Table of Contents

Overview

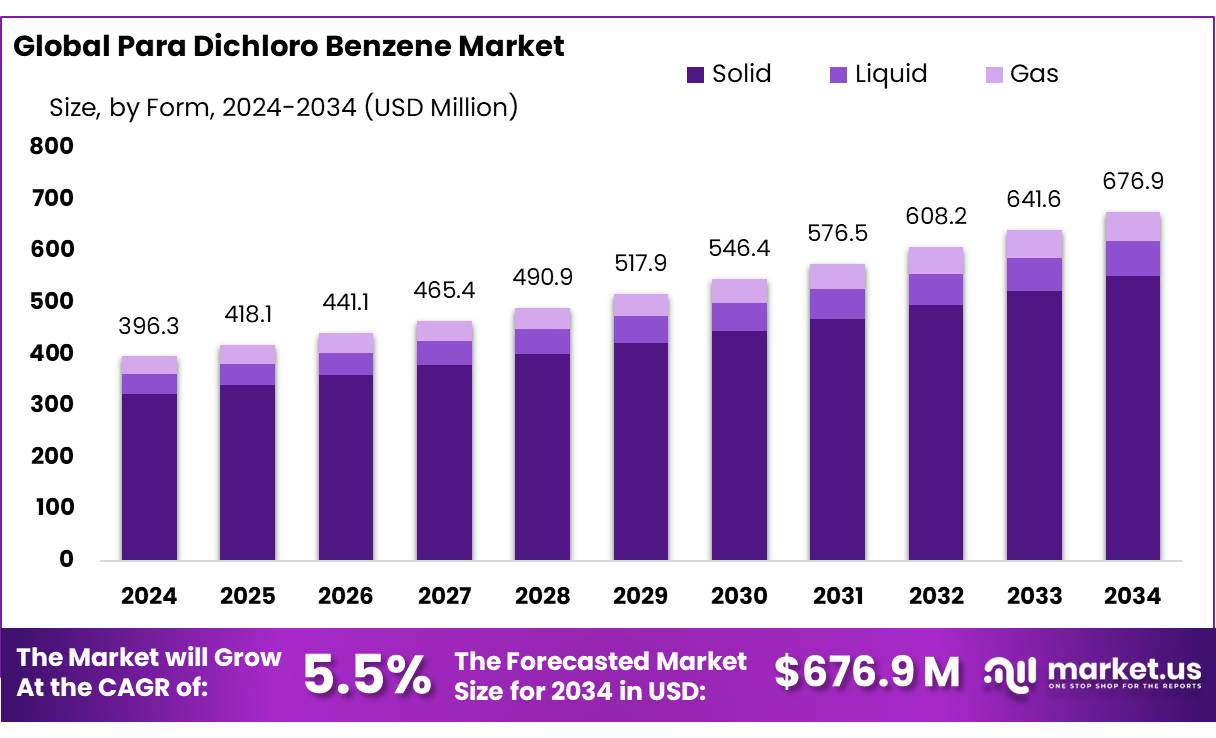

New York, NY – September 01, 2025 – The Global Para-Dichlorobenzene (PDCB) Market is projected to grow from USD 396.3 million in 2024 to USD 676.9 million by 2034, with a CAGR of 5.5% during the 2025–2034 forecast period. In 2024, the Asia-Pacific region led the market, accounting for 43.8% of the share, equivalent to USD 173.5 million in revenue.

Para-dichlorobenzene (p-DCB; CAS 106-46-7) is a chlorinated aromatic compound, a white solid with a mothball-like odor, produced through benzene chlorination and isomer separation. It serves as a key intermediate, notably for polyphenylene sulfide (PPS), and as an odor agent in deodorant blocks. In the U.S., the EPA’s Chemical Data Reporting indicates 50–100 million pounds of p-DCB were manufactured or imported, highlighting its industrial significance despite declining consumer applications.

PDCB is widely used as a chemical intermediate, industrial solvent, and in moth repellents and air fresheners. In India, a major player in the global chemical industry, PDCB production supports a sector that contributes 7% to the nation’s GDP. India, the sixth-largest chemical producer globally and third in Asia, manufactures over 80,000 chemical products.

