Table of Contents

Overview

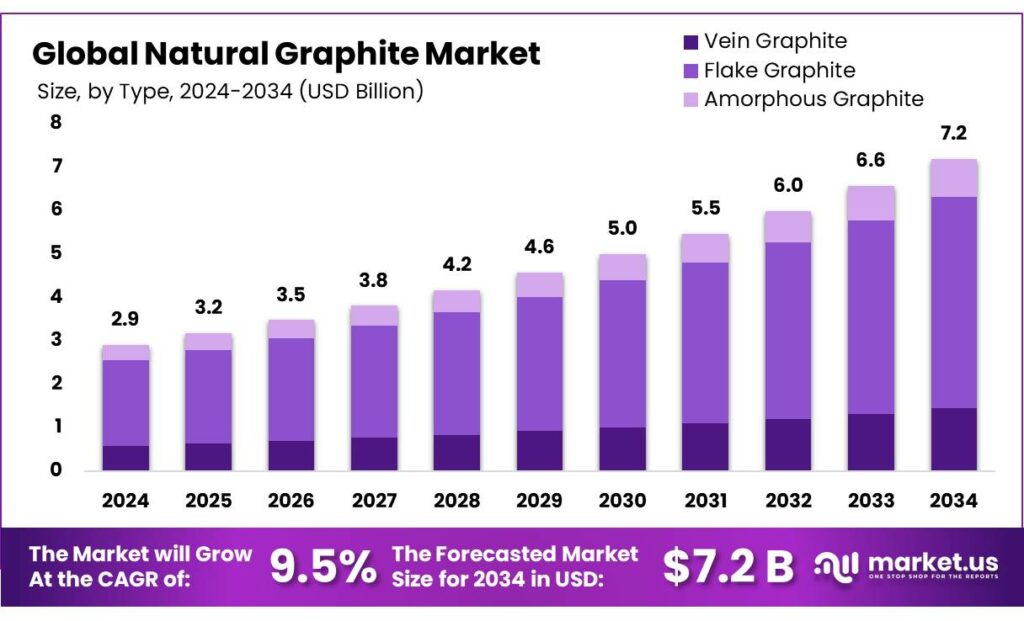

New York, NY – October 09, 2025 – The Global Natural Graphite Market is projected to reach USD 7.2 Billion by 2034, up from USD 2.9 Billion in 2024, reflecting a CAGR of 9.5% from 2025 to 2034. In 2024, the Asia Pacific dominated the market with a 52.1% share, generating around USD 1.52 billion in revenue.

Natural graphite is a crystalline form of pure carbon characterized by a metallic luster and gray-black color. It is one of the two naturally occurring forms of pure carbon, along with diamond. Due to its hexagonal layered structure, graphite exhibits excellent conductivity, corrosion resistance, lubrication properties, and high-temperature stability. Among its types, flake graphite is the most commonly used, particularly in battery production, which remains a key driver of market expansion.

With the global shift toward a circular economy, several companies are investing in graphite recycling technologies to support sustainability goals. The growing emphasis on lightweight and energy-efficient components has also fueled demand from the automotive and aerospace industries, as graphite materials enhance performance and reduce fuel consumption.

However, the market faces challenges related to environmental and health concerns from graphite mining activities. Moreover, the rise of sustainable synthetic graphite alternatives may limit demand for natural graphite in certain applications. The United States Geological Survey (USGS) estimates that global recoverable graphite resources exceed 800 million tons, with 2024 mine production reaching approximately 1.6 million tons. Of this, China contributed about 1.3 million tons, highlighting its dominance in global supply.

Key Takeaways

- The Global Natural Graphite Market was valued at USD 2.9 billion in 2024, at a CAGR of 9.5% and is estimated to reach USD 7.2 billion by 2034.

- Based on product types, flake graphite dominated the natural graphite market in 2024, comprising about 67.8% share of the total global market.

- Among the applications of natural graphite, the battery manufacturing industry dominated the market in 2024, accounting for 52.1% of the market share.

- Asia Pacific was the largest market for natural graphite in 2024, with a share of 52.1% owing to rapidly growing industrialization.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-natural-graphite-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.9 Billion |

| Forecast Revenue (2034) | USD 7.2 Billion |

| CAGR (2025-2034) | 9.5% |

| Segments Covered | By Type (Vein Graphite, Flake Graphite, Amorphous Graphite), By Applications (Batteries, Refractories, Castings, Lubricants, Friction Materials, Others) |

| Competitive Landscape | AMG Critical Materials N.V., Superior Graphite, Imerys, Asbury Carbons, BTR New Material Group Co., Ltd., Mineral Commodities Ltd., Syrah Resources Limited, Nacional de Grafite, Qingdao Haida Graphite Co., Ltd., Tirupati Carbons & Chemicals Pvt. Ltd., SGL Carbon SE, Tokai Carbon Co., Ltd., Hexagon Energy Materials, China Carbon Graphite Group, Inc., Elcora Advanced Materials, Other Key Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158106

Key Market Segments

Type Analysis

In 2024, flake graphite led the natural graphite market, capturing a 67.8% share. The market is divided into vein graphite, flake graphite, and amorphous graphite. Flake graphite’s dominance stems from its suitability for advanced applications like lithium-ion batteries, owing to its high purity and large, well-defined flake structure ideal for battery anodes.

