Table of Contents

Overview

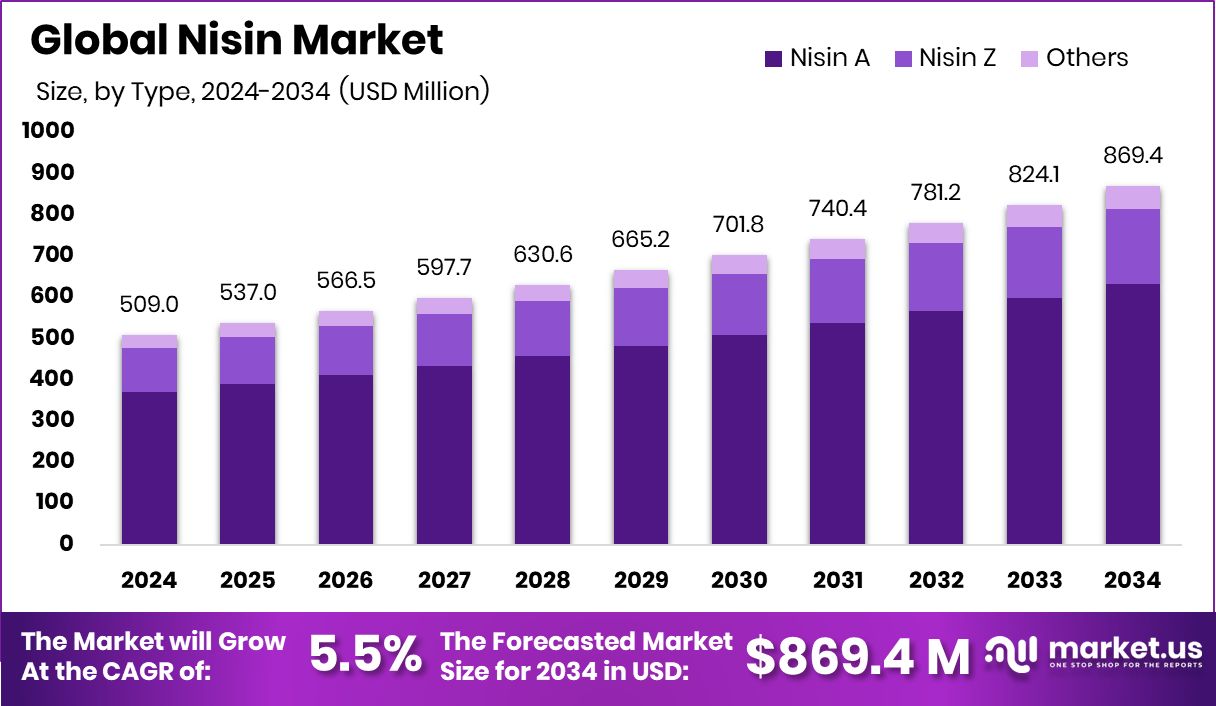

New York, NY – August 05, 2025 – The Global Nisin Market is projected to reach approximately USD 869.4 million by 2034, rising from USD 509.0 million in 2024, and is expected to grow at a CAGR of 5.5% from 2025 to 2034. This growth is strongly supported by the increasing demand for natural preservatives, particularly in North America, which currently holds a dominant market share of 46.1% within the food processing sector.

Nisin, a natural antimicrobial peptide produced by Lactococcus lactis, is widely recognized for its effectiveness against Gram-positive bacteria such as Listeria and Clostridium species. It is approved by key regulatory authorities, including the U.S. FDA and the European Food Safety Authority (EFSA), and is frequently used in processed cheese, dairy products, canned vegetables, and meats to extend shelf life without compromising taste or texture.

The Nisin market encompasses its global trade and application across multiple industries, with primary use in food and beverage, pharmaceuticals, and cosmetics. The shift towards replacing synthetic preservatives with natural alternatives has made Nisin a preferred choice, especially in ready-to-eat and minimally processed food categories.

Consumer demand for clean-label products and heightened awareness of food safety are major factors driving market expansion. As the consumption of convenience and packaged food continues to rise worldwide, the use of Nisin in preserving freshness and preventing spoilage in dairy, meat, and bakery products is expected to grow steadily, reinforcing its importance in modern food processing.

Key Takeaways

- The Global Nisin Market is expected to be worth around USD 869.4 million by 2034, up from USD 509.0 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- Nisin A dominates the market with 72.6%, driven by its superior antimicrobial effectiveness and regulatory acceptance.

- Powdered Nisin holds a 69.4% share due to its longer shelf life and easy incorporation in formulations.

- Meat, poultry, and seafood account for 34.8%, where nisin is used to prevent spoilage and contamination.

- The market in North America was valued at USD 200.5 million in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/nisin-market/request-sample/

Report Scope

| Market Value (2024) | USD 509.0 Million |

| Forecast Revenue (2034) | USD 869.4 Million |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Nisin A, Nisin Z, Others), By Form (Powder, Liquid, Encapsulated), By Application (Meat, Poultry And Seafood Products, Dairy Products, Beverages, Bakery And Confectionery Products, Canned And Frozen Food Products, Others) |

| Competitive Landscape | DSM, Cayman Chemicals, Siveele B.V., Zhejiang Silver-Elephant Bioengineering, Shandong Freda Biotechnology, Chihon Biotechnology, Mayasan Biotech, Handary S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153622

Key Market Segments

By Type Analysis

Nisin A holds a commanding 72.6% share of the Nisin market in 2024, driven by its superior efficacy against a broad spectrum of Gram-positive bacteria and its regulatory approval for use in various food categories worldwide. Its thermal stability and compatibility with other preservation methods make it a top choice for processed cheese, canned foods, and dairy products.

