Table of Contents

Overview

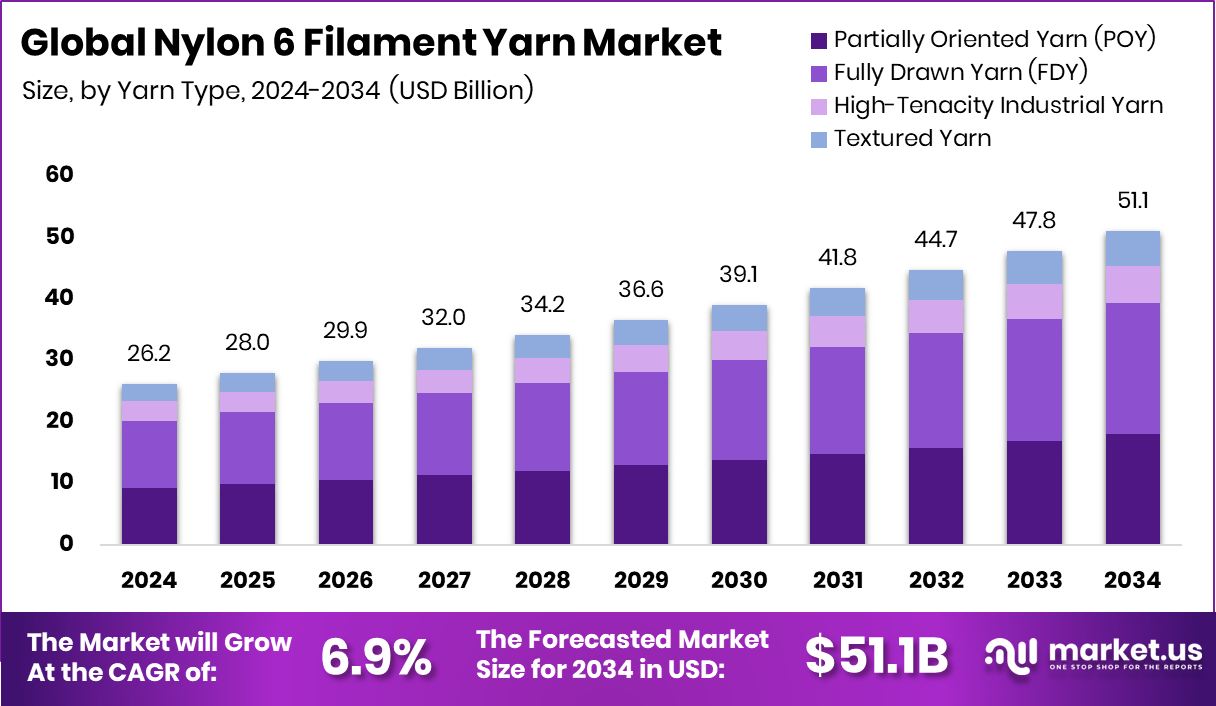

New York, NY – Nov 20, 2025 – The Global Nylon 6 Filament Yarn Market is projected to reach USD 51.1 billion by 2034, rising from USD 26.2 billion in 2024 at a steady 6.9% CAGR. Growth is led by Asia Pacific, which holds a strong 48.90% share thanks to expanding apparel and industrial production.

Nylon 6 filament yarn is produced by polymerizing caprolactam into smooth, continuous fibers known for strength, elasticity, abrasion resistance, and excellent dyeability. These qualities make it a preferred material in sportswear, activewear, upholstery, and industrial fabrics where durability and flexibility are essential.

The market benefits from rapid innovation in textiles, rising demand for high-performance apparel, and the strong expansion of Asian textile manufacturing. Performance-driven clothing trends continue to speed up consumption, supported by major investments flowing into sports, athleisure, and online apparel platforms.

Key funding examples include Outdoor Voices’ USD 34 million raise, Fanatics’ USD 27 billion valuation, Fanchest’s USD 4 million, Fanatics’ later jump to USD 31 billion after a USD 700 million injection, and Ghost’s USD 40 million raise—all signaling strong confidence in performance-oriented apparel ecosystems.

