Table of Contents

Overview

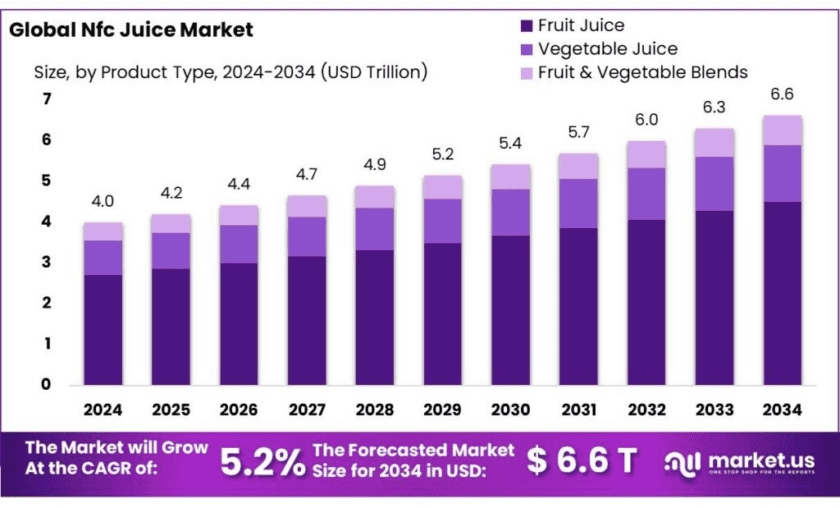

New York, NY – Nov 03, 2025 – The global NFC juice market is projected to grow from USD 4.0 trillion in 2024 to approximately USD 6.6 trillion by 2034, reflecting a compound annual growth rate CAGR of 5.2% over the period 2025–2034. In 2024, North America held a leading position in the market, accounting for over 31.8% share and generating around USD 1.2 trillion in revenue.

In India, the NFC-juice sector is gaining traction thanks to rising health awareness and a preference for natural, preservative-free drinks. Indian fruit production reached approximately 110.21 million tonnes in 2022–23 and is estimated to rise to about 112.08 million tonnes in 2023–24. This strong raw-material base underpins the expansion of the NFC-juice industry.

Supportive government initiatives further complement the growth of India’s NFC-juice market. The Ministry of Food Processing Industries (MoFPI) has approved the Production Linked Incentive Scheme (PLIS) covering the food‐processing sector—including processed fruits and vegetables—to boost competitiveness and attract investment. Additionally, the National Horticulture Board reports that India produced around 107.24 million metric tonnes of fruits in 2021-22, reinforcing the raw-material availability for juice processing.

- Under the Operation Greens Scheme, the MoFPI approved 53 projects with total grant funding of roughly ₹634.59 crore, out of a total project cost of about ₹2,457.49 crore, to enhance farmer value-realisation and reduce post-harvest losses—thus improving raw-material quality and supply for NFC-juice production.

Key Takeaways

- Nfc Juice Market size is expected to be worth around USD 6.6 Trillion by 2034, from USD 4.0 Trillion in 2024, growing at a CAGR of 5.2%.

- Fruit Juice held a dominant market position, capturing more than a 67.9% share of the NFC Juice market.

- Organic held a dominant market position, capturing more than a 79.3% share of the NFC juice market.

- Non-alcoholic held a dominant market position, capturing more than a 73.4% share of the NFC juice market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 59.8% share of the NFC juice market.

- North America dominated the NFC juice market, capturing a significant 31.8% share, valued at approximately USD 1.2 trillion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/nfc-juice-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.0 Tr |

| Forecast Revenue (2034) | USD 6.6 Tr |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Product Type (Fruit Juice, Vegetable Juice, Fruit And Vegetable Blends), By Nature (Organic, Conventional), By Application (Non-alcoholic, Alcoholic, Bakery And Confectionery, Dairy And Frozen Desserts, Others), By Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, E-Commerce, Others) |

| Competitive Landscape | Binder International GmbH, Citromax Group, Louis Dreyfus Company, Döhler GmbH, Julian Soler, S.A., Lemon Concentrate, Meykon, Nafoods Group, Nongfu Spring Co., Ltd., PepsiCo, Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159155

Key Market Segments

By Product Type Analysis — Fruit Juice Dominates with 67.9% Market Share

In 2024, the Fruit Juice segment held a dominant position, accounting for over 67.9% of the global NFC Juice Market. Its popularity stems from strong consumer preference for natural, fresh, and preservative-free beverages. As more consumers move away from sugary and processed drinks, demand for cleaner, healthier alternatives has surged. Fruit juices, particularly those made from citrus fruits such as orange and lemon, are widely favored in both retail and foodservice sectors. This trend is reinforced by growing awareness of nutrition and the health benefits of vitamin-rich fruit beverages.

