Table of Contents

Overview

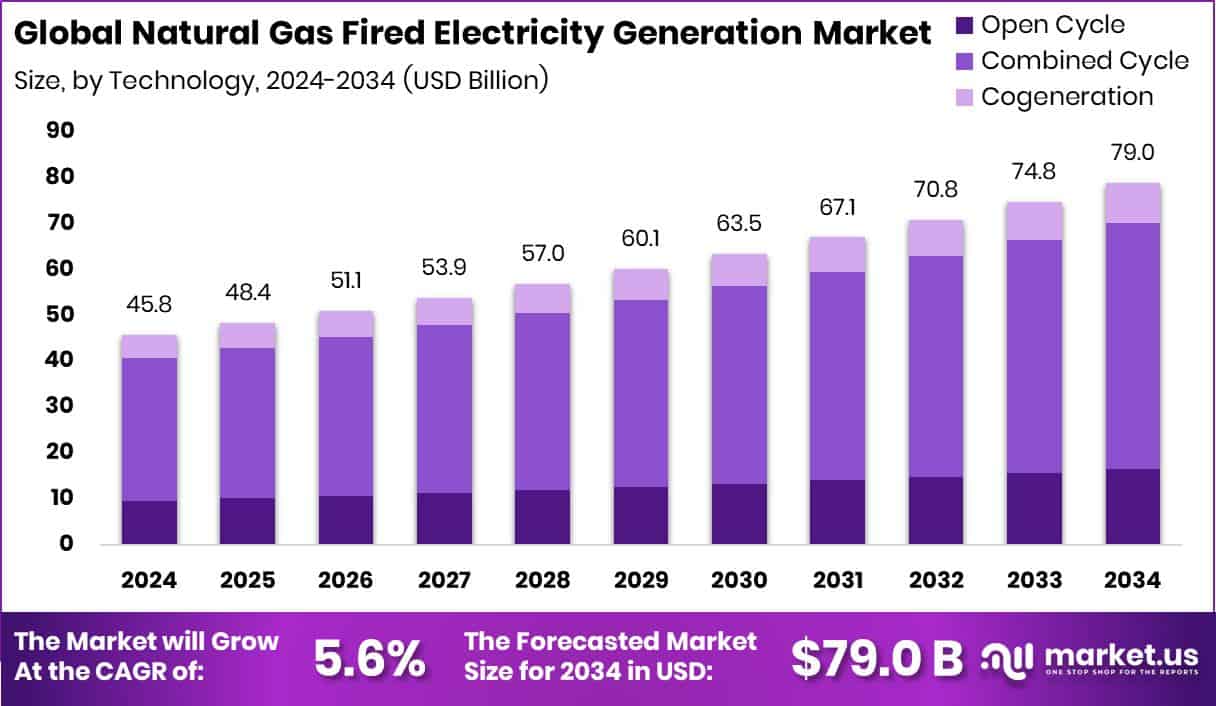

New York, NY – August 11, 2025 – The Global Natural Gas-Fired Electricity Generation Market is forecast to climb from USD 45.8 billion in 2024 to USD 79.0 billion by 2034, reflecting a CAGR of 5.6% between 2025 and 2034. Asia-Pacific dominates with a 43.60% market share, equating to USD 19.9 billion. This form of generation uses natural gas in turbines or combined-cycle plants, delivering lower CO₂, SO₂, and particulate emissions than coal or oil, while offering rapid start-up capabilities that help stabilize renewable energy output.

The sector spans infrastructure, gas supply chains, turbine manufacturing, construction, and distribution. Expansion is fueled by urban and industrial growth, the phase-out of coal plants, and the global drive toward cleaner energy. Natural gas produces roughly 50% less CO₂ than coal, supporting climate targets. Key moves include NRG Energy’s USD 216 million Houston gas plant funded by the Texas Energy Fund and Texas’s USD 1.8 billion allocation for solar, battery, and gas microgrids.

Ontario is assessing ways to lower its USD 450 billion electricity costs. Known for reliability and flexibility, gas plants back up intermittent renewables, while turbine innovations are improving efficiency and reducing expenses, further encouraging uptake in markets with accelerating electricity demand.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/natural-gas-fired-electricity-generation-market/request-sample/

Key Takeaways

- The Global Natural Gas Fired Electricity Generation Market is expected to be worth around USD 79.0 billion by 2034, up from USD 45.8 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Combined cycle technology dominates the Natural Fired Electricity Generation Market, accounting for 67.9% of the market share globally.

- Sweet natural gas is the leading fuel source, contributing 56.2% to total electricity generation capacity.

- Power plants with 100-500 MW output hold a 42.1% share in the overall generation capacity market.

- Industrial application leads demand in the Natural Gas Fired Electricity Generation Market with a 56.8% contribution.

