Table of Contents

Introduction

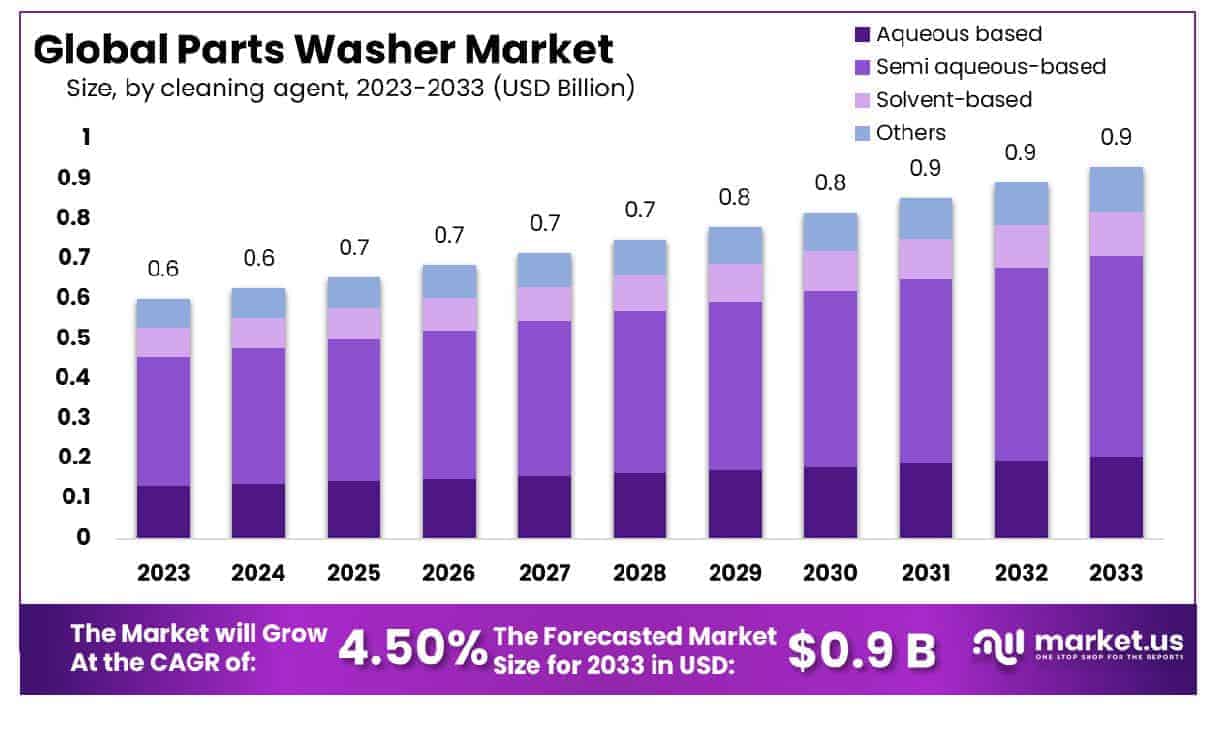

The Global Parts Washer Market is projected to reach a value of approximately USD 0.9 billion by 2033, increasing from USD 0.6 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 4.50% during the forecast period from 2024 to 2033.

A parts washer is a specialized cleaning equipment used to remove contaminants, such as grease, oil, dirt, and other residues, from components in various industries. These machines employ a variety of cleaning methods, including aqueous, solvent-based, or ultrasonic cleaning, depending on the nature of the contaminants and the material of the parts. Parts washers are essential in industries like automotive, manufacturing, aerospace, and metalworking, where maintaining the cleanliness of components is critical for ensuring optimal performance, longevity, and safety.

The parts washer market refers to the industry that manufactures, distributes, and services these cleaning systems. It includes a wide range of products, from manual hand-wash stations to automated, high-efficiency machines that meet specific industry standards. This market has experienced steady growth, driven by increasing demands for precision, quality control, and adherence to environmental regulations. The rise in industrial automation and the expanding manufacturing sector, particularly in emerging economies, has further bolstered the market’s expansion. Additionally, the growing focus on sustainability and the shift towards eco-friendly, water-based cleaning solutions has led to increased adoption of parts washers that utilize less harmful chemicals and conserve water.

