Table of Contents

Overview

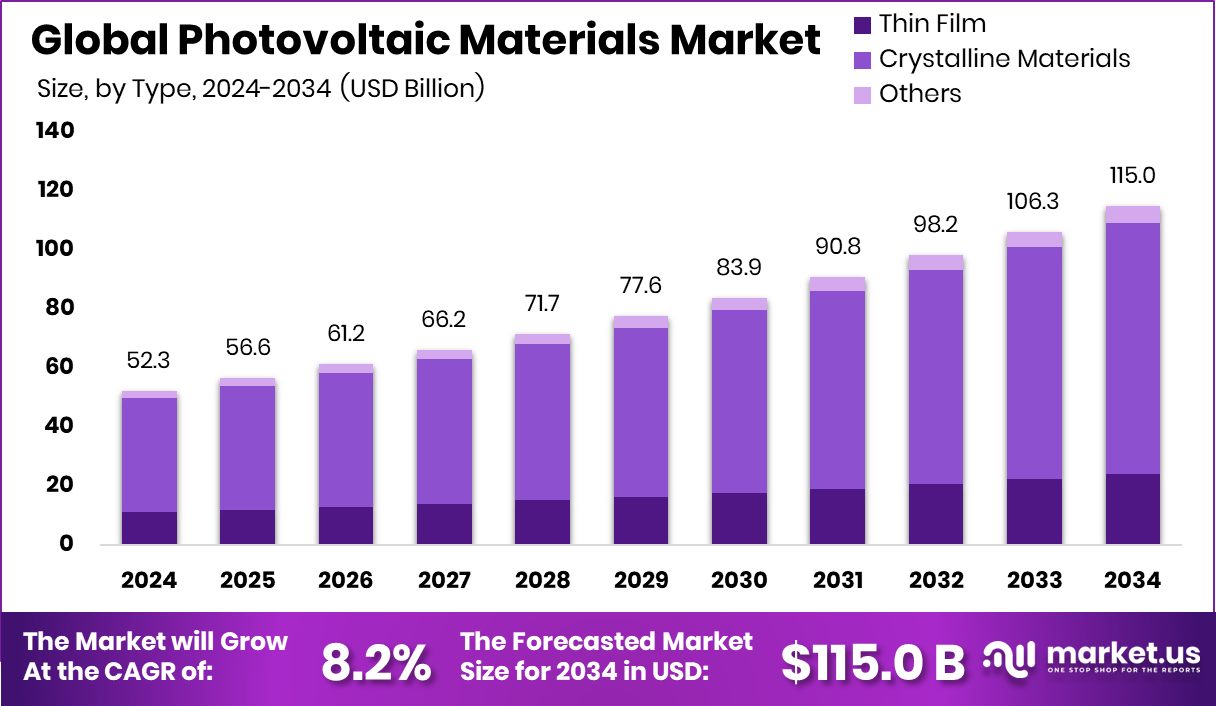

New York, NY – August 22, 2025 – The Global Photovoltaic Materials Market is projected to grow from USD 52.3 billion in 2024 to USD 115.0 billion by 2034, achieving a CAGR of 8.2% from 2025 to 2034. The Asia Pacific region leads with a 47.2% market share in photovoltaic materials.

Photovoltaic materials are specialized compounds that convert sunlight into electricity via the photovoltaic effect. These include crystalline silicon, thin-film materials, and emerging options like organic or perovskite-based materials, which are critical for producing solar cells, the core of solar panels. Their efficiency, durability, and cost significantly impact the performance and feasibility of solar energy systems.

The photovoltaic materials market encompasses the global industry focused on the production, development, and commercialization of materials for solar energy generation. It includes semiconductors, conductive coatings, and encapsulants used in utility-scale, commercial, and residential solar projects. The market is shaped by trends in renewable energy adoption, manufacturing advancements, and supportive government policies.

For instance, Spain has invested over €210 million in solar PV manufacturing, while Hemlock Semiconductor received up to US$325 million under the revised CHIPS Act. Market growth is fueled by the global push for clean energy to reduce carbon emissions, supported by government incentives, declining production costs, and technological innovations.

The U.S. Department of Energy has committed $3 billion to battery manufacturing and recycling, and Art-PV India secured a $10 million grant to enhance solar cell production. Rising global solar installations, driven by energy security needs and lower solar power costs per watt, are boosting demand. Electrification in off-grid regions further increases the consumption of photovoltaic materials.

Key Takeaways

- The Global Photovoltaic Materials Market is expected to be worth around USD 115.0 billion by 2034, up from USD 52.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- Crystalline materials hold a 74.9% share in the Photovoltaic Materials Market, dominating global solar cell production.

- Silicon-based materials account for 89.2% of the market share, reflecting their efficiency and reliability in photovoltaic applications.

- The utility sector leads with a 67.5% share, driving large-scale demand in the photovoltaic materials market.

- Strong solar adoption drives Asia Pacific’s USD 24.6 Bn market.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/photovoltaic-materials-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 52.3 Billion |

| Forecast Revenue (2034) | USD 115.0 Billion |

| CAGR (2025-2034) | 8.2% |

| Segments Covered | By Type (Thin Film, Crystalline Materials, Others), By Material (Silicon-based, Non-Silicon-based), By End Use (Utility, Residential, Commercial, and Industrial) |

| Competitive Landscape | Wacker Chemie AG, DuPont, Honeywell International Inc., COVEME s.p.a., Mitsubishi Materials Corporation, Targray, HANGZHOU FIRST APPLIED MATERIAL CO., LTD., Ferrotec Holdings Corporation, Jinko Solar, SunPower Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154985

Key Market Segments

By Type Analysis

Crystalline materials, primarily monocrystalline and polycrystalline silicon, lead the market due to their high efficiency, long lifespan, and widespread use in residential and commercial solar installations. Their durability across diverse climates and well-established manufacturing processes enhances cost-effectiveness, supporting large-scale adoption. Advancements like passivated emitter rear cell (PERC) technology and bifacial designs further boost module efficiency, while compatibility with various settings from rooftops to solar farms solidifies their appeal.

