Table of Contents

Overview

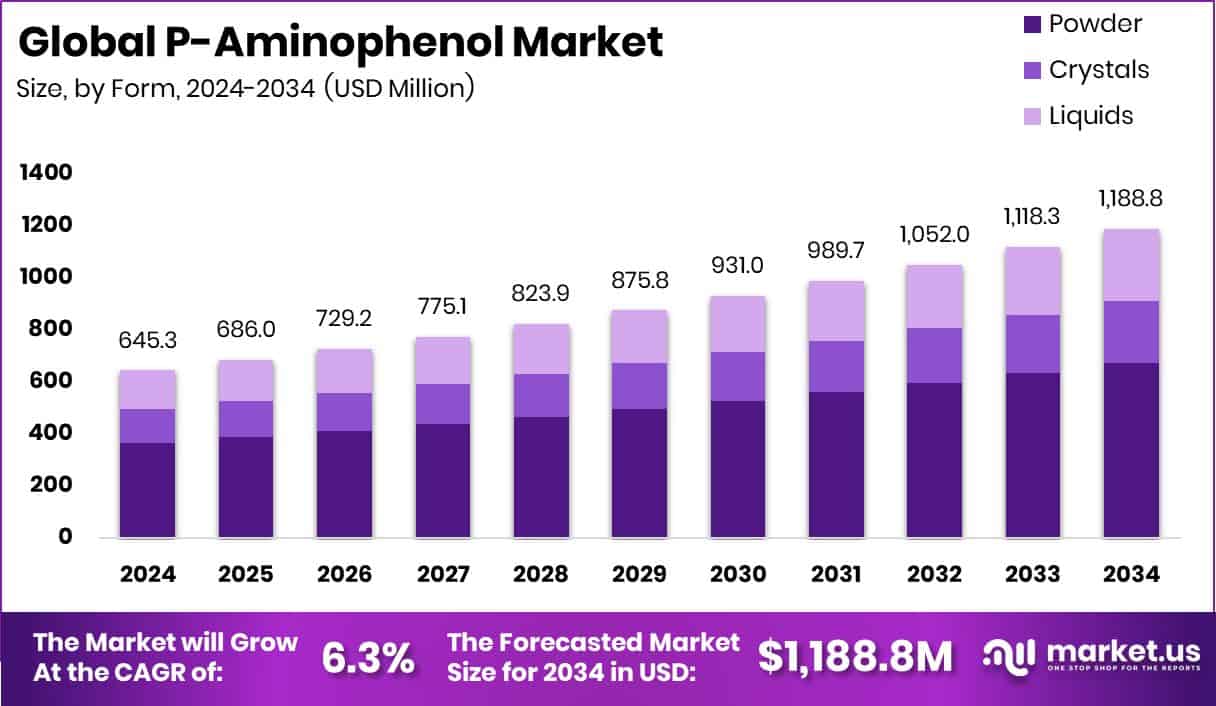

New York, NY – October 16, 2025 – The global P-Aminophenol market is projected to reach USD 1,188.8 million by 2034, growing from USD 645.3 million in 2024 at a 6.3% CAGR. Asia-Pacific, valued at USD 282.6 million, remains a key production hub. P-Aminophenol (C₆H₇NO) is a crystalline compound widely used in paracetamol manufacturing and hair dyes due to its reactive hydroxyl and amino groups.

Rising global demand for fever and pain-relief medicines, driven by population growth and healthcare expansion, strongly supports market growth. Beyond pharmaceuticals, its use in dyeing, photography, and polymer synthesis further adds value. Emerging bio-based production technologies and green chemistry innovations are creating sustainable growth pathways.

With government support for eco-friendly manufacturing and increased pharmaceutical R&D investments, the industry is shifting toward cleaner synthesis and higher-purity outputs, ensuring long-term development and wider industrial adoption of P-Aminophenol worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-p-aminophenol-market/request-sample/

Key Takeaways

- The Global P-Aminophenol Market is expected to be worth around USD 1,188.8 million by 2034, up from USD 645.3 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, the P-Aminophenol Market saw powder form dominate with a 56.8% share.

- Technical grade P-Aminophenol led the market, accounting for 67.5% due to wide industrial usage.

- Pharmaceuticals dominated the P-Aminophenol Market, capturing 63.4% of global consumption in 2024.

- Strong pharmaceutical production and expanding healthcare industries supported Asia-Pacific’s leading 43.80% share.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161223

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 645.3 Million |

| Forecast Revenue (2034) | USD 1,188.8 Million |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Form (Powder, Crystals, Liquids), By Grade (Technical Grade, Pharmaceutical Grade), By Application (Pharmaceuticals, Hair Dye Intermediates, Rubber Chemicals, Others) |

| Competitive Landscape | Anhui Bayi Chemical Industry Co. Ltd., CDH Fine Chemicals, Haihang Industry, Jayvir Dye Chem, Liaoning Shixing Pharmaceutical & Chemical Co., Ltd., Loba Chemie, Parachem Fine & Specialty Chemicals, Sadhana Nitro Chem Limited, Taixing Yangzi Pharm Chemical Co., Ltd., Valiant Organics Ltd., Wego Chemical Group |

Key Market Segments

By Form Analysis

In 2024, the Powder form dominated the By Form segment of the P-Aminophenol Market, accounting for a 56.8% share. Its popularity stems from high purity, easy handling, and suitability for large-scale paracetamol production. The powdered variant offers stable composition, better solubility, and consistent formulation results essential for pharmaceutical synthesis.

