Table of Contents

Overview

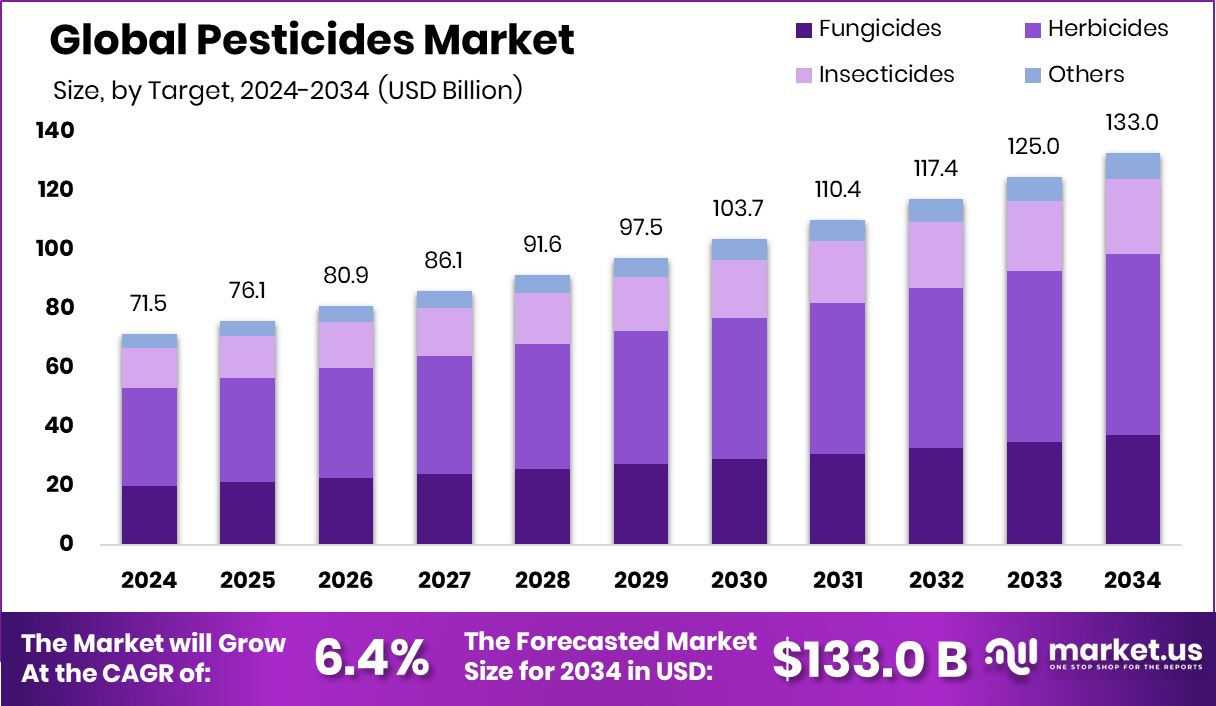

New York, NY – August 22, 2025 – The Global Pesticides Market is forecasted to reach approximately USD 133.0 billion by 2034, rising from USD 71.5 billion in 2024, reflecting a compound annual growth rate (CAGR) of 6.4% between 2025 and 2034. Asia-Pacific currently leads the market with a 43.2% share, supported by favorable climatic conditions and vast arable land.

Pesticides, which include insecticides, herbicides, fungicides, and rodenticides, are essential for safeguarding crops, livestock, and human health. They protect yields from pests, weeds, and diseases, thereby ensuring food security and maintaining quality standards. Beyond agriculture, pesticides are also integral to public health initiatives, such as mosquito control programs. Recent initiatives like CABI’s USD 37 million FARM programme are working to reduce dependency on pesticides and plastics in farming.

The pesticides market represents a broad global industry spanning agriculture, horticulture, forestry, and public health. Market growth is shaped by regulatory frameworks, technological advances in formulations, and evolving farming practices. At the same time, the sector is witnessing strong investment flows. BiocSol secured €5.2 million in seed funding for microbial pesticide development, India’s Agrim raised USD 17.3 million to expand farmer access to crop inputs, and BioPrime obtained USD 6 million to introduce bio-fungicides and bio-insecticides.

Rising global food demand and pressure for higher agricultural productivity are key drivers fueling pesticide adoption. As commercial farming expands, farmers are increasingly relying on innovative crop protection methods to minimize losses. The University of Exeter has launched a £1.7 million research network targeting antifungal resistance, while Michigan State University received USD 500,000 to address herbicide-resistant weeds in soybeans. Meanwhile, UK-based RootWave raised USD 15 million to develop non-chemical weed-control technologies, and ADM led a USD 10.5 million funding round for Harpe Bioherbicide Solutions.

