Table of Contents

Overview

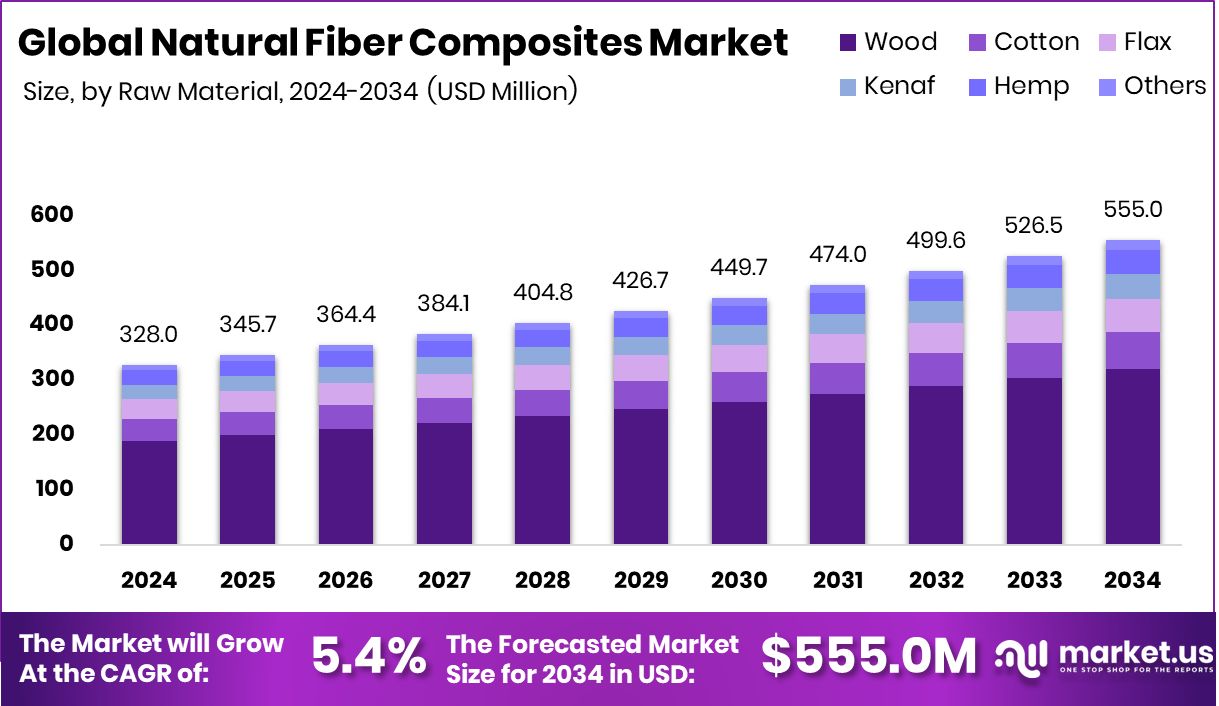

New York, NY – Nov 04, 2025 – The global market for natural-fiber composites (NFCs) is on course to reach approximately USD 555.0 million by 2034, up from about USD 328.0 million in 2024, reflecting a projected CAGR of 5.4% through 2025-2034. In 2024, North America led the sector, accounting for a 45.30% share and generating about USD 148.5 million in revenue.

NFCs—combinations of plant-based fibers such as jute, flax, hemp, or kenaf embedded in a polymer matrix—offer a lighter, more sustainable alternative to traditional synthetic-fiber composites. These bio-based materials deliver strength and stiffness while aligning with cost-effectiveness and eco-friendly credentials, making them attractive for uses in automotive components, building products, furniture, and consumer goods.

The growth of the NFC market is being propelled by stronger demand for sustainable and lightweight materials, tighter environmental regulations, and the industrial shift toward renewable alternatives. Consumer preferences are trending toward greener products, and NFCs meet this demand through their biodegradability and recyclability, helping manufacturers reduce reliance on petroleum-derived materials.

Significant government and institutional support further enhances opportunity in this space: the USDA Forest Service recently announced USD 41 million in funding under its Wood Innovations Grant Program, and its Community Wood Energy & Innovation Program awarded USD 6 million to advance wood-based products. These initiatives, along with increasing investor interest, underpin a fertile environment for NFC adoption and innovation.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-natural-fiber-composites-market/request-sample/

Key Takeaways

- The Global Natural Fiber Composites Market is expected to be worth around USD 555.0 million by 2034, up from USD 328.0 million in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- Wood holds a 57.9% share in the Natural Fiber Composites Market, highlighting its dominance in sustainability.

- Synthetic polymers account for 59.3%, showcasing their essential role in strengthening natural fiber composites globally.

- Injection molding leads with 43.6%, reflecting its efficiency and scalability in composite manufacturing processes.

- Automotive applications capture 47.1%, driven by demand for lightweight, eco-friendly materials, enhancing fuel efficiency.

- The Natural Fiber Composites Market in North America reached USD 148.5 Mn, capturing 45.30%.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159878

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 328.0 Million |

| Forecast Revenue (2034) | USD 555.0 Million |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Raw Material (Wood, Cotton, Flax, Kenaf, Hemp, Others), By Matrix (Inorganic Compound, Natural Polymer, Synthetic Polymer), By Technology (Injection Molding, Compression Molding, Pultrusion, Others), By Application(Automotive (Door Panels, Seat Backs and Headrests, Package Trays, Dashboards, Interior Trim, Others), Construction (Decking and Railing Systems, Window and Door Frames, Wall Panels and Sidings, Roof Tiles, Insulation Materials, Others), Consumer Goods and Packaging (Furniture Components, Luggage and Cases, Sports Equipment, Packaging Materials, Others), Aerospace (Interior Panels, Overhead Storage Bins, Seat Components, Others), Marine (Boat Hulls and Decks, Interior Panels, Buoys and Marine Structures, Others), Others) |

| Competitive Landscape | Flexform SpA, Procotex, TECNARO GMBH, Trex Company, Inc., Bcomp, Polyvlies Franz Beyer GmbH, Green Dot Bioplastics, Fiberon LLC,, Tecnaro GmbH |

Key Market Segments

By Raw Material Analysis

In 2024, wood dominated the By Raw Material segment of the Natural Fiber Composites Market, holding a 57.9% share. Its leadership stems from the widespread use of wood fibers in composites, driven by their high availability, affordability, and strong mechanical properties. Wood-based composites are widely applied in construction, automotive interiors, and consumer goods, offering an ideal mix of strength, durability, and sustainability.

