Table of Contents

Overview

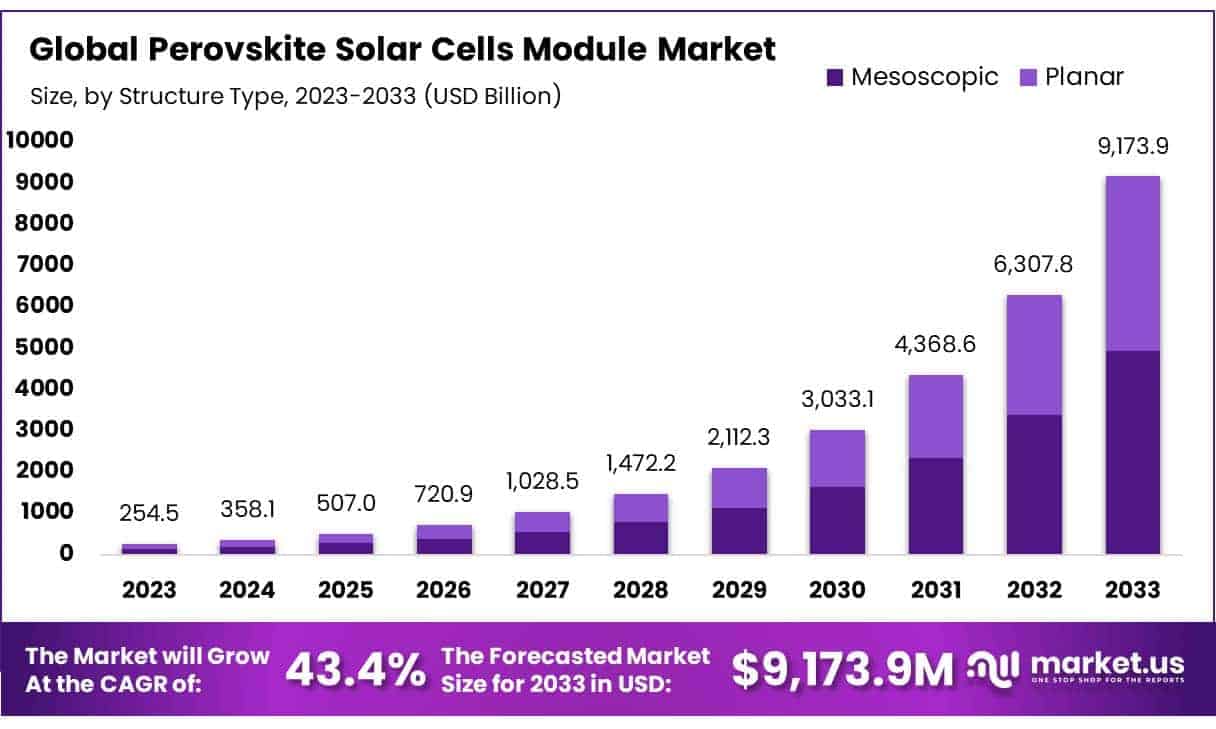

The global perovskite solar cells module market was valued at USD 254.45 million in 2023 and is projected to grow significantly, reaching around USD 9,173.94 million by 2033, expanding at a remarkable CAGR of 43.4% during the forecast period from 2024 to 2033.

Among structure types, mesoscopic perovskite solar cells held the dominant market share of 53.9% in 2023, favored for their robust performance and manufacturing advantages over planar structures. By product type, flexible modules led the segment with a commanding 61.8% share, attributed to their lightweight design, flexibility, and adaptability for diverse applications ranging from portable electronics to curved architectural surfaces.

In terms of cell configuration, single junction perovskite modules accounted for the largest share of 63.3% in 2023, benefiting from cost-effective manufacturing, simpler design, and solid efficiency levels. Based on fabrication technologies, the solution method dominated with a 47.6% share, owing to its low-cost production, simplicity, and scalability for mass manufacturing.

