Table of Contents

Introduction

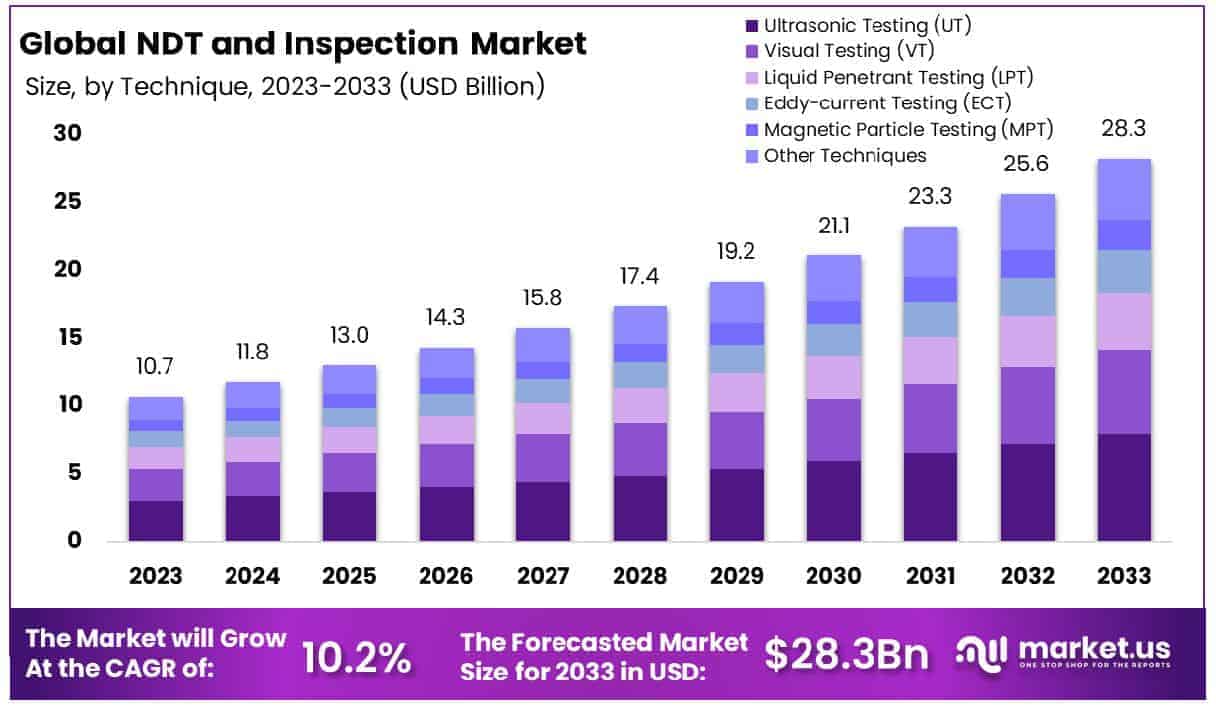

The Global Non-Destructive Testing (NDT) and Inspection market is projected to reach a value of approximately USD 28.3 billion by 2033, up from USD 10.7 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 10.20% during the forecast period from 2024 to 2033.

Non-Destructive Testing (NDT) and Inspection refer to a set of analytical techniques used to evaluate the properties of a material, component, or structure without causing damage. This methodology is widely applied across industries such as aerospace, automotive, energy, manufacturing, and construction to detect flaws, cracks, or weaknesses in materials while ensuring their continued functionality.

The NDT and Inspection market encompasses a range of technologies and services that facilitate the detection, evaluation, and prevention of material defects, ensuring the safety, reliability, and performance of assets. The market for NDT and Inspection has experienced steady growth driven by the increasing emphasis on safety and quality assurance across various industries. This growth can be attributed to heightened regulatory standards, advancements in technology, and the need for improved asset longevity and operational efficiency.

Additionally, the growing adoption of Industry 4.0 technologies, such as automation and real-time data analytics, has further propelled demand for NDT and Inspection services, providing more accurate and efficient diagnostic capabilities. The global expansion of the manufacturing and energy sectors, particularly in emerging economies, presents significant opportunities for market growth.