By Nature Analysis — Organic NFC Juice Leads with 79.3% Market Share

The Organic segment emerged as the clear leader in 2024, securing more than a 79.3% share of the NFC Juice Market. This dominance is fueled by rising consumer awareness about the health and environmental benefits of organic, pesticide-free, and sustainably sourced juices. Health-conscious buyers, particularly in North America and Europe, are increasingly opting for certified organic products that reflect their commitment to wellness and sustainability. The growth of this segment is supported by regulatory incentives for organic farming and expanding portfolios from leading juice producers.

By Application Analysis — Non-Alcoholic NFC Juice Holds 73.4% Market Share

In 2024, the Non-Alcoholic segment captured a substantial 73.4% share of the NFC Juice Market, reinforcing its position as the preferred choice among consumers seeking healthier beverage options. Growing interest in alcohol-free, nutrient-rich, and natural drinks has accelerated this trend. Consumers are increasingly turning to non-alcoholic NFC juices as alternatives to carbonated soft drinks and alcoholic beverages, which are often criticized for high sugar and calorie content. The segment’s growth is also supported by rising awareness of the nutritional and antioxidant properties of fresh fruit juices.

By Distribution Channel Analysis — Supermarkets/Hypermarkets Lead with 59.8% Market Share

In 2024, Supermarkets and Hypermarkets led the NFC Juice Market with a commanding 59.8% share, making them the primary retail channel for these beverages. Their success is driven by the convenience of one-stop shopping, wide product assortments, and strategic urban and suburban locations. Consumers benefit from easy access to premium, organic, and cold-pressed NFC juice varieties offered at competitive prices. The rise of health-focused shopping trends has prompted major retailers to expand their beverage shelves with functional and exotic fruit juices.

List of Segments

By Product Type

- Fruit Juice

- Orange

- Pineapple

- Mango

- Mixed Berries

- Peach

- Others

- Vegetable Juice

- Fruit & Vegetable Blends

By Nature

- Organic

- Conventional

By Application

- Non-alcoholic

- Alcoholic

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Others

By Distribution Channel

- Supermarkets/ Hypermarkets

- Convenience Stores

- E-Commerce

- Others

Regional Analysis

North America Holds 31.8% Share of Global NFC Juice Market in 2024

In 2024, North America emerged as the leading region in the global Not From Concentrate (NFC) Juice Market, accounting for an impressive 31.8% share, valued at around USD 1.2 trillion. This dominance is attributed to the region’s strong health-conscious consumer base, well-established retail infrastructure, and rising inclination toward natural, organic, and preservative-free beverages. The growing awareness of the nutritional advantages of NFC juices—such as higher vitamin retention and freshness without added sugars or chemicals—has significantly propelled demand.

Within the region, the United States remains the largest contributor to NFC juice consumption. The availability of premium, organic, and non-GMO juices across major retail chains like supermarkets and hypermarkets continues to boost sales. As reported by the U.S. Department of Agriculture (USDA), the organic food sector in the U.S. has expanded by over 5% annually, underscoring the strong consumer shift toward healthier beverage options. Additionally, growing plant-based diet adoption and sugar-reduction trends have accelerated the preference for non-alcoholic and low-sugar NFC juices, reinforcing North America’s leadership in this market segment.

Top Use Cases

Retail Premiumization And EU Label Compliance: Position NFC juices as “fresh-like” SKUs that meet EU fruit-juice definitions and labelling rules. Use this for on-pack claims and retailer range reviews in Europe.

Cold-Chain Execution for Quality And Waste Control: Build chilled supply chains at 0–5 °C from filling to shelf; pasteurized NFC orange juice typically cools to ~4 °C before bottling, with shelf life ~7–30 days depending on pH and pack. Use this to size warehouse space, delivery frequency, and date-code policy.

Frozen Inventory Buffering for Foodservice And Airlines: Leverage frozen NFC/juice logistics to smooth seasonality: frozen product can hold ~3 years, then ~60 days post-defrost, enabling centralized thaw-to-order programs for airlines, rail, and caterers without quality loss.

Differentiation vs. From-Concentrate in EU Buying Decks: Educate buyers: 1 L of concentrate typically reconstitutes to 5–6 L of single-strength juice; NFC avoids this reconstitution step and supports “minimal processing” narratives for premium pricing and margin defense.

India Label Review & Claim Risk Mitigation: For India launches and audits, align with FSSAI standards and the June 3, 2024 advisory curbing “100% fruit-juice” front-of-pack claims that could mislead. Use this to update artwork, claims substantiation, and SOPs for compliance.

Supply-Risk Scenario Planning for Orange-Led Portfolios: Account for raw-material shocks: Brazil’s orange-juice exports dropped ~23% (Jul–Dec) in 2024/25, hitting series lows; USDA also flags supply constraints in MY 2023/24. Use this to stress-test NFC orange pricing, diversify into apple/grape NFC, and expand multi-fruit blends.