Demand for parts washers is expected to rise as industries seek to enhance operational efficiency and minimize downtime through faster, more effective cleaning processes. The opportunity lies in the development of innovative, automated systems that can reduce labor costs, improve throughput, and integrate with existing manufacturing workflows. Furthermore, the increasing emphasis on regulatory compliance and environmentally friendly solutions provides ample growth prospects for companies focusing on sustainable technologies.

Key Takeaways

- The Global Parts Washer Market is projected to grow from USD 0.6 billion in 2023 to USD 0.9 billion by 2033, at a CAGR of 4.50% over the forecast period.

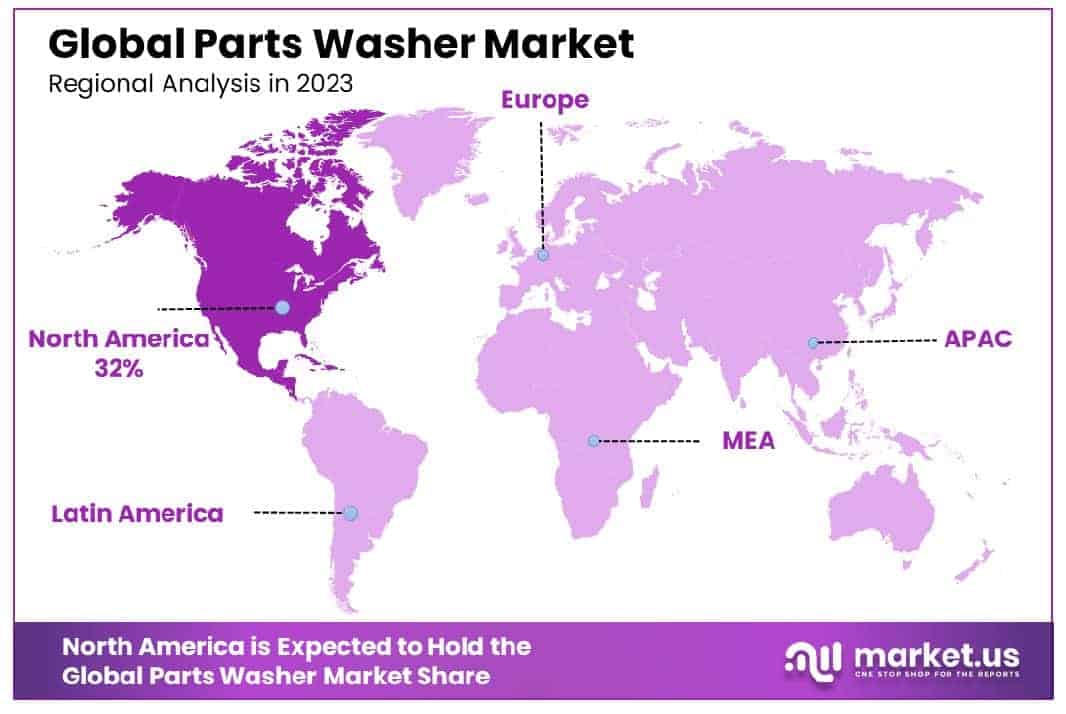

- North America holds the largest market share, contributing approximately 32% of global sales, driven by strong demand in automotive and industrial sectors.

- Solvent-based cleaning agents lead the market, holding a 43% share, due to their effective cleaning properties in heavy-duty industrial applications.

- The automotive industry dominates parts washer usage, accounting for 31% of total applications, with widespread adoption for vehicle maintenance and repair.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 0.6 Billion |

| Forecast Revenue (2033) | USD 0.9 Billion |

| CAGR (2024-2033) | 4.50% |

| Segments Covered | By Cleaning Agent(Aqueous based, Semi aqueous-based, Solvent-based, Others), By Application (Aerospace, Automotive, Printing, Manufacturing, Other Applications) |

| Competitive Landscape | ALKOTA, RG Hanson, AEC Systems, Renegade Parts Washers USA, Roto-jet, RAMCO, Sturm Holding GmbH, PROCECO, Jenfab, Stoelting Cleaning, Other Key Players |

Emerging Trends

- Automation Integration: The integration of automation technology into parts washers is on the rise. Automated washers, utilizing robotic arms and conveyor systems, are increasingly being adopted to improve efficiency, reduce human intervention, and ensure consistent washing quality.

- Sustainability Focus: There is a growing emphasis on eco-friendly parts washers that minimize water and chemical usage. Many manufacturers are shifting towards closed-loop systems, reducing waste generation and making parts washing more sustainable in industrial environments.

