Table of Contents

Overview

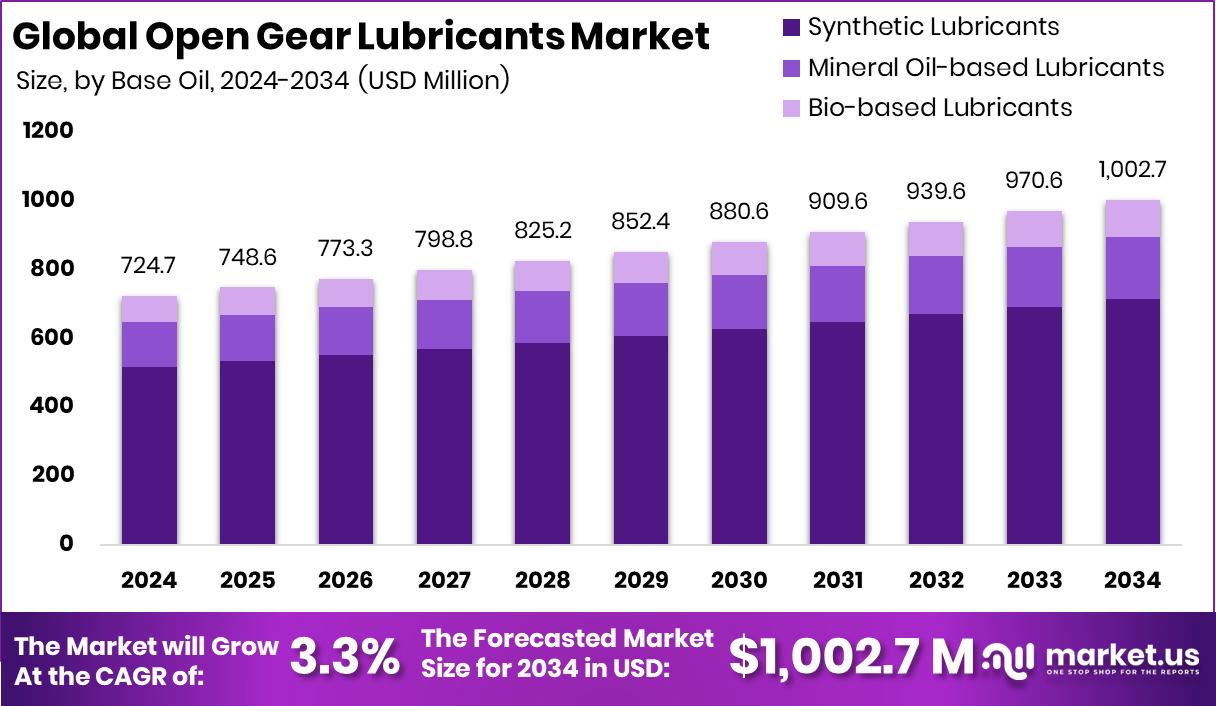

New York, NY – August 12, 2025 – The Global Open Gear Lubricants Market is projected to grow from USD 724.7 million in 2024 to USD 1,002.7 million by 2034, achieving a CAGR of 3.3% from 2025 to 2034. The Asia-Pacific region, driven by robust industrial expansion, contributed significantly with a market value of USD 346.4 million in 2024.

Open gear lubricants are heavy-duty, specialized lubricants designed to protect large, exposed gears in industrial machinery. These open gears, not enclosed in gearboxes, operate under extreme pressures and harsh conditions in applications such as mining equipment, cement kilns, mills, and power plants. The lubricants ensure durability and efficiency in these high-load environments.

The open gear lubricants market encompasses the global production, supply, and demand for lubricants tailored for open gear systems in industries like mining, cement, steel, and power generation. It includes various lubricant types, such as greases, semi-fluid lubricants, and synthetic or mineral-based oils, critical for minimizing equipment downtime and maintaining operational efficiency in heavy industrial operations.

The market’s growth is fueled by increased investments in heavy industries, including mining, construction, and cement production. Expanding infrastructure projects in developing economies are driving demand for large machinery reliant on open gear systems. Notable funding activities include Terra CO₂’s USD 124.5 million Series B round for sustainable cement solutions and Queens Carbon’s USD 10 million seed funding for low-carbon cement technology, reflecting the industrial momentum boosting lubricant demand.

The shift toward sustainability and modernization is evident in related innovations, such as Fiber Elements’ €2.6 million funding for basalt-based construction materials and Boral’s AUD 24.5 million federal grant for carbon-reducing cement kiln upgrades. These developments align with the growing emphasis on eco-friendly and efficient industrial solutions, further driving the open gear lubricants market.

Key Takeaways

- The Global Open Gear Lubricants Market is expected to be worth around USD 1,002.7 million by 2034, up from USD 724.7 million in 2024, and is projected to grow at a CAGR of 3.3% from 2025 to 2034.

- Synthetic lubricants dominate the Open Gear Lubricants Market with a 71.3% share due to superior performance.

- Mining leads the Open Gear Lubricants Market with a 48.2% share, driven by heavy machinery operations.

- The Asia-Pacific market was valued at USD 346.4 million during the year 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/open-gear-lubricants-market/request-sample/

Report Scope

| Market Value (2024) | USD 724.7 Million |

| Forecast Revenue (2034) | USD 1,002.7 Million |

| CAGR (2025-2034) | 3.3% |

| Segments Covered | By Base Oil (Synthetic Lubricants, Mineral Oil-based Lubricants, Bio-based Lubricants), By End-use (Mining, Cement, Construction, Power Generation, Oil and Gas, Marine, Others) |

| Competitive Landscape | Kluber Lubrications, Carl Bechem GmbH, FUCHS SE, Exxon Mobil Corporation, Chevron Corporation, BP P.L.C., CWS Industrials, Inc., Shell plc, TotalEnergies SE, Petron Corporation, Specialty Lubricants Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154045

Key Market Segments

By Base Oil Analysis

In 2024, synthetic lubricants commanded a 71.3% share of the Open Gear Lubricants Market in the base oil segment. Their dominance stems from superior performance attributes, including high thermal stability, excellent load-carrying capacity, and extended service intervals, making them ideal for open gear systems in harsh industrial environments.

