Table of Contents

Overview

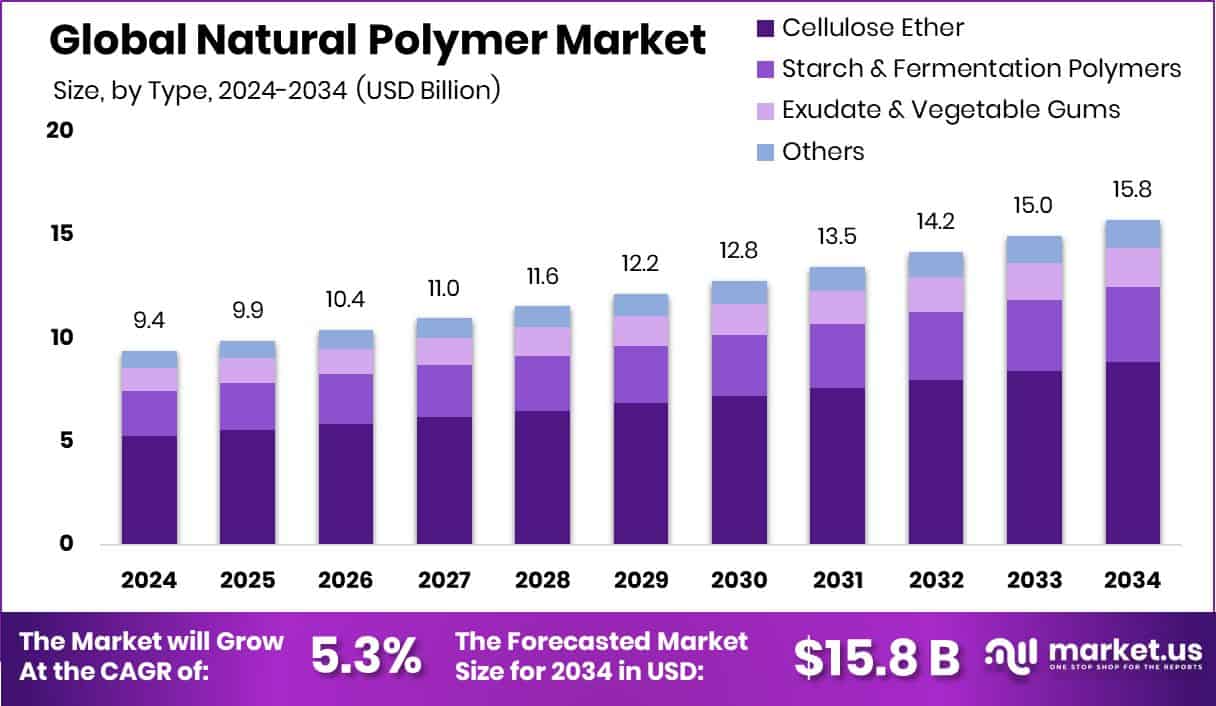

New York, NY – May 14, 2025 – The global Natural Polymer Market is experiencing strong growth, driven by increasing demand for eco-friendly and biodegradable materials across industries like food packaging, pharmaceuticals, cosmetics, and textiles. In 2024, the market was valued at USD 9.4 billion and is projected to reach USD 15.8 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034.

Cellulose Ether dominated the By Type segment of the Natural Polymer Market with a 56.3% share, reflecting its widespread use across industries. Pharmaceuticals led the By Application segment of the Natural Polymer Market with a 34.9% share, driven by the growing use of natural polymers in drug delivery, controlled-release tablets, and bio-compatible excipients.

US Tariff Impact on Market

On March 6, 2025, President Donald Trump announced a further delay in imposing tariffs on select imports from Canada and Mexico. A U.S.-based polymers trader noted on March 6 that tariffs are significantly disrupting business, with Chinese buyers avoiding risks and European clients facing uncertainties.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-natural-polymer-market/request-sample/

S&P Global Commodity Insights’ Platts reported high-density polyethylene film FAS Houston at $992/mt on March 5, unchanged from the prior week. Another source highlighted that anticipated 25% tariffs on Canada and Mexico create substantial uncertainty, with tariffs on Canada expected to have a greater impact on the U.S. construction sector than those on Mexico.

Key Takeaways

- Global Natural Polymer Market is expected to be worth around USD 15.8 billion by 2034, up from USD 9.4 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- Cellulose ether accounts for 56.3% in type, showing a dominant preference in natural polymer applications globally.

- Pharmaceuticals lead application segment at 34.9%, highlighting strong demand for natural polymers in healthcare.

- In 2024, Asia-Pacific captured 43.9% market share, worth USD 4.1 billion.

Analyst Viewpoint

The Natural Polymers Market is a bright spot for investors. Consumers are driving this boom, craving sustainable, biodegradable alternatives like chitosan and cellulose for eco-friendly packaging, medical devices, and food products. Investments in biodegradable polymers are especially promising, as they align with global sustainability goals.

However, risks include high production costs and tariff-related supply chain disruptions, particularly with 145% tariffs on Chinese imports, which could raise costs for U.S. manufacturers. Smaller companies may struggle, but those innovating in cost-effective production could thrive.

Technological advancements, like improved fermentation for biopolymer production, are making natural polymers stronger and cheaper, opening doors for wider use in pharmaceuticals and agriculture. Regulatory tailwinds in North America and Europe, with bans on single-use plastics, boost demand, but complex global standards can increase compliance costs.