- Use of Solvent-Free Systems: Solvent-free parts washers are gaining popularity as they align with stricter environmental regulations. These systems are designed to operate without hazardous solvents, thereby reducing harmful emissions and chemical exposure.

- Rise of IoT-Enabled Solutions: Internet of Things (IoT) integration in parts washers is becoming more common, allowing real-time monitoring of washer performance, maintenance needs, and energy consumption. These smart washers help optimize maintenance schedules and increase the lifespan of the equipment.

- Compact and Mobile Solutions: The demand for compact and portable parts washers is increasing, especially in industries that require mobile cleaning solutions. These systems are flexible, easy to deploy, and often used in smaller manufacturing setups or maintenance operations.

Top Use Cases

- Automotive Manufacturing: Parts washers are essential in automotive manufacturing to clean components such as engine parts, transmission components, and brake systems. These washers ensure parts are free from contaminants before assembly, which is crucial for vehicle performance and safety.

- Aerospace Industry: In aerospace, parts washers are critical for cleaning turbine blades, jet engine parts, and other delicate components. The cleaning process ensures that parts meet strict quality standards and are free from oil, grease, and other contaminants that could compromise their integrity.

- Heavy Equipment Manufacturing: Parts washers are used extensively in the heavy equipment industry, where large machinery parts, such as gears and bearings, need to be cleaned thoroughly to maintain operational efficiency and safety.

- Medical Device Manufacturing: Precision is paramount in the medical device industry, and parts washers are employed to clean small, intricate components like surgical instruments, ensuring they are free from contaminants and meet sterilization standards.

- Maintenance and Repair Operations (MRO): Parts washers are essential in MRO applications, where equipment parts, tools, and machinery undergo routine cleaning. These washers support regular maintenance practices, extending equipment life and enhancing operational reliability.

Major Challenges

- High Operational Costs: The cost of maintaining and operating parts washers, especially those using solvents, can be quite high. Expenses related to energy consumption, water treatment, and disposal of waste materials are significant, which may discourage smaller manufacturers from investing in such systems.

- Environmental Compliance: Adhering to environmental regulations regarding the disposal of wastewater, chemicals, and oils remains a challenge. Parts washers must meet stringent requirements to ensure they do not cause environmental damage, requiring continuous investment in compliance efforts.

- Equipment Downtime: Regular maintenance of parts washers is essential to ensure smooth operations, but unexpected downtime can occur due to mechanical failures or clogging. This can disrupt production processes and lead to delays, impacting the overall efficiency of operations.

- Need for Specialized Training: Parts washers, especially advanced automated and IoT-enabled systems, often require specialized skills for setup, operation, and maintenance. Training the workforce to operate and troubleshoot these systems can be time-consuming and costly.

- Space Constraints in Small Facilities: In small manufacturing or repair facilities, there is often a lack of space to install large parts washers. The need for compact and mobile solutions has increased, but integrating parts washers in space-constrained environments remains a challenge for many operators.

Top Opportunities

- Shift Towards Eco-Friendly Solutions: The rising demand for eco-friendly and solvent-free parts washers presents a significant opportunity for manufacturers. By innovating in green technologies and providing solutions that align with sustainability goals, companies can capture market share in environmentally conscious industries.

- Growth in Emerging Markets: Expanding industrialization in emerging markets offers a growth opportunity for parts washer manufacturers. As manufacturing activities increase, especially in countries with developing automotive and aerospace sectors, there is a growing demand for efficient and reliable parts cleaning systems.

- Technological Advancements: The development of more efficient and technologically advanced parts washers, including IoT-enabled systems, can revolutionize the market. These innovations can drive demand for more automated and data-driven solutions, which promise improved operational efficiency and cost reduction.

- Regulatory Push for Cleaner Processes: Stricter regulations around industrial cleaning processes, particularly in high-precision industries such as aerospace and automotive, provide an opportunity to develop advanced cleaning solutions that comply with these standards, positioning manufacturers for success in these sectors.

- Adoption in New Sectors: Parts washers are increasingly being adopted outside traditional industries like automotive and aerospace. Sectors such as electronics, pharmaceuticals, and food processing, where cleanliness and precision are essential, represent untapped markets for parts washer technology.

