Table of Contents

Overview

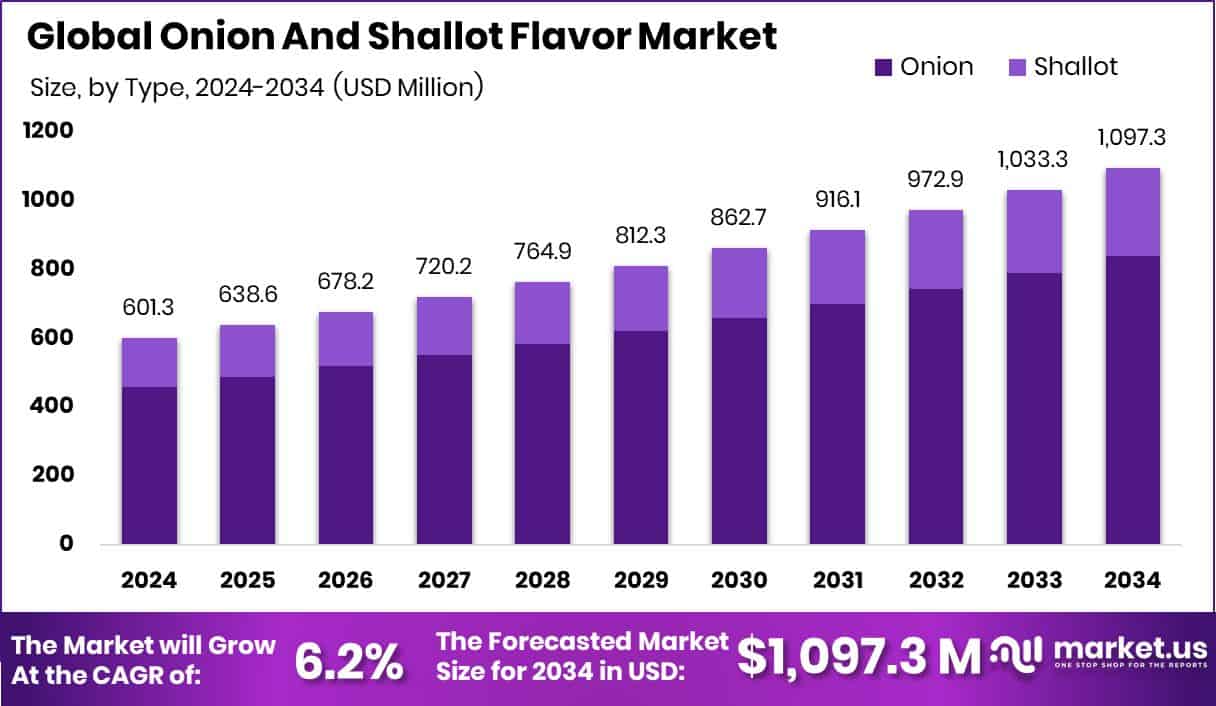

New York, NY – Oct 17, 2025 – The global Onion and Shallot Flavor Market is projected to reach approximately USD 1,097.3 million by 2034, rising from USD 601.3 million in 2024, with a CAGR of 6.2% between 2025 and 2034. Asia-Pacific accounted for the largest share of consumption at 43.30%, representing a market value of around USD 260.3 million, underscoring the region’s significant growth potential.

Onion and shallot flavor refers to a natural or synthetic additive that replicates the signature savory, mildly sweet, and pungent taste of onions and shallots. Available in powdered, oil-based, or liquid forms, it is widely used in processed foods such as soups, sauces, snacks, and ready-to-eat meals. These flavorings are particularly beneficial in scenarios where fresh ingredients are impractical due to limited shelf life or production challenges.

The market for onion and shallot flavors is witnessing steady growth, driven by the surging demand for convenience foods and snacks worldwide. As consumers increasingly prefer ready-to-eat, flavorful meal options, food producers are turning to these flavors to enhance taste without relying on fresh onions or shallots, which can pose storage and preparation difficulties.

Growth momentum is further supported by the global shift toward plant-based and clean-label products. These flavors enhance umami and savory depth in vegetarian and vegan recipes, offering a suitable alternative where meat-based flavors are avoided. Natural formulations are gaining traction, reflecting the broader trend toward clean ingredients across food categories.

Additionally, the globalization of regional cuisines such as curries, stir-fries, and stews is fueling demand. Onion and shallot flavorings enable manufacturers to deliver authentic taste experiences in scalable formats, meeting consumer preferences for culturally diverse flavors in mainstream markets.

Key Takeaways

- The global onion and shallot flavor market is projected to reach approximately USD 1,097.3 million by 2034, rising from USD 601.3 million in 2024, with a CAGR of 6.2% between 2025 and 2034.

- Onion flavors dominate the market with a 76.50% share, attributed to their wide culinary applications.

- The dehydrated segment holds 38.30% of the market, driven by its extended shelf life and ease of use.

