Table of Contents

Overview

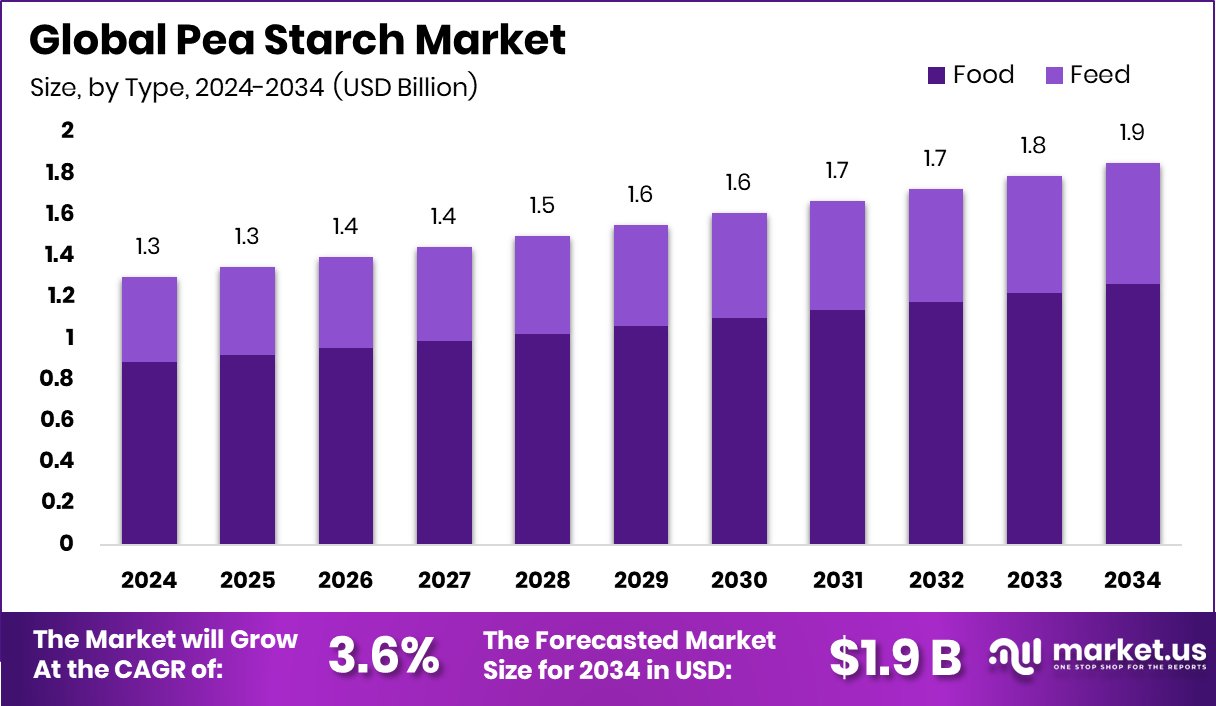

New York, NY – October 07, 2025 – The Global Pea Starch Market is projected to reach USD 1.9 billion by 2034, rising from USD 1.3 billion in 2024, at a CAGR of 3.6% from 2025 to 2034. North America held a 32.9% share, equivalent to USD 0.4 billion, driven by growing adoption in bakery and plant-based foods. Pea starch, a natural carbohydrate derived from yellow peas, is valued as a clean-label, allergen-free alternative to wheat and corn starch.

It serves as a thickener, gelling agent, and stabilizer in food applications, while its versatility extends into pharmaceuticals, pet nutrition, and industrial uses. Market growth is fueled by the rising popularity of plant-based and gluten-free diets. Pea starch offers functional benefits that align with consumer demand for natural, sustainable ingredients. Its increasing use in pea protein production, where starch emerges as a valuable by-product, further contributes to market expansion.