As industries continue to prioritize cost-effective maintenance strategies and asset integrity, the demand for NDT and Inspection services is expected to rise. Furthermore, the increasing adoption of digital NDT solutions and remote inspection techniques offers new avenues for growth, enabling companies to enhance operational efficiency, reduce downtime, and minimize human error in critical inspections.

Key Takeaways

- The global Non-Destructive Testing (NDT) and Inspection market is projected to reach a value of approximately USD 28.3 billion by 2033, up from USD 10.7 billion in 2023, growing at a compound annual growth rate (CAGR) of 10.20% from 2024 to 2033.

- North America currently holds a 37% share of the global NDT and Inspection market.

- Utilizes high-frequency sound waves to effectively detect internal flaws.

- Involves direct assessment of items to ensure compliance with quality and safety standards.

- Focus on developing expertise in NDT techniques, thereby enhancing inspection accuracy.

- Ensures that components adhere to precise specifications using accurate sizing techniques.

- The Manufacturing sector represents 23% of the overall demand for NDT services, highlighting the critical role of quality control in production processes.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 10.7 Billion |

| Forecast Revenue (2033) | USD 28.3 Billion |

| CAGR (2024-2033) | 10.20% |

| Segments Covered | By Technique(Visual Testing (VT), Magnetic Particle Testing (MPT), Liquid Penetrant Testing (LPT), Eddy-current Testing (ECT), Ultrasonic Testing (UT), Other Techniques), By Method(Visual Inspection, Surface Inspection, Volumetric Inspection), By Service(Inspection Services, Training Services, Equipment Rental Services, Calibration Services), By Application(Flaw Detection, Dimensional Measurement, Chemical Composition Determination, Stress and Structure Analysis, Leak Detection, Other Applications), By Vertical(Manufacturing, Oil & Gas, Power Generation, Automotive, Other Verticals) |

| Competitive Landscape | Olympus Corporation, Previan Technologies, Bureau Veritas, Fischer Technologies Inc., Sonatest, Mistras Group, Inc., MME Group, Nikon Metrology Inc., Zetec Inc., Intertek Group plc |

Emerging Trends

- Automation and Robotics Integration: The adoption of automation and robotics in NDT is increasing rapidly. Robots equipped with NDT sensors are performing inspections in hazardous or difficult-to-reach environments, thereby improving both safety and efficiency. These innovations are especially prominent in industries such as aerospace, oil & gas, and power generation.

- AI and Machine Learning in NDT Analysis: The incorporation of artificial intelligence (AI) and machine learning (ML) algorithms into NDT inspection systems is enhancing data analysis capabilities. These technologies enable faster, more accurate defect detection and predictive maintenance, reducing the potential for human error and increasing operational efficiency.

- Portable and Wearable NDT Equipment: The demand for portable and wearable NDT equipment is rising, driven by the need for on-site, real-time inspections. This trend allows for greater flexibility in maintenance schedules and immediate problem-solving in critical operations, particularly in the construction and manufacturing sectors.

- Advanced Ultrasonic Testing (UT) Technologies: Ultrasonic testing technologies, particularly phased array ultrasonic testing (PAUT) and time-of-flight diffraction (TOFD), are becoming more advanced, providing enhanced resolution and the ability to inspect complex structures. These technologies are revolutionizing the inspection of welds and materials, ensuring higher-quality results.

- Digitalization and Data Integration: The integration of NDT inspection data into centralized digital systems is transforming the way data is stored, analyzed, and shared. Cloud-based platforms and the Internet of Things (IoT) are facilitating remote monitoring and data access, enabling real-time decision-making and enhancing predictive maintenance capabilities.

Top Use Cases

- Aerospace: NDT plays a critical role in aerospace, where the safety of components such as turbine blades, fuselage, and engine parts is crucial. Techniques like ultrasonic and eddy current testing are used to detect cracks or other defects in structural materials, ensuring safety and compliance with regulatory standards.

- Oil & Gas: In the oil and gas industry, NDT methods are essential for inspecting pipelines, offshore platforms, and storage tanks. Techniques such as magnetic particle testing (MPT) and radiographic testing (RT) help identify cracks, corrosion, and material degradation, reducing the risk of leaks and operational failures.