Key Takeaways

- The Global Pesticides Market is expected to be worth around USD 133.0 billion by 2034, up from USD 71.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- Herbicides dominate the pesticides market with 46.3%, driven by rising weed control needs in modern farming.

- Chemical pesticides hold an 81.7% share, reflecting their wide application and effectiveness in large-scale agricultural production.

- Liquid formulations lead the market at 56.9%, offering ease of application and better crop coverage efficiency.

- Cereals and grains account for 46.2% usage, highlighting their priority in global food security and crop protection.

- Strong agricultural activities and rising food demand boosted the Asia-Pacific’s USD 30.8 Bn. pesticides market share and value.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/pesticides-market/request-sample/

Report Scope

| Market Value (2024) | USD 71.5 Billion |

| Forecast Revenue (2034) | USD 133.0 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Target (Fungicides, Herbicides, Insecticides, Others), By Type (Chemical Pesticides, Bio-pesticides, Bio chemical Pesticide, Microbial Pesticides, Plant Incorporated Protectants, Others), By Formulation (Liquid, Dry), By Crop Type (Cereals and Grains, Vegetables and Fruits, Oilseeds and Pulses, Commercial Crops, Plantation Crops, Turfs and Ornamentals, Others) |

| Competitive Landscape | Dow Inc., Adama Agricultural Solutions Ltd., Syngenta AG, Corteva Agriscience, BASF SE, bioworks inc., Bayer Cropscience, Certis USA L.L.C., FMC Corporation, Aegis Sciences Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155155

Key Market Segments

By Target Analysis

Herbicides dominate the pesticides market, commanding a 46.3% share in 2024. Their leading position stems from the critical need to manage weeds that compete with crops for essential resources like nutrients, water, and sunlight, ultimately affecting yields. Herbicides offer efficient, targeted weed control with reduced labor compared to traditional methods, making them a preferred choice, particularly in large-scale farming where effective weed management is vital for productivity.

The demand for herbicides has surged in both developed and developing regions, driven by increased cultivation of cereals, oilseeds, and commercial crops. Advancements in selective herbicide formulations allow precise targeting of specific weeds without harming crops, improving efficiency and cutting costs for farmers. Climate change and erratic weather patterns have also intensified weed growth, further increasing reliance on herbicides.

By Type Analysis

Chemical pesticides hold a commanding 81.7% market share in 2024, dominating the By Type segment of the pesticides market. Their widespread use in modern agriculture is driven by their rapid action, high efficacy, and consistent performance across diverse crops and climates. Available in various formulations liquids, powders, and granules, chemical pesticides are versatile, supporting both large-scale commercial farming and smallholder operations.

The growth of chemical pesticides is fueled by rising global food demand and the need to boost crop yields on limited arable land. These products significantly reduce yield losses, making them integral to integrated crop protection strategies. Advances in active ingredients and application technologies have improved precision, minimizing waste and environmental impact compared to older formulations. Despite growing interest in sustainable practices, chemical pesticides remain the go-to choice due to their reliability and cost-effectiveness.

By Formulation Analysis

Liquid formulations lead the pesticides market with a 56.9% share in 2024. Their dominance is driven by high efficiency, ease of application, and uniform coverage compared to other forms. Liquid pesticides are easily diluted, sprayed, and absorbed, ensuring effective pest contact and penetration.

Their compatibility with modern spraying equipment makes them ideal for large-scale farming. Liquid formulations are popular across diverse crops, including cereals, fruits, vegetables, and commercial plantations, offering flexibility for pre- and post-emergence applications. They also minimize dust-related handling issues, enhancing safety and convenience for farmers.

By Crop Type Analysis

Cereals and grains account for 46.2% of pesticide usage in 2024, leading the By Crop Type segment. This dominance reflects the high global demand for staple crops like wheat, rice, maize, and barley, which are critical for food security. Protecting these crops from pests, weeds, and diseases is essential, as even minor infestations can lead to substantial yield losses.

The extensive cultivation area for cereals and grains amplifies the need for effective pest control. Farmers rely heavily on pesticides to combat insects, fungal diseases, and weeds, particularly as changing climate conditions exacerbate pest proliferation. Modern pesticide formulations and precision application methods enhance productivity while optimizing resource use.

