Table of Contents

Overview

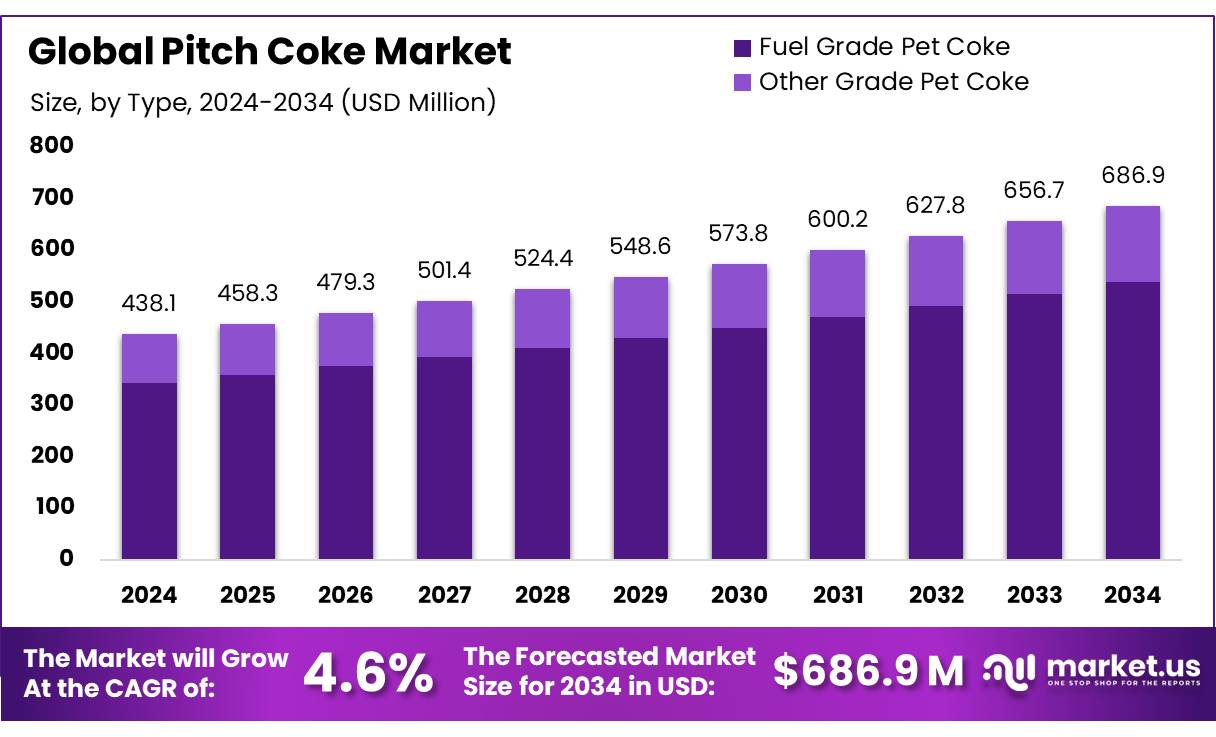

New York, NY – August 08, 2025 – The Global Pitch Coke Market is projected to reach USD 686.9 million by 2034, growing from USD 438.1 million in 2024 at a CAGR of 4.6% during the 2025–2034 forecast period. In 2024, North America led the market, holding a 48.3% share with USD 211.6 million in revenue.

Pitch coke, derived from coal tar or petroleum, is vital for producing graphite electrodes and anodes used in steel manufacturing and energy storage systems. In India, pitch coke production is tied to the coal and petroleum sectors, with the country being a major global coal consumer. However, the lower quality of domestic coal hampers high-quality metallurgical coke production, increasing reliance on imports to meet steel industry demands.

India’s pitch coke industry is shaped by domestic production and import dynamics. For the 2025–26 fiscal year, the Directorate General of Foreign Trade (DGFT) allocated 1.87 million tonnes of Green Petroleum Coke (GPC), down slightly from 1.9 million tonnes the previous year, distributed among 25 calciners, with Rain CII Carbon receiving the largest share of 462,589 tonnes.

Additionally, the Commission for Air Quality Management increased the Calcined Petroleum Coke (CPC) quota to 800,000 tonnes annually for 2025–26, up from 500,000 tonnes. India’s steel industry, with an annual production capacity of approximately 200 million metric tons, drives demand for high-quality coke.

In May 2023, India’s metallurgical coke production rose 8% month-on-month to 4.16 million tonnes, reflecting growing needs. However, challenges with domestic coke quality and consistency persist, prompting import restrictions. In December 2024, the government capped low-ash metallurgical coke imports at 713,583 tonnes per quarter for the first half of 2025 to support local production.

Key Takeaways

- The Global Pitch Coke Market is projected to reach USD 686.9 million by 2034, up from USD 438.1 million in 2024, registering a CAGR of 4.6% over the forecast period.

- Fuel Grade Pet Coke dominated the market with a 78.4% share of the global pitch coke demand.

- Aluminum Anode was the leading application segment, accounting for 34.8% share of the global market.

