Table of Contents

Overview

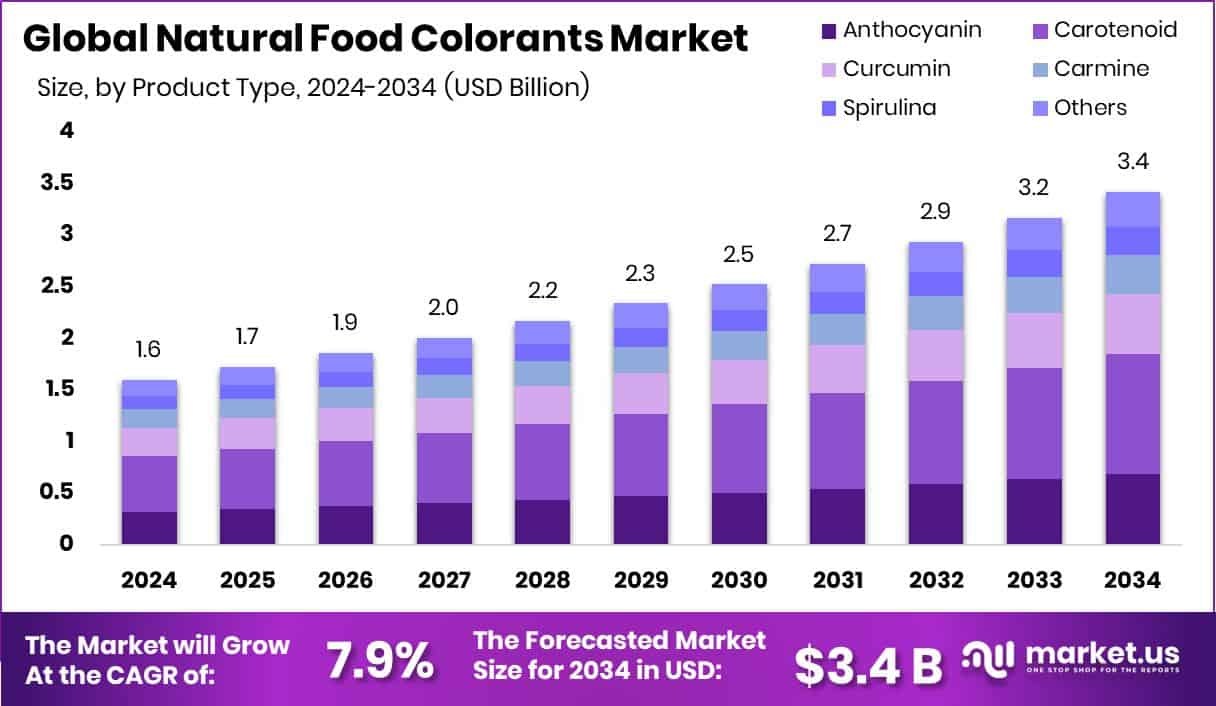

New York, NY – 06 Aug, 2025 – The global natural food colorants market is projected to reach approximately USD 3.4 billion by 2034, rising from USD 1.6 billion in 2024, with a compound annual growth rate (CAGR) of 7.9% between 2025 and 2034. Europe accounted for the largest share at 43.8% in 2024 valued at around USD 0.7 billion driven by strong consumer demand for clean-label products.

Natural food colorants are pigments obtained from natural sources such as plants, animals, and minerals, and are widely used to enhance the visual appeal of foods and beverages. Unlike synthetic dyes, these colorants are extracted from ingredients like beetroot, turmeric, spirulina, paprika, and other fruits, vegetables, flowers, herbs, and spices. Their natural origin makes them a preferred choice among health-conscious consumers, particularly those seeking clean-label and organic products.

These naturally derived pigments are increasingly recognized as safer and healthier alternatives to artificial additives, aligning with the global shift toward transparency and wellness in food consumption. The growing appeal of health-focused and sustainable food solutions is also reflected in industry investments 20 nutraceutical companies have recently raised a combined $22 million, highlighting investor confidence in clean and natural innovations.

The natural food colorants market encompasses the global production, trade, and use of these pigments across a wide range of applications, including beverages, bakery products, confectionery, dairy, and processed foods. As ingredient transparency becomes a consumer priority, food manufacturers are moving away from synthetic dyes and incorporating natural alternatives to meet market expectations. For example, an Indian startup specializing in animal-free dairy products recently raised $4 million through bioengineering innovation, further underlining momentum in the clean-label segment.