The material’s eco-friendly nature and alignment with renewable resource initiatives further enhance its appeal. As industries increasingly prioritize environmental performance, wood remains the most preferred and reliable raw material, reinforcing its pivotal role in advancing the global Natural Fiber Composites Market.

By Matrix Analysis

In 2024, the synthetic polymer matrix dominated the By Matrix segment of the Natural Fiber Composites Market, accounting for a 59.3% share. This strong position is due to the versatility and superior processing characteristics of synthetic polymers when combined with natural fibers. These materials deliver enhanced bonding strength, durability, and wear resistance, making them ideal for extensive applications across automotive, construction, and consumer goods sectors.

Their adaptability in molding and shaping processes allows manufacturers to create lightweight yet robust components efficiently. With their proven performance and scalability, synthetic polymers continue to lead as the preferred matrix material, playing a critical role in advancing the widespread adoption of natural fiber composites globally.

By Technology Analysis

In 2024, Injection Molding dominated the By Technology segment of the Natural Fiber Composites Market, capturing a 43.6% share. This leadership stems from the process’s exceptional efficiency and scalability in manufacturing intricate, high-volume components. Injection molding enables precise shaping, uniform quality, and cost-effective mass production, making it the technology of choice for industries utilizing natural fiber composites.

Its capacity to seamlessly integrate natural fibers into polymer matrices while preserving strength and lightness further enhances its appeal. These combined advantages reinforce injection molding’s position as the most extensively adopted production method, playing a vital role in expanding the use of natural fiber composites across diverse industrial applications worldwide.

By Application Analysis

In 2024, the Automotive segment led the By Application category of the Natural Fiber Composites Market, holding a 47.1% share. This dominance reflects the growing need for lightweight, fuel-efficient, and low-emission materials in vehicle production. Natural fiber composites provide an excellent combination of strength, reduced weight, and sustainability, making them ideal for dashboards, interior panels, and structural components.

Their added benefits of thermal stability and sound insulation enhance comfort and performance in modern vehicles. As automakers increasingly prioritize eco-friendly manufacturing and sustainability goals, natural fiber composites have become a core material choice, reinforcing the automotive industry’s position as the largest and most influential application segment in this market.

Regional Analysis

In 2024, North America led the Natural Fiber Composites Market, commanding a 45.30% share, valued at USD 148.5 million. This dominance stems from the region’s strong commitment to sustainability, advanced infrastructure, and the widespread use of natural fiber composites in automotive and construction applications. Europe maintained steady growth, driven by stringent environmental regulations and a rising shift toward renewable resources.

The Asia Pacific region, supported by rapid industrial expansion and robust manufacturing activity, is emerging as a key growth hub. Meanwhile, the Middle East & Africa are exploring composite applications in construction and infrastructure, and Latin America is witnessing growing adoption across furniture and consumer goods. Collectively, these regions reflect both mature and evolving opportunities, with North America setting the benchmark for global market advancement in sustainable composite solutions.

Top Use Cases

- Automotive interior panels: NFCs are increasingly used in vehicle interiors for items such as door panels, seat backs and dashboard components. These materials help reduce weight and cost while enhancing sustainability compared to traditional synthetic fibres.

- Construction & building panels: In construction, natural-fiber composites replace timber or conventional materials, forming prefabricated wall or cladding panels that offer lower environmental impact and lighter weight.

- Furniture structural components: Furniture makers are using natural-fiber reinforced composites instead of wood or board materials to achieve sustainable design, better dimensional stability, and flexibility in shapes and aesthetics.

- Acoustic and thermal insulation boards: Because the natural fibers offer hollow-structure and low density, NFCs serve as insulation boards or sound-absorbing materials in walls, floors or ceilings in buildings.

- Consumer goods & packaging applications: NFCs find use in consumer goods items such as packaging, molded housings or decorative items, offering renewable alternatives to plastics or conventional composites.

- Marine, rail, or non-structural transport components: In transportation beyond cars, natural-fiber composites are used in rail interiors, marine cabins, and non-load-bearing components where lower weight and improved sustainability are valued.

Recent Developments

- In March 2025, the company formerly known as Apply Carbon France officially changed its name to Procotex France. This move is meant to unify branding under the Procotex name and simplify communication with customers and suppliers in France.

- In February 2024, TECNARO exhibited its core biocomposite brands (ARBOFORM®, ARBOBLEND® and ARBOFILL®) at the KPA trade fair in Ulm, Germany (28-29 Feb 2024). This activity underscores the firm’s push to promote its renewable-material portfolio across moulding and composite applications.

- In 2024, Flexform released its new “2024 Collection” catalog — a full range of both indoor and outdoor furniture pieces that combine the brand’s care for craftsmanship with updated design details. The catalog emphasises continuity between tradition and innovation.

Conclusion

The Natural Fiber Composites Market reflects a growing shift toward sustainability, driven by the need for eco-friendly and lightweight materials across industries. These composites blend natural fibers with polymers, offