Table of Contents

Overview

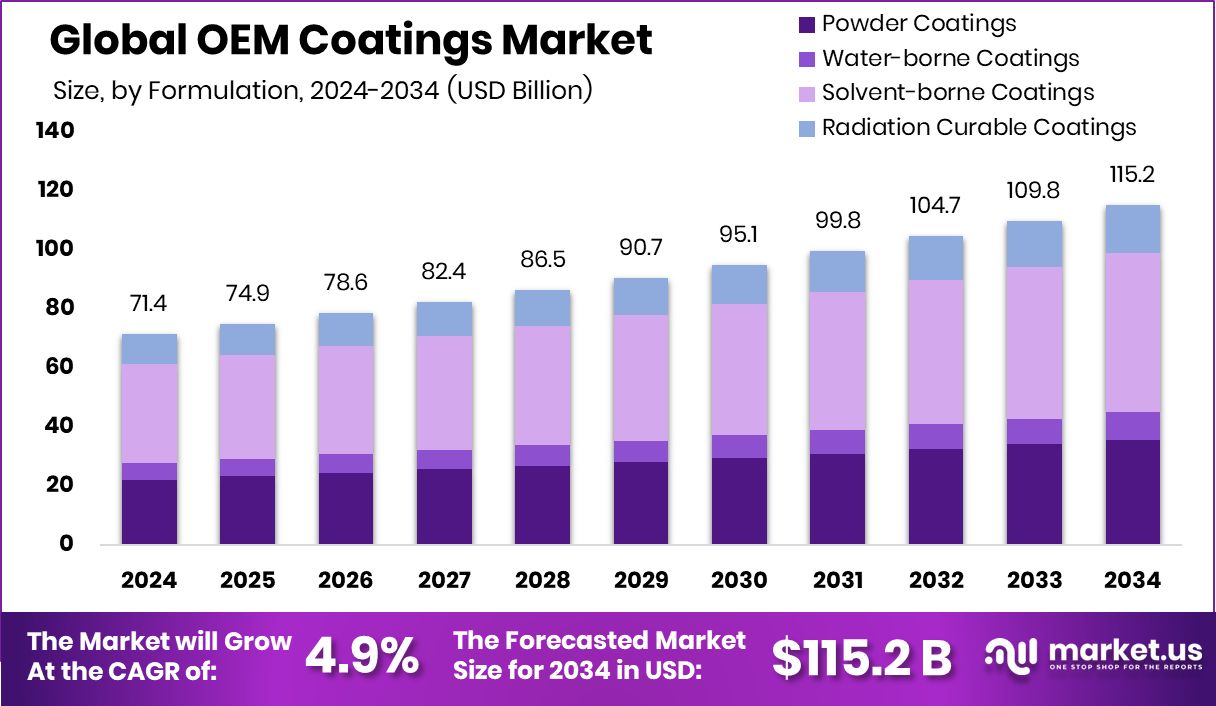

New York, NY – August 04, 2025 – The Global OEM Coatings Market is projected to reach USD 115.2 billion by 2034, growing from USD 71.4 billion in 2024 at a CAGR of 4.9% from 2025 to 2034. In 2024, the Asia-Pacific region accounted for 48.3% of global OEM coatings demand, driven by robust manufacturing and automotive production.

OEM coatings are protective and decorative layers applied during the manufacturing of products, such as automobiles, appliances, machinery, and electronics. These coatings offer corrosion resistance, UV protection, chemical resistance, and aesthetic enhancement, ensuring both durability and optimal performance.

The OEM coatings market serves industries such as automotive, consumer electronics, construction equipment, and industrial machinery. It includes coating types like solvent-borne, water-borne, and powder coatings, applied via spray, dip, or electro-deposition methods.

Market growth is fueled by rising demand for durable, high-quality products, increased manufacturing output, and stringent regulations on corrosion protection and emissions, pushing the adoption of eco-friendly, high-performance coatings. Key drivers include the need for long-lasting products in transportation and electronics, as well as post-pandemic production recovery and global infrastructure growth.