Health and wellness trends continue to be the primary drivers of market growth. Consumers are increasingly concerned about the potential health risks associated with synthetic additives, leading to a pronounced shift toward natural ingredients particularly in developed markets where clean-label products are gaining shelf space in both supermarkets and e-commerce channels. This demand is further bolstered by notable investments such as Sid’s Farm securing $10 million to expand its naturally positioned dairy operations.

The rapid expansion of organic and plant-based food categories is also fueling demand for natural colorants, which align seamlessly with the branding and labeling standards of these products. Recent funding activity includes Delhi-based dairy startup Doodhvale Farms raising $3 million to scale its naturally sourced dairy offerings. Similarly, Germany’s sustainable protein company Formo secured $36 million in financing from the European Investment Bank, reinforcing the strong investor appetite for plant-based, natural food systems.

Key Takeaways

- The global natural food colorants market is projected to grow from USD 1.6 billion in 2024 to approximately USD 3.4 billion by 2034, registering a compound annual growth rate (CAGR) of 7.9% between 2025 and 2034.

- Carotenoids represent the leading product type, accounting for 34.9% of the market, largely driven by increasing consumer focus on health and wellness.

- Red remains the most popular color category, capturing a 39.3% market share, supported by strong demand from the confectionery and bakery sectors.

- Powdered colorants dominate the form segment with a 71.2% share, favored for their longer shelf life and ease of integration, especially in beverage formulations.

- Beverages continue to be the largest application area, comprising 29.4% of the global market due to rising demand for naturally colored drinks.

- Europe leads the regional landscape, with the market value reaching approximately USD 0.7 billion in 2024, underpinned by regulatory support and a strong clean-label movement.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-natural-food-colorants-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.6 Billion |

| Forecast Revenue (2034) | USD 3.4 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Product Type (Anthocyanin, Carotenoid, Curcumin, Carmine, Spirulina, Others), By Color (Red, Blue, Green, Yellow, Others), By Form (Powder, Liquid), By Application (Beverages (Alcoholic Beverages, Non-alcoholic Beverages), Bakery and Confectionery, Dairy-based Products, Nutraceuticals, Snacks and Cereals, Others) |

| Competitive Landscape | Sensient Technologies Corporation, Archer Daniels Midland, Naturex S.A., Döhler GmbH, Symrise AG, McCormick & Company, Kalsec Inc., ROHA Dyechem Pvt. Ltd. (JJT Group), Aakash Chemicals and Dyestuffs, AFIS (Australian Food Ingredient Suppliers), San-Ei Gen F.FI Inc., GNT International BV (EXBERRY), Adama Agricultural Solutions Ltd. (LycoRed), Novonesis Group |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153263

Key Market Segments

By Product Type Analysis: In 2024, carotenoids led the product type segment of the natural food colorants market, commanding a 34.9% share. Their popularity stems from the widespread use of natural pigments like beta-carotene, lutein, and lycopene in various food and beverage applications, valued for both their vivid hues and health-enhancing antioxidant properties. Extracted from natural sources such as carrots, tomatoes, and marigold flowers, carotenoids align well with the growing global demand for clean-label, chemical-free ingredients.

By Color Analysis: Red emerged as the leading color in the natural food colorants market in 2024, holding a substantial 39.3% share. This leadership is driven by the strong demand for red hues in diverse product categories including confectionery, dairy, sauces, snacks, and ready-to-eat meals. Red’s vibrant visual appeal significantly enhances product attractiveness, which is especially critical in markets where purchase decisions are heavily influenced by appearance.

By Form Analysis: In terms of formulation, powdered natural food colorants led the market in 2024 with a commanding 71.2% share. This dominance is largely due to the format’s longer shelf life, stability, and ease of storage and handling in food production. Powdered forms are widely used in dry mixes, baked goods, snack coatings, and powdered beverages, where they maintain consistency without compromising moisture or texture.

By Application Analysis: Beverages remained the top application for natural food colorants in 2024, accounting for 29.4% of the global market share. This reflects the increasing demand for naturally colored drinks such as juices, flavored waters, carbonated beverages, and functional drinks as consumers seek healthier, more transparent product formulations. Beverage manufacturers are rapidly replacing synthetic dyes with plant-based alternatives to meet clean-label standards and consumer preferences.

Regional Analysis

In 2024, Europe dominated the global natural food colorants market, capturing a leading 43.8% share equivalent to a market value of approximately USD 0.7 billion. This regional leadership is largely attributed to strong consumer demand for clean-label and organic food products, reinforced by stringent regulatory policies that promote the use of natural ingredients over synthetic alternatives.

European food manufacturers have proactively embraced natural colorants to meet both health-focused consumer expectations and compliance with regional labeling requirements. North America followed with consistent demand growth, fueled by heightened awareness of food safety and increasing interest in plant-based, minimally processed food options.

