Table of Contents

Introduction

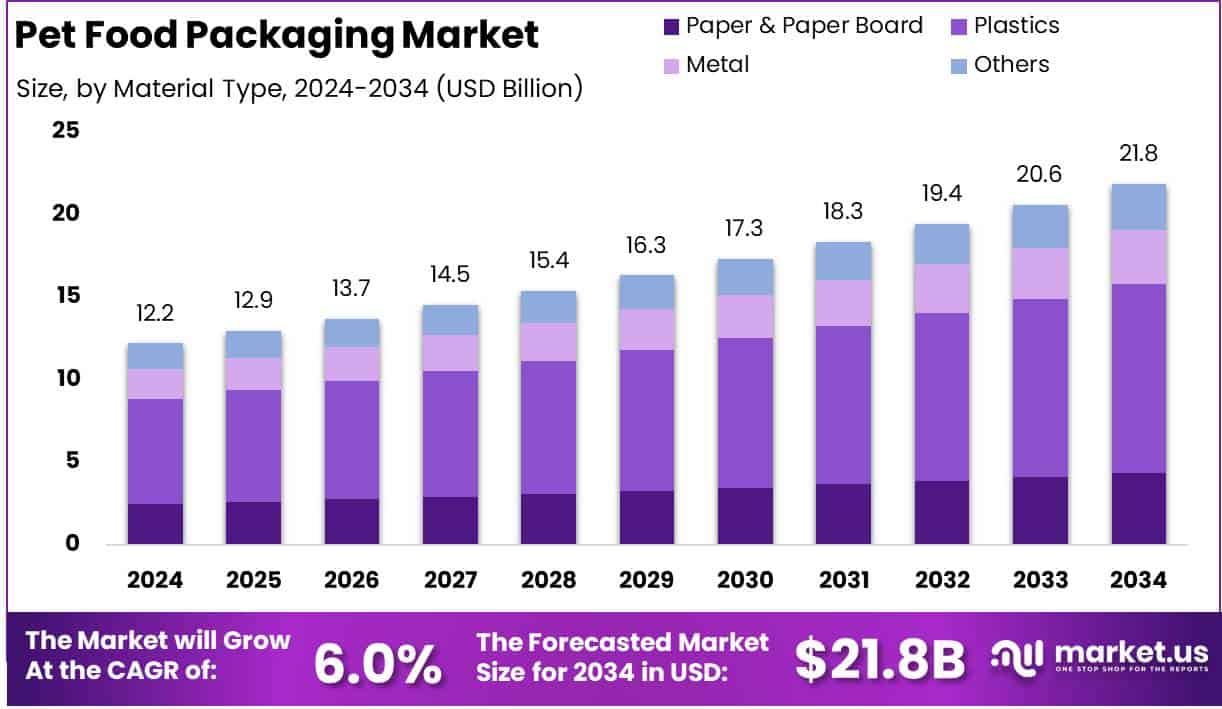

The Global Pet Food Packaging Market is projected to reach approximately USD 21.8 billion by 2034, up from USD 12.2 billion in 2024, exhibiting a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2034.

Pet food packaging refers to the specialized packaging solutions designed to store, protect, and preserve pet food while ensuring convenience for pet owners and maintaining product freshness. It encompasses various packaging formats, including pouches, bags, cans, and cartons, made from materials such as plastic, paper, and metal.

The pet food packaging market represents the global industry involved in the manufacturing, innovation, and distribution of such packaging solutions, catering to the growing demand for premium, organic, and sustainable pet food products. The market is experiencing significant growth due to increasing pet ownership, rising consumer awareness regarding pet nutrition, and the shift towards sustainable packaging.

The demand is further driven by the expansion of the pet food industry, particularly premium and functional pet food categories that require advanced packaging solutions for extended shelf life and product differentiation.

Additionally, the rise of e-commerce and direct-to-consumer sales channels is creating a need for durable, lightweight, and tamper-proof packaging. Opportunities within the market lie in the development of biodegradable and recyclable packaging materials, as sustainability concerns push manufacturers to adopt eco-friendly alternatives. Innovations in smart packaging, including QR codes for traceability and freshness indicators, are expected to enhance consumer engagement and brand trust.

Emerging economies in Asia-Pacific and Latin America present untapped potential, as pet humanization trends and disposable incomes continue to rise. Overall, the pet food packaging market is poised for steady growth, driven by evolving consumer preferences, technological advancements, and regulatory shifts favoring sustainable packaging solutions.

Key Takeaways

- Global Pet Food Packaging Market Expected to reach USD 21.8 billion by 2034, growing from USD 12.2 billion in 2024 at a CAGR of 6.0% (2025–2034).

- Plastics accounted for the largest share 52.4% of total revenue in 2024.

- Pouches led the market, capturing 39.2% of the share in 2024.

- Dog food dominated the market with a 47.4% share in 2024.

- Dry pet food held the largest segment, representing 43.3% of the market in 2024.

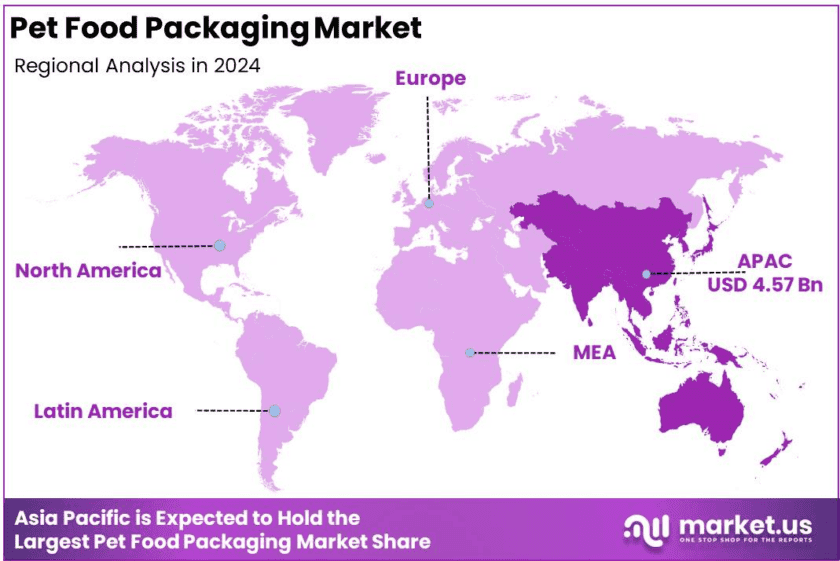

- Asia Pacific remained the leading region, commanding 37.5% of the market share in 2024, valued at approximately USD 4.57 billion.

Pet Food Packaging Statistics

Plastic Packaging Waste

- 40% of global plastic waste comes from packaging materials.

- 141 million tonnes of plastic packaging waste is generated annually worldwide.

- The EU produces 84 million tonnes of packaging waste per year.

- EU residents generate 7 kg of packaging waste per person annually.

- Main packaging waste materials in the EU:

- Paper & cardboard: 34 million tonnes

- Plastic: 16.1 million tonnes

- Glass: 15.6 million tonnes

- The EU recycles 84.2% of its packaging waste.

- In the US, 2 million tonnes of municipal solid waste (MSW) come from containers and packaging.

- 63% of US MSW is from packaging materials.

- In the UK, 72% of glass and 69% of paper/cardboard packaging is recycled.

- Only 44% of plastic packaging waste is recycled in the UK.

Consumer Preferences for Sustainable Packaging

- 90% of consumers prefer brands with eco-friendly packaging.

- 54% of consumers bought sustainable packaging in the past six months.

- 43% of consumers are willing to pay extra for sustainable packaging.

- Younger consumers (18-34 years) prioritize sustainability more:

- 54% choose sustainable packaging when shopping.