Companies are also investing in infrastructure and innovation to meet growing demand. For instance, Cargill’s USD 75 million investment in U.S. pea protein production highlights the link between protein and starch value chains. Sustainability initiatives and government research support are strengthening the market’s foundation. The University of Saskatchewan’s USD 7 million funding for livestock research underlines the role of pea-based ingredients in promoting food sustainability and safety.

Such programs align agricultural goals with eco-friendly ingredient development. Additionally, innovation-driven projects are unlocking new opportunities. Equinom’s USD 10 million Series B funding and Phyto Organix’s USD 10 million grant for a net-zero protein facility reflect a shift toward greener production. These advancements are broadening pea starch applications into nutraceuticals, bioplastics, and other emerging sectors, ensuring steady, long-term market growth.

Key Takeaways

- The Global Pea Starch Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In the pea starch market, food applications dominate with 68.3%, reflecting strong global dietary trends.

- Pea starch achieves 31.2% in gelling applications, offering superior texture and stability across food categories.

- Food and beverage hold a 48.9% share, showcasing pea starch’s widespread role in daily nutrition choices.

- Strong consumer demand for clean-label foods in North America supported a 32.9% market share worth USD 0.4 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-pea-starch-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 1.9 Billion |

| CAGR (2025-2034) | 3.6% |

| Segments Covered | By Type (Food, Feed), By Function (Gelling, Thickeners, Texturizing, Film Forming, Others), By End-use (Food and Beverage, Animal Feed, Paper, Pharmaceuticals, Textiles, Others) |

| Competitive Landscape | Ingredion, Roquette Frères, Yantai Shuangta Food Co., Ltd, Ebro Foods, S.A., Puris, DSM-Firmenich, AGT Food and Ingredients, Emsland-Stärke, Cosucra, Agrocorp International Pte Ltd |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158580

Key Market Segments

By Type Analysis

Food dominates the pea starch market, capturing a 68.3% share in 2024. This segment’s growth is fueled by rising demand for clean-label, gluten-free, and plant-based products. Pea starch is valued for its thickening, gelling, and stabilizing properties, making it a key ingredient in bakery goods, snacks, soups, sauces, and meat alternatives. Increasing consumer preference for natural, allergen-free ingredients, alongside investments in plant-based production and sustainability initiatives, has solidified the food segment’s leading position in the market.

By Function Analysis

Gelling holds a 31.2% share of the pea starch market in 2024, leading the by-function segment. The high amylose content of pea starch provides firm textures and stability, making it ideal for confectionery, meat alternatives, dairy products, and ready-to-eat meals where texture and mouthfeel are critical. The rise in plant-based and clean-label product demand has boosted gelling applications, as pea starch serves as a natural, allergen-free solution, reinforcing its dominance in this segment.

By End-Use Analysis

The food and beverage sector leads the by-end-use segment with a 48.9% share in 2024. Pea starch is widely used in bakery, snacks, dairy alternatives, soups, sauces, and meat substitutes due to its clean-label, gluten-free, and allergen-free attributes. The growing popularity of plant-based diets and processed convenience foods has driven demand for pea starch’s superior texture, stability, and gelling properties, positioning food and beverage as the top end-use category.

Regional Analysis

North America leads the pea starch market in 2024, holding a 32.9% share valued at USD 0.4 billion. Strong demand for clean-label, gluten-free, and plant-based foods, combined with high consumer awareness and food innovation investments, drives the region’s dominance. Europe follows, supported by its focus on sustainable ingredients and regulatory support for natural additives.

The Asia Pacific region is growing rapidly due to expanding processed food industries and health-conscious consumers. Latin America is seeing gradual adoption in bakery and convenience foods, while the Middle East & Africa show steady growth driven by urbanization and dietary diversification. While North America and Europe lead, the Asia Pacific and emerging markets offer significant growth potential for the pea starch market.