Future opportunities concentrate on sustainable and advanced fibers. Growing interest in recycled and bio-based Nylon 6, paired with investment momentum in digital commerce and athletic brands, allows manufacturers to develop eco-friendly, premium yarns that align with global quality expectations and environmental goals.

➤ Click the sample report link for complete industry insights: https://market.us/report/nylon-6-filament-yarn-market/request-sample/

Key Takeaways

- The Global Nylon 6 Filament Yarn Market is expected to be worth around USD 51.1 billion by 2034, up from USD 26.2 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In the Nylon 6 Filament Yarn Market, Fully Drawn Yarn (FDY) holds a 34.8% share.

- The fabric segment leads the Nylon 6 Filament Yarn Market by application, accounting for 34.2%.

- By end-user, the apparel and fashion sector dominates the Nylon 6 Filament Yarn Market with 38.3%.

- Direct Sales through Spinners represent the largest distribution channel in the nylon 6 Filament Yarn Market at 49.1%.

- The Asia Pacific market value reached approximately USD 12.8 billion, highlighting strong textile manufacturing growth.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165244

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 26.2 Billion |

| Forecast Revenue (2034) | USD 51.1 Billion |

| CAGR (2025-2034) | 6.9% |

| Segments Covered | By Yarn Type (Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), High-Tenacity Industrial Yarn, Textured Yarn), By Application (Fabric, Sports Apparel, Sports and Adventure Equipment, Travel Accessories, Fishing Nets), By End-user (Apparel and Fashion, Industrial and Technical Textiles, Automotive Components, Consumer Goods, Others), By Distribution Channel (Textile Traders / Distributors, Direct Sales (Spinners), E-commerce Platforms) |

| Competitive Landscape | JCT Group, Century Enka Limited, Zhejiang Century ChenXing Fiber Technology Co., Ltd., Singhal Industries Pvt. Ltd., Salud Industry (Dongguan) Co., Ltd., Changzhou Yida Chemical Fiber Co., Ltd., Anand Rayons Ltd., Yiwu Huading Nylon Co., Ltd., TORAY INDUSTRIES, INC., Prutex Nylon Co., Ltd., EAST ASIA TEXTILE TECHNOLOGY LTD. |

Key Market Segments

By Yarn Type Analysis

In 2024, Fully Drawn Yarn (FDY) dominated the Nylon 6 Filament Yarn Market’s By Yarn Type segment with a strong 34.8% share. Its leadership comes from its high tensile strength, uniform structure, and superior dyeing performance, making it ideal for apparel, home textiles, and various industrial fabric uses. FDY’s smooth texture and consistent quality also make it a preferred material in premium fashion and advanced textile applications.

Rising demand for high-performance fabrics—especially in sportswear and functional clothing—continues to reinforce FDY’s advantage. Its durability, versatility, and cost efficiency support wide adoption among global textile manufacturers. These attributes enable FDY to maintain a competitive edge as industries increasingly shift toward materials that blend performance, aesthetics, and production reliability.

By Application Analysis

In 2024, Fabric dominated the Nylon 6 Filament Yarn Market’s By Application segment with a solid 34.2% share, reflecting its broad use across apparel, home textiles, and upholstery. This leadership stems from Nylon 6 filament yarn’s strength, elasticity, and smooth texture—qualities essential for woven and knitted fabric production.

Its excellent color fastness, durability, and ability to maintain shape make it a preferred choice for both everyday fashion and heavy-use industrial textiles. These performance benefits enhance fabric quality and extend product life, driving steady demand from global manufacturers.

Ongoing advancements in fabric engineering, along with rising interest in high-performance and functional textiles, continue to support the dominance of the fabric segment. As innovation accelerates, Nylon 6 fabrics remain central to applications requiring durability, flexibility, and long-lasting visual appeal.

By End-user Analysis

In 2024, Apparel and Fashion led the Nylon 6 Filament Yarn Market’s end-user segment with a notable 38.3% share, driven by rising demand for clothing that is comfortable, lightweight, and long-lasting. Nylon 6 filament yarn’s strong elasticity, softness, and abrasion resistance make it well-suited for sportswear, casual wear, and performance-driven fashion.

