Table of Contents

Overview

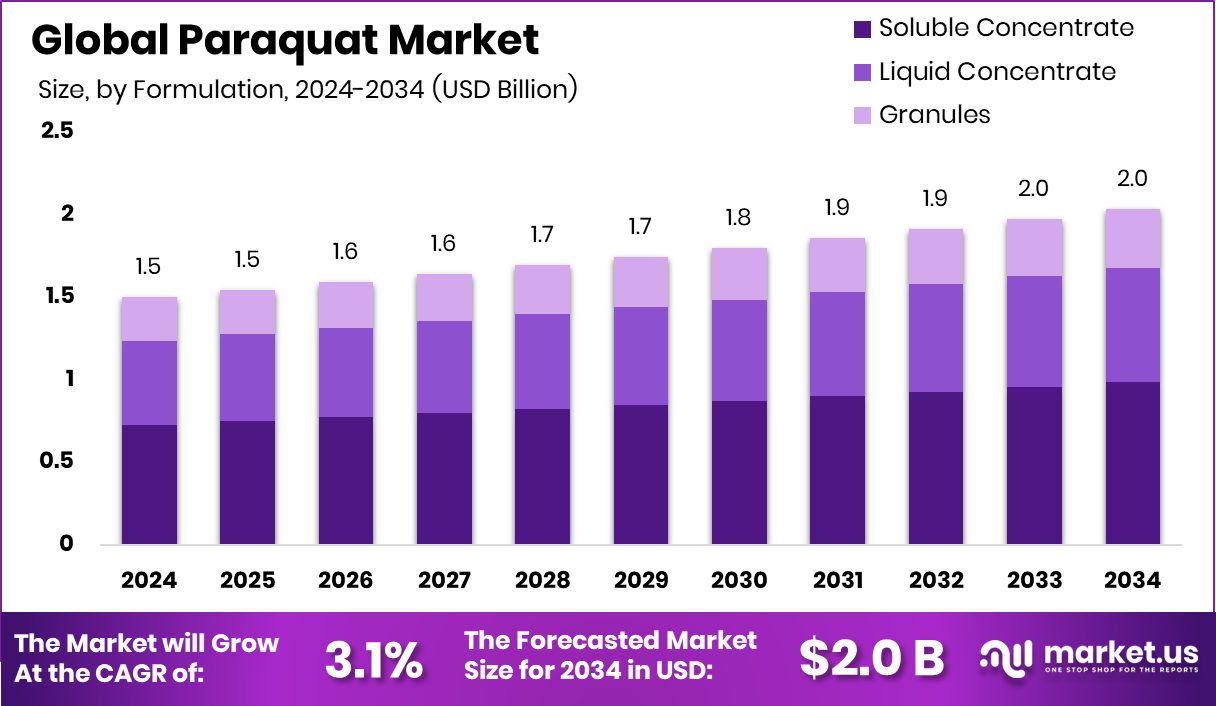

New York, NY – September 23, 2025 – The Global Paraquat Market is projected to reach approximately USD 2.0 billion by 2034, up from USD 1.5 billion in 2024, reflecting a CAGR of 3.1% between 2025 and 2034. North America holds a dominant share of 43.9%, valued at around USD 0.6 billion, driven by the region’s reliance on effective herbicides for large-scale agriculture.

Paraquat is a fast-acting, non-selective herbicide commonly used to control weeds and unwanted grasses across diverse crop fields. Its effectiveness in managing invasive plants and preparing land for new cultivation makes it a vital tool for modern agriculture. However, due to its high toxicity, strict safety protocols and handling regulations are mandatory to protect both farmers and the environment.

The paraquat market encompasses the global production, trade, and consumption of this herbicide. It is influenced by factors such as rising agricultural demand, government policies, and the need for efficient weed management solutions. Research and innovation also play a role, as exemplified by UTIA scientists receiving an $800,000 grant to advance studies on oilseed crops.

A key driver of market growth is the increasing demand for higher crop yields to ensure global food security. With the world population expected to surpass 9 billion, farmers are seeking reliable herbicides like paraquat to quickly and effectively manage weeds, enabling optimal crop growth.

Additionally, the herbicide’s use in crops such as soybeans, maize, cotton, and rice supports its widespread adoption. Its rapid action reduces labor requirements and saves time, making it an attractive choice in regions with heavy weed pressure. Cano-ela’s recent €1.6 million funding to develop innovative plant-based oilseed ingredients further underscores the focus on agricultural efficiency and sustainable crop solutions.