Regional Analysis

Asia-Pacific led the global pesticides market in 2024 with a 43.2% share, valued at USD 30.8 billion. Its dominance is driven by a vast agricultural base, favorable climates, and heavy reliance on crop protection chemicals. Countries like China, India, and Japan lead in pesticide use, supported by expanding cultivation of cereals, grains, fruits, and vegetables.

Rapid population growth and rising food demand have spurred pesticide adoption to maximize yields and meet quality standards for domestic and export markets. In contrast, North America and Europe show steady growth, driven by advanced farming practices and eco-friendly formulations, while Latin America and the Middle East & Africa see gradual expansion due to agricultural modernization.

Asia-Pacific benefits from innovations in pesticide formulations and precision agriculture technologies, enabling efficient pest control. With strong government support for agricultural productivity and growing awareness of pest management, the region is expected to maintain its leadership in the global pesticides market.

Top Use Cases

Weed Control in Crop Fields: Herbicides, holding a market share, effectively eliminate weeds that compete with crops for nutrients, water, and sunlight. Farmers use selective herbicides to target specific weeds without harming crops, boosting yields and reducing manual labor, especially in large-scale farming of cereals and oilseeds.

Protecting Cereals and Grains: Pesticides are vital for cereals and grains, which account for pesticide use. They protect crops like wheat and rice from insects, fungi, and weeds, ensuring food security. Modern formulations enhance crop health, addressing pest challenges worsened by climate change.

Enhancing Precision Agriculture: Liquid pesticides work well with precision tools like drones and GPS-guided sprayers. Farmers apply them accurately, reducing waste and environmental impact while targeting pests effectively, improving crop yields, and supporting sustainable farming practices.

Supporting Organic Farming Growth: Biopesticides, derived from natural sources, are gaining popularity in organic farming. They offer eco-friendly pest control, targeting specific pests with minimal harm to beneficial organisms, aligning with consumer demand for sustainable, residue-free produce and stricter environmental regulations.

Boosting Commercial Crop Exports: Pesticides ensure high-quality commercial crops like fruits and vegetables meet export standards. By controlling pests and diseases, they maintain crop appearance and yield, supporting the Asia-Pacific’s market dominance, driven by countries like China and India.

Recent Developments

1. Dow Inc.

Dow is advancing its ENLIST CROP TECHNOLOGY platform. Recent developments focus on the launch of Enlist Duo 3 and Enlist One herbicides, paired with Enlist E3 soybeans. This system is designed to manage resistant weeds while promoting stewardship through reduced volatility and a favorable toxicity profile. The expansion focuses on providing farmers with more tools for sustainable weed control.

2. Adama Agricultural Solutions Ltd.

ADAMA is expanding its portfolio of biological solutions. A key recent launch is Mevalone, a bio-fungicide based on Aureobasidium pullulans, for botrytis management in vineyards and soft fruits. This aligns with the growing demand for sustainable crop protection that minimizes chemical residues and supports Integrated Pest Management (IPM) strategies, offering effective resistance management.

3. Syngenta AG

Syngenta is heavily investing in agtech and biologicals. A major development is the launch of its new biologicals platform, BioSolutions, featuring products like Univoq insecticide. They are also integrating digital tools like Cropwise to help farmers optimize pesticide use. Their focus is on creating more targeted, sustainable solutions and reducing the environmental impact of crop protection.

4. Corteva Agriscience

Corteva is driving innovation with its Pyraxalt insecticide platform. This novel insecticide controls hoppers and aphids in rice with a favorable environmental profile. They are also rapidly expanding their biologicals portfolio, including the recent acquisition of Symborg, strengthening their offerings in nitrogen-fixing and bio-stimulant products to complement traditional chemical solutions.

5. BASF SE

BASF is focusing on sustainable solutions and digital farming. A key launch is Axalion Insecticide, a novel insect control agent effective against sucking pests with a new mode of action. They are also advancing their digital platform, Xarvio, for precise field zone management. This helps optimize pesticide application timing and rates, reducing the environmental footprint.

Conclusion

The Pesticides Market is thriving, driven by the need for higher crop yields and food security. Herbicides and chemical pesticides dominate due to their effectiveness, while biopesticides and precision technologies gain traction for sustainability. Asia-Pacific leads with strong agricultural demand. Ongoing innovations in eco-friendly solutions and application methods will shape the market’s future, balancing productivity with environmental concerns.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)