Industries such as mining, cement, and power generation rely on synthetic lubricants to reduce wear and friction on exposed gear teeth, ensuring reliable operation under extreme pressures and temperature fluctuations. Their low volatility and high oxidation resistance minimize re-application frequency, reducing maintenance costs and extending equipment lifespan.

By End-Use Analysis

In 2024, the mining sector held a leading 48.2% share of the Open Gear Lubricants Market in the end-use segment. This dominance is driven by the extensive use of open gear systems in mining equipment, such as grinding mills, rotary kilns, and draglines, which operate under intense mechanical stress in harsh conditions like dust, moisture, and heavy loads.

High-performance open gear lubricants are critical for maintaining efficiency, minimizing downtime, and extending the lifespan of costly components. The mining industry’s emphasis on preventive maintenance and cost reduction further fuels demand for durable, high-load-carrying lubricants, solidifying the sector’s significant market share.

Regional Analysis

In 2024, Asia-Pacific led the Open Gear Lubricants Market with a 47.8% share, valued at USD 346.4 million. This leadership is driven by the region’s robust heavy industries, including mining, cement, and power generation, particularly in countries like China, India, and Southeast Asia.

The region’s large-scale industrialization and extensive machinery fleets fuel high lubricant consumption. North America and Europe maintained steady market performance, supported by advanced infrastructure and established industrial sectors.

Emerging regions like the Middle East & Africa and Latin America are seeing growing lubricant demand due to increasing industrial and infrastructure investments. Asia-Pacific’s ongoing industrial growth positions it as the primary hub for open gear lubricant consumption, a trend expected to continue.

Top Use Cases

- Mining Operations: Open gear lubricants are vital in mining for heavy machinery like crushers and mills. They reduce wear and friction under extreme pressure, ensuring smooth operation and longer equipment life. These lubricants protect gears from dust and harsh conditions, minimizing downtime and maintenance costs in mines worldwide.

- Power Generation: In power plants, open gear lubricants support turbines and gearboxes in thermal, hydro, and wind systems. They provide high load-bearing capacity and resist oxidation, ensuring reliable performance. This helps maintain an uninterrupted power supply, reduces maintenance needs, and extends the lifespan of critical equipment.

- Construction Equipment: Open gear lubricants are used in construction machinery like cranes and mixers. They offer strong adhesion and wear protection, enabling equipment to handle heavy loads in dusty environments. This ensures efficient operation, reduces breakdowns, and supports the growing demand for infrastructure projects globally.

- Cement Production: In cement plants, open gear lubricants protect rotary kilns and grinding mills. They withstand high temperatures and heavy loads, reducing friction and preventing gear failures. This enhances productivity, lowers maintenance costs, and supports the increasing cement demand driven by global urbanization and construction activities.

- Marine Applications: Open gear lubricants are essential for marine equipment like winches and cranes. They resist corrosion from saltwater and provide excellent load-carrying capacity. This ensures reliable performance in harsh marine environments, supporting offshore projects like wind farms and oil exploration, while reducing equipment wear and downtime.

Recent Developments

1. Klüber Lubrication

In early August 2025, its production capacity in India, reinforcing its global footprint in open‑gear and other specialty lubricants, Chevron Lubricants. The expansion underscores Klüber’s dual focus on sustainability and high-performance tribological solutions, with India poised as a strategic production hub for industrial lubricants.

2. Carl Bechem GmbH

Carl Bechem continues its strategic emphasis on eco‑friendly innovation, notably with its PFAS‑free “Nexus Technology” launched in March 2025. This advanced lubricant delivers high load‑carrying performance while cutting carbon emissions to equiv/kg—well below industry norms, highlighting its leadership in sustainable open‑gear lubricants.

3. FUCHS SE

FUCHS strengthened its specialty lubricants portfolio through the January 2025 acquisition of Boss Lubricants GmbH & Co. KG, enhancing its capabilities in niche industrial applications. FUCHS continues broad geographic expansion into South America, the Middle East, and the Asia Pacific, reinforcing its leadership in open‑gear lubrication technologies.

4. Exxon Mobil Corporation

While there are no specific news items on open‑gear lubricants in mid‑2025, ExxonMobil remains a key player in the sector and recently announced strong Q2 2025 financial results, with earnings and substantial project start‑ups in Singapore and elsewhere. They offer open‑gear lubrication guidance via their Mobil industrial lubricant portal, though no new product launches were found.

5. Chevron Corporation

Chevron continues offering its Open Gear Lubricant and Open Gear Grease designed for heavy‑duty operations, providing high film‑strength, shock‑load wear protection, low environmental impact, and ease of application, especially suited for mining, cement, and power‑generation sectors. However, there were no recent product or strategic updates regarding open-gear lubricants.

Conclusion

The Open Gear Lubricants Market is growing steadily due to rising demand from industries like mining, power generation, construction, cement, and marine. These lubricants ensure equipment efficiency, reduce maintenance costs, and extend machinery life in harsh conditions. With increasing infrastructure projects and a shift toward eco-friendly and synthetic lubricants, the market offers significant opportunities for innovation and expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)