- 50% are willing to travel over 10 miles for sustainable products.

- 79% are ready to pay a premium for eco-friendly packaging.

Emerging Trends

- Sustainable Packaging Solutions: There is a growing shift towards recyclable and biodegradable packaging materials in the pet food industry. Over 35% of pet food brands have transitioned to compostable packaging, aiming to reduce plastic waste and enhance brand reputation. The demand for paper-based packaging solutions has increased by 30%, reflecting consumer environmental concerns.

- Integration of Smart Packaging Technologies: The adoption of smart packaging, including QR codes and interactive labels, has risen by 25%. Over 20% of new packaging products now feature freshness indicators and digital tracking capabilities, enhancing transparency and consumer trust.

- E-Commerce-Friendly Packaging Designs: With a 45% increase in demand, lightweight and durable packaging tailored for online deliveries has become essential. More than 50% of pet food brands have introduced packaging solutions that minimize damage during transit, catering to the growing e-commerce sector.

- Premiumization and Humanization: Pet owners increasingly view their pets as family members, driving demand for high-quality, natural ingredient products. This trend extends to packaging, with a preference for premium designs that reflect product quality.

- Personalized Nutrition Packaging: The trend of personalized nutrition has extended to pets, leading to packaging that accommodates tailored pet food options, including portion control and customizable blends.

Top Use Cases

- Flexible Packaging Formats: Flexible packaging, such as pouches and stand-up bags, has become the most preferred format, capturing over 55% of the market share. These formats offer convenience and extended shelf life.

- High-Barrier Packaging Films: The use of high-barrier films to protect pet food from moisture, oxygen, and contaminants has increased by 35%, ensuring product freshness and safety.

- Resealable Packaging Solutions: There has been a 30% increase in demand for resealable packaging, driven by consumer preference for maintaining product freshness and convenience.

- Transparent Packaging: The demand for transparent packaging has risen by 30%, allowing consumers to inspect food quality before purchase, thereby enhancing trust and satisfaction.

- Interactive Packaging Features: The incorporation of interactive elements, such as QR codes linking to informative content, has enhanced consumer engagement and brand loyalty.

Major Challenges

- Regulatory Compliance: Adapting to evolving regulations, such as the EU Packaging and Packaging Waste Regulation (PPWR), requires significant adjustments in packaging design and materials.

- Maintaining Packaging Performance: Transitioning to sustainable materials without compromising packaging performance, including barrier properties and durability, poses a significant challenge.

- Cost Implications: Implementing sustainable packaging solutions can entail higher costs, impacting profit margins, especially for smaller brands.

- Consumer Education: Educating consumers on proper disposal methods for new packaging materials is crucial to ensure the effectiveness of sustainability initiatives.

- Supply Chain Adaptation: Aligning supply chain operations with new packaging technologies and materials requires comprehensive adjustments, which can be resource-intensive.

Top Opportunities

- Investment in Sustainable Packaging: Brands have the opportunity to invest in recyclable and biodegradable packaging solutions, aligning with consumer preferences and regulatory requirements.

- Adoption of Smart Packaging Technologies: Integrating technologies such as QR codes and freshness indicators can enhance consumer engagement and trust.

- Development of E-Commerce-Specific Packaging: Designing packaging that withstands the rigors of online shipping can reduce product damage and improve customer satisfaction.

- Customization and Personalization: Offering packaging that caters to personalized pet nutrition trends can differentiate brands in a competitive market.

- Enhancement of Packaging Aesthetics: Investing in premium packaging designs can attract discerning pet owners willing to pay a premium for perceived quality.

Key Player Analysis

In 2024, the global pet food packaging market remained highly competitive, with key players focusing on innovation, sustainability, and strategic expansions. Amcor Plc, Berry Global Inc., and Mondi plc led the industry with advanced flexible packaging solutions, emphasizing recyclable and biodegradable materials to meet rising consumer demand for sustainable options. Ardagh Group S.A. and Crown dominated the metal packaging segment, catering to premium pet food brands.