By Material Analysis

In 2024, silicon-based materials, especially crystalline silicon, dominate with an 89.2% market share due to their high efficiency, abundance, and proven stability. Widely used in large-scale, residential, and commercial solar projects, silicon benefits from advanced production techniques like PERC and improved wafer designs, which enhance energy output and reduce costs. A robust global supply chain ensures availability and competitiveness.

By End Use Analysis

In 2024, utility-scale applications dominate with a 67.5% share, fueled by large solar projects meeting rising electricity needs and renewable energy goals. These solar farms generate high volumes of clean energy for national grids, benefiting from cost efficiencies in installation and maintenance. Supportive policies and investments in infrastructure further strengthen this segment. Photovoltaic materials’ consistent performance and advancements in efficiency and durability enhance their role in utility projects.

Regional Analysis

Asia Pacific leads with a 47.2% share, valued at USD 24.6 billion in 2024.

The Asia Pacific region dominates the photovoltaic materials market, driven by rapid solar growth in China, India, Japan, and Australia. Favorable policies, significant investments, and abundant sunlight support its 47.2% share, valued at USD 24.6 billion. Low manufacturing costs and a strong production base ensure competitive pricing.

North America sees steady growth through clean energy initiatives and residential solar, particularly in the U.S. Europe advances with decarbonization goals and building-integrated photovoltaics. The Middle East & Africa and Latin America are expanding due to utility-scale projects and supportive policies. Asia Pacific’s dominance is expected to persist, driven by technological advancements and its central role in the global supply chain.

Top Use Cases

- Use Case 1: Residential Solar Panels Photovoltaic materials like crystalline silicon power rooftop solar panels for homes. These materials convert sunlight into electricity, reducing energy bills and carbon footprints. Their high efficiency and durability make them ideal for small-scale installations, supporting the growing trend of homeowners adopting clean energy solutions for sustainable living.

- Use Case 2: Utility-Scale Solar Farms Large solar farms rely on silicon-based photovoltaic materials to generate electricity for national grids. These materials ensure high energy output and cost efficiency for massive projects. Their scalability and reliability meet rising energy demands, making them crucial for countries aiming to achieve renewable energy targets and reduce fossil fuel dependency.

- Use Case 3: Building-Integrated Photovoltaics (BIPV) Emerging materials like perovskites and organic photovoltaics enable solar integration into building materials, such as windows or facades. These lightweight, flexible materials generate power while maintaining aesthetics. They’re perfect for urban settings, allowing buildings to produce clean energy without traditional panels, driving adoption in modern architecture and sustainable city planning.

- Use Case 4: Off-Grid Power Systems Photovoltaic materials, especially thin-film technologies, power off-grid systems in remote areas. These materials provide electricity for homes, schools, or clinics without grid access. Their portability and lower costs make them ideal for electrification in rural regions, supporting energy security and improving living standards in developing economies.

- Use Case 5: Portable Solar Devices Flexible photovoltaic materials, like organic or thin-film cells, are used in portable solar chargers and wearable devices. These lightweight, bendable materials generate power for small electronics, such as phones or camping gear. Their versatility supports the growing demand for mobile, eco-friendly energy solutions in consumer markets.

Recent Developments

1. Wacker Chemie AG

Wacker is expanding its production capacity for polysilicon, the key material for high-efficiency solar cells. Their recent focus is on meeting the demand for ultra-pure polysilicon used in N-type technologies, which offer higher efficiency. They are also investing in recycling technologies for silicon, supporting the industry’s sustainability goals and securing the raw material supply chain for the future.

2. DuPont

DuPont continues to innovate in PV metallization pastes. Their recent Tedlar PVF film frontsheet now features a new, highly reflective backsheet technology. This innovation is designed to boost module power output by reflecting unused light to the cell, increasing energy yield. They also focus on developing new conductive adhesives and inks to improve cell efficiency and module reliability for next-generation cell architectures.

3. Honeywell International Inc.

Honeywell is supplying its Solstice zeotropic blend for ultra-low global warming potential (GWP) in the manufacturing of photovoltaic cells. This product is used in the epitaxial silicon deposition process, a critical step for creating high-efficiency N-type TOPCon and heterojunction (HJT) cells. This helps manufacturers reduce their carbon footprint while meeting the stringent process requirements of advanced cell production.

4. COVEME s.p.a.

COVEME is advancing lightweight and flexible photovoltaic modules with its specialty films. Their recent developments include enhanced backsheets and frontsheets designed for Building-Integrated Photovoltaics (BIPV) and vehicle-integrated applications. These materials offer improved durability, weather resistance, and design flexibility, enabling solar technology to be seamlessly integrated into roofs, facades, and curved surfaces beyond traditional panels.

5. Mitsubishi Materials Corporation

Mitsubishi Materials is developing advanced pastes for next-generation cell contacts. Their focus includes low-temperature curing silver pastes optimized for heterojunction (HJT) cell technology, which is sensitive to heat. These pastes enable finer line printing for reduced shading losses and higher conversion efficiency.

Conclusion

The Photovoltaic Materials Market is thriving, driven by diverse applications like residential solar, utility-scale farms, building-integrated systems, off-grid solutions, and portable devices. With global demand for clean energy soaring, innovations in crystalline silicon, perovskites, and thin-film materials are enhancing efficiency and affordability. As governments and industries push for sustainability, these materials will play a pivotal role in shaping a renewable energy future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)