Table of Contents

Introduction

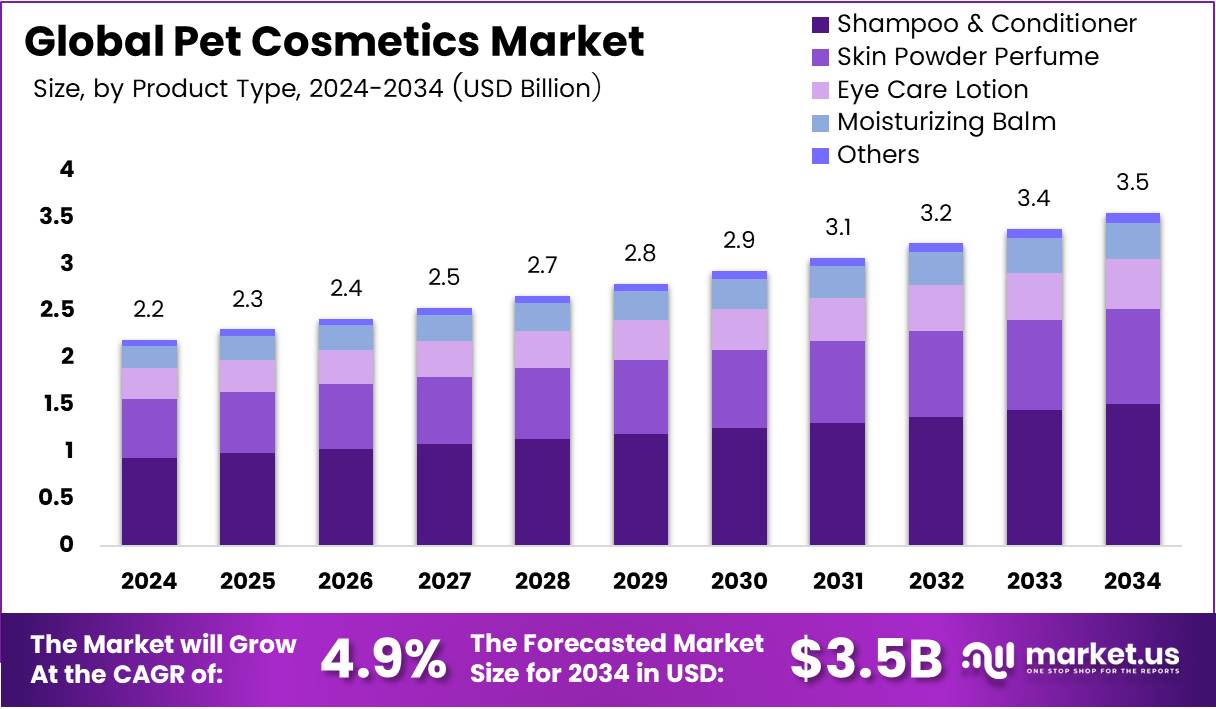

The Global Pet Cosmetics Market is projected to reach USD 3.5 Billion by 2034, rising from USD 2.2 Billion in 2024, expanding at a CAGR of 4.9% during 2025–2034. This growth highlights increasing humanization of pets and strong consumer preference for premium grooming products.

Furthermore, as pet care evolves into a wellness-focused lifestyle, cosmetics such as shampoos, lotions, and perfumes have become mainstream essentials. Digital retail platforms and innovative grooming solutions are making pet cosmetics more accessible and appealing to diverse consumer bases worldwide.

Additionally, the global expansion of luxury pet spas, eco-friendly brands, and specialized grooming services is driving strong demand. Companies offering cruelty-free and hypoallergenic products are witnessing rapid adoption, reflecting the shift toward sustainability and personalized pet care.

Key Takeaways

- The Global Pet Cosmetics Market is projected to reach USD 3.5 Billion by 2034, up from USD 2.2 Billion in 2024, at a CAGR of 4.9%.

- In 2024, Shampoo & Conditioner dominated the product type segment with a 42.7% share, reflecting its essential role in grooming routines.

- The Dog segment led the pet type category with a 63.8% share, driven by high grooming needs.

- Individual Pet Owners represented the largest end-user segment with a 73.6% share.