Top Use Cases

- Food Thickener and Stabilizer: Pea starch acts as a natural thickener in soups, sauces, and dairy alternatives, improving texture and consistency without changing taste. It helps bind water and fats in processed foods, making products creamier and more stable during cooking or freezing. This makes it ideal for clean-label items, appealing to health-focused consumers seeking gluten-free options in everyday meals.

- Gluten-Free Baking Aid: In bakery products like bread and snacks, pea starch replaces wheat flour to create fluffy textures and better crumb structure. It enhances volume, firmness, and shelf life in gluten-free recipes, preventing dryness and improving freeze-thaw stability. This supports the rising demand for allergen-free baked goods among sensitive eaters.

- Meat and Plant-Based Texturizer: Pea starch binds ingredients in meat products and plant-based alternatives, such as burgers and canned meats, to control moisture and maintain firmness. It forms strong gels that mimic real meat texture, reducing sogginess during storage and enhancing overall mouthfeel for vegan options popular in sustainable diets.

- Edible Film and Coating: Used in thin films, pea starch preserves freshness in fruits, vegetables, and nuts by forming protective layers that resist temperature changes and prevent spoilage. It maintains nutritional value and firmness in packaged foods, offering an eco-friendly way to extend shelf life without synthetic additives.

- Pharmaceutical Binder: In tablets and capsules, pea starch serves as a filler and disintegrant, helping drugs break down properly for better absorption. Its neutral properties make it suitable for nutraceuticals, supporting clean formulations that align with natural health trends and improving product stability in various dosage forms.

Recent Developments

1. Ingredion

Ingredion is expanding its pea protein and starch capabilities through its joint venture with Verdient Foods. Recent focus includes scaling production to meet the rising demand for plant-based ingredients, emphasizing supply chain localization in North America. They continue to innovate in texturizing and functional native pea starches for meat and dairy alternatives, aiming to improve clean-label offerings and sustainability profiles for their global customers.

2. Roquette Frères

Roquette has significantly invested in its pea starch and protein capacity with its new plant in Portage la Prairie, Manitoba, one of the world’s largest pea protein facilities. This expansion strengthens their NUTRALYS portfolio, supporting the fast-growing plant-based market. Their recent R&D focuses on enhancing the functionality and purity of pea starch for clinical nutrition and texturizing applications, driving innovation in the sector.

3. Yantai Shuangta Food Co., Ltd

As a leading Chinese manufacturer, Yantai Shuangta continues to vertically integrate and expand its pea starch and protein production. A key recent development is their increased focus on high-purity, non-GMO isolates for the domestic and Asian markets, particularly for cell-cultured meat scaffolding and transparent pea protein beverages. They are leveraging their scale to become a dominant supplier in the Asia-Pacific region, investing in new extraction technologies.

4. Ebro Foods, S.A.

Through its subsidiary Pastas Gallo, Ebro Foods is leveraging pea starch to develop innovative, high-fiber, and protein-enriched pasta products. Their recent development focuses on clean-label reformulation, using pea starch to improve the texture and nutritional profile of gluten-free and legume-based pasta. This strategic move diversifies their traditional rice and pasta portfolio to capture health-conscious consumers, particularly in the European market.

5. Puris

Puris, backed by Cargill, continues its vertical integration from seed to shelf, recently scaling its pea starch and protein production at its Minnesota facility. A key development is the commercialization of their pure, functional pea starch for use in plant-based meats, noodles, and bakery products, emphasizing its non-GMO and allergen-free credentials. Their proprietary pea varieties are bred for superior functionality, a key innovation driver for the company.

Conclusion

Pea starch represents a promising ingredient in the evolving food and industrial landscape, driven by consumer shifts toward plant-based, gluten-free, and sustainable options. Its versatile properties, including strong gelling and thickening, enable innovative applications across sectors like baking, meat analogs, and pharmaceuticals. As clean-label demands grow, pea starch supports healthier, eco-friendly products, positioning it for continued expansion in response to wellness and environmental priorities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)