Clean-Label Smoothies & Lower-Sugar Blends: Develop NFC-based blends (fruit + veg) to cut sugar while keeping taste—an industry direction noted across NFC and smoothie formats (e.g., mixes with beets/carrots/tomato). Position SKUs for wellness channels and school/office catering.

HoReCa Fresh-Like Programs with Short DSD Cycles: Design 2–3 deliveries/week for cafés and QSRs to exploit NFC’s 7–30-day chilled life; match pack sizes and closures to high-turnover dayparts (breakfast/brunch). Improves freshness scores and reduces returns.

Recent Developments

Binder International GmbH & Co. KG: Founded in 1923, Binder International is a Germany-based global supplier specialising in fresh and frozen fruits, IQF fruits & vegetables, purees, concentrates, natural aromas and notably NFC (Not From Concentrate) juices. The firm reports that it imports over 100 000 tons of ingredients annually (2023) through its ten global locations. It offers conventional and organic juice varieties including citrus, berries, exotics, and is expanding its NFC juice business under its trading and service production model.

Citromax Group: Citromax is a vertically integrated processor and world-leader in organic lemon production based in Argentina and the U.S., offering NFC juices (both organic and conventional) alongside essential oils, concentrates, peel and pulp–derived products. Its 2024 sustainability report highlights the provision of organic NFC juice with tailored pulp levels for premium beverage applications. The firm emphasises sustainable farming and full control from orchard to processing facility, positioning itself to meet growing demand for clean-label, natural citrus-based NFC juices.

Louis Dreyfus Company (LDC): In 2023-24, LDC expanded its NFC juice portfolio by launching the “Montebelo Brasil” brand in France, aiming for a 10 % market share of the fresh-juice category within three to four years. Earlier, in late 2022, LDC developed an NFC orange juice variant with 30 % reduced natural sugar and 3× the dietary fibre compared to its standard offering.

Döhler GmbH: In 2023, Döhler increased its focus on NFC juices, citing rising demand for “100 % natural” and fresh-taste fruit & vegetable products processed with gentle methods. They promote a global procurement network and owned processing facilities to support this growth. Additionally, in December 2023 they emphasized the role of sustainability and functional formulations as key drivers in their NFC juice ingredient portfolio.

Julián Soler S.A.: Based in Castilla-La-Mancha, Spain, Julián Soler produces NFC grape juices (white Airén and red Bobal varieties) and concentrates from fresh Spanish grapes. By 2023 the company exports to over 60 countries across five continents and positions its NFC grape juice as sulphite-free and additive-free.

Lemon Concentrate S.L.: Headquartered in Spain and vertically integrated from tree-to-drum, Lemon Concentrate supplies NFC lemon juice and concentrates. In 2024 the firm emphasises fresh Mediterranean-grown citrus, packed same-day to retain flavour, offering NFC lemon juice in formats such as tankers, drums and bag-in-box.

Meykon: In 2023, Meykon focused on supplying high-quality NFC juices—such as orange, pomegranate and lemon—from its Turkey-based facility near Antalya, where fresh fruits from plantations within ~50 km are processed immediately after harvest. The product lines emphasise clean-label claims (GMO-free, halal, natural) and global export reach, positioning Meykon as a preferred ingredient partner for beverage manufacturers seeking premium NFC formats.

Nafoods Group: In 2024, Nafoods Group expanded its NFC-juice production in Vietnam, processing over 20,000 tons annually of juice/puree/NFC formats across multiple factories in Nghe An, Long An and the Central Highlands. The company exports to more than 50 countries, sources from ~30,000 hectares of raw-material area, and markets an ingredient portfolio featuring guava, banana, dragon-fruit and other exotic NFC juices, supporting global beverage innovation.

Nongfu Spring Co., Ltd.: In the first half of 2023, Nongfu Spring reported that its “NFC” juice and “17.5°” juice lines saw heightened consumer recognition under its “Farmer’s Orchard” branding. In 2022 the company recorded RMB 2,879 million in revenue from its juice beverage products, marking a 10.1 % increase compared to 2021 and accounting for 8.7 % of total annual revenue.

PepsiCo, Inc.: While PepsiCo does not publicly isolate “NFC juice” figures, in 2024 the company emphasised its beverage evolving-nutrition strategy, noting its top 26 beverage markets comprised 78 % of global beverage volume and that its Nutrition Sciences team guided reformulations to meet health-authority targets. The firm also flagged new organic and juice-based launches in late 2023 as part of its “Positive Choices” expansion.

Conclusion

In conclusion, the global market for Not‑From‑Concentrate (NFC) juice presents a compelling growth narrative as consumers increasingly favour minimally-processed, premium beverages. The market is not without its challenges: cost pressures from raw-material volatility, the need for refrigerated distribution for many NFC formats, and competitive pressures from alternative beverage categories all require manufacturers and brands to be disciplined in sourcing, processing, packaging and channel strategy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)