Table of Contents

Introduction

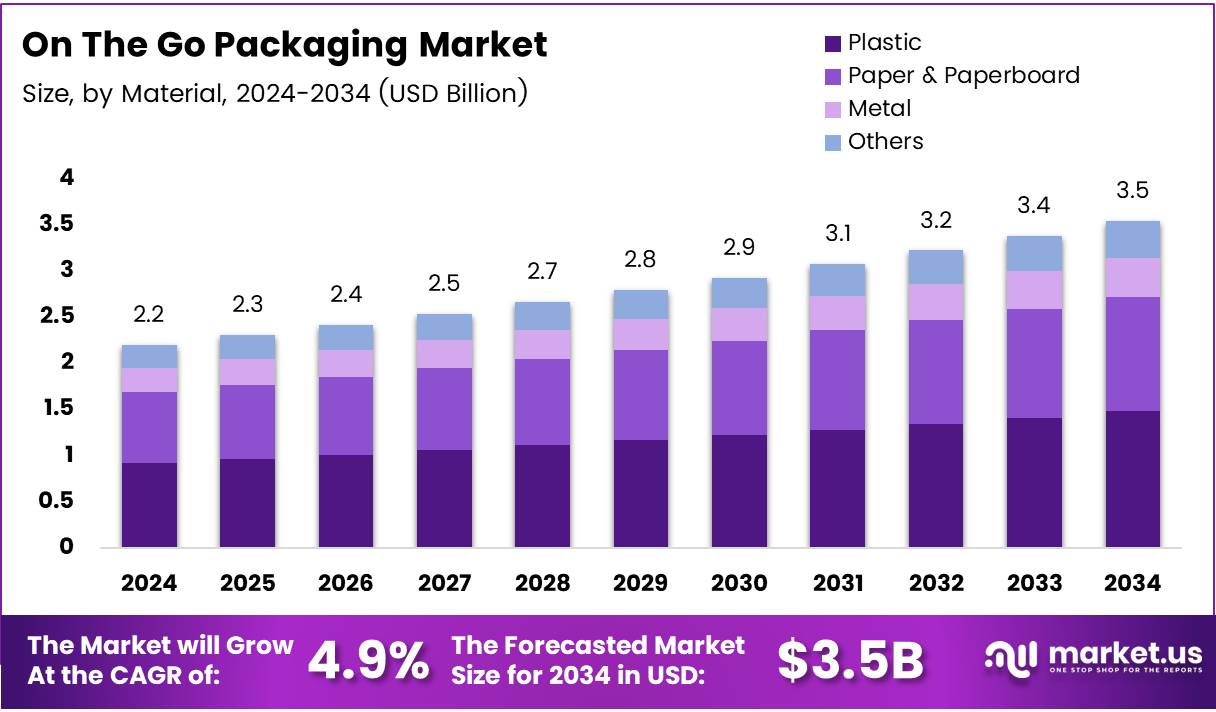

The Global On-The-Go Packaging Market is witnessing robust expansion, driven by evolving consumer lifestyles and a growing demand for convenience-based packaging. The market is projected to reach USD 3.5 Billion by 2034, increasing from USD 2.2 Billion in 2024 at a steady CAGR of 4.9% between 2025 and 2034.

This growth is primarily fueled by urbanization, busy work cultures, and the rising preference for portable and lightweight packaging. Moreover, increasing awareness of sustainability and recyclability is reshaping product innovation, as consumers seek eco-friendly and smart packaging solutions that align with their environmental values.

Manufacturers are rapidly adapting to these shifts by investing in sustainable materials, smart technology integration, and enhanced functionality. As a result, the On-The-Go Packaging Market is becoming a dynamic segment where innovation meets convenience, catering to the needs of a fast-paced, mobility-driven global consumer base.

Key Takeaways

- The Global On-The-Go Packaging Market is projected to reach USD 3.5 Billion by 2034, up from USD 2.2 Billion in 2024, growing at a CAGR of 4.9% from 2025 to 2034.

- In 2024, Plastic dominated the material segment with a 41.2% share, favored for its versatility, affordability, and preservation capabilities.

- Pouches & Bags led the packaging type segment in 2024, driven by their lightweight, resealable, and multi-use design features.

- Food Service Outlets held the largest share in the end-user segment in 2024, due to their need for high-volume, disposable packaging.

- North America dominated the global market with a 40.3% share and a valuation of USD 0.9 Billion in 2024, led by the U.S., thanks to urbanization and fast-paced consumer lifestyles.