Key Takeaways

- The Global Paraquat Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 3.1% from 2025 to 2034.

- Soluble concentrate formulations dominated the Paraquat market, capturing a strong 48.5% share.

- Cereals accounted for 44.8% of the Paraquat market, highlighting their essential role in staple crop production.

- Agriculture applications led the Paraquat market with 66.7% share, reflecting its widespread adoption in farming practices.

- Contact herbicides dominated the Paraquat market at 74.9%, showcasing paraquat’s effectiveness in quick weed control.

- The strong market position of North America, 43.9% share, USD 0.6 Bn, reflects advanced agricultural practices.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-paraquat-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 3.1% |

| Segments Covered | By Formulation (Soluble Concentrate, Liquid Concentrate, Granules), By Crop Type (Cereals, Oilseeds, Fruits, Vegetables), By Application (Agriculture, Horticulture, Industrial), By Herbicide Mechanism (Contact Herbicide, Non-Selective Herbicide) |

| Competitive Landscape | Adama, Corteva Agriscience, FMC, UPL, Jiangsu Taibai Agriculture, Syngenta, BASF, Shandong Luba Chemical |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156991

Key Market Segments

By Formulation Analysis

In 2024, soluble concentrate formulations led the paraquat market, commanding a 48.5% share. This dominance is driven by their ease of application, rapid action, and high efficacy in controlling a wide range of weeds. Soluble concentrates are favored for their quick absorption, which minimizes labor and time in land preparation and crop protection.

Their compatibility with standard spraying equipment and consistent performance across diverse climatic and soil conditions make them a top choice for large-scale farming. Additionally, their ease of transport and storage enhances their appeal for both small and large agricultural operations, particularly for crops like rice, maize, soybeans, and cotton, where effective weed control is critical for healthy yields.

By Crop Type Analysis

Cereals held a leading 44.8% share of the paraquat market in 2024, underscoring paraquat’s vital role in staple crop production, including wheat, rice, maize, and barley. With global population growth and rising food demand, paraquat’s fast-acting, broad-spectrum weed control is essential for protecting cereal yields from aggressive weed competition.

Its dominance reflects the extensive global cultivation of cereals and their importance to food security across regions like the Asia-Pacific and Latin America. Paraquat’s rapid action, ease of use, and cost-effectiveness make it indispensable for large-scale cereal farming, where timely weed management directly impacts productivity and profitability. Its continued reliance is expected to sustain its leadership in this segment.

By Application Analysis

Agriculture applications dominated the paraquat market in 2024, capturing a 66.7% share. This reflects paraquat’s critical role in modern farming, particularly in managing weed pressure across extensive cultivation areas. It’s fast-acting, broad-spectrum weed control protects yields in crops such as rice, maize, soybeans, and cotton, making it a key tool for maintaining crop health and preparing fields for planting.

The significant share highlights the demand for efficient crop protection in regions with intensive farming, driven by rising global food needs. Paraquat’s adaptability to various climates and soil types, combined with its ability to reduce labor-intensive practices, reinforces its importance in enhancing agricultural productivity and profitability.

By Herbicide Mechanism Analysis

Contact herbicides, led by paraquat, held a commanding 74.9% share of the market in 2024. This dominance is due to their rapid action, directly targeting plant tissues for quick and visible weed control. This is particularly valuable in agricultural systems where weeds compete aggressively with crops for resources.

Paraquat’s effectiveness in pre-planting field preparation and its ability to control a wide range of annual weeds make it a preferred choice for staple crops like cereals and oilseeds. Its simplicity, reduced labor needs, and reliability across diverse farming operations further drive its widespread adoption.

Regional Analysis

North America led the Paraquat Market, capturing a 43.9% share with a market value of USD 0.6 billion.

The Paraquat Market exhibits diverse regional dynamics influenced by varying agricultural practices, regulatory frameworks, and crop demands across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America’s dominance in 2024, with a 43.9% market share, is driven by extensive cultivation of cereals, maize, and soybeans, where paraquat’s rapid, broad-spectrum weed control is essential for sustaining high yields and profitability.

Farmers in the U.S. and Canada favor paraquat for its quick action and compatibility with advanced, mechanized farming systems. North America’s leadership is bolstered by robust agricultural infrastructure and widespread herbicide use in both commercial and subsistence farming.