- Liquid formats lead with 58.40%, preferred for their consistent blending in sauces, marinades, and dressings.

- Conventional products account for 82.30%, aligning with prevailing processing practices and cost efficiencies.

- The food service sector commands 67.30% of demand, reflecting extensive use in restaurants, catering, and quick-service outlets.

- Asia-Pacific recorded strong growth, reaching USD 260.3 million, fueled by rising demand for savory flavors in processed foods.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/onion-and-shallot-flavor-market/free-sample/

Report Scope

| Market Value (2024) | USD 601.3 Million |

| Forecast Revenue (2034) | USD 1,097.3 Million |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Type (Onion, Shallot), By Profile Type (Dehydrated, Boiled, Fried, Others), By Form (Liquid, Dry), By Category (Organic, Conventional), By Application (Household, Food Service Sector (Bakery Products, Condiments, Dairy Products, Processed Food and Snacks, Others)) |

| Competitive Landscape | Azelis Group NV, Boardman Foods, Inc, Flavor Dynamics, Inc, Matrix Flavours & Fragrances Sdn Bhd, Mevive International Food Ingredients Pvt Ltd, Sensient Technologies Corporation, Stringer Flavour. Ltd, Symrise, T.Hasegawa USA Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145170

Key Market Segments

By Type Analysis

Onion flavor dominates the market, holding a substantial 76.50% share in 2024. This dominance is largely due to its extensive use in a wide range of products, from soups and sauces to snacks, seasonings, and ready-to-eat meals. Onion provides a bold, familiar base note that enhances savory depth, making it a preferred ingredient for manufacturers. In contrast, shallot flavor, with its milder and slightly sweet profile, caters to premium and gourmet applications but holds a smaller share due to higher production costs and limited mainstream use. Onion’s versatility, cultural familiarity, and adaptability across formats dry, liquid, or encapsulated further cement its lead, while clean-label and plant-based trends boost demand for natural onion flavorings as an alternative to meat-based umami enhancers.

By Profile Type Analysis

The dehydrated profile leads with a 38.30% market share in 2024, valued for its long shelf life, convenience, and easy incorporation into processed foods. Dehydrated onion and shallot flavors are common in seasoning blends, dry mixes, soups, and snack coatings, offering consistent taste during high-heat processing and extended storage. Their adaptability in powdered and shelf-stable products makes them ideal for manufacturers seeking operational efficiency and flavor stability in mass production. Compared with liquid or oil-based forms, dehydrated profiles are better suited for dry applications, aligning with the growing demand for convenient, shelf-stable meal options.

By Form Analysis

Liquid formats dominate with a 58.40% share in 2024, driven by superior blendability, fast flavor release, and versatility. They are widely used in soups, sauces, dressings, marinades, and frozen meals where even dispersion and a fresh-cooked aroma are crucial. Manufacturers favor liquids for consistent taste in large-scale production, easy integration into hot or cold applications, and compatibility with clean-label formulations. Compared with dry forms, liquids eliminate rehydration needs, save preparation time, and work well in emulsified or oil-based recipes, making them a preferred choice in both industrial and commercial kitchens.

By Category Analysis

Conventional flavors hold the largest share at 82.30% in 2024, reflecting their cost-effectiveness, availability, and scalability. Manufacturers prefer them for consistent quality, high yield, and suitability for mass production across snacks, soups, seasonings, and frozen meals. Supported by established sourcing and processing infrastructure, conventional flavors maintain stable supply chains and competitive pricing. While natural and clean-label variants are gaining attention, many mainstream products still rely on conventional options to deliver strong, savory flavors at affordable prices. Their compatibility with varied processing methods from frying to freeze-drying adds to their appeal.

By Application Analysis

The food service sector leads with 67.30% of market demand in 2024, driven by high-volume needs in restaurants, catering services, quick-service outlets, and institutional kitchens. Ready-to-use flavor formats, especially liquid and dehydrated, support fast-paced operations by reducing prep time, ensuring menu consistency, and streamlining large-scale production. This dominance is further fueled by changing consumer habits, with more people dining out or ordering prepared meals, pushing the food service industry to seek cost-effective, flavorful solutions that meet customer expectations globally.

Regional Analysis

In 2024, Asia-Pacific led the Onion and Shallot Flavor Market with a 43.30% share, valued at USD 260.3 million. This dominance is fueled by the surging demand for processed foods, snacks, and ready-to-eat meals in high-population markets such as China, India, and Southeast Asia. The region benefits from a strong food manufacturing base and rapid urbanization, both of which drive higher consumption of flavor ingredients.

North America ranked as the second-largest market, supported by steady demand for savory flavor enhancers in frozen meals, snacks, and restaurant-style offerings. Europe also maintained solid growth, leveraging its mature food processing sector and increasing consumer preference for convenient, gourmet-inspired products.

