Table of Contents

Overview

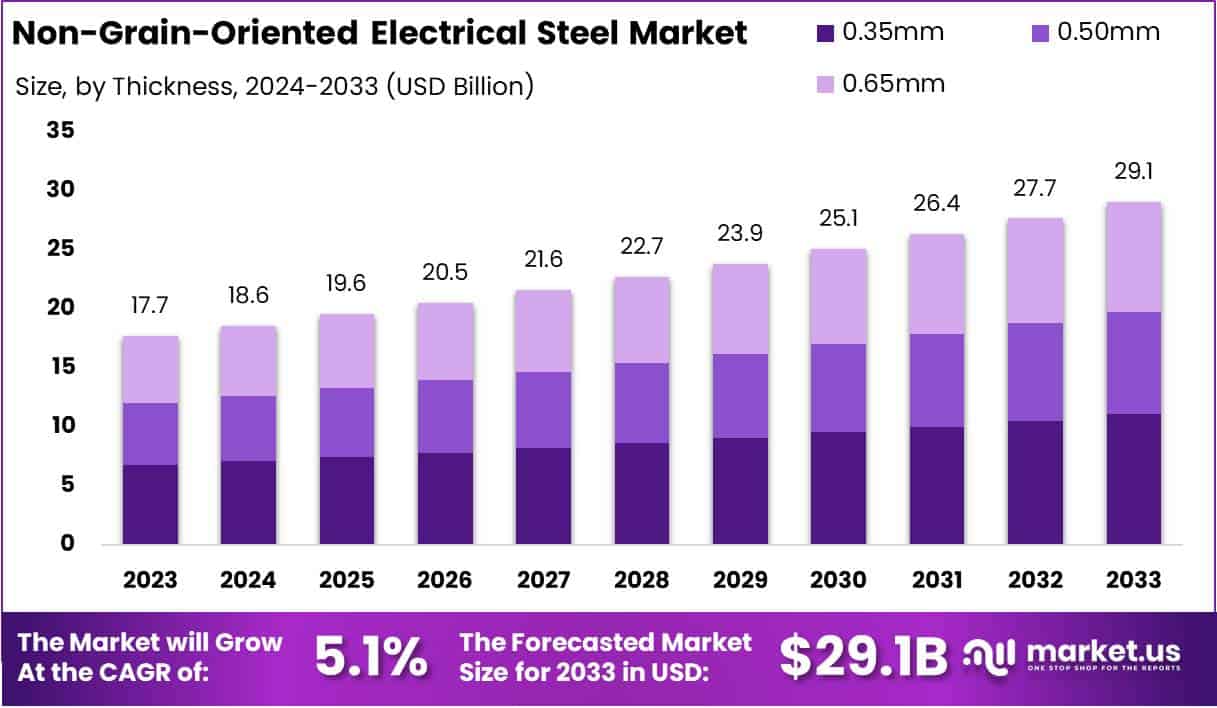

New York, NY – August 01, 2025 – The Global Non-Grain-Oriented Electrical Steel (NGOES) Market is projected to grow from USD 17.7 billion in 2023 to USD 29.1 billion by 2033, achieving a CAGR of 5.1% from 2024 to 2033.

NGOES, a specialized steel with uniform grain structure and isotropic magnetic properties, is optimized for high-efficiency electrical applications like electric motors, generators, and transformers. Its low core loss and high magnetic permeability minimize energy waste, making it ideal for high-speed and variable-load systems.

In 2023, China exported 1.23 million tonnes of electrical steel, a 4% decline from 1.28 million tonnes in 2022 but a significant increase from 860,959 tonnes in 2021. India was the top importer, purchasing 189,184 tonnes (15% of total exports). In Q1 2024, exports surged 30% year-on-year to 356,726 tonnes, with India importing 58,896 tonnes (17%). China’s 2023 electrical steel production reached 15.28 million tonnes, up 15% from 2022, with NGOES accounting for 12.04 million tonnes (an 8% increase). Production capacity is expected to hit 18-20 million tonnes.

India, the world’s second-largest steel producer, is a key player in the NGOES market, with its steel industry generating over USD 100 billion annually and employing more than 2 million people. The sector has reduced energy intensity by 20% over the past decade, reflecting a focus on sustainability. NGOES demand is expected to rise with India’s infrastructure growth, including plans for 100 new airports.

The steel industry, contributing 2% to India’s manufacturing sector, is well-positioned to support energy-efficient technologies in automotive and industrial applications. The NGOES market is further propelled by the booming electric vehicle (EV) sector, valued at over $250 billion with more than 40 million EVs on roads globally and annual sales surpassing 6 million plug-in models. This trend underscores NGOES’s critical role in energy-efficient electrical systems.

Key Takeaways

- The Non-Grain-Oriented Electrical Steel Market is projected to grow from USD 17.7 billion in 2023 to USD 29.1 billion by 2033, at a CAGR of 5.1%.

- The 0.35mm thickness segment led the market with a 38% share in 2023, driven by its application in high-efficiency motors and transformers.

- Semi-processed NGOES dominated with a 53% market share in 2023, due to their cost-efficiency and customization flexibility for manufacturers.

- The Power Generation segment accounted for over 40% of the market share in 2023, fueled by the demand for renewable energy infrastructure and grid modernization.

