Table of Contents

Overview

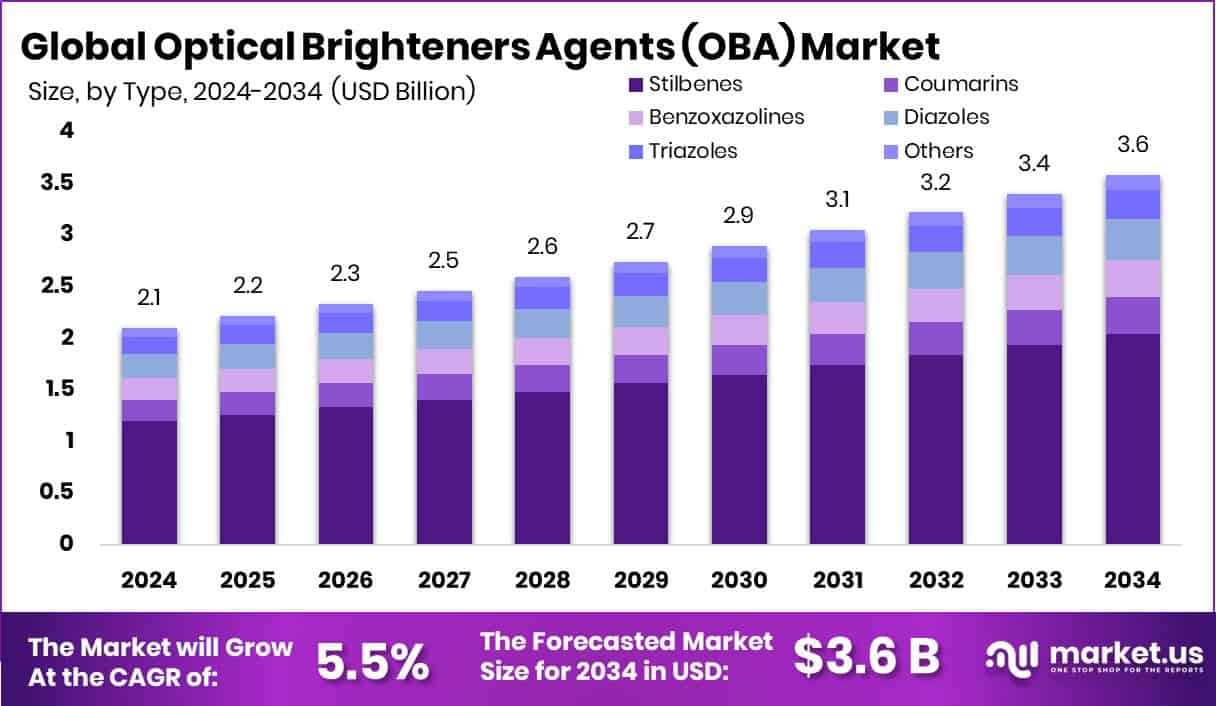

New York, NY – August 08, 2025 – The Global Optical Brightening Agents Market is projected to reach approximately USD 3.6 billion by 2034, growing from USD 2.1 billion in 2024, at a CAGR of 5.5% between 2025 and 2034. The Asia-Pacific region leads the market, contributing around USD 0.9 billion in 2024, which is about 45.2% of the global share. Optical brighteners, also called fluorescent whitening agents, are specialty chemicals that absorb ultraviolet light and re-emit it as visible blue light, creating the visual effect of brighter, cleaner, and whiter surfaces. These agents are commonly used in textiles, detergents, paper, and plastics to enhance visual appeal without requiring bleach.

The OBA market covers a wide range of industrial and consumer applications, driven by the increasing demand for products with high-brightness finishes. In laundry detergents, OBAs are added in small concentrations (up to 0.2%) to restore the whiteness of clothes that fade over time, enhancing their fresh and clean appearance. In the paper industry, OBAs are essential in the manufacturing of high-brightness paper, where they improve fluorescence under UV light and increase the paper’s visual whiteness. The brightness of paper treated with OBAs is typically measured at around 457 nanometers, a wavelength that aligns with the optimal fluorescence range of these agents.

OBAs are also widely used in textiles, where up to 0.5% of the agent may be added to fabrics to improve their appearance. However, this added brightness makes such fabrics more detectable under night vision equipment, as OBAs fluoresce under black light. This feature has implications in both civilian and military contexts, particularly where visibility and detection are concerns. The ongoing expansion of industries like personal care, home cleaning, and premium packaging continues to fuel market demand for optical brighteners across the globe.

Key Takeaways

- The Global Optical Brightening Agents (OBA) Market is projected to grow from USD 2.1 billion in 2024 to approximately USD 3.6 billion by 2034, expanding at a CAGR of 5.5% between 2025 and 2034.

- In 2024, Stilbene based OBAs dominated application use, accounting for 57.3% of the market due to their effectiveness and versatility.

- The powder form of OBAs led the product type segment with a 64.9% share, favored for its ease of integration in manufacturing processes.

- Water soluble OBAs captured 71.7% of the market, reflecting their high adaptability and compatibility with aqueous based industrial formulations.

- Anionic OBAs held 52.4% market share, widely adopted for their chemical stability and efficiency, especially in detergent and textile sectors.

- The detergents and soaps category emerged as the leading application area, contributing 43.1%, fueled by rising consumer expectations for brighter, cleaner fabrics.

- With a 45.2% market share valued at USD 0.9 billion, the Asia-Pacific region remained the dominant force, driven by its robust textile manufacturing base.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/optical-brighteners-agents-oba-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.1 Billion |

| Forecast Revenue (2034) | USD 3.6 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Stilbenes (Disulfonated, Tetrasulfonated, Hexasulfonated), Coumarins, Benzoxazolines, Diazoles, Triazoles, Others), By Form (Powder, Liquid), By Solubility (Water Soluble, Solvent Soluble), By Ionicity (Anionic, Cationic, Nonionic), By Application (Detergents and Soaps, Paper, Fabrics, Synthetics and Plastic, Cosmetics, Others) |

| Competitive Landscape | BASF SE, Dorf Ketal, Huntsman International LLC, Archroma, Kolorjet Chemicals Pvt Ltd, DayGlo Color Corp., 3V Sigma S.p.A., Aron Universal Limited, Deepak Nitrite Limited, Teh Fong Min International Co., Ltd., Mayzo, Inc., Meghmani Group, Sarex, United Specialities Pvt. Ltd, Zhejiang Transfar Whyyon Chemical Co., Ltd., Milliken Chemical, Brilliant Group Inc., Pylam Products Company, Inc., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146494

Key Market Segments

1. By Type Analysis:

- In 2024, Stilbene-based OBAs led the Optical Brightening Agents market with a 57.3% share, driven by their superior ability to enhance brightness and whiteness in textiles and detergents. Their strong UV reactivity, good bonding with cellulose and synthetic fibers, and excellent stability during wash cycles make them highly preferred. Additionally, their high solubility in water-based systems and cost-effectiveness boost their appeal across various industries like printing, packaging, and plastics, sustaining their dominant position in the market.

2. By Form Analysis:

- The powder form of OBAs held a commanding 64.9% share in 2024, owing to its extended shelf life, ease of handling, and high compatibility with detergent and textile formulations. Manufacturers favor powdered OBAs for their stability in varying environmental conditions and ability to maintain performance at lower dosages. This form is especially beneficial in bulk processing industries like paper and plastics, where uniform dispersion and consistent optical results are essential.

3. By Solubility Analysis:

- In terms of solubility, water-soluble OBAs dominated with a 71.7% global share in 2024. Their popularity stems from excellent dispersion in aqueous systems, fast mixing capabilities, and consistent whitening effects, making them ideal for liquid detergents and fabric softeners. These OBAs are also preferred in eco-regulated markets for their lower environmental impact, aligning with the growing demand for sustainable and high-efficiency cleaning and fabric care solutions.

