Table of Contents

Overview

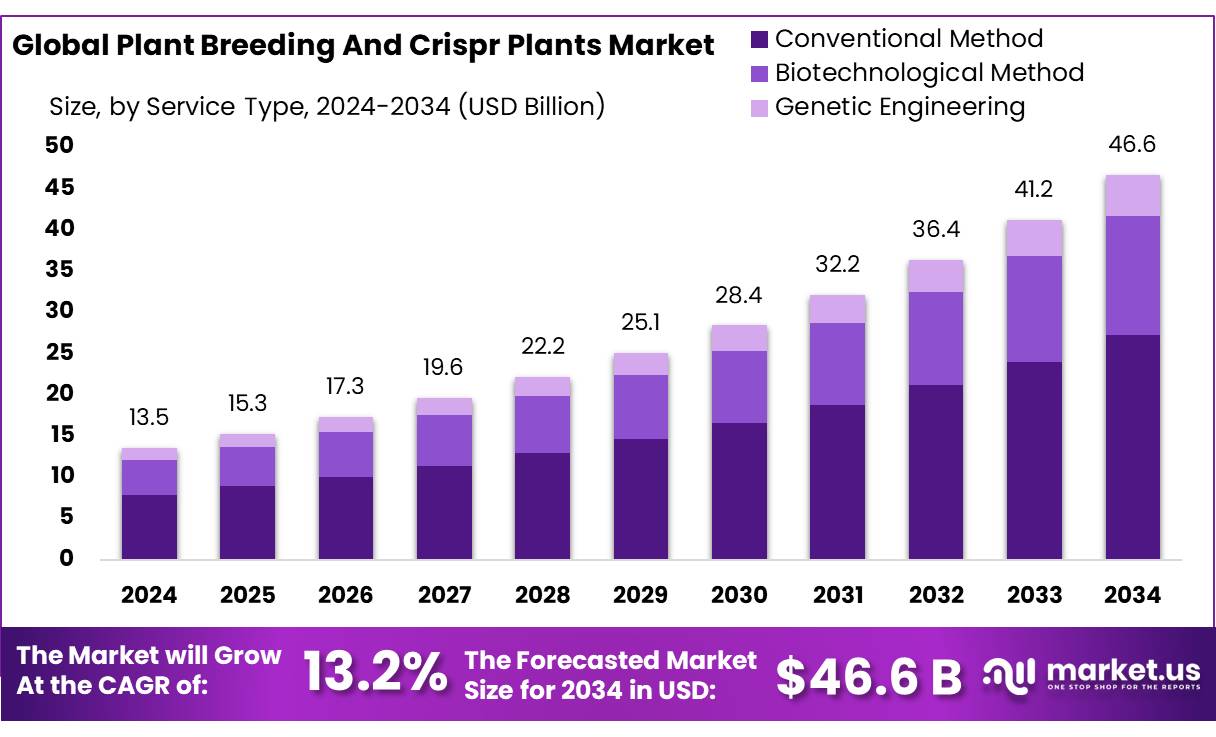

New York, NY – September 12, 2025 – The Global Plant Breeding and Crispr Plants Market, valued at USD 13.5 billion in 2024, is projected to reach USD 46.6 billion by 2034, growing at a CAGR of 13.2% from 2025 to 2034. In 2024, the Asia-Pacific region dominated the market, holding a 47.8% share with USD 6.4 billion in revenue.

The market’s growth is driven by the transformative potential of CRISPR technology, which enables precise genetic modifications to enhance crop yields, disease resistance, and adaptability to environmental changes. According to the U.S. Department of Agriculture, CRISPR has facilitated the development of crops resilient to pests, diseases, and climate change, offering solutions to global food insecurity.

The global population is expected to reach 9.7 billion, and the United Nations estimates that a 70% increase in food production will be necessary, amidst challenges like climate-induced weather variability, soil degradation, and water scarcity. CRISPR technology addresses these issues by improving crop resilience and resource efficiency, making it vital for sustainable agriculture.

