Table of Contents

Overview

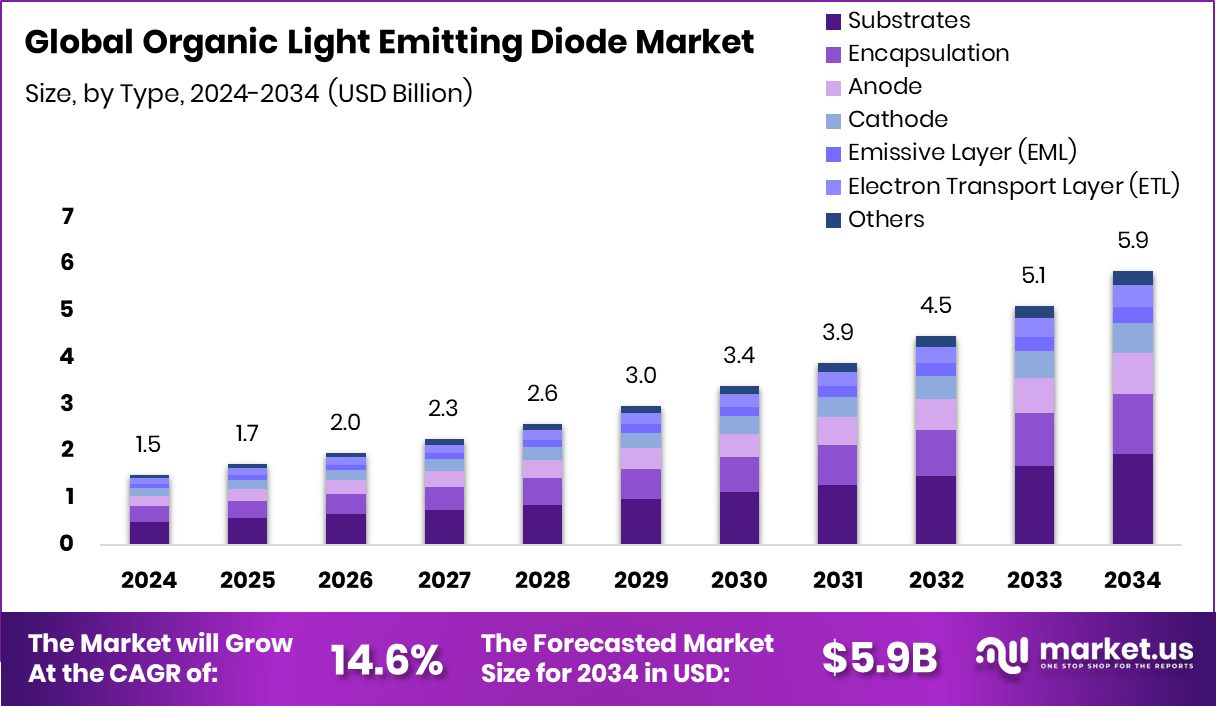

New York, NY – Nov 10, 2025 – The global Organic Light Emitting Diode (OLED) market is set to reach USD 5.9 billion by 2034, rising from USD 1.5 billion in 2024 at a CAGR of 14.6%. Asia-Pacific leads with 46.2%, valued at USD 0.6 billion, propelled by rapid industrialization and advanced manufacturing.

OLEDs, made from light-emitting organic compounds, offer thin, flexible, and energy-efficient displays without a backlight—ideal for smartphones, TVs, wearables, and automotive panels.

Growth is driven by consumer demand for premium, eco-friendly screens and innovations in organic materials. Strong global funding further supports OLED-related material science: Anaphite raised $13.7 M to scale dry-coating EV battery tech; QUT secured $2.2 M for cathode supply-chain research; Tozero gained €3.5 M for cathode recovery; the Faraday Institution invested £9 M in battery research; and ACT-ion attracted $7.5 M for cathode active materials.

These initiatives indirectly strengthen OLED innovation, enhancing efficiency and sustainability. Expanding uses in foldable phones, transparent displays, and automotive lighting, alongside declining costs, are paving the way for mass-market adoption. The market’s evolution is now closely tied to advancements in organic materials and the global shift toward greener technologies.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-organic-light-emitting-diode-market/request-sample/

Key Takeaways

- The Global Organic Light Emitting Diode Market is expected to be worth around USD 5.9 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 14.6% from 2025 to 2034.

- In 2024, substrates dominated the Organic Light Emitting Diode Market, capturing 26.7% share globally.

- Displays held the leading position in the Organic Light Emitting Diode Market with an 87.3% share.