- Asia-Pacific’s strong energy demand supported its USD 19.9 billion market dominance in 2024.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 45.8 Billion |

| Forecast Revenue (2034) | USD 79.0 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Technology (Open Cycle, Combined Cycle, Cogeneration), By Source (Sweet Natural Gas, Sour Natural Gas, LNG), By Power Output (Less than 100 MW, 100-500 MW, 500-1000 MW, Above 1000 MW), By Application (Industrial, Residential, Commercial) |

| Competitive Landscape | Ansaldo Energia S.P.A., Bharat Heavy Electricals Limited, BP, Centrax Gas Turbines, Chevron, Enagas, ExxonMobil, Gasunie, General Electric, Kawasaki Heavy Industries, Ltd. |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=154682

Key Market Segments

By Technology Analysis

In 2024, Combined Cycle technology dominated the Natural Gas-Fired Electricity Generation Market’s By Technology segment with a 67.9% share. Its leadership stems from the high efficiency of using both gas and steam turbines to generate power from the same fuel, boosting thermal performance and cutting fuel use per unit. This approach lowers operational costs and emissions, appealing to producers under stricter carbon reduction rules and coal phase-outs.

Combined cycle plants emit fewer greenhouse gases, aligning with global energy transition targets, while their flexibility supports variable grid demands amid rising renewable integration. This reliability and responsiveness make them a key choice in modern energy planning, with adoption set to grow as electricity needs increase worldwide.

By Source Analysis

In 2024, Sweet Natural Gas led the By Source segment of the Natural Gas-Fired Electricity Generation Market with a 56.2% share. Its dominance is driven by low sulfur content, which cuts processing needs, lowers harmful emissions, and helps meet environmental regulations cost-effectively. Easier handling, compatibility with existing turbine technologies, and reduced maintenance demands boost operational efficiency.

Cleaner combustion lessens equipment wear and atmospheric impurities, supporting low-emission goals. Broad availability from major reserves and strong pipeline integration further enhance its reliability, reinforcing its leadership as utilities shift from coal to cleaner fuels.

By Power Output Analysis

In 2024, the 100–500 MW segment led the Natural Gas-Fired Electricity Generation Market’s By Power Output category with a 42.1% share. This range is favored for its balance of scalability, efficiency, and compatibility with regional and national grids. It meets urban and industrial energy needs without the high costs or complexity of larger plants, while enabling flexible deployment across diverse locations.

Offering an optimal mix of investment, space, and output, these plants suit both base-load and peak-load roles. Their role in modernizing infrastructure and supporting cleaner energy goals has solidified their dominance.

By Application Analysis

In 2024, the Industrial segment dominated the Natural Gas-Fired Electricity Generation Market’s By Application category with a 56.8% share. This leadership stems from the rising need for reliable, efficient power in energy-intensive sectors like manufacturing, chemicals, and metallurgy, where a continuous supply is essential.

Growing adoption of captive natural gas-based power units enables industries to cut grid reliance, control costs, and boost energy security. Cleaner emissions compared to coal or diesel, along with operational flexibility and lower fuel expenses, have further reinforced the segment’s strong position.

Regional Analysis

In 2024, Asia-Pacific led the Natural Gas-Fired Electricity Generation Market with a 43.60% share, valued at USD 19.9 billion. This leadership is driven by surging electricity demand, rapid urbanization, and a steady shift from coal to cleaner fuels. Investments in gas-fired plants and LNG infrastructure are accelerating growth.

North America follows, benefiting from abundant shale gas and advanced grid systems that favor combined cycle technology. Europe advances as coal phase-outs continue, while the Middle East & Africa leverage gas reserves to expand domestic power capacity. Latin America’s growth is fueled by integrating natural gas to stabilize grids and reduce hydropower dependence, yet Asia-Pacific remains the dominant force.

Top Use Cases

Grid Support and Renewable Backup: Natural gas plants can quickly turn on and off, filling in power when the sun doesn’t shine or the wind doesn’t blow. This helps keep electricity stable when renewable sources fluctuate.

Cleaner Replacement for Coal & Oil: Using natural gas instead of coal or oil can cut CO₂ emissions by up to 60–65% thanks to higher efficiency and lower carbon content—making electricity cleaner and more climate-friendly.

On-Site Power (Fuel Cells & Microturbines): Natural gas can power small generators or fuel cells at homes or businesses, producing both electricity and heat efficiently with lower emissions—ideal for local energy use.

Stabilizing Grids with Flexible Dispatch: Because they can be turned on or off quickly, gas-fired plants help stabilize the electricity supply against short-term and seasonal demand swings, adding reliability to power systems.

Recent Developments

- In August 2024, BHEL received its first order to showcase methanol firing in a gas turbine at the 350 MW Kayamkulam Combined Cycle Power Plant in Kerala. The scope includes technology support, equipment supply, and installation with commissioning. Phase one will test the turbine at 30–40% load, followed by a full-load demonstration.

- In February 2024, Ansaldo Energia secured a significant contract to reconstruct the Almaty CHPP-3 in Kazakhstan. The plan involves installing two AE94.2 gas turbines, two generators, and related auxiliary systems. Designed for natural gas operation, the combined cycle facility can also handle hydrogen blends of up to 40%, boosting efficiency and reducing emissions.

Conclusion

The Natural Gas-Fired Electricity Generation Market is evolving as a key player in delivering cleaner, reliable, and efficient power. Its flexibility in balancing renewable sources, lower emissions compared to coal, and ability to meet growing industrial and residential demand make it an essential part of modern grids.

Advances in turbine technology, integration with hydrogen blends, and adoption of alternative fuels like methanol are further enhancing its sustainability. As global energy systems transition, natural gas remains a vital bridge toward a low-carbon future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)