Approximately 50% of natural graphite is flake graphite, which can be purified to high levels through processes like grinding and flotation. Its excellent thermal conductivity, lubrication, and oxidation resistance also make it valuable in industries such as refractories, metallurgy, aerospace, and friction materials. Amorphous graphite is challenging to purify due to its tightly bound minerals, while vein graphite, despite its high quality, is rare and costly, limiting its widespread use.

Application Analysis

The battery manufacturing sector dominated the natural graphite market in 2024, accounting for 52.1% of the market share. The market is segmented into batteries, refractories, castings, lubricants, friction materials, and other applications. The surge in demand for batteries, driven by electric vehicles and energy storage systems, reflects the growing shift toward renewable energy.

Graphite is the primary anode material in lithium-ion batteries due to its high theoretical capacity (approximately 372 mAh/g), electrical conductivity, and stable, low-voltage platform. Its layered structure supports reversible lithium-ion intercalation during charge-discharge cycles, making it essential for battery performance.

Regional Analysis

In 2024, the Asia Pacific region dominated the global natural graphite market, holding a 52.1% share, with China leading the region. The market in this region was valued at approximately USD 1.52 billion. This dominance is driven by robust production and rapid industrialization, particularly in the battery sector for automotive and energy applications, as well as growth in the lubricants and refractories industries.

The International Energy Agency (IEA), China accounted for 82% of the global graphite supply and 93% of battery-grade graphite in 2024. Additionally, China produced 80% of the world’s battery cells, a key graphite-consuming sector. The production of lithium-ion battery manufacturing equipment is also heavily concentrated in China, alongside South Korea and Japan, further solidifying the region’s market leadership.

Top Use Cases

- Lithium-Ion Batteries: Natural graphite serves as the main anode material in lithium-ion batteries, powering electric vehicles and portable gadgets. Its layered structure allows easy movement of lithium ions, ensuring efficient charging and long-lasting performance. This makes it essential for the shift to clean energy, where batteries store power from renewables like solar and wind, helping reduce reliance on fossil fuels in daily transport and tech.

- Refractories in Steel Production: In steelmaking, natural graphite lines furnaces and ladles to withstand extreme heat without breaking down. It adds strength and stability to bricks used in blast furnaces, protecting them from molten metal corrosion. This use keeps production smooth and safe, supporting the global need for durable infrastructure like buildings and cars, while promoting efficient metal recycling.

- Lubricants and Industrial Machinery: Natural graphite acts as a dry lubricant in heavy machines, reducing friction without needing oil. Its slippery layers coat gears and bearings, cutting wear in engines and tools. This application boosts energy savings in factories and vehicles, making operations greener and less costly, especially in harsh environments like mining or automotive assembly lines.

- Brake Linings for Vehicles: In car and truck brakes, natural graphite provides the right friction to stop wheels safely while resisting heat buildup. It replaces harmful materials like asbestos, offering reliable grip and fade resistance during hard braking. This enhances road safety and vehicle longevity, aligning with eco-friendly trends in automotive design for better performance and lower maintenance.

- Thermal Management in Electronics: Natural graphite sheets spread heat quickly from chips in phones, laptops, and servers, preventing overheating. Its high conductivity keeps devices cool and reliable during heavy use. This is key for the booming tech sector, enabling slimmer gadgets with longer battery life, and supporting innovations in data centers for faster, more efficient computing.

Recent Developments

1. AMG Critical Materials N.V.

AMG is expanding its Brazilian natural graphite operations to meet booming EV demand. The company is commissioning a new purification furnace and has signed a multi-year agreement to supply coated spherical purified graphite to a major European battery manufacturer. This strategic expansion focuses on the anode material supply chain, positioning AMG as a key Western supplier.

2. Superior Graphite

Superior Graphite continues to leverage its patented thermal purification technology, which produces high-purity graphite without chemicals. Recent developments focus on scaling this process for battery anode material, emphasizing its environmental advantages. The company is working on qualifying its products with North American and European cell manufacturers, positioning itself as a sustainable and domestic supplier for the region’s burgeoning EV and energy storage markets.

3. Imerys

Imerys is making a major strategic move with its “EMERALD” project to develop one of Europe’s largest natural graphite mines in Finland. This multi-year initiative aims to produce anode-grade graphite annually, creating a fully local, ESG-compliant supply chain for European battery manufacturers. This is a direct response to the critical need for non-Chinese graphite sources.

4. Asbury Carbons

As a leading global distributor, Asbury Carbons’ key development is its strategic stockpiling and supply chain diversification to ensure consistent material availability for its customers. They are focusing on securing graphite from non-Chinese sources and providing a range of natural and synthetic graphite products to the industrial and emerging battery sectors, helping customers navigate volatile market conditions and import restrictions.

5. BTR New Material Group Co., Ltd.

BTR, a global leader in anode materials, is aggressively expanding its production capacity for both natural and synthetic graphite. Recent developments include constructing large-scale production bases in China and Europe to serve international battery gigafactories. They are also advancing R&D in silicon-carbon composites and fast-charging technologies, integrating natural graphite into next-generation anode formulations to enhance performance.

Conclusion

Natural Graphite is a cornerstone material driving the green energy revolution and industrial efficiency. Its unique ability to conduct electricity, resist heat, and lubricate smoothly positions it at the heart of batteries for electric vehicles and renewables, while sustaining traditional sectors like steel and manufacturing. With global pushes toward sustainability, demand will surge, rewarding innovators in purification and recycling who ensure a steady supply amid rising needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)