- Pet Stores accounted for the leading distribution channel with a 39.1% share.

- North America held a dominant 47.8% market share, valued at USD 1.0 Billion.

Market Segmentation Overview

The Product Type segment is led by Shampoo & Conditioner, capturing 42.7% of the market in 2024. These products form the foundation of pet hygiene, making them indispensable for owners. Their consistent use in grooming routines reflects both necessity and preference for premium formulations.

The Pet Type analysis shows dogs dominating with a 63.8% share. Their frequent grooming requirements and breed-specific care needs contribute to higher cosmetic consumption. Cat and other pet segments follow, representing emerging opportunities for tailored grooming solutions.

Under End Users, Individual Pet Owners lead with a 73.6% share, reflecting emotional spending and preference for safe, high-quality grooming products. Professional groomers form a secondary but influential group that guides consumer choices and promotes brand trust.

By Distribution Channel, Pet Stores hold the highest share at 39.1%. These outlets offer personalized advice and exclusive brands, building credibility and consumer loyalty. Online platforms continue expanding rapidly, supported by convenience, variety, and discounts.

Drivers

One of the primary drivers is the rising humanization of pets, where owners increasingly treat animals as family members. This behavioral shift fuels demand for premium, natural grooming products that ensure comfort, health, and aesthetics. As disposable incomes rise, spending on high-end pet cosmetics continues to escalate.

Another key driver is the growth of e-commerce platforms. Digital retail enhances product visibility, simplifies access to global brands, and supports subscription-based models. Pet owners can now discover organic, niche brands easily, accelerating global product adoption and fostering competitive innovation across regions.

Use Cases

Pet cosmetics play a crucial role in maintaining coat and skin health. Regular use of shampoos and conditioners helps control allergens, remove dirt, and sustain the natural oils vital for a pet’s overall wellness. Specialized formulations also target sensitivities, ensuring comfort and long-term hygiene.

In addition, the market finds use in professional grooming and spa treatments. Pet salons utilize specialized lotions, perfumes, and balms to enhance texture, scent, and appearance. This professional application promotes premium product demand and introduces owners to high-performance grooming lines.

Major Challenges

A major challenge lies in limited consumer awareness about advanced pet cosmetic benefits. Many pet owners stick to basic hygiene practices, overlooking specialized care like moisturizing balms or eye-care products. This gap slows penetration in emerging and price-sensitive markets.

Another significant obstacle involves stringent regulatory standards. Compliance with safety certifications and ingredient testing adds financial and operational burdens, especially for small and mid-scale manufacturers. These hurdles can delay product launches and limit global scalability.

Business Opportunities

Innovation in hypoallergenic and vegan formulations presents vast opportunities. Brands focusing on cruelty-free, chemical-free, and eco-certified solutions can capture the growing conscious consumer base. These products also appeal to owners seeking safe alternatives for pets with skin allergies.

Another opportunity arises from subscription-based delivery models. Regular product shipments simplify purchasing and build brand loyalty. Companies adopting these models enjoy predictable revenue streams and long-term customer relationships, enhancing market sustainability.

Regional Analysis

North America dominates the market with a 47.8% share valued at USD 1.0 Billion. The region’s mature retail ecosystem, strong disposable incomes, and premium brand penetration sustain leadership. The U.S. and Canada demonstrate high spending on eco-friendly and luxury pet grooming solutions.

Asia Pacific is rapidly emerging as the fastest-growing region. Urbanization, rising middle-class incomes, and increasing pet adoption in China, Japan, and India are propelling demand. Expanding e-commerce infrastructure further boosts accessibility to innovative pet cosmetic products.

Recent Developments

- In June 2024, MyMicrobiome introduced the world’s first Microbiome-Friendly Certification Standard for pet cosmetics, promoting transparency and safety in formulations.

- In August 2024, Dolce & Gabbana launched a premium $100 perfume for dogs, marking its entry into the luxury pet fragrance segment.

Conclusion

The Pet Cosmetics Market is entering a transformative phase driven by humanization, sustainability, and innovation. Brands adopting ethical sourcing, advanced formulations, and digital distribution are expected to outperform traditional competitors. With increasing global awareness and expanding premium segments, the market promises consistent long-term growth through 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)