- The Asia-Pacific region recorded a strong market value of USD 0.6 billion in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164224

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 5.9 Billion |

| CAGR (2025-2034) | 14.6% |

| Segments Covered | By Type (Substrates, Encapsulation, Anode, Cathode, Emissive Layer (EML), Electron Transport Layer (ETL), Others), By Application (Display, Lighting) |

| Competitive Landscape | Idemitsu Kosan Co.,Ltd., Toray Industries, Solus Advanced Materials, UNIVERSAL DISPLAY, Novaled GmbH, DUSKAN NEOLUX, SAMSUNG SDI, JiLin OLED Material Tech Co., Ltd |

Key Market Segments

By Type Analysis

In 2024, Substrates dominated the OLED market’s By Type segment with a 26.7% share, underscoring their vital role in advancing flexible and high-resolution display technologies. These materials provide the essential foundation for OLED devices, offering stability, heat resistance, and mechanical durability—critical for foldable and curved displays.

The surge in OLED adoption across smartphones, televisions, and automotive lighting has intensified the need for reliable substrate solutions. Innovations in glass, plastic, and flexible substrates have improved production efficiency, reduced material weight, and extended device longevity.

As manufacturers focus on thinner, more adaptable, and energy-efficient designs, substrates remain central to OLED performance and sustainability. Their technological evolution continues to shape the market’s growth, making them indispensable to the next generation of display and lighting applications.

By Application Analysis

In 2024, the Display segment led the OLED market by application with an 87.3% share, driven by widespread integration in smartphones, televisions, laptops, and wearables. OLED technology offers unmatched advantages such as superior brightness, high contrast, flexibility, and ultra-thin design, setting it apart from traditional display types.

Rising consumer demand for energy-efficient and high-quality visual experiences continues to accelerate OLED adoption globally. Furthermore, ongoing innovations in flexible and foldable display designs have reinforced OLED’s dominance in next-generation devices.

Its ability to deliver vivid color performance and sleek aesthetics has made it the primary revenue generator in the OLED industry, reflecting a strong blend of performance, sustainability, and design adaptability that caters to evolving consumer electronics trends.

Regional Analysis

In 2024, Asia-Pacific led the global OLED market, commanding a 46.20% share with a market value of USD 0.6 billion. This dominance stems from its robust manufacturing ecosystem, fast industrialization, and the widespread use of advanced display technologies in consumer electronics and automotive sectors. China, South Korea, and Japan serve as the region’s key production hubs, supported by strong R&D investments and government-backed incentives for high-tech industries.

North America followed with rising demand for premium, energy-efficient display devices, particularly across the United States, while Europe saw steady expansion through OLED lighting applications in architecture and vehicles.

Latin America and the Middle East & Africa are gradually adopting OLED technologies for both consumer and commercial uses. Overall, regional growth reflects technological progress, higher disposable incomes, and sustainability-focused demand for efficient, flexible, and visually advanced display materials.

Top Use Cases

- Smartphones & TVs: OLED panels are used in smartphones, televisions, laptops, and monitors because they emit their own light (no back-lighting), deliver deep blacks, wide viewing angles, and vivid colours. That makes screens thinner, lighter, and more energy-efficient compared to older display types.

- Wearable Devices: In wearables such as smartwatches and fitness bands, OLEDs are popular because they are ultra-thin, flexible, and use less power—ideal for curved or small surfaces worn on the body.

- Automotive Infotainment & Panels: OLED displays are being integrated into car dashboards, infotainment systems and even transparent screens in windows, offering high-quality image display and flexible design in vehicles.

- Transparent & Smart Window Displays: Transparent OLED screens can be built into shop windows, glass walls or vehicle windshields: they show digital images while letting you see through to the other side, making for sleek, interactive displays.

- Architectural & Decorative Lighting Panels: OLED lighting panels (rather than displays) are used for ambient lighting in interiors or decorative installations because they are thin, can be bent or shaped, and offer soft, even light without harsh glare.

- Medical / Wearable Health Applications: OLEDs are also emerging in medical devices—for example, flexible patches or light-emitters that attach to skin and monitor signals or provide therapy—thanks to the thin, conformable form and gentle light output.

Recent Developments

- In July 2025, Toray announced the development of STF-2000, a photosensitive polyimide material that enables high-aspect-ratio fine patterning.

- In May 2025, Solus Advanced Materials announced that its new green phosphorescent host material for OLED displays had received customer approval and is gearing up for mass production. The company says this material offers high efficiency, low voltage, and long lifetime, and does not require deuterium substitution—making it more cost-effective.

Conclusion

The Organic Light Emitting Diode market is evolving rapidly, supported by innovation in flexible displays, advanced materials, and sustainable technologies. OLEDs have redefined visual performance across smartphones, TVs, wearables, and automotive panels through their superior clarity, thin design, and energy efficiency. Continuous breakthroughs in organic compounds and manufacturing processes are expanding applications beyond electronics into lighting and architectural use.

With growing emphasis on eco-friendly and high-performance materials, OLED technology is positioned to play a central role in next-generation visual and lighting solutions. Its adaptability and design potential make it a cornerstone of the future display and smart materials ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)