Manufacturers prefer it for controlled reactions, minimal impurities, and enhanced storage stability. Additionally, its cost-effectiveness and compatibility with automated processing systems make it a practical choice for both pharmaceutical and fine chemical sectors.

These advantages have reinforced the powder segment’s leadership in 2024, reflecting its crucial role in ensuring production efficiency and product uniformity across industrial applications, thereby maintaining its strong position within the global P-Aminophenol market landscape.

By Grade Analysis

In 2024, the Technical Grade segment led the P-Aminophenol Market by grade, capturing a 67.5% share. Its dominance is driven by extensive use in industrial and pharmaceutical synthesis, where efficiency and reliability are vital. Technical-grade P-Aminophenol is a key raw material for large-scale paracetamol and hair dye production, offering an ideal balance between purity and affordability.

Its uniform composition enables smooth chemical reactions and consistent product performance. With rising demand for bulk intermediates across pharmaceutical and cosmetic manufacturing, this grade remains the preferred choice for high-volume applications.

Its ability to deliver cost-effective, stable results reinforces its leadership in 2024, ensuring continued reliance on technical-grade material as a cornerstone of global P-Aminophenol production and industrial formulation processes.

By Application Analysis

In 2024, the Pharmaceuticals segment dominated the P-Aminophenol Market by application, accounting for a 63.4% share. This leadership stems from its essential role as an intermediate in producing paracetamol, one of the world’s most widely used analgesics and antipyretic drugs. The compound’s high purity, chemical stability, and reliable performance make it indispensable for precise pharmaceutical formulations.

Rising global healthcare needs, increasing drug consumption, and expanding medicine manufacturing capacities continue to strengthen this segment’s position. Moreover, the industry’s commitment to stringent quality standards and dependence on consistent raw materials sustain its leadership.

In 2024, these factors collectively ensured that pharmaceuticals remained the primary consumer of P-Aminophenol, reinforcing its importance in global drug production and maintaining its commanding role in the market landscape.

Regional Analysis

In 2024, Asia-Pacific dominated the global P-Aminophenol market, contributing 43.80% of total revenue, valued at approximately USD 282.6 million. This leadership is driven by a robust pharmaceutical manufacturing base in India, China, and Japan, where large-scale production of paracetamol and related drugs thrives. Government initiatives promoting local drug manufacturing and expanding healthcare infrastructure have further strengthened regional growth.

North America ranked next, supported by advanced R&D and efficient drug synthesis technologies, while Europe sustained steady demand through strict quality standards and rising healthcare spending. Emerging regions like Latin America and the Middle East & Africa are witnessing gradual growth as healthcare access expands.

Overall, Asia-Pacific remains the primary production and consumption hub for P-Aminophenol, backed by cost-effective manufacturing, strong pharmaceutical demand, and favorable regulations, reaffirming its global leadership in 2024.

Top Use Cases

- Intermediate in Paracetamol (Acetaminophen) synthesis: P-Aminophenol is acetylated (reacted with acetic acid or acetic anhydride) to form paracetamol, a common pain-reliever and fever reducer. It’s a critical precursor in that drug’s production.

- Hair dye precursor/developer: PAP is used in permanent hair dye formulations. It reacts with other dye intermediates to produce a stable color on hair, especially in oxidative dye systems.

- Textile and fabric dyeing: It serves as a building block for azo dyes used in coloring textiles, fur, feathers, etc., providing vibrant colors when coupled with other dye molecules.

- Photographic development/imaging chemicals: In black & white photography, PAP is used as a developer agent that helps convert latent images to visible ones by reducing silver halides and increasing contrast.

- Fine chemical building block / organic synthesis reagent: Chemists use PAP as a base molecule to build more complex compounds—whether in pharmaceuticals, specialty chemicals, or intermediates in organic synthesis.

- Analytical chemistry reagent: PAP can act as a reagent in spectrophotometry or chromatography, helping quantify or detect substances in a sample because of its known chemical reactivity and absorption properties.

Recent Developments

- In September 2024, a fire broke out at one of the company’s storage tanks in Roha, Maharashtra. Three contract workers died, and three sustained injuries. The fire was controlled in ~30 minutes. The company said it would review safety protocols.

- In August 2024, a statement was issued noting that Anhui Bayi Chemical Industry failed a GMP (Good Manufacturing Practice) inspection. The finding cited serious violations, contamination in the final product (which includes p-Aminophenol), and a lack of sufficient GMP knowledge.

Conclusion

The P-Aminophenol market continues to grow steadily, driven by its vital role in pharmaceutical and chemical manufacturing. Its use as a key intermediate in paracetamol production ensures consistent industrial demand worldwide. Expanding healthcare infrastructure, technological improvements in synthesis, and the shift toward sustainable chemical processes are shaping the industry’s future.

Producers are focusing on quality, safety, and environmental compliance to strengthen their market presence. With ongoing innovation in green chemistry and support from regulatory initiatives promoting cleaner production, the P-Aminophenol market is poised for stable expansion across pharmaceutical, cosmetic, and industrial applications in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)