Stringent regulations promote safe application, while strong demand for efficient weed management supports paraquat’s adoption. The region’s ability to align productivity with environmental considerations through clear guidelines further strengthens its position. Moving forward, North America is poised to retain its market lead, driven by ongoing advancements in farming techniques and the need to meet rising food production demands effectively.

Top Use Cases

- Weed Control in Soybean Fields: Farmers spray paraquat on soybean crops to quickly knock out tough weeds that steal water and nutrients from the plants. This fast-acting spray clears the field without harming the main crop, helping growers boost yields and cut down on hand-weeding labor. It’s a go-to choice for busy seasons when weeds pop up fast, keeping fields clean and healthy for better harvests.

- Pre-Plant Burndown in Corn Planting: Before sowing corn seeds, paraquat is used to burn down old weeds and crop leftovers on the soil surface. This quick cleanup prepares the ground smoothly, saving time and reducing the need for deep plowing. Farmers love how it works in just days, ensuring seeds get a strong start without weed competition right from the beginning.

- Cotton Defoliation Before Harvest: Paraquat acts as a defoliant to dry up cotton plant leaves near picking time, making it easier to gather the fluffy bolls without green bits mixed in. This speeds up the harvest process and improves fiber quality for mills. It’s especially handy in areas with wet weather that could delay natural leaf drop.

- Non-Farm Weed Management Along Roadsides: Highway crews apply paraquat to control overgrown grasses and bushes along roads and railways, keeping visibility clear and preventing fire risks. The spray’s contact action zaps weeds on the spot without spreading to nearby areas, making it ideal for quick maintenance jobs that keep public spaces safe and tidy year-round.

- Desiccant for Legume Crop Drying: In legume fields like peas or beans, paraquat dries out the plants evenly before harvest, locking in seed quality and avoiding mold from uneven ripening. This helps farmers collect crops faster, even in damp conditions, and ensures cleaner storage. It’s a simple tool that turns tricky weather into no big deal for steady output.

Recent Developments

1. Adama

Adama continues to face significant legal and regulatory pressure over its paraquat-based herbicide, Gramoxone. The company is actively defending against thousands of lawsuits in the US alleging a link between paraquat and Parkinson’s disease. Recent developments include ongoing court-ordered mediation attempts to reach a potential settlement, while the company maintains its position on the safety of its product when used as directed.

2. Corteva Agriscience

Corteva Agriscience fully divested from its former parent, DowDuPont, in 2019 and no longer manufactures or sells paraquat. The company has shifted its focus towards developing a more sustainable portfolio of crop protection products, including biologicals and precision agriculture technologies. Their current operations and recent developments are entirely separate from the ongoing paraquat-related litigation faced by other manufacturers.

3. FMC

FMC Corporation does not produce or sell paraquat. Their current crop protection portfolio is focused on insecticides, herbicides, and fungicides that do not include this chemistry. Recent developments highlight their investment in innovative R&D for new active ingredients and proprietary precision application systems, distinctly separating their business from the paraquat market and its associated legal challenges.

4. UPL

UPL Ltd. remains a major global producer of paraquat, marketed under brands like Chevron and Gramoxone. The company emphasizes proper stewardship and safe use protocols. Recent developments are dominated by its involvement in the extensive US multi-district litigation (MDL) concerning Parkinson’s disease claims. UPL, alongside other defendants, is engaged in the legal defense and mediation process while continuing global sales where approved.

5. Jiangsu Taibai Agriculture

Jiangsu Taibai Agriculture is a significant Chinese manufacturer of paraquat. A key recent development was the industry-wide shift following China’s 2016 ban on paraquat aqueous solutions, which led manufacturers to produce only paraquat technical concentrates (TK) for export. The company focuses on supplying this ingredient to international agrochemical partners who then formulate end-use products, primarily for markets in the Americas and Asia.

Conclusion

Paraquat remains a key player in global farming despite growing calls for safer options. Its quick weed-busting power and fit for modern no-till methods make it vital for protecting staple crops and easing labor in tough fields. Yet, with rising focus on health and eco-friendly practices, the shift toward targeted sprays and gentler alternatives will shape its future. Overall, paraquat’s role in feeding a growing world stays strong, but smart innovations must balance its benefits with better safeguards for users and nature.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)