The Middle East & Africa showed gradual adoption, with the food service industry playing a central role in market entry. Latin America recorded stable demand from fast-food and packaged meal producers, though limited local production in both MEA and Latin America continues to pose challenges for faster expansion.

Top Use Cases

1. Ready-to-Eat Meals Enhancement:

In the booming ready-to-eat sector, onion and shallot flavorings elevate the taste of pre-packaged meals like soups, sauces, and instant noodles without using fresh produce. They bring consistent savory depth, extend shelf life, and streamline production for manufacturers aiming to deliver flavorful, convenient meals that meet busy consumer needs.

2. Plant-Based Product Development:

As plant‐based foods gain popularity, onion and shallot flavors are used to mimic umami and meat-like richness. Their naturally savory notes enhance veggie burgers, vegan sausages, or dairy-free soups, helping producers deliver taste that satisfies expectations without relying on animal-based ingredients boosting appeal among vegan and vegetarian consumers.

3. Food Service Industry Efficiency:

Restaurants, catering services, and quick-service chains rely heavily on onion and shallot flavor additives particularly liquid or powdered forms. These formats simplify prep, reduce kitchen time, and maintain consistent taste across dishes, making them ideal for high-throughput kitchens that demand efficiency and flavor uniformity in daily operations.

4. Snack and Seasoning Formulation:

Snack producers and seasoning companies use onion and shallot flavors in chips, snack coatings, and dry seasoning blends. The flavors deliver bold, savory character in powdered or dehydrated form, ensuring easy mixing, stable taste, and strong consumer appeal particularly in savory snacks and seasoning mixes.

5. Clean-Label and Natural Product Positioning:

With rising demand for transparent, clean-label ingredients, natural onion and shallot variants serve as authentic flavor enhancers. Manufacturers position them as recognizable, plant-derived alternatives to synthetic additives supporting marketing claims around natural origin, simplicity, and ingredient integrity for health-conscious shoppers.

Recent Developments

1.Azelis Group NV

- In 2024, Azelis strengthened its role as a key distributor of specialty food ingredients, including onion and shallot flavors, leveraging strategic acquisitions and an expanded network across Europe and Asia to deliver localized, clean-label and plant-based flavor solutions tailored to regional tastes. Its FY 2024 results show revenue growth (EUR 4,214 m, +1.5%) with notable contributions from acquisitions and life sciences, reinforcing its financial stability and investment capacity in flavor innovation.

2. Sensient Technologies Corporation

- In January 2025, Sensient Technologies launched a brand-new range of natural onion and shallot flavor extracts aimed at the growing clean-label market, supporting demand for natural savory ingredients. Through its Sensient Natural Ingredients division, the company emphasizes premium dehydrated California-grown onion and garlic non-GMO, USDA Organic, halal, kosher, and traceable ideal for clean-label savory applications. Their dehydrated product portfolio supports savored, authentic flavors in soups, sauces, snacks, and plant-based formulations.

3. Flavor Dynamics, Inc.

- As of 2024, Flavor Dynamics, Inc. continues to prioritize rapid R&D and product innovation in its savory flavor portfolio, focusing particularly on enhancing natural onion and shallot flavors while reducing sodium content to meet health-conscious trends. Their agile formulation capabilities are enabling food manufacturers to deliver flavorful, lower-sodium options in processed foods, aligning with consumer demand for cleaner, tastier products.

4. T. Hasegawa USA Inc.

- In September 2024, T. Hasegawa USA Inc. acquired Abelei Flavors, Inc., enhancing its portfolio with sweet brown, citrus, and fruit flavors. While not directly onion-based, this acquisition broadens T. Hasegawa’s flavor innovation capabilities in North America, potentially complementing its existing savory offerings such as onion and shallot flavors.

5. Symrise

- In December 2024, Symrise expanded its production facilities in Germany to increase its output of onion and shallot flavor compounds positioning the company to meet rising global demand for savory, authentic flavorings in processed and convenience foods. This capacity expansion supports supply to key markets and reinforces Symrise’s role in savory flavor innovation.

Conclusion

The onion and shallot flavor market is experiencing steady global expansion, supported by rising demand for convenience foods, snacks, and ready-to-eat meals. Growth is further fueled by increasing adoption of clean-label and plant-based formulations, where these flavors provide a natural umami boost without animal-derived ingredients. Onion flavors maintain a dominant position due to their widespread culinary use and adaptability across various product formats, while shallot flavors continue to gain traction in premium applications.

Dehydrated and liquid forms remain highly preferred for their versatility, consistency, and ease of integration in large-scale production. Conventional variants lead overall consumption, driven by cost-effectiveness and compatibility with diverse processing methods. The food service sector remains a major growth driver, leveraging these flavors for operational efficiency and menu consistency. Regional demand is strongest in Asia-Pacific, followed by North America and Europe, with emerging opportunities in the Middle East, Africa, and Latin America.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)