In India, the government is actively supporting CRISPR advancements through initiatives like the Department of Biotechnology’s Rs 4 crore project at Punjab Agricultural University for predictive guava breeding to enhance fruit quality and shelf life. Additionally, India’s regulatory update exempting genome-edited plants without foreign genes from biosafety assessments has accelerated the adoption of CRISPR-modified crops, such as DRR Rice 100 (Kamala) and Pusa DST Rice 1, reinforcing the country’s commitment to agricultural biotechnology.

Key Takeaways

- Plant Breeding and Crispr Plants Market size is expected to be worth around USD 46.6 billion by 2034, from USD 13.5 billion in 2024, growing at a CAGR of 13.2%.

- Conventional Method held a dominant market position, capturing more than a 58.3% share.

- Herbicide Resistance held a dominant market position, capturing more than a 31.7% share.

- Agriculture held a dominant market position, capturing more than a 59.4% share.

- Asia–Pacific (APAC) was the clear demand center for plant breeding and CRISPR-enabled crops, holding a dominant 47.8% share, valued at roughly USD 6.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/plant-breeding-and-crispr-plants-market/request-sample/

Report Scope

| Market Value (2024) | USD 13.5 Billion |

| Forecast Revenue (2034) | USD 46.6 Billion |

| CAGR (2025-2034) | 13.2% |

| Segments Covered | By Type (Conventional Method, Biotechnological Method, Genetic Engineering), By Trait (Herbicide Resistance, Insect Resistance, Disease Resistance, Abiotic Stress Tolerance, Yield Improvement, Nutritional Enhancement), By Application (Agriculture, Food Production, Bioenergy, Pharmaceuticals, Others) |

| Competitive Landscape | Bayer AG, Corteva, Syngenta Group, KWS SAAT SE & Co. KGaA, Limagrain, BASF, SAKATA SEED CORPORATION, Rijk Zwaan Zaadteelt en Zaadhandel B.V., PacBio, Evogene Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155266

Key Market Segments

By Type Analysis

In 2024, the Conventional Method commanded a 58.3% market share, solidifying its dominance. Its widespread adoption by breeders stems from established seed-production networks, predictable regulatory frameworks, and cost-effective development timelines. Companies leverage conventional breeding for traits with proven field performance and clear intellectual property, enabling swift variety releases and broad regional adaptability.

Backed by robust germplasm pools, advanced testing infrastructure, and farmer trust, this method ensures steady royalty and licensing revenue. In 2025, the Conventional Method remains a cornerstone of product portfolios, enhanced by marker-assisted selection and targeted screening to streamline pipeline decisions. Genome-editing, like CRISPR, is reserved for traits requiring precision or speed, complementing conventional approaches as they continue to drive commercialization.

By Trait Analysis

Herbicide Resistance led the market in 2024 with a 31.7% share, driven by the critical need for effective weed management to boost crop yields and farm profitability. Farmers favor these varieties for simplifying weed control, reducing labor, and optimizing herbicide use, especially in large-scale operations.

The trait’s strength lies in its reliable performance across diverse agro-climatic zones and synergy with conservation tillage. In 2025, herbicide resistance is poised to maintain its lead as growers address rising weed pressures, including herbicide-tolerant weeds, while adhering to sustainable practices and environmental regulations.

By Application Analysis

Agriculture dominated in 2024 with a 59.4% market share, propelled by the need for high-yield, resilient crops to meet growing food demand from population growth and shifting diets. Plant breeding and CRISPR technologies are pivotal in developing crops with enhanced resistance to pests, diseases, and climate stress, ensuring stable yields in tough conditions. These advancements reduce input costs, improve resource efficiency, and boost farmer profitability.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region led demand for plant breeding and CRISPR crops, capturing a 47.8% share valued at approximately USD 6.4 billion. This dominance is driven by its massive crop production, with India and China contributing roughly 28% and 27% of global rice output in 2024/25, fueling consistent seed and trait investments across diverse farming systems.

