, household, and pharmaceutical packaging. Large-scale, repeat consumption across these industries keeps packaging volumes consistently high.

Injection molding is widely used to produce caps, closures, containers, lids, tubs, and protective housings that are lightweight, durable, and leak-proof. Fast production cycles, design flexibility, and cost efficiency allow manufacturers to meet branding, safety, and convenience requirements at scale.

Growing consumer focus on hygienic, tamper-resistant, and easy-to-use packaging continues to drive reliance on injection-molded plastics. At the same time, expanding polypropylene recycling programs and funding-backed improvements in material recovery infrastructure support sustainability goals. These factors together strengthen packaging’s leadership position while enabling manufacturers to balance performance, cost control, and environmental responsibility.

Regional Analysis

The plastics injection molding market shows clear regional variation, shaped by manufacturing scale, end-use demand, and material adoption patterns. Asia-Pacific dominates with a 36.8% share, valued at USD 4.4 billion, supported by high packaging consumption, strong consumer goods production, and a well-established polymer processing base. Ongoing investment in molding machines, tooling, and component manufacturing reinforces the region’s role as a key supply hub.

North America maintains a steady demand for precision-molded parts, particularly in medical, electronics, and industrial uses, backed by strict quality standards and advanced material testing practices. Europe continues to grow at a stable pace, driven by engineered plastics, safety-oriented applications, and compliance-led molding improvements.

The Middle East & Africa experience gradual growth linked to packaging, automotive parts, and everyday consumer products. Latin America benefits from moderate industrial expansion and commodity-supported manufacturing. Across regions, cost-efficient production, design flexibility, durability, and multi-material compatibility sustain demand for injection-molded plastic components.

Top Use Cases

- Packaging (bottles, caps, containers, lids, jars, etc.): Injection molding is widely used to make packaging items like water/juice bottles, caps, food containers, cosmetic jars, and medicine blister packs. These items benefit from being lightweight, leak-proof, and produced in massive volumes with consistent quality.

- Automotive components (interior panels, trims, dashboards, functional parts): Many car and two-wheeler parts — including dashboards, trim panels, interior housings, covers, and structural plastic components — are manufactured via injection molding. It enables the production of durable, dimensionally accurate parts at scale, important for the automotive sector’s demands.

- Consumer electronics housings, gadget casings, and electronic enclosures: Injection molding is used to make casings for smartphones, laptops, remote controls, keyboards, and other electronics. It helps ensure precise tolerances, protective enclosures, and cost-effective high-volume production.

- Household goods and daily-use consumer products (kitchenware, storage containers, toys, daily items): Everyday items — such as kitchen utensils, storage boxes, toys (e.g., plastic bricks or figures), toothbrush handles, and small household gadgets — often come from injection molding because the process supports varied shapes, volumes, and cost-efficient runs.

- Medical and healthcare devices (disposables, medical housings, syringes etc.): In medical and healthcare sectors, injection molding is critical for producing sterile, precise, and disposable plastic items — such as syringes, containers, housings for devices — where dimensional accuracy and hygiene are essential.

- Complex plastic parts requiring precision, custom shapes, snap-fits, hinges, threaded parts: Injection molding shines when making intricate designs: parts with snap-fits, living hinges, threads (e.g., container necks), undercuts, or thin-wall structures — where uniformity, repeatability, and tight tolerances matter.

Recent Developments

- In October 2024, Aptar CSP was awarded a contract by the U.S. federal government to advance its “ActivShield™” sterilization technology for medical devices.

- In May 2024, ALPLA reorganized its injection-moulding business under a dedicated division, ALPLAinject. This groups brings all its injection, injection blow & compression-moulding capabilities (caps, closures, jars, multi-part packaging components) under one brand to improve efficiency, accelerate new product launches and access new segments.

Conclusion

The plastics injection molding market remains a vital part of modern manufacturing due to its efficiency, flexibility, and wide industrial adoption. The process supports consistent quality, fast production cycles, and the ability to create complex and customized plastic components.

Strong demand from packaging, automotive, healthcare, electronics, and consumer goods continues to sustain long-term relevance. Ongoing improvements in automation, tooling precision, and material performance are helping manufacturers enhance productivity and design freedom.

At the same time, growing focus on recyclability and circular material use is guiding innovation toward more sustainable molding practices. With its ability to balance cost efficiency, durability, and scalability, plastic injection molding is well-positioned to support evolving product needs across global industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)