Top Use Cases

- Beverages:

Natural colorants are used in juices, functional drinks, flavored waters, and teas to create vivid hues while aligning with clean‑label trends. These pigments deliver consumer‑friendly visuals sourced from fruits or botanicals, helping brands replace synthetic dyes without sacrificing appeal. Clean-label labeling and ease of solubility make this a top application in the beverage sector. - Bakery & Confectionery:

In cakes, pastries, candies, and icings, natural colorants like annatto, beetroot, and spirulina provide vibrant red, orange, and purple tones. These options meet clean‑label consumer expectations and improve product perception. Their stability in baked environments and ability to blend into doughs and frostings make them practical choices for confectionery producers. - Dairy & Frozen Products:

Natural pigments are incorporated into yogurts, ice creams, drinks, and butter to enhance appearance while matching consumer demand for minimally processed and additive‑free dairy. Carotenoids and anthocyanins are valued not only for their colors but also for antioxidant potential, aligning with perceived health benefits and premium positioning of clean‑label dairy goods. - Savory & Snacks:

Snack manufacturers use pigments such as paprika, turmeric, and annatto to color chips, crackers, spreads, sauces, and processed meats. These ingredients lend natural orange to red tones without changing taste profiles. Clean-label conscious consumers find these colorants appealing, and producers benefit from stable, powder‑based formats that blend easily into dry or savory formulations. - Dietary Supplements & Nutraceuticals:

Natural colorants derived from botanicals like beet, spirulina, or lutein are used in dietary supplements, vitamins, and functional powders to provide attractive appearance while reflecting health‑oriented branding. These pigments also offer perceived antioxidant or plant‑based value. Clean‑label supplement makers benefit from natural coloring that enhances product trust and user experience.

Recent Developments

- Sensient Technologies Corporation: Sensient is accelerating the development of next‑generation natural colorants, including its new Simplifine™ Microfine technology and a stable clean-label blue pigment derived from spirulina and beet juice. The company is supporting clients in transitioning away from synthetic dyes, though analysts note full market demand may take up to six years to meet. Sensient is also scaling production partnerships with farmers to boost raw material supply ahead of industry-wide reforms by 2026.

- Archer Daniels Midland (ADM): ADM continues to expand its natural color offerings under the Colors from Nature™ brand, serving food, beverage, and pet food manufacturers globally. The company leverages its broad supply network and sustainable sourcing to deliver anthocyanins, caramel colors, and other naturally derived pigments. ADM is also expanding through strategic acquisitions and partnerships in agriculture and food‑ingredients, reinforcing its position as a major supplier of natural color solutions.

- Naturex S.A.: Now part of Givaudan, Naturex expanded its Vegebrite Ultimate Spirulina range, tripling extraction capacity at its Avignon facility to meet rising demand for clean-label blues and greens. At Health Ingredients Europe, the company highlighted integration with its nutraceutical ingredients portfolio including powders, pectins, and fruits/vegetable extracts broadening its clean‑label coloring footprint across multiple food sectors.

- GNT International BV (EXBERRY®): GNT continues innovation in plant‑based natural colors via its EXBERRY® brand recently launching a certified organic “Brilliant Pink” from purple sweet potato, compliant with EU and US organic standards. The company is also scaling fermentation-produced pigments in collaboration with Plume Biotechnology for improved functionality and year‑round sustainability. GNT reports a 22% reduction in carbon intensity since 2020 and serves over 2,700 manufacturers worldwide.

- Symrise AG: Symrise has moved to refocus its Food & Nutrition division by divesting its natural food color business (Diana Food), which is being acquired by Oterra™. Meanwhile, Symrise is investing in sustainable sourcing and supply chain resilience for other natural ingredients, and expanding modular beverage formulation capabilities via its newly launched b Works™ platform.

Conclusion

The natural food colorants market is undergoing significant transformation, driven by increasing consumer demand for clean-label, plant-based, and minimally processed food and beverage products. As synthetic additives face greater scrutiny, manufacturers are shifting toward naturally derived pigments from fruits, vegetables, and botanicals to enhance visual appeal without compromising safety or transparency. Key market segments such as beverages, confectionery, and dairy are leading the adoption of these colorants, with powdered formats and red hues showing strong dominance.

Carotenoids and anthocyanins remain the most widely used pigment types due to their vibrant colors and additional health benefits. Regionally, Europe leads the market, supported by stringent food regulations and high consumer awareness, while North America and Asia-Pacific show robust growth potential. Major industry players are actively investing in innovation, expanding natural pigment lines, and acquiring specialist firms to strengthen their portfolios. As the clean-label movement accelerates, natural colorants are expected to remain central to product reformulation strategies globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)