Supportive policies, such as India’s guidelines exempting SDN-1/SDN-2 genome-edited plants from stringent GMO regulations, have streamlined development and reduced uncertainty for seed companies and public institutes. APAC’s growth is bolstered by the push for yield stability, reduced input use, and climate-resilient staples and horticulture.

Adoption of herbicide-, pest-, and disease-tolerant traits, combined with conventional and marker-assisted breeding, delivers multi-season returns for farmers and expands licensing opportunities for developers. Long-term demand, particularly for cereals, is supported by OECD-FAO projections of strong Asian rice production, driving investment in stress-tolerant and quality traits tailored to regional needs.

Top Use Cases

- Herbicide Resistance: CRISPR creates crops that resist herbicides, simplifying weed control. Farmers can spray herbicides without harming crops, reducing labor and boosting yields. This is popular in large-scale farming, especially in regions with heavy weed pressure, ensuring higher productivity and sustainable practices.

- Disease Resistance: CRISPR edits plant genes to fight diseases like viruses or fungi. This reduces crop losses and pesticide use, improving food security. For example, edited soybeans resist mosaic virus, benefiting farmers with healthier crops and lower costs in diverse climates.

- Drought Tolerance: CRISPR develops crops that thrive with less water, ideal for drought-prone areas. Edited genes enhance water efficiency, ensuring stable yields despite climate challenges. This supports farmers in regions like Africa, promoting sustainable agriculture and resilience against unpredictable weather.

- Improved Nutrition: CRISPR enhances crop nutritional value, like increasing vitamin content in rice or reducing allergens in wheat. This meets consumer demand for healthier foods, boosts market appeal, and supports public health, especially in regions with dietary deficiencies.

- Faster Breeding: CRISPR speeds up plant breeding by targeting specific traits, unlike slow traditional methods. It creates high-yield, climate-adapted crops in less time, helping farmers meet rising food demand and adapt to changing environments efficiently.

Recent Developments

1. Bayer AG

Bayer is advancing short-stature corn, developed through conventional breeding, for improved resilience and yield. In CRISPR, their subsidiary Pairwise is commercializing gene-edited mustard greens under the Conscious Foods brand, designed for better flavor. They are also applying CRISPR to develop crops with improved nitrogen use efficiency and disease resistance.

2. Corteva

Corteva is a leader in commercial CRISPR products. They launched the waxy corn variety, developed through CRISPR-Cas9, for improved starch quality. They continue to expand their gene-editing pipeline, focusing on yield, sustainability, and drought tolerance in key crops like soybeans and canola. Their proprietary CRISPR technology platform, GTx, is central to accelerating these precision breeding efforts.

3. Syngenta Group

Syngenta is integrating CRISPR into its broad R&D pipeline. They focus on enhancing yield, disease resistance, and nutritional quality in staple crops. A key development is gene-editing wheat for improved resistance to fungal diseases like powdery mildew. They also leverage AI and predictive breeding to identify genetic editing targets faster, aiming for more sustainable crop production systems.

4. KWS SAAT SE & Co. KGaA

KWS is applying CRISPR to develop mildew-resistant barley and sugar beets with lower water needs. A significant milestone is the commercial launch of a non-browning, CRISPR-edited lettuce variety in the U.S. They strongly advocate for updated EU regulations to allow the use of precision breeding techniques, crucial for climate-resilient agriculture.

5. Limagrain

Through its subsidiaries, Limagrain is researching CRISPR for disease resistance in vegetables and cereals. They focus on editing genes for resistance to viruses and fungi, reducing pesticide use. In partnership with other breeders, they are also exploring editing for quality traits like improved taste and shelf life in produce, aligning with their commitment to sustainable and diversified agriculture.

Conclusion

Plant breeding with CRISPR is transforming agriculture by creating crops that resist weeds, diseases, and drought while improving nutrition and speeding up development. These advancements boost yields, cut costs, and enhance sustainability, addressing global food security challenges. As demand for resilient, high-quality crops grows, CRISPR’s precision offers immense market potential, especially in regions facing climate and population pressures.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)