Nisin A’s ability to extend shelf life without affecting taste or texture aligns with the growing consumer preference for natural, clean-label preservatives. Its consistent performance in high-moisture, protein-rich environments further solidifies its dominance, with steady growth expected as demand for minimally processed foods rises.

By Form Analysis

In 2024, the powder form of Nisin captured a 69.4% market share, favored for its long shelf life, ease of handling, and stability during storage and transport. Powdered Nisin’s versatility allows seamless integration into seasonings, mixes, and food batches, particularly in dry and semi-moist products.

Its uniform distribution and reliable antimicrobial activity make it ideal for quality-sensitive food production. The powder’s cost-effectiveness in bulk manufacturing and logistics, combined with its compatibility with heat-treated products, reinforces its leading position in the market.

By Application Analysis

Meat, poultry, and seafood products led the Nisin market in 2024, accounting for 34.8% of demand. Nisin’s robust antimicrobial properties, effective against spoilage organisms and pathogens like Listeria monocytogenes and Clostridium botulinum, drive its widespread use in these perishable, high-protein categories.

The rise in consumption of ready-to-eat and packaged protein products, coupled with consumer demand for clean-label and minimally processed foods, bolsters Nisin’s adoption. Its thermal stability ensures effectiveness through various processing methods, supporting compliance with strict safety standards and maintaining product freshness.

Regional Analysis

North America dominated the global Nisin market in 2024, holding a 46.1% share with a market value of USD 200.5 million. Strong demand for clean-label preservatives and stringent food safety regulations in the U.S. and Canada fuel this growth, alongside the region’s high consumption of processed and packaged foods.

Europe follows closely, driven by health-conscious consumers and strict EU standards favoring natural additives. The Asia Pacific region is expanding rapidly due to urbanization, a growing middle class, and increased food quality awareness in countries like China, Japan, and India. Latin America and the Middle East & Africa, while smaller markets, are seeing gradual adoption of Nisin to meet the demand for safe, shelf-stable food products.

Top Use Cases

- Dairy Preservation: Nisin is widely used in dairy products like cheese and yogurt to prevent spoilage by Gram-positive bacteria. It extends shelf life without affecting taste or texture, making it ideal for processed cheese spreads and dairy desserts, ensuring safety and quality in high-moisture environments.

- Meat and Poultry Safety: In meat, poultry, and seafood, nisin acts as a natural preservative, controlling pathogens like Listeria monocytogenes. It helps maintain freshness in ready-to-eat products, meeting consumer demand for clean-label foods while ensuring compliance with strict safety standards.

- Canned Food Stability: Nisin is added to canned goods like vegetables and soups to inhibit thermophilic bacteria, reducing spoilage at high storage temperatures. Its effectiveness in low-pH foods, like canned tomatoes, allows less heat processing, preserving quality and safety.

- Beverage Shelf Life: Nisin is used in beverages, including fruit juices and beer, to prevent spoilage from lactic acid bacteria. It ensures product stability without altering flavor, supporting the growing demand for natural preservatives in the beverage industry.

- Bakery and Confectionery: In baked goods and confectionery, nisin prevents microbial growth, extending shelf life. Its compatibility with dry and semi-moist products makes it a reliable choice for manufacturers aiming to maintain product freshness and meet clean-label trends.

Recent Developments

1. DSM (Firmenich)

DSM has been focusing on expanding its natural preservative portfolio, including Nisin, to meet clean-label demands in food and beverages. Recent innovations involve enhancing Nisin’s stability in plant-based products. DSM also emphasizes sustainable production methods. Their research highlights Nisin’s efficacy against antibiotic-resistant bacteria, broadening its pharmaceutical applications.

2. Cayman Chemicals

Cayman Chemicals supplies high-purity Nisin for research, particularly in antimicrobial studies. Recent updates include providing Nisin for studies on biofilm disruption and synergistic effects with antibiotics. The company has expanded its analytical standards for Nisin to support academic and pharmaceutical research.

3. Siveele B.V.

Siveele B.V. specializes in natural preservatives, with Nisin as a key product. They recently improved Nisin formulations for dairy and meat applications, enhancing shelf-life extension. The company is also exploring Nisin’s role in animal feed as an antibiotic alternative.

4. Zhejiang Silver-Elephant Bioengineering

This Chinese manufacturer has scaled up Nisin production using advanced fermentation tech. They recently secured regulatory approvals in new markets, including South America. Their R&D focuses on cost-effective Nisin for large-scale food preservation.

5. Shandong Freda Biotechnology

Freda Biotech has optimized Nisin for use in canned foods and ready-to-eat meals. They recently partnered with global food brands to integrate Nisin into natural preservation systems. Their research highlights Nisin’s heat stability in processed foods.

Conclusion

Nisin’s versatility as a natural antimicrobial peptide drives its growing adoption in the food industry. Its ability to extend shelf life, ensure safety, and align with clean-label trends makes it a valuable preservative across dairy, meat, beverages, and more. With ongoing innovations like nisin nanoparticles and active packaging, the market is poised for steady growth, fueled by consumer demand for safe, natural food solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)