Energy-efficient coatings that enhance thermal insulation and operational efficiency are also gaining traction. Notably, BASF is exploring the sale of its coatings division, valued at approximately USD 6.8 billion, signaling strategic industry shifts and investor interest. Additionally, LiquiGlide’s USD 16 million funding to advance its coating technology platform underscores the growing focus on innovative surface solutions in OEM applications.

Key Takeaways

- The Global OEM Coatings Market is expected to be worth around USD 115.2 billion by 2034, up from USD 71.4 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In the OEM Coatings Market, solvent-borne coatings dominate, holding a 47.9% share in 2024.

- Base coat emerged as the leading product type, capturing 38.5% share of the OEM Coatings Market.

- Metal substrate accounted for a 59.6% share, making it the most preferred surface in OEM Coatings.

- The transportation sector led the OEM Coatings Market, contributing 48.1% to total end-use applications.

- The Asia-Pacific OEM coatings market reached a valuation of USD 34.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-oem-coatings-market/request-sample/

Report Scope

| Market Value (2024) | USD 71.4 Billion |

| Forecast Revenue (2034) | USD 115.2 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Formulation (Powder Coatings, Water-borne Coatings, Solvent-borne Coatings, Radiation Curable Coatings), By Product Type (Primer, Base Coat, Clear Coat, Electro Coat), By Substrate (Metal, Wood, Plastic, Others), By End-use (Transportation (Automotive, Marine, Others), Consumer Products, Heavy Equipment and Machinery, Others) |

| Competitive Landscape | 3M, AkzoNobel N.V., Allnex Group, Axalta Coating Systems, Ltd., BASF SE, Covestro AG, Dow, HMG Paints Ltd, Kansai Paint Co., Ltd., KAPCI Coatings, KCC Corporation, Nippon Paint Holdings Co., Ltd., NOROO Paint & Coatings Co., Ltd., PPG Industries, Inc., SEM Products, Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153557

Key Market Segments

By Formulation Analysis

Solvent-borne coatings led the OEM Coatings Market in 2024, capturing a 47.9% share in the formulation segment. Their dominance stems from superior adhesion, durability, and resistance to harsh environmental conditions, making them ideal for industrial manufacturing. These coatings offer fast-drying properties and long shelf life, boosting efficiency in high-throughput OEM operations.

Despite regulatory pressures favoring eco-friendly alternatives, solvent-borne coatings remain favored for their consistent performance across diverse substrates like metal and plastic, particularly in automotive and industrial equipment sectors where durability and finish quality are critical.

By Product Type Analysis

Base coats dominated the OEM Coatings Market in 2024, holding a 38.5% share in the product type segment. Essential for color uniformity, gloss, and durability, base coats are widely used in automotive and appliance manufacturing.

Positioned between primer and clear coat, they enhance visual appeal, UV resistance, and weather protection while supporting metallic and pearlescent finishes for branding and aesthetic differentiation. Their compatibility with spray and electrostatic application systems ensures efficient production, driving high consumption in OEM lines.

By Substrate Analysis

Metal substrates accounted for a 59.6% share of the OEM Coatings Market in 2024. Their dominance reflects the widespread use of metal in automotive, industrial machinery, and appliance manufacturing, where coatings are crucial for corrosion resistance, durability, and protection against moisture, chemicals, and UV exposure. Metal’s compatibility with various coating formulations and automated application methods supports its critical role in high-volume production, ensuring long-lasting performance and aesthetic quality.

By End-use Analysis

The transportation sector led the OEM Coatings Market in 2024 with a 48.1% share. This reflects the heavy reliance on coatings for vehicles like automobiles, trucks, and buses, where they provide aesthetic appeal and protection against corrosion, wear, and environmental factors.

High-performance coatings are essential to meet rigorous quality standards and withstand UV rays, road salts, and temperature fluctuations. Automated manufacturing processes in transportation enable efficient coating application, supporting steady global demand.

Regional Analysis

In 2024, Asia-Pacific dominated the OEM Coatings Market with a 48.3% share, valued at approximately USD 34.4 billion. This leadership is driven by robust manufacturing in China, India, Japan, and South Korea, particularly in the automotive, electronics, and appliance sectors.

The region’s demand for durable, corrosion-resistant coatings fuels growth. North America and Europe, as mature markets, maintain stable demand with a focus on eco-friendly solutions. Emerging regions like the Middle East & Africa and Latin America show gradual growth tied to expanding industrial and infrastructure activities, though their market shares remain smaller.

Top Use Cases

- Automotive Protection and Aesthetics: OEM coatings enhance vehicle durability by protecting against corrosion, UV rays, and scratches. Applied during manufacturing, they ensure long-lasting color and gloss, thereby improving aesthetics and enhancing consumer appeal. Base coats and clear coats are key in achieving vibrant finishes, especially for passenger cars and luxury vehicles.

- Electronics Durability: OEM coatings shield electronic devices like smartphones and laptops from moisture, dust, and wear. These coatings, often water-based or UV-cured, improve device longevity and performance. They also provide insulation against electromagnetic interference, meeting the demand for reliable, high-quality electronics in consumer markets.

- Industrial Machinery Longevity: OEM coatings protect machinery from harsh environments, preventing rust and wear on metal parts. Powder and solvent-borne coatings ensure durability in construction and agricultural equipment. They enhance operational efficiency by reducing maintenance needs, supporting high-volume production in industrial settings.

- Appliance Aesthetic and Functionality: OEM coatings on appliances like refrigerators and washing machines offer corrosion resistance and a sleek finish. Water-based and powder coatings provide durability and eco-friendly options. These coatings meet consumer demand for visually appealing, long-lasting household products while ensuring resistance to daily wear.

- Aerospace Component Protection: OEM coatings safeguard aerospace parts from extreme conditions like high temperatures and corrosion. Specialized coatings, such as thermal sprays, enhance component lifespan and performance. They ensure safety and reliability in aircraft manufacturing, supporting the industry’s need for high-performance, durable materials.

Recent Developments

1. 3M

- 3M has been advancing its OEM coatings with innovations in sustainable solutions, including low-VOC (volatile organic compound) coatings for automotive and industrial applications. The company recently introduced high-performance abrasion-resistant coatings for electronics and automotive parts, enhancing durability.

2. AkzoNobel N.V.

- AkzoNobel has expanded its Interpon and Sikkens OEM coating ranges with eco-friendly, low-carbon footprint products. The company launched a new UV-resistant coating for the automotive and aerospace industries, improving longevity. AkzoNobel also partnered with Boeing to develop lightweight, corrosion-resistant coatings for aircraft.

3. Allnex Group

- Allnex has introduced ECOFAST Pure, a sustainable, bio-based resin for automotive OEM coatings, reducing environmental impact. The company also developed UV/LED-curable coatings for faster production cycles in industrial applications. Allnex is collaborating with automotive manufacturers to enhance scratch-resistant coatings for electric vehicles (EVs).

4. Axalta Coating Systems, Ltd.

- Axalta launched Imron Industrial, a high-durability coating for heavy machinery and transportation OEMs. The company also introduced Voltatex 7000, a next-gen insulation coating for EV components. Axalta’s Color360 digital platform helps OEMs streamline color matching and coating selection.

5. BASF SE

- BASF has developed iGloss matt clearcoat, a scratch-resistant OEM coating for luxury vehicles. Their CathoGuard 800 e-coat provides superior corrosion protection for automotive bodies. BASF is also investing in waterborne coatings to meet stricter environmental regulations.

Conclusion

The OEM coatings market is thriving, driven by demand for durable, aesthetically pleasing, and eco-friendly solutions across automotive, electronics, industrial, and medical sectors. Innovations like water-based and smart coatings address environmental regulations and performance needs. With strong growth in Asia-Pacific and advancements in sustainable technologies, the market is poised for robust expansion, offering opportunities for manufacturers to innovate and meet evolving industry demands.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)