In 2018, India exported approximately 41,665 metric tonnes of PDCB, valued at USD 40.05 million, reflecting strong global demand, per the Ministry of Commerce and Industry. The demand for PDCB is fueled by its applications in pest control (e.g., mothballs), deodorizing products, and as an intermediate in chemical manufacturing, ensuring its ongoing relevance in industrial processes.

Key Takeaways

- The Global Para-Dichlorobenzene Market size is expected to be worth around USD 676.9 million by 2034, from USD 396.3 million in 2024, growing at a CAGR of 5.5%.

- Solid held a dominant market position, capturing more than an 81.5% share of the para-dichlorobenzene market.

- High Purity held a dominant market position, capturing more than a 62.9% share in the para-dichlorobenzene market.

- Pesticides held a dominant market position, capturing more than a 39.8% share in the para-dichlorobenzene market.

- In 2024, the Asia-Pacific held a dominant market position, capturing more than a 43.8% share valued at USD 173.5 Mn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/para-dichloro-benzene-market/request-sample/

Report Scope

| Market Value (2024) | USD 396.3 Million |

| Forecast Revenue (2034) | USD 676.9 Million |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Form (Solid, Liquid, Gas), By Purity (High Purity, Low Purity), By Application (Pesticides, Fungicides, Herbicidal, Others) |

| Competitive Landscape | LANXESS, Arkema, KUREHA, SUMTOMO |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155244

Key Market Segments

By Form Analysis

In 2024, the solid form of para-dichlorobenzene (p-DCB) commanded an 81.5% market share due to its stability, ease of storage, and suitability for large-scale industrial uses, including moth repellents, deodorant blocks, and as an intermediate for polyphenylene sulfide (PPS). Its crystalline structure offers a longer shelf life and lower handling risks compared to liquid forms, making it a preferred choice for industrial buyers seeking consistent quality and cost efficiency in bulk chemical production.

Looking ahead to 2025, demand for solid p-DCB is expected to remain robust, supported by its compatibility with closed-loop industrial processes and compliance with stringent transportation and storage regulations. The solid form’s consistent physical properties enable precise dosing in manufacturing, ensuring process reliability and quality control. Its lower volatility also aligns with environmental safety and occupational health standards, reinforcing its market dominance.

By Purity Analysis

In 2024, high-purity p-DCB captured a 62.9% market share, driven by its critical role in specialty chemical manufacturing, particularly for high-performance polymers like PPS and precision applications requiring consistent chemical composition. Industries favored high-purity grades for their superior performance, minimal impurities, and compliance with strict regulatory and quality standards.

In 2025, this trend is expected to persist as demand grows in electronics, automotive, and advanced materials sectors. High-purity p-DCB’s stable composition enhances product yields and process efficiency, justifying its premium pricing. Stricter environmental and safety regulations are also pushing manufacturers toward cleaner, high-purity inputs to minimize byproducts and emissions, further solidifying their market position.

By Application Analysis

In 2024, pesticides accounted for a 39.8% share of the p-DCB market, leveraging its potent insecticidal and fumigant properties for controlling moths, beetles, and other pests in stored grains and agricultural settings. Farmers and storage operators valued p-DCB-based pesticide formulations for their long-lasting protection and cost-effectiveness.

The solid form’s stability and low volatility facilitate easy application and storage, particularly in rural supply chains. In 2025, demand is expected to remain steady, driven by the need to protect crops and food stocks from post-harvest losses. Its role in integrated pest management, especially in high-grain-production regions, will likely sustain this segment’s strength despite increasing regulatory scrutiny.

Regional Analysis

APAC dominates with a 43.8% share, valued at USD 173.5 million in 2024.

In 2024, the Asia-Pacific region led the p-DCB market with a 43.8% share, generating USD 173.5 million in revenue. This dominance is driven by large chemical hubs, integrated chlor-alkali capacity, and consistent demand for pesticides, deodorant blocks, and PPS intermediates.

