Table of Contents

Introduction

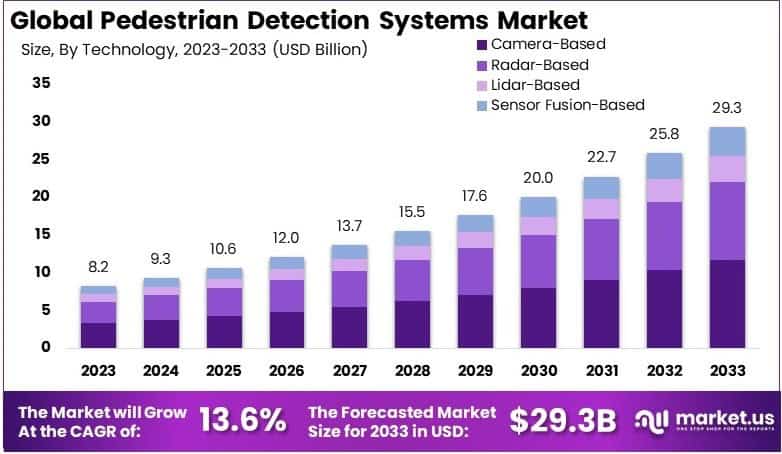

New York, NY – April 10, 2025 – The Global Pedestrian Detection Systems Market is projected to reach approximately USD 29.3 billion by 2033, up from an estimated USD 8.2 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 13.6% during the forecast period spanning 2024 to 2033.

Pedestrian Detection Systems (PDS) are advanced safety technologies integrated into vehicles or surveillance infrastructures to identify and respond to the presence of pedestrians in real-time, thereby enhancing road safety and reducing the risk of accidents. These systems utilize a combination of sensors, cameras, radar, and artificial intelligence algorithms to detect pedestrians’ movements, especially in complex urban environments and low-visibility conditions.

The Pedestrian Detection Systems Market refers to the global landscape of technologies, products, and services associated with the development, manufacturing, and deployment of these systems across automotive and public safety sectors.

The growth of this market is being driven by rising awareness regarding road safety, stringent government regulations mandating advanced driver assistance systems (ADAS), and the increasing adoption of autonomous and semi-autonomous vehicles. With global traffic fatalities involving pedestrians witnessing a surge, automotive OEMs and smart city projects are investing significantly in intelligent detection technologies.

Demand is further supported by rapid urbanization, technological advancements in computer vision and machine learning, and the growing emphasis on reducing human error in traffic management. A major opportunity lies in the integration of pedestrian detection features with broader vehicle-to-everything (V2X) communication systems and infrastructure-based monitoring solutions.

Emerging markets in Asia-Pacific and Latin America are also anticipated to offer high growth potential, driven by improving road infrastructure, regulatory reforms, and rising vehicle sales. As consumer preference shifts toward vehicles equipped with enhanced safety features, the pedestrian detection systems market is expected to witness robust expansion, supported by ongoing innovation and government-led road safety initiatives.

Key Takeaways

- The global Pedestrian Detection Systems Market was valued at USD 8.2 billion in 2023 and is projected to reach USD 29.3 billion by 2033, growing at a CAGR of 13.6% during the forecast period.

- In 2023, camera-based systems accounted for the largest share of the market, owing to their high accuracy, cost-efficiency, and effective deployment across diverse pedestrian detection applications.

- The automotive sector emerged as the dominant application segment in 2023, fueled by the increased integration of pedestrian detection systems within advanced driver-assistance systems (ADAS).

- Short-range detection (0–10 meters) held the highest market share in 2023, primarily due to its critical role in ensuring safety in urban areas with dense pedestrian activity.

- Integrated pedestrian detection systems with ADAS led the market in 2023, reflecting the growing adoption of automated safety technologies in modern passenger and commercial vehicles.

- Original Equipment Manufacturers (OEMs) accounted for the majority of market share in 2023, driven by the widespread incorporation of pedestrian detection technologies into new vehicle models at the manufacturing stage.

- North America led the global market in 2023 with a 36.4% share, supported by technological innovations, robust automotive industry presence, and early adoption of ADAS and pedestrian safety regulations.

Request A Sample Copy Of This Report at https://market.us/report/pedestrian-detection-systems-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 8.2 Billion |

| Forecast Revenue (2033) | USD 29.3 Billion |

| CAGR (2024-2033) | 13.6% |

| Segments Covered | By Technology (Radar-Based, Camera-Based, Lidar-Based, Sensor Fusion-Based), By Application (Automotive, Smart Cities, Transportation, Robotics), By Detection Range (Short Range (0-10 meters), Medium Range (10-50 meters), Long Range (50+ meters)), By System Integration (Standalone Systems, Integrated Systems with Advanced Driver Assistance Systems (ADAS)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By End User (Original Equipment Manufacturers (OEMs), Aftermarket, Infrastructure Providers, Transportation Agencies) |

| Competitive Landscape | Robert Bosch GmbH, Mobileye, Continental AG, FLIR Systems, Denso Corporation, Valeo SA, ZF Friedrichshafen AG, BMW AG, Toyota Motor Corporation, Blaxtair, Aptiv PLC, Magna International Inc., Autoliv Inc., Hyundai Mobis, Subaru Corporation |

Emerging Trends

- Integration of Artificial Intelligence (AI): AI and machine learning algorithms are being incorporated to improve the accuracy of pedestrian detection, enabling systems to better interpret complex environments and predict pedestrian movements.

- Vehicle-to-Pedestrian (V2P) Communication: Development of V2P technologies facilitates direct communication between vehicles and pedestrians, enhancing safety through timely alerts. For instance, Honda is exploring smartphone-based systems to warn drivers and pedestrians of potential collisions.

- Adoption of Multi-Modal Sensor Fusion: Combining data from various sensors, such as cameras, radar, and LiDAR, enhances object detection and tracking capabilities, leading to more reliable pedestrian detection systems.

- Implementation in Autonomous Vehicles: As autonomous vehicles become more prevalent, integrating advanced pedestrian detection systems is essential to ensure the safety of all road users.

- Smart Infrastructure Integration: Cities are incorporating smart crossings equipped with sensors and communication devices to alert both pedestrians and drivers, thereby reducing accidents. South Korea’s implementation of such crossings has shown promising results.

Top Use Cases

- Automotive Safety Systems: Pedestrian detection is a key component of advanced driver-assistance systems (ADAS), providing automatic braking or alerts to prevent collisions.

- Autonomous Vehicles: Self-driving cars rely on pedestrian detection to navigate safely in urban environments, ensuring the protection of vulnerable road users.

- Smart City Applications: Integration with urban infrastructure, such as intelligent traffic management systems, helps monitor and manage pedestrian movement, enhancing overall city safety.

- Public Transportation Systems: Buses and trams equipped with pedestrian detection can prevent accidents in crowded urban areas, improving public transport safety.

- Industrial Vehicle Operations: In manufacturing and warehouse settings, pedestrian detection systems on forklifts and other vehicles help prevent workplace accidents.

Major Challenges

- High Implementation Costs: Advanced sensor technologies and system integration can be expensive, potentially limiting adoption, especially in cost-sensitive markets.

- Environmental Limitations: Performance can be affected by adverse weather conditions or poor lighting, which may reduce detection accuracy.

- Regulatory Compliance: Varying safety regulations across regions necessitate that manufacturers ensure their systems meet diverse standards, complicating deployment.

- Sensor Limitations: Certain materials, such as high-visibility clothing, can interfere with sensor detection, potentially making pedestrians less visible to detection systems.

- Data Privacy Concerns: The use of AI and data analytics raises issues regarding the handling of personal data, requiring robust measures to maintain consumer trust.

Top Opportunities

- Expansion into Emerging Markets: Rapid urbanization and increasing vehicle ownership in regions like Asia-Pacific and Latin America present significant growth opportunities for pedestrian detection systems.

- Advancements in AI and Machine Learning: Continued innovation in AI can enhance detection accuracy and system reliability, making pedestrian detection systems more effective.

- Integration with Smart City Initiatives: Collaborations with urban planners to incorporate pedestrian detection into city infrastructure can improve traffic management and pedestrian safety.

- Development of Cost-Effective Solutions: Creating affordable pedestrian detection technologies can increase adoption rates, particularly in developing countries.

- Enhanced Sensor Technologies: Innovations in sensor design, such as improved LiDAR and radar systems, can overcome current limitations related to environmental conditions and detection accuracy.

Key Player Analysis

In 2024, the global Pedestrian Detection Systems market is being significantly shaped by the strategic initiatives and technological advancements of key players such as Robert Bosch GmbH, Mobileye, Continental AG, and FLIR Systems. These companies continue to lead innovation through AI-integrated detection systems, thermal imaging, and camera-based safety solutions. Denso Corporation, Valeo SA, and ZF Friedrichshafen AG are strengthening their positions by offering cost-effective, sensor-fusion technologies tailored for integration in both luxury and mass-market vehicles.

Automakers like BMW AG, Toyota Motor Corporation, and Subaru Corporation are embedding these systems into their ADAS portfolios, driving broader adoption through OEM partnerships. Blaxtair is differentiating itself with industrial vehicle applications, while Aptiv PLC and Magna International Inc. are expanding their modular, scalable system offerings. Autoliv Inc. and Hyundai Mobis are leveraging expertise in automotive safety and electronics to support regulatory compliance and consumer safety demands, thereby reinforcing the competitive intensity of this evolving market.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=134957

Major Companies in the Market

- Robert Bosch GmbH

- Mobileye

- Continental AG

- FLIR Systems

- Denso Corporation

- Valeo SA

- ZF Friedrichshafen AG

- BMW AG

- Toyota Motor Corporation

- Blaxtair

- Aptiv PLC

- Magna International Inc.

- Autoliv Inc.

- Hyundai Mobis

- Subaru Corporation

Regional Analysis

North America Leads the Pedestrian Detection Systems Market with the Largest Market Share of 36.4% in 2024

North America emerged as the leading region in the global pedestrian detection systems market in 2024, accounting for the highest market share of 36.4%, which translates to a market valuation of approximately USD 2.98 billion. This regional dominance is primarily attributed to the early adoption of advanced driver-assistance systems (ADAS), the presence of major automotive OEMs and technology providers, and the strong regulatory framework mandating pedestrian safety features in vehicles.

The United States, in particular, has witnessed significant investments in intelligent transportation systems and road safety infrastructure, which has further accelerated the integration of pedestrian detection systems in both passenger and commercial vehicles.

Recent Developments

- In 2024, Iteris and Sumitomo Electric formed a strategic partnership to introduce an advanced pedestrian detection sensor in the U.S. market. This smart mobility technology, already proven successful in Japan, is designed to improve road safety by identifying pedestrians and enhancing signal timing at intersections. The goal is to reduce accidents and make crossings safer, especially in busy urban zones.

- In 2023, HCO Innovations launched an AI-powered pedestrian detection system for forklifts in warehouse environments. This solution helps prevent collisions by identifying workers in close proximity to moving vehicles. The system uses real-time alerts to notify drivers, improving workplace safety and operational efficiency across distribution centers.

- In 2024, Las Vegas received a $1.4 million federal grant to implement AI pedestrian detection systems along the Fremont Street corridor. The technology adjusts crosswalk signals based on pedestrian flow and crossing time, aiming to reduce congestion and enhance public safety in one of the city’s most crowded areas.

- In 2024, SLB introduced two new electric submersible pump systems designed to improve energy efficiency and reduce emissions. These smart lift solutions include digital monitoring tools that allow for faster response and lower maintenance costs. The systems are engineered to support cleaner and more stable oil production operations worldwide.

Conclusion

The pedestrian detection systems market is set to grow steadily, supported by rising road safety awareness, stricter regulations, and continuous advancements in sensor and AI technologies. Governments and automotive OEMs are increasingly focusing on integrating these systems into vehicles to reduce pedestrian-related accidents. While North America and Europe currently dominate due to early adoption and strong safety norms, the Asia-Pacific region is expected to offer strong growth potential. As smart city projects expand and demand for ADAS-equipped vehicles rises, the adoption of pedestrian detection systems will continue to accelerate globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)