- Power Generation: NDT is widely used in power generation plants to inspect critical components, including boilers, pressure vessels, and turbine blades. Methods like visual testing (VT) and acoustic emission testing (AET) help detect faults early, preventing costly downtime and enhancing the longevity of equipment.

- Construction and Civil Engineering: Structural integrity is vital in construction and civil engineering projects. NDT methods, including concrete testing and ground-penetrating radar (GPR), are used to evaluate the condition of foundations, bridges, and tunnels. This ensures the safety and durability of the infrastructure.

- Automotive Manufacturing: In automotive manufacturing, NDT techniques such as ultrasonic testing and laser scanning are employed to ensure the quality of components like engine parts, chassis, and exhaust systems. These methods help in identifying potential failures during production, ensuring that only high-quality products are delivered to consumers.

Major Challenges

- High Initial Investment Costs: The cost of setting up advanced NDT systems, including specialized equipment and skilled personnel, can be a significant barrier for small and mid-sized companies. Despite the long-term savings, the initial expenditure required for high-tech NDT solutions remains a challenge for broader adoption.

- Skilled Labor Shortage: There is a growing shortage of skilled personnel proficient in advanced NDT techniques. The complexity of modern NDT technologies, combined with the need for rigorous certification, makes it challenging to find qualified inspectors, particularly in specialized sectors like aerospace and nuclear.

- Complexity of Inspection in Harsh Environments: While NDT technologies are becoming more advanced, inspecting components in harsh or extreme conditions (such as deep-sea environments or high-temperature areas) still presents significant technical challenges. Ensuring reliability and accuracy in these conditions requires specialized equipment and expertise.

- Data Management and Interpretation: The volume of data generated by modern NDT methods, particularly when integrated with IoT devices and cloud systems, can be overwhelming. Effective data management and interpretation require advanced analytics capabilities, which many organizations may lack or struggle to implement.

- Regulatory Compliance: Adherence to industry-specific standards and regulations remains a significant challenge in the NDT market. As technology evolves, ensuring that NDT methods align with the latest safety regulations and standards requires continuous training and updating of equipment.

Top Opportunities

- Growth in Emerging Markets: The increasing industrialization of emerging markets in Asia, Africa, and Latin America presents significant opportunities for the expansion of NDT services. As these regions develop their infrastructure and manufacturing sectors, demand for reliable inspection services is expected to grow.

- Integration with Industry 4.0: The growing trend towards Industry 4.0 presents significant opportunities for NDT. The integration of NDT systems with automated production lines, robotics, and predictive maintenance platforms can enhance efficiency and reduce operational costs across various sectors, including automotive, manufacturing, and energy.

- Advancements in AI and Automation: The ongoing development of AI and machine learning algorithms presents opportunities for enhancing NDT processes. Automation of defect detection, real-time data analysis, and predictive analytics are expected to improve the accuracy and speed of inspections, reducing human error and operational downtime.

- Expanding Applications in Additive Manufacturing: As additive manufacturing (3D printing) continues to grow, there is an increasing need for NDT to ensure the quality of 3D-printed parts. Advanced inspection methods will be required to evaluate the integrity of materials used in 3D printing, offering new market opportunities in aerospace, healthcare, and automotive industries.

- Environmental Sustainability: NDT plays a critical role in sustainability efforts by enabling the inspection of renewable energy systems, such as wind turbines and solar panels. The increasing focus on green energy presents opportunities for NDT services to support the maintenance and longevity of environmentally friendly infrastructure.

Key Player Analysis

In 2024, key players in the global Non-Destructive Testing (NDT) and Inspection market are strategically positioned to capture market share through diverse technological advancements and strong operational footprints. Olympus Corporation, with its comprehensive NDT solutions, continues to lead the market through innovations in ultrasonic testing and advanced imaging technologies. Bureau Veritas, a prominent global entity, leverages its wide network of inspection services and expertise in asset integrity management to maintain a competitive edge. Companies like Fischer Technologies Inc. and Sonatest contribute with precision testing instruments and specialized solutions for critical industrial applications.

Mistras Group, Inc. capitalizes on its integrated services, combining inspection with condition monitoring, providing added value to clients across various industries. Nikon Metrology Inc. and Zetec Inc. also maintain a strong position by offering advanced inspection equipment, particularly in the aerospace and manufacturing sectors. Additionally, Intertek Group plc is focused on expanding its testing services and increasing its global presence. These companies are poised for growth as demand for NDT solutions increases across industries such as aerospace, oil and gas, and construction.