China’s expertise in chlorination and benzene derivatives ensures competitive pricing and reliable supply, while India’s robust agro-inputs sector supports steady demand for pesticides and storage-protection applications. Buyers in 2024 preferred APAC suppliers for short lead times, consistent crystalline quality, and efficient port networks backed by contract manufacturing clusters.

Producers enhanced compliance through investments in closed-loop handling, emissions control, and wastewater treatment, meeting stricter plant audits and gaining favor with multinational clients. In 2025, APAC’s leadership is expected to continue, supported by capacity expansions, improved rail-port logistics, and a shift toward higher-purity grades for specialty synthesis.

Stable feedstock availability for benzene and chlorine will maintain price discipline, reducing volatility and supporting consistent quarterly contracts. APAC’s combination of scale, feedstock integration, and robust environmental, health, and safety practices ensures sustained market leadership, with strong utilization in pesticide formulations and PPS polymer production across key markets.

Top Use Cases

- Moth Repellent in Household Products: PDCB is widely used in mothballs and pest control products to protect clothes and fabrics from moths and insects. Its solid form releases a vapor that repels pests effectively, making it a popular choice for home storage solutions due to its long-lasting effect and affordability.

- Deodorizer for Restrooms and Waste Areas: PDCB is a key ingredient in deodorant blocks for toilets and trash cans. Its strong odor masks unpleasant smells, ensuring fresher environments in public and commercial spaces. The solid form’s slow vapor release provides consistent deodorizing performance, making it cost-effective for facility management.

- Chemical Intermediate for PPS Production: PDCB serves as a crucial intermediate in manufacturing polyphenylene sulfide (PPS), a high-performance polymer used in electronics and automotive parts. Its stable chemical properties ensure quality in industrial processes, meeting the growing demand for durable, heat-resistant materials in advanced manufacturing sectors.

- Pesticide in Agricultural Storage: PDCB is used in pesticide formulations to protect stored grains and crops from pests like beetles and moths. Its fumigant properties ensure effective pest control in agricultural storage, reducing post-harvest losses and supporting food security, especially in regions with large-scale grain production.

- Solvent in Industrial Applications: PDCB acts as a solvent in chemical manufacturing, aiding in the production of dyes, pharmaceuticals, and plastics. Its ability to dissolve various compounds makes it valuable for precise industrial processes, supporting efficient production in specialty chemical industries with consistent quality and performance.

Recent Developments

1. LANXESS

LANXESS focuses on p-DCB as a key precursor for its high-performance engineering plastics. Recent developments are tied to their strategic expansion in Asia, particularly China, to strengthen the value chain for polyamide 66, where p-DCB is an intermediate for the monomer. This supports growing demand in the automotive and electrical industries for heat-resistant components.

2. Arkema

Arkema’s recent developments involve managing its p-DCB production, a critical raw material for paradichlorobenzene-based products. The company’s focus is on integrating p-DCB into its broader value chain for technical polymers and other specialty chemicals. Their R&D emphasizes process optimization and safety, ensuring a stable supply for downstream applications while adhering to stringent global regulatory and environmental standards for the substance.

3. KUREHA

KUREHA is a major global producer of p-DCB. A key recent development is their focus on securing and expanding their market position by leveraging their integrated production process from chlorine to the final product. Their strategy emphasizes high-purity p-DCB, primarily for use as an intermediate in producing Polyphenylene Sulfide (PPS) resin, a high-growth engineering plastic, rather than for moth repellent applications.

4. SUMITOMO CHEMICAL

Sumitomo Chemical’s main development regarding p-DCB is its phase-out in consumer products. The company has publicly stated its commitment to ceasing production and sales of moth repellents and deodorants containing p-DCB due to environmental and health concerns. Their current production is focused on supplying p-DCB strictly for industrial use as a chemical intermediate, not for consumer-facing applications.

Conclusion

Para-dichlorobenzene (PDCB) is a versatile chemical with strong demand across household, agricultural, and industrial applications. Its role in moth repellents, deodorizers, pesticides, solvents, and PPS production highlights its market relevance. Despite regulatory scrutiny, PDCB’s cost-effectiveness and efficacy ensure steady growth, particularly in the Asia-Pacific.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)