4. By Ionicity Analysis:

- Anionic OBAs led the market by ionic type in 2024, holding a 52.4% share, due to their superior compatibility with synthetic detergents and cellulose fabrics. Their strong bonding ability enhances brightness retention even after multiple washes, making them ideal for laundry and textile applications. Their effectiveness in both warm and cold water conditions, combined with cost-efficiency and easy formulation in water-based products, strengthens their widespread use in detergents, paper, and plastics.

5. By Application Analysis:

- The detergents and soaps segment captured a 43.1% share of the global OBA market in 2024, driven by the rising demand for brighter, cleaner looking fabrics. OBAs enhance the whitening effect by converting UV light into visible blue light, a feature highly valued in laundry products. Their ability to maintain visual brightness across repeated wash cycles and their compatibility with both powder and liquid formulations make them a staple in household cleaning products, particularly in cost-sensitive markets.

Regional Analysis

- In 2024, the Asia-Pacific region emerged as the leading market for Optical Brightening Agents (OBAs), capturing 45.2% of the global share, equivalent to approximately USD 0.9 billion. This dominance is largely attributed to the region’s robust textile manufacturing capacity, growing detergent consumption, and a rapidly expanding paper industry. Key markets such as China, India, and Southeast Asian countries are driving demand through both domestic consumption and export-oriented production.

- North America sustained a consistent presence in the market, supported by stable demand from household care and industrial cleaning sectors. Europe followed closely, benefiting from high quality standards in paper and textile processing. Meanwhile, the Middle East & Africa witnessed moderate growth, particularly in detergent-based applications, while Latin America showed promise due to its rising usage in industrial packaging and paper production.

- Despite global competition, Asia-Pacific contributed the highest revenue and volume, solidifying its position as the primary growth hub for OBA producers. The region’s economic development, increasing output in consumer goods, and cost-efficient manufacturing environment continue to fuel its market leadership.

Top Use Cases

- Laundry & Detergent Enhancement: OBAs are widely used in laundry detergents to absorb invisible UV light and emit blue light, making fabrics appear whiter, brighter, and visually cleaner. They replace older bluing agents and are effective even at very low concentrations, boosting aesthetic appeal and perceived cleanliness in consumer laundry products.

- Textile Whitening & Finishing: In textile manufacturing, OBAs are applied during fabric finishing to eliminate yellowish tints and enhance whiteness. They improve brightness and color vibrancy across a range of materials—cotton, linen, synthetics helping garments maintain “new” looks through multiple wash cycles and appealing to quality‑conscious apparel brands.

- Paper & Packaging Brightening: Paper mills incorporate OBAs into pulp or coatings to offset natural yellow tones, increasing brightness and whiteness for notebooks, printing papers, tissue, and packaging. This fluorescent effect improves print contrast, enhances perceived product quality, and aligns with branding standards in high‑end packaging and office stationery.

- Plastics & Polymer Whitening: OBAs are added into white or light‑colored plastics such as PVC, household items, and packaging films to counter yellowing from UV exposure or heat. They help plastics retain a fresh, clean appearance over time, extending visual lifespan and improving consumer perception of quality and hygiene.

- Cosmetics & Personal Care Formulations: In beauty and skincare products—like shampoos, conditioners, face powders, eye creams OBAs act as light‑reflective additives to brighten skin tones or hair shades, reduce yellowish undertones, and enhance radiance. They deliver an immediate visual effect that supports product claims around luminosity or complexion correction.

- Security & Anti Counterfeiting Applications: OBAs are used in security‑printing, such as banknotes, identity documents, labels, and packaging, where they fluoresce under UV light to verify authenticity. This hidden brightening property helps security experts, law‑enforcement agencies, and consumers distinguish genuine items and deter counterfeit products.