From an application standpoint, solar panels constituted the largest use-case, holding 42.9% of the market in 2023, driven by strong demand for scalable and efficient energy generation solutions. When segmented by end-user, the utility sector led with a 54.1% share, reflecting large-scale renewable energy deployment needs and the cost competitiveness of perovskite solar technologies in grid-level applications. Regionally, Asia-Pacific emerged as the leading market in 2023, capturing 59.5% of the global share.

Key Takeaways

- The global perovskite solar cells module market was valued at US$ 254.45 million in 2023.

- The global perovskite solar cells module market is projected to reach US$ 9,173.94 million by 2033.

- Among structure type, the mesoscopic held the majority of the revenue share at 53.9%.

- Based on product types, flexible accounted for the largest market share with 61.8%.

- Among types, single junction accounted for the majority of the perovskite solar cells module market share with 62.9%.

- Among technologies, solution method accounted for the majority of the perovskite solar cells module market share with 59.2%.

- Among applications, solar panel accounted for the majority of the perovskite solar cells module market share with 42.9%.

- Based on end-uses, the utility dominated the market with a share of 42.0%.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/perovskite-solar-cells-module-market/free-sample/

Report Scope

| Market Value (2024) | USD 254.45 Million |

| Forecast Revenue (2034) | USD 9,173.94 Million |

| CAGR (2025-2034) | 43.4% |

| Segments Covered | Global Perovskite Solar Cells Module Market By Structure Type (Mesoscopic , and Planar), By Product Type (Rigid, and Flexible), By Type (Single Junction, and Multi Junction) By Technology (Solution Method, Vapor-Assisted Solution Method, and Vapor-Deposition Method) By Application (Smart Glass, Building-Integrated Photovoltaics, Solar Panel, and Others), By End-Use (Residential, Commercial, Industrial, and Utility) |

| Competitive Landscape | Hanwha Group, Toshiba Corporation, CubicPV, Greatcell Energy, Oxford Photovoltaics Ltd., EneCoat Technologies Co., Ltd., Swift Solar, Solaronix SA, Saule Technologies, Tandem PV, Inc., Hangzhou Microquanta Co. Ltd., Perovskia Solar AG, Front Materials Co. Ltd., P3C Technology and Solutions Pvt. Ltd. Others |

Key Market Segments

By Structure Type

- Mesoscopic

- Planar

By Product Type

- Rigid

- Flexible

By Type

- Single Junction

- Multi Junction

By Technology

- Solution Method

- One-step

- Two-step

- Vapor-Assisted Solution Method

- Vapor-Deposition Method

By Application

- Smart Glass

- Building-Integrated Photovoltaics

- Solar Panel

- Others

By End-User

- Residential

- Commercial

- Industrial

- Utility

Regional Analysis

In 2023, the Asia-Pacific region led the global perovskite solar cells module market, accounting for 59.5% of the total market share. This dominance is largely attributed to the rapid industrial growth across countries such as China, India, and several Southeast Asian nations. Key sectors including packaging, commercial printing, and labeling—major end-users of perovskite solar cell modules—have seen strong expansion.

The surge in demand for high-quality, durable packaging, especially in industries like consumer goods, pharmaceuticals, food and beverages, and e-commerce, has further driven the region’s growth. As industrialization and urbanization continue, the need for efficient and scalable solar technologies is expected to intensify across Asia-Pacific.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=15931

Recent Developments

Hanwha Qcells achieved a world-record 28.6% efficiency on a full-area M10-sized perovskite–silicon tandem cell—certified by Fraunhofer ISE—marking industrial-scale readiness for commercialization. The pilot production line at their Jincheon facility is undergoing final testing, targeting mass production by 2026. This milestone bridges a critical gap between laboratory advances and real-world deployment, enhancing energy yield while reducing material use. Hanwha continues to invest heavily in R&D and supports grid integration via energy storage systems.