Market Segmentation Overview

By material, Plastic continues to dominate with a 41.2% market share owing to its lightweight and cost-effective nature. Paper & Paperboard is gaining traction as consumers shift toward eco-friendly packaging. Meanwhile, biodegradable polymers are gradually emerging as viable sustainable alternatives.

In terms of packaging type, Pouches & Bags hold the largest share due to their portability, resealable designs, and adaptability for various food and beverage applications. Bottles & Jars remain popular for beverages, while boxes and cartons are increasingly adopted for structured meals and eco-conscious branding.

Food Service Outlets lead the end-user segment, driven by demand from quick-service restaurants and cafes. Institutional Food Services follow closely, emphasizing bulk and sustainable solutions. Online food delivery services represent a growing segment, requiring leak-proof and temperature-resistant packaging options.

Drivers

One of the primary growth drivers is the expansion of e-commerce food delivery platforms. As online meal ordering becomes mainstream, there is a significant surge in demand for packaging that ensures food freshness and safety during transit. This drives innovation in clamshells, insulated bags, and leak-proof containers.

Additionally, the increasing adoption of lightweight and durable materials supports market expansion. Delivery services and retailers prefer packaging that balances convenience and strength while minimizing environmental impact. Consequently, manufacturers are exploring coated papers, thin-wall containers, and recyclable materials to optimize efficiency and cost.

Use Cases

On-the-go packaging is revolutionizing the foodservice industry by enabling restaurants and cafes to offer ready-to-eat meals that are both portable and sustainable. Whether for take-out, curbside pickup, or delivery, these packages maintain freshness and enhance customer satisfaction while promoting brand reliability.

Another key application lies in beverages and snacks. From resealable pouches for smoothies to recyclable cans for energy drinks, on-the-go packaging allows brands to target consumers with active lifestyles. It provides convenience during commuting, travel, or outdoor activities, ensuring easy handling and disposal.

Major Challenges

The high cost of sustainable packaging materials remains a major barrier. Biodegradable films and compostable plastics are more expensive to produce than traditional options, making it difficult for smaller companies to adopt them without increasing product prices or compromising margins.

Additionally, limited recycling infrastructure in developing regions hampers progress. Even when recyclable materials are used, inadequate collection and processing systems often lead to waste mismanagement, undermining sustainability efforts and discouraging eco-conscious packaging adoption.

Business Opportunities

The integration of smart packaging technologies offers vast potential. Features like freshness indicators, QR codes, and tracking sensors enhance consumer engagement and safety. These innovations also support supply chain transparency, giving brands a competitive advantage in traceability and trust.

Moreover, the development of edible and biodegradable packaging materials presents lucrative opportunities. Products made from seaweed, cornstarch, or other natural substances minimize environmental waste and appeal to environmentally aware consumers. These solutions are especially promising for food and beverage brands targeting sustainability-driven audiences.

Regional Analysis

North America dominates the On-The-Go Packaging Market with a 40.3% share and a valuation of USD 0.9 Billion. The region’s growth is fueled by a strong food delivery ecosystem, advanced packaging innovation, and a consumer base that prioritizes speed and convenience in purchasing behavior.

Meanwhile, Asia Pacific is experiencing rapid growth due to expanding urbanization and increasing disposable incomes. Rising demand for convenience food and beverages in China and India, combined with booming e-commerce and retail industries, positions the region as a key emerging hub for packaging innovation.

Recent Developments

- In May 2024, JK Paper Ltd. acquired an additional 15% stake in its subsidiaries, Horizon Packs Private Ltd. and Securipax Packaging Private Ltd., reinforcing its commitment to sustainable packaging solutions.

- In May 2025, ProAmpac partnered with ScottsMiracle-Gro to develop eco-friendly packaging for the new O.M. Scott & Sons natural grass seed line, combining innovation with sustainability.

- In February 2025, the launch of ‘ProDairy’ packaging reduced plastic content to below 10% while maintaining performance, marking a milestone in sustainable dairy packaging design.

Conclusion

The Global On-The-Go Packaging Market is entering a transformative phase, propelled by convenience-driven lifestyles and sustainability goals. With innovations in smart and eco-friendly materials, the market is set to witness sustained growth. Companies aligning their strategies with environmental standards and digital innovation will lead the next decade of packaging evolution.

As consumer expectations continue to shift toward functionality and environmental responsibility, the industry’s future will depend on collaboration, technology adoption, and adaptability. The journey toward sustainable, intelligent, and convenient packaging is not just a trend—it is shaping the future of modern consumption worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)