- Fiber Whitening in Synthetic Materials: OBAs are incorporated during polymer melt or fiber spinning processes to enhance whiteness within synthetic fibers like polyester or nylon. This internal whitening improves the base color uniformity and avoids surface treatment, delivering consistent brightness across bulk materials for textiles and technical fabrics.

- Industrial Cleaning & Institutional Products: OBAs are used in institutional or industrial surface cleaners and polishes to impart a visibly bright, clean appearance on surfaces. They help make floors, counters, and shared spaces appear more hygienic even when actual cleanliness levels remain constant enhancing consumer and user perception.

Recent Developments

1. BASF SE:

- In mid‑2022, BASF completed a multi‑million‑euro expansion at its Monthey, Switzerland facility to boost capacity for its flagship Tinopal CBS optical brightener, meeting surging global demand from detergent and home‑care markets. Tinopal CBS is widely used in both powder and liquid detergents, including high‑concentrate formats and single‑dose packs, aligning with EU Ecolabel criteria. BASF continues to position itself as a leader in sustainable brightness solutions by combining regulatory compliance (e.g. REACH, EPA‑Safer‑Choice) with advanced formulation expertise, maintaining its top-tier share (~18–22%) in the global fluorescent brightening agents market.

2. Dorf Ketal Chemicals (India):

- In April 2022, Dorf Ketal agreed to acquire Ahmedabad‑based Khyati Chemicals India’s second‑largest OBA producer for approximately ₹225 crore. Khyati brings a significant export footprint (Brazil, Germany, Thailand, etc.) and a strong client base in detergent, textile, and paper sectors. Post‑acquisition, Dorf Ketal will house a fully owned OBA arm, leveraging its global research capabilities, distribution network, and technological leadership to scale Khyati’s OBA offerings internationally.

3. Huntsman International LLC:

- In May 2025, Huntsman commissioned a new E‑GRADE purification and packaging unit at its Conroe, Texas plant. This facility enhances its ability to supply high purity amine oxides and related chemistries critical to next generation optical brightening systems tailored for regulated markets requiring ultra clean formulations. This strategic move reinforces Huntsman’s technological leadership in OBAs for textiles, detergents, paper, and plastics, aligning with the broader industry shift toward sustainable, high performance, and low formaldehyde brighteners.

4. Archroma

- In May 2024, the U.S. Court of International Trade ruled that the U.S. Department of Commerce must reinstate antidumping duty orders on stilbenic optical brightening agents imported from Taiwan and China, following Archroma U.S., Inc.’s legal challenge. The court ordered full sunset reviews to begin on July 1, 2024 ensuring protection of domestic OBA suppliers against unfairly priced imports. This decision significantly impacts Archroma’s competitive positioning in the U.S. market, reinforcing its role as a domestic OBA producer.

5. Deepak Nitrite Limited

- Deepak Nitrite operates a dedicated Advanced Intermediates division that manufactures optical brightening agents (OBAs) including DASDA (Diamino Stilbene Disulphonic Acid), a key precursor in stilbene based OBAs used in paper, textile, and detergent applications. In August 2006, Deepak Nitrite acquired the DASDA manufacturing assets of Vasant Chemicals for ₹55 crores, strengthening its vertically integrated OBA supply chain in India. This acquisition allowed control over both DASDA and downstream OBAs, improving cost-efficiency and market reach in Indian and export-oriented sectors.

Conclusion

The Optical Brighteners Agents market is growing steadily due to rising demand across detergents, textiles, plastics, and paper industries. Companies like BASF, Archroma, and Deepak Nitrite are expanding their production capacities and strengthening supply chains to meet global needs. Government regulations, such as U.S. antidumping rulings and environmental safety standards, are shaping competitive dynamics especially in regions like North America and Europe.

Additionally, M&A activity, as seen in Dorf Ketal’s acquisition of Khyati Chemicals, signals strategic efforts to expand OBA portfolios globally. As end-user industries continue prioritizing product brightness and consumer appeal, the OBA market is expected to stay on a strong growth path.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)