- North America emerged as the leading regional market, holding a 48.3% share of global demand, valued at approximately USD 211.6 million in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-pitch-coke-market/request-sample/

Report Scope

| Market Value (2024) | USD 438.1 Million |

| Forecast Revenue (2034) | USD 686.9 Million |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Type (Fuel Grade Pet Coke, Other Grade Pet Coke), By Application (Aluminum Anode, Artificial Graphite Electrode, Recarburizer, Carbon Specialty, Carbon Additive, Antifriction, Flame Retardant, Refectories, Others) |

| Competitive Landscape | SUMMIT CRM Limited, Rain Carbon Inc., Sojitz JECT Corporation, ASBURY CARBONS, Bilbaina de Alquitranes, S.A., Shamokin Carbons, Mitsubishi Chemical, Tianjin Yunhai Carbon Element Products Co., Ltd., RESORBENT S.R.O., NIPPON STEEL Chemical & Material Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153815

Key Market Segments

By Type Analysis

In 2024, Fuel Grade Pet Coke led the global pitch coke market, holding a 78.4% share. Its high energy output and low cost make it ideal for power plants, cement kilns, and industrial boilers, especially in developing countries. In 2025, demand for this type is expected to stay strong due to its affordability and limited alternatives, despite environmental concerns. Large-scale exports from refining-heavy nations further boost their global dominance.

By Application Analysis

In 2024, Aluminum Anode applications dominated the pitch coke market with a 34.8% share. The need for high-purity carbon anodes in aluminum smelting drives this segment, fueled by rising demand in automotive, construction, and packaging sectors. In 2025, this segment will likely maintain its lead as smelters in countries like China, India, and Gulf nations expand, prioritizing efficient, high-quality pitch coke to enhance production and lower emissions.

Regional Analysis

In 2024, North America accounted for 48.3% of the global pitch coke market, valued at USD 211.6 million. The region’s strong industrial base, particularly in the U.S. and Canada, supports its leadership in aluminum smelting and graphite electrode production. Stable output of high-purity carbon materials, as tracked by industry reports, ensures consistent demand. North America’s advanced infrastructure continues to drive its dominant market position in 2025.

Top Use Cases

- Aluminum Production: Pitch coke is a key material for making carbon anodes used in aluminum smelting. Its high carbon content and low impurities ensure efficient electrolytic reduction, meeting the growing demand for lightweight aluminum in industries like automotive, aerospace, and packaging, driving its market growth.

- Graphite Electrode Manufacturing: Pitch coke is essential for producing graphite electrodes used in electric arc furnaces for steelmaking. Its high thermal conductivity and stability make it ideal for high-performance electrodes, supporting the rising steel production in emerging economies and infrastructure projects.

- Carbon Additives: Pitch coke serves as a carbon additive in the steel and foundry industries to enhance carbon content in molten metal. Its low sulfur content improves metal quality, making it valuable for high-strength steel production used in construction and manufacturing.

- Recarburizers: As a recarburizer, pitch coke increases carbon levels in steel and iron casting. Its consistent quality and low impurities make it a preferred choice for foundries, supporting the demand for high-quality metal products in the automotive and machinery sectors.

- Semiconductor Crucibles: Pitch coke is used to produce crucibles for semiconductor manufacturing due to its high purity and thermal stability. These crucibles are critical for growing silicon crystals, supporting the expanding electronics industry, including chips for computers and mobile devices.

Recent Developments

1. SUMMIT CRM Limited

SUMMIT CRM Limited has been focusing on expanding its pitch coke supply chain, particularly for the aluminum and steel industries. Recent reports highlight their efforts in securing high-quality raw materials to meet growing demand. The company is also investing in sustainable production methods to reduce environmental impact.

2. Rain Carbon Inc.

Rain Carbon Inc., a leading producer of calcined petroleum coke (CPC) and pitch coke, has been optimizing its production processes to enhance efficiency. The company recently emphasized its commitment to sustainability, including carbon emission reduction initiatives. They continue to supply high-grade pitch coke for anode production in the aluminum sector.

3. Sojitz JECT Corporation

Sojitz JECT Corporation has strengthened its pitch coke procurement network, particularly from Asian refineries. The company is catering to the growing demand from lithium-ion battery and steel manufacturers. Recent updates highlight their focus on high-purity pitch coke for specialty applications.

4. ASBURY CARBONS

ASBURY CARBONS has been expanding its pitch coke offerings, focusing on high-carbon variants for metallurgical uses. The company recently highlighted advancements in material consistency and supply chain reliability. They serve industries like aerospace, automotive, and energy storage.

5. Bilbaina de Alquitranes, S.A

Bilbaina de Alquitranes, a key player in coal tar pitch and pitch coke, has been modernizing its production facilities in Spain. Recent developments include improved refining techniques to meet stricter environmental regulations while maintaining product quality for the aluminum and graphite industries.

Conclusion

The Pitch Coke Market is growing steadily, driven by its critical role in the aluminum, steel, and renewable energy sectors. Demand from the automotive, aerospace, and electronics industries, along with infrastructure development, fuels its expansion. However, environmental regulations and resource depletion pose challenges, pushing companies toward sustainable production methods and innovative technologies to maintain growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)