Oxford PV has advanced its perovskite–silicon tandem module technology with record achievements: a 26.9% efficiency in residential-sized modules (60 cell) at Intersolar Europe 2024, and commercial deployment to a U.S. solar farm yielding around 20% more energy than conventional modules. Additionally, they licensed their technology to Trina Solar for China manufacture and secured European Investment Bank backing to convert a former Bosch site into a pilot fab in Germany.

Saule Technologies, headquartered in Poland, opened its first perovskite solar cell factory in Wrocław in May 2021. It focuses on fully printed, flexible modules, which offer lightweight and versatile applications. Recent pilot batches are being evaluated in Europe for smart building integration. The company aims to reduce costs and scale production, addressing stability challenges associated with flexible perovskite panels. Continued technological refinement and manufacturing scale-up position Saule as a pioneering provider in the flexible solar technology segment.

EneCoat Technologies is actively working on advanced surface coatings for perovskite cells to enhance durability. Their patented nano-coating improves moisture and UV resistance—key for commercial viability in flexible and building-integrated modules. Recent collaborative pilot projects in Japan and South Korea aim to validate these coatings in real-world outdoor conditions. EneCoat’s innovation supports improved module lifespan, aligning with broader industry goals of enhancing stability for perovskite commercialization.

Greatcell Energy (formerly GreatCell Solar) is working on low-cost roll-to-roll production for high-efficiency indoor perovskite panels aimed at IoT applications. The company is scaling up its facility in Australia to support full-sun research collaborations with universities and industry groups. It received AUD 6 million from the Australian Renewable Energy Agency (ARENA) to accelerate its printable perovskite solar cell development. Their focus remains on delivering stable, commercial-grade perovskite modules for indoor device use.

Oxford PV continues its momentum in perovskite–silicon tandem technology. While latest specific figures were not found, their ongoing work at Brandenburg is increasing industrial-scale production, building on record module efficiencies reported earlier. Oxford PV’s modules are being deployed commercially, marking a successful transition from lab to the field.

Swift Solar has been recognized as a top cleantech company, expanding its leadership with tandem perovskite–silicon cells reaching 34.8% efficiency in 2025—significantly above silicon-only norms. In March 2025, Swift Solar added Gunter Erfurt to its advisory board, strengthening its strategy ahead of commercial deployment. The company is also exploring integration of its modules with American Tower’s telecom infrastructure, demonstrating strong commercial interest in critical infrastructure applications.

Poland-based Saule Technologies focuses on printed, flexible perovskite solar panels. Its first factory in Wrocław (opened in 2021) is producing pilot modules for smart building integration. The company continues refining manufacturing processes and stability, targeting lightweight BIPV and flexible-device markets using scalable roll-to-roll techniques.

Tandem PV secured USD 50 million in Series A funding in March 2025, led by Eclipse, to build commercial-scale tandem manufacturing in the U.S. The company produces panels reaching 28% efficiency, aiming for over 30% by late 2025. Named one of TIME’s “World’s Top GreenTech Companies 2025,” Tandem PV is moving toward U.S. leadership in perovskite solar module mass production.

Key Players Analysis

- Hanwha Group

- Toshiba Corporation

- CubicPV

- Greatcell Energy

- Oxford Photovoltaics Ltd

- EneCoat Technologies Co., Ltd

- Swift Solar

- Solaronix SA

- Saule Technologies

- Tandem PV, Inc.

- Hangzhou Microquanta Co. Ltd.

- Perovskia Solar AG

- Front Materials Co. Ltd

- P3C Technology and Solutions Pvt. Ltd.

- Other Key Players

Conclusion

In conclusion, the perovskite solar cell module industry is transitioning from laboratory innovation to industrial readiness. The technology offers a transformative path for achieving sustainable and cost-effective solar power through scalable solutions like flexible modules and efficient production techniques. With strong growth prospects, regional leadership, and advancing regulatory frameworks, perovskite modules are becoming a vital component of global renewable energy strategies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)