Key Player Analysis

In 2024, the Global Parts Washer Market continues to be shaped by key players that offer a range of specialized cleaning and maintenance solutions for various industries. Companies like ALKOTA, RG Hanson, and AEC Systems are expected to leverage their long-established reputations and strong market presence to drive innovation and maintain competitive advantage. Renegade Parts Washers USA and Roto-jet are anticipated to focus on expanding their product offerings with advanced, eco-friendly cleaning technologies, aligning with growing sustainability trends.

RAMCO and Sturm Holding GmbH are likely to emphasize customization and automation in their systems, catering to diverse customer needs across sectors such as automotive and aerospace. PROCECO, Jenfab, and Stoelting Cleaning are expected to continue developing high-performance washers, driven by increasing demand for efficient, cost-effective cleaning solutions. Together, these players are well-positioned to maintain leadership in the market, although the rise of new entrants and technological advancements may foster increased competition.

Market Key Players

- ALKOTA

- RG Hanson

- AEC Systems

- Renegade Parts Washers USA

- Roto-jet

- RAMCO

- Sturm Holding GmbH

- PROCECO

- Jenfab

- Stoelting Cleaning

- Other Key Players

Regional Analysis

North America is the dominant region in the parts washer market, expected to account for 32% of the global market share in 2024. This leading position can be attributed to the strong presence of key industries such as automotive, aerospace, and heavy machinery manufacturing, which require efficient cleaning systems for parts and components. The demand for parts washers in this region is further bolstered by stringent regulatory frameworks focused on environmental sustainability and workplace safety.

The U.S., in particular, is a significant contributor to the regional market, driven by continuous advancements in industrial technology and the widespread adoption of eco-friendly and automated washing solutions. Additionally, high investments in the maintenance of machinery and equipment in sectors like manufacturing, automotive repair, and oil and gas also foster market growth.

Another critical factor driving the North American market is the growing preference for compliance with environmental regulations regarding waste disposal and water usage. These regulatory pressures encourage industries to adopt advanced cleaning technologies that are not only more efficient but also environmentally friendly. As a result, demand for more sophisticated parts washers, such as those using ultrasonic, aqueous, and solvent-based cleaning technologies, is expected to rise.

The integration of smart technologies into parts washers, such as IoT-based solutions that offer real-time monitoring and maintenance capabilities, is also becoming more prevalent in North America. These innovations contribute to operational efficiency and cost savings, which further solidify the region’s leadership in the market.

Recent Developments

- In January 2025, Infosys (NSE: INFY) announced the introduction of a new digital transformation platform designed to optimize manufacturing processes for global clients. This platform integrates AI and machine learning to improve operational efficiency, providing real-time data analysis to enhance decision-making and reduce production downtime. The solution leverages advanced automation tools to streamline workflows and increase productivity across industries.

- In October 2024, AcmeTech Inc. (NASDAQ: ACTX) launched a groundbreaking software solution aimed at reducing cybersecurity risks for small and medium-sized enterprises (SMEs). The software offers an intuitive interface for monitoring and responding to potential security threats, providing SMEs with affordable and easy-to-use tools to safeguard their digital infrastructure. This initiative is expected to contribute significantly to enhancing the cybersecurity posture of businesses with limited resources.

- In March 2025, GreenEarth Innovations, a leading sustainable energy company, announced a new partnership with a major utility provider to install their cutting-edge solar panel systems across urban regions in the U.S. This collaboration aims to accelerate the adoption of renewable energy solutions and help cities achieve their sustainability goals by reducing carbon emissions and improving energy efficiency.

- In July 2024, BrightTech Industries (LSE: BRT) revealed its plans to introduce an advanced 3D printing technology for the automotive industry. This innovation will allow manufacturers to produce lightweight and durable vehicle parts faster and at a lower cost, with the potential to revolutionize supply chains and reduce material waste. The new technology is expected to significantly enhance the production process for electric vehicle manufacturers globally.

Conclusion

The global parts washer market is poised for continued growth as industries increasingly prioritize efficiency, sustainability, and regulatory compliance. Technological advancements, including automation, IoT integration, and solvent-free solutions, are shaping the future of the market, offering significant opportunities for both established players and new entrants. The rising demand for eco-friendly and cost-effective cleaning systems, coupled with the expanding industrial base in emerging economies, is expected to drive the adoption of advanced parts washers across a range of sectors. As industries focus on optimizing operational performance and minimizing environmental impact, parts washers will remain essential tools in ensuring the cleanliness, functionality, and longevity of critical components.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)