Market Key Players

- Olympus Corporation

- Previan Technologies

- Bureau Veritas

- Fischer Technologies Inc.

- Sonatest

- Mistras Group, Inc

- MME Group

- Nikon Metrology Inc.

- Zetec Inc.

- Intertek Group plc

Regional Analysis

North America Leads NDT and Inspection Market with Largest Market Share of 37% in 2024

The Non-Destructive Testing (NDT) and inspection market in North America has exhibited a substantial footprint in the industry, commanding a dominant 37% market share in 2024. Valued at USD 3.9 million, this region underscores its pivotal role in shaping market dynamics. The prominence of North America can be attributed to the advanced technological adoption and rigorous regulatory standards that necessitate robust inspection protocols across various sectors, including aerospace, automotive, and infrastructure.

The concentrated presence of leading market players and high investment in R&D activities further consolidate its market position, propelling the region’s growth trajectory. As industries continue to emphasize safety and quality assurance, the demand for NDT and inspection services in North America is anticipated to sustain its upward trend, reinforcing its leading stance in the global market.

Recent Developments

- In 2024, NDT Global introduced a 56-inch ultrasonic inline inspection tool, developed with Aramco. The tool, designed for large-diameter pipelines, represents a step forward from traditional inspection methods like magnetic flux leakage (MFL). As the largest of its kind by NDT Global, it enhances detection of cracks and metal loss while navigating complex pipeline systems. Nathan Leslie, Vice-President of Product Management at NDT Global, expressed enthusiasm about the partnership, highlighting the tool’s potential to improve pipeline inspections.

- In March 6, 2024, MISTRAS Group, Inc. (MG: NYSE) reported its financial performance for the fourth quarter and the year ended December 31, 2023. As a provider of asset protection solutions, MISTRAS continues to deliver integrated technology solutions for a variety of industries.

- In 2025, GE Aerospace rolled out an AI-driven inspection tool for narrowbody aircraft engines. This new tool, which leverages AI for better inspection consistency, enables technicians to rapidly identify and address issues, ultimately reducing inspection time by half and increasing engine availability amid high demand for air travel.

- On January 14, 2025, Wabtec Corporation (NYSE: WAB) announced it would acquire the Inspection Technologies division of Evident, a former part of Olympus Corporation. The acquisition strengthens Wabtec’s digital intelligence capabilities, positioning the company for further growth by enhancing its portfolio of inspection technologies.

- In 2024, Element Materials Technology expanded its offerings by acquiring ISS Inspection Services. ISS specializes in non-destructive testing and special process services, and the acquisition enhances Element’s ability to serve sectors like aerospace, energy, and defense, broadening its footprint in critical industries.

- In 2023, TÜV Rheinland in Spain acquired Burotec, a Spanish business known for its inspection, engineering, and security services. This acquisition enhances TÜV Rheinland’s presence in the voluntary services sector and expands its capabilities across various industrial processes in Spain and beyond.

- In 2023, Intertek Group plc announced the acquisition of Controle Analítico, a leading Brazilian environmental analysis firm specializing in water testing. The acquisition reflects the growing importance of environmental health and sanitation services, especially as Brazil aims to meet ambitious goals for water and sanitation infrastructure by 2033.

Conclusion

The global Non-Destructive Testing (NDT) and Inspection market is poised for significant growth as industries continue to prioritize safety, quality assurance, and asset longevity. Driven by advancements in technologies such as automation, AI, and digitalization, NDT is becoming an integral part of industrial operations, enhancing the efficiency and accuracy of inspections across sectors like aerospace, oil & gas, manufacturing, and construction. The increasing focus on regulatory compliance and operational efficiency, combined with the rise of Industry 4.0 and the expansion of emerging markets, presents ample opportunities for market players. However, challenges related to high initial costs, skilled labor shortages, and complex inspection environments remain, requiring ongoing innovation and investment. As the demand for reliable, cost-effective solutions grows, the NDT market is set to play a critical role in ensuring the safety and performance of industrial assets worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)