- Asia-Pacific led the market with a 36.2% share in 2023, driven by rapid industrialization, EV adoption, and renewable energy investments, particularly in China and India.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/non-grain-oriented-electrical-steel-market/request-sample/

Report Scope

| Market Value (2023) | USD 17.7 Billion |

| Forecast Revenue (2033) | USD 29.1 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Thickness (0.35mm, 0.50mm, 0.65mm), By Type (Semi-Processed, Fully Processed), By Application (Household Appliances, Power Generation, AC Motors) |

| Competitive Landscape | Longbank Steel, Tata Steel, Nucor Corporation NLMK, ArcelorMittal S.A., Shougang Group, thyssenkrupp Steel, Baosteel Group Corporation, POSCO, Nippon Steel Corporation, Voestalpine Group, Yieh Corporation, Aperam S.A., Arnold Magnetic Technologies, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=15054

Key Market Segments

By Thickness Analysis

In 2023, the 0.35 mm thickness segment dominated the Non-Grain-Oriented Electrical Steel (NGOES) Market, holding over 38% of the market share. Its prominence stems from its widespread use in high-efficiency motors and transformers, where low core loss and high magnetic permeability are critical for minimizing energy waste. This thickness is a top choice for industrial and automotive applications requiring superior performance.

By Type Analysis

In 2023, Semi-Processed Non-Grain-Oriented Electrical Steel captured over 53% of the global market share, driven by its use in cost-sensitive applications like standard motors, generators, and transformers in automotive, industrial, and energy sectors. Its flexibility, allowing manufacturers to perform annealing to tailor magnetic properties, enhances its appeal for cost-effective, customized solutions.

The Fully Processed segment, though smaller, is vital for high-efficiency applications, particularly in electric vehicle (EV) motors and premium electrical equipment. Its demand is growing due to the rise in EVs and stricter global energy efficiency standards, signaling a strong growth trajectory.

By Application Analysis

In 2023, the Power Generation segment dominated the NGOES market, accounting for over 40% of the market share. This is fueled by global demand for renewable energy and modernized power infrastructure, with NGOES integral to transformers and generators for enhanced energy efficiency and reduced losses.

The Household Appliances segment maintained a strong presence, driven by demand for energy-efficient products like refrigerators, washing machines, and air conditioners. Urbanization and the shift toward smart appliances supported its stable market share in 2023. AC Motors also held a significant share, propelled by industrial automation and the need for high-performance, energy-efficient motors.

Regional Analysis

Asia-Pacific Dominates with 36.2% Market Share in 2023. In 2023, Asia-Pacific led the NGOES market with a 36.2% share, valued at approximately USD 6.4 billion. China, accounting for over 60% of the region’s market, and India, with its electrification and industrial growth, drive demand due to robust electrical, electronics, and EV sectors, alongside renewable energy infrastructure development.

Europe, with a 28% share, is driven by Germany and France, where EU climate goals promote energy-efficient technologies in the automotive and renewable energy sectors. North America, holding nearly 20% of the market, benefits from U.S. and Canadian investments in smart grids and EV infrastructure.

The Middle East & Africa and Latin America together represent about 16% of the market. Countries like Saudi Arabia, South Africa, and Brazil are seeing increased investments in power infrastructure and industrialization, positioning these regions for accelerated growth amid ongoing urbanization and energy reforms.

Top Use Cases

- Electric Vehicle Motors: Non-Grain-Oriented Electrical Steel (NGOES) is crucial for electric vehicle motors due to its uniform magnetic properties, reducing energy loss. It enhances motor efficiency, supporting longer EV range and performance, meeting the rising demand in the growing global EV market, projected to exceed vehicles.

- Power Generators: NGOES is widely used in power generators for its low core loss and high magnetic permeability. It ensures efficient energy conversion, vital for renewable energy systems like wind and hydroelectric power, supporting global efforts to expand sustainable energy infrastructure.

- Transformers: NGOES are essential in transformer cores, especially for high-speed applications. Its isotropic magnetic properties minimize energy losses, improving efficiency in power distribution systems, which is critical as global electricity demand rises with urbanization and industrial growth.

- Household Appliances: NGOES are used in motors for appliances like refrigerators and washing machines. Its energy-efficient properties reduce power consumption, aligning with consumer demand for sustainable, smart appliances in rapidly urbanizing regions worldwide.

- Industrial Automation: NGOES supports motors and generators in industrial automation, enhancing efficiency in factories. Its low energy loss and high durability make it ideal for high-performance equipment, driving productivity and cost savings in expanding industrial sectors.

Recent Developments

1. Longbank Steel

- Longbank Steel has expanded its production capacity for high-grade NGO electrical steel to meet rising demand from EV and renewable energy sectors. The company introduced a new low-loss, high-efficiency grade tailored for electric motors. Longbank is also investing in R&D to improve magnetic properties.

2. Tata Steel

- Tata Steel launched Tata Steel NOES Advanced, a high-performance NGO electrical steel for energy-efficient motors. The company is collaborating with global automakers to develop next-gen EV motor solutions. Tata also plans to increase production capacity in India.

3. Nucor Corporation

- Nucor has introduced Nucor Electrical Steel (NES), a new NGO steel line optimized for electric vehicles and industrial motors. The company is expanding its Berkeley mill to enhance production. Nucor emphasizes sustainability with lower-carbon steelmaking processes.

4. ArcelorMittal S.A.

- ArcelorMittal developed iCARe NGO steels, offering ultra-low core loss for high-speed motors. The company is investing in European facilities to boost NGO steel output for the EV market. Their new grades improve motor efficiency.

5. Shougang Group

- Shougang Group has advanced its high-efficiency NGO electrical steel production, targeting China’s booming EV sector. The company’s latest grades reduce energy loss and are used in premium electric vehicles. Shougang is scaling up output to meet domestic demand.

Conclusion

The Non-Grain-Oriented Electrical Steel market is poised for strong growth, driven by its critical role in energy-efficient applications like electric vehicles, renewable energy systems, and industrial automation. With rising global demand for sustainable technologies and infrastructure development, NGOES’s unique magnetic properties make it indispensable. Its versatility across automotive, power, and consumer sectors ensures robust market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)