Report Scope

| Market Value (2024) | USD 9.4 Billion |

| Forecast Revenue (2034) | USD 15.8 Billion |

| CAGR (2025-2034) | 5.3% |

| Segments Covered | By Type (Cellulose Ether (Methyl Cellulose (MC), Hydroxyethyl cellulose (HEC), Carboxymethyl cellulose (CMC), Microcrystalline cellulose (MCC), Others), Starch and Fermentation Polymers (Starch Derivatives, Polylactic Acid, Hyaluronic Acid, Others), Exudate and Vegetable Gums (Guar Gum, Xanthan Gum, Gum Arabic, Others), Others), By Application (Pharmaceuticals, Oil and Gas, Food and Beverages, Cosmetics and Personal Care, Others) |

| Competitive Landscape | Akzo Nobel N.V., Archer Daniels Midland Company, Ashland Inc., BASF, Borregaard, Cargill, CP Kelco, Croda International, Dow Chemical Company, Encore Natural Polymers, Ingredion, JRS Pharms, Kuraray, Novamont S.p.A., Roquette Freres |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147773

Key Market Segments

By Type Analysis

- In 2024, Cellulose Ether dominated the By Type segment of the Natural Polymer Market with a 56.3% share, reflecting its widespread use across industries. Its multifunctional properties make it a go-to choice for sustainable polymer solutions, driving significant demand. This commanding share, over half the market, highlights its critical role in shaping market trends and performance. Cellulose Ether’s consistent leadership in 2024 underscores its reliability and broad acceptance, setting the standard for natural polymers and guiding industry strategies.

By Application Analysis

- In 2024, Pharmaceuticals led the By Application segment of the Natural Polymer Market with a 34.9% share, driven by the growing use of natural polymers in drug delivery, controlled-release tablets, and bio-compatible excipients. Representing over a third of all applications, this segment underscores the vital role of natural polymers in healthcare. The 34.9% share reflects strong adoption to meet regulatory and consumer demands for safe, sustainable solutions, cementing pharmaceuticals as a key focus for manufacturers.

Regional Analysis

Asia-Pacific led the Natural Polymer Market, securing a 43.9% share and generating USD 4.1 billion in revenue. This dominance is driven by rising demand in pharmaceuticals, food, and packaging industries, leveraging natural polymers’ biodegradable and functional properties. Countries like China, India, and Japan fueled this growth.

North America held a strong position, propelled by technological advancements and sustainable material adoption in healthcare and food processing. Europe followed, bolstered by stringent environmental regulations promoting bio-based polymers. The Middle East & Africa and Latin America, though smaller markets, showed growth potential with increasing awareness and industrial use.

Top Use Cases

- Pharmaceutical Drug Delivery: Natural polymers like cellulose and chitosan are used in tablets and capsules for controlled drug release. Their biodegradability and safety make them ideal for delivering medications effectively, improving patient outcomes. They meet strict health regulations, driving demand in the pharmaceutical sector.

- Food Packaging: Cellulose ethers and starch-based polymers create biodegradable food packaging, reducing plastic waste. These materials extend shelf life and maintain freshness, appealing to eco-conscious consumers. Their use in films and coatings supports the Asia-Pacific market share, driven by sustainable packaging trends.

- Cosmetics and Personal Care: Chitosan and collagen enhance skincare products with moisturizing and anti-aging properties. These natural polymers align with demand for chemical-free cosmetics, boosting market growth in personal care. Their non-toxic nature ensures consumer safety, supporting North America’s leadership in this segment.

- Textile Applications: Cellulose-based polymers like rayon are used in eco-friendly fabrics. They offer breathability and biodegradability, meeting consumer demand for sustainable clothing. The textile industry in Asia-Pacific, particularly China and India, leverages these polymers.

- Agricultural Mulch Films: Polylactic acid (PLA) and starch blends are used in biodegradable mulch films to improve soil health and crop yield. These films decompose naturally, reducing environmental impact. Their adoption in agriculture supports sustainable farming, especially in emerging markets like Latin America.

Recent Developments

1. Akzo Nobel N.V.

- Akzo Nobel has been advancing bio-based binders for coatings and adhesives, using natural polymers like lignin and cellulose derivatives. Their Eco Circle initiative focuses on sustainable raw materials, reducing reliance on fossil fuels. The company is collaborating with research institutes to enhance polymer performance in water-based coatings.

2. Archer Daniels Midland Company (ADM)

- ADM expanded its plant-based protein and biopolymer portfolio, including soy and pea protein isolates for biodegradable packaging. Their Protexin line includes natural polymers for food and industrial applications, supporting circular economy goals.

3. Ashland Inc.

- Ashland launched Aquaflow NHS 300, a bio-based thickener derived from cellulose, for personal care products. They also introduced natural polymer solutions for pharmaceutical drug delivery, emphasizing sustainability.

4. BASF SE

- BASF developed Ecovio, a compostable biopolymer blend containing PLA (polylactic acid) from corn starch, used in agricultural films and packaging. They also partnered with PepsiCo for sustainable snack packaging.

5. Borregaard

- Borregaard produces Exilva, a microfibrillated cellulose (MFC) used in coatings, construction, and personal care. They recently expanded production capacity to meet rising demand for bio-based alternatives to synthetic polymers.

Conclusion

The Natural Polymer Market is on a strong growth path, driven by the global shift toward sustainable and biodegradable materials. With increasing environmental concerns and stricter regulations against plastic waste, industries like packaging, pharmaceuticals, and cosmetics are rapidly adopting natural alternatives such as starch, cellulose, and chitosan. Key factors fueling this expansion include rising consumer demand for eco-friendly products, technological advancements in bio-based materials, and government support for green initiatives.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)