Sonoco Products Company, Smurfit Kappa, and Constantia Flexibles capitalized on paper-based packaging, leveraging eco-friendly trends. Sealed Air, ProAmpac, and Printpack Inc. strengthened their market presence with high-barrier films and resealable packaging technologies, enhancing product shelf life and convenience. Meanwhile, Huhtamaki Oyj, Winpak Ltd., and Transcontinental Inc. expanded their manufacturing capabilities to support the growing demand in Asia-Pacific. KM Packaging, Uniflex, and ePac Holdings, LLC gained traction with digital printing and customized packaging solutions, catering to niche brands and premium offerings in the market.

Top Key Players in the Market

- Amcor Plc

- Ardagh Group S.A.

- Berry Global Inc.

- Sonoco Products Company

- Constantia Flexibles

- Crown

- ePac Holdings, LLC

- Goglio S.p.A.

- H.B. Fuller Company

- Huhtamaki Oyj

- KM Packaging Services Ltd.

- Mondi plc

- Printpack Inc.

- ProAmpac

- Sealed Air

- Silgan Holdings Inc.

- Smurfit Kappa

- Sonoco Products Company

- Transcontinental Inc.

- Uniflex

- Winpak Ltd.

Regional Analysis

Asia Pacific Leads the Global Pet Food Packaging Market with the Largest 37.5% Share in 2024

The Asia Pacific region emerged as the dominant player in the global pet food packaging market, accounting for 37.5% of the total market share in 2024, valued at approximately USD 4.57 billion. The region’s dominance is attributed to the rising pet ownership rates, increasing disposable incomes, and a growing demand for premium and sustainable pet food packaging solutions. Countries such as China, Japan, and India are key contributors, with China experiencing a surge in urban pet adoption and premium pet food consumption.

The demand for flexible packaging formats, including pouches and stand-up bags, is increasing, driven by consumer preference for convenience and extended product shelf life. Additionally, regional manufacturers are investing in eco-friendly and recyclable packaging materials to comply with stringent environmental regulations. The strong presence of local and global packaging players, along with rapid market expansion, continues to reinforce Asia Pacific’s leadership in the pet food packaging industry.

Recent Developments

- In 2024, General Mills finalized the acquisition of Whitebridge Pet Brands’ North American premium cat food and pet treat business from NXMH for $1.45 billion. This acquisition includes well-known brands such as Tiki Pets and Cloud Star, strengthening General Mills’ presence in the growing pet nutrition market.

- In February 2025, Amcor plc (NYSE: AMCR, ASX: AMC) and Berry Global Group, Inc. (NYSE: BERY) announced that their shareholders had overwhelmingly approved the planned merger. The approval, secured during separate shareholder meetings, fulfills a key condition for the combination, which was initially revealed in November 2024.

- In 2023, Kormotech introduced Kormotech Ventures, a separate entity focused on fostering innovation in the pet care industry across Europe and the United States. Operating independently, this venture will support emerging companies and will be headquartered in London.

- In 2024, Premium Petfood Brands acquired organic pet food brand Yarrah, which had recently filed for bankruptcy. With operations spanning Belgium, the Netherlands, and Luxembourg, Premium Petfood Brands secured Yarrah’s product portfolio, including the Smølke and Rodi brands, reinforcing its position in the organic pet food market.

Conclusion

The pet food packaging market is growing due to rising pet ownership and demand for premium products. Sustainability is a key focus, with many brands shifting to compostable materials. Smart packaging, including QR codes and freshness indicators, is enhancing transparency. The e-commerce boom has driven demand for durable, lightweight packaging, while flexible formats like pouches dominate. Challenges include regulatory compliance, cost management, and maintaining packaging performance. Opportunities exist in sustainable solutions, smart packaging, and e-commerce-friendly designs, shaping the industry’s future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)