Its ability to retain vibrant colors and withstand repeated washing helps brands deliver durable garments with consistent visual appeal. These qualities keep Nylon 6 yarn highly competitive in modern apparel manufacturing.

Ongoing advances in fabric engineering and the global shift toward functional, stylish, and high-performance clothing further reinforce the dominance of the apparel and fashion segment, ensuring steady consumption of Nylon 6 filament yarn across premium and mainstream categories.

By Distribution Channel Analysis

In 2024, Direct Sales (Spinners) dominated the Nylon 6 Filament Yarn Market’s distribution channel segment with a significant 49.1% share. This leadership reflects manufacturers’ preference for direct engagement, which ensures better control over yarn quality, customized supply options, and improved cost efficiency.

The direct sales model allows quicker adjustments to evolving yarn specifications, helping textile producers respond rapidly to market trends. This channel also encourages stronger supplier–buyer collaboration, improving communication and long-term reliability.

With textile production expanding globally and consistent-quality yarn becoming increasingly important, direct sales continue to be the most trusted and efficient distribution route. This approach strengthens operational flexibility and supports the stable supply chains required in modern textile manufacturing.

Regional Analysis

In 2024, Asia Pacific led the Nylon 6 Filament Yarn Market with a commanding 48.90% share, valued at USD 12.8 billion. Its dominance is fueled by strong textile manufacturing bases in China, India, and Japan, where expanding apparel, industrial fabric, and automotive sectors consistently boost consumption. Growing middle-class demand, rising fashion preferences, and supportive government policies further reinforce the region’s leadership.

North America shows steady progress, driven by the need for high-performance sportswear and advanced technical fabrics, along with innovations in sustainable yarn technologies. Europe benefits from refined textile engineering and its focus on environmentally friendly materials.

Emerging regions such as the Middle East & Africa and Latin America continue to develop gradually, supported by investments in textile infrastructure and export-driven growth. Overall, Asia Pacific remains the fastest-growing and most influential market due to its manufacturing strength and expanding end-use industries.

Top Use Cases

- Sportswear & Activewear: Nylon 6 filament yarn is widely used in clothing like gym wear, swimwear, and sports garments because it offers strong stretch, elasticity, and resilience. It helps fabrics return to shape, resist wear and tear, and handle repeated movement.

- Luggage, Bags & Travel Gear: Nylon 6 filament yarn is also used in rugged items like backpacks, travel bags, and suitcases, where strength and durability matter. Its wear and tear resistance make it suitable for gear that’s dragged, packed, and handled frequently.

- Fishing Nets & Marine Uses: Due to its high tensile strength, elasticity, and durability under harsh outdoor/marine conditions, nylon 6 filament yarn is used in fishing nets and related equipment. It resists abrasion, salt, and water better than many alternatives.

- Industrial Textiles & Technical Fabrics: In industrial settings—ropes, cords, conveyor belts, heavy-duty textile uses—this yarn shows up because it combines strength, flexibility, and wear resistance, making it more reliable under tough working conditions.

Recent Developments

- In June 2025, the company was admitted into the Corporate Insolvency Resolution Process (CIRP) following an order issued by the National Company Law Tribunal (NCLT) on June 10, 2025. As part of this process, all powers of the Board of Directors were suspended, and an Interim Resolution Professional (IRP) was appointed to take charge of the company’s operations and oversee its financial restructuring.

Conclusion

The Nylon 6 Filament Yarn Market continues to grow as industries increasingly prefer strong, flexible, and durable synthetic fibers for apparel, home textiles, automotive interiors, and industrial applications. Its smooth texture, color retention, and ability to withstand frequent use make it a dependable choice for manufacturers seeking high-performance materials.

Advances in textile innovation, rising demand for activewear, and the steady shift toward sustainable yarn solutions are shaping the market’s future direction. As global production capabilities expand and brands pursue better-quality fabrics, Nylon 6 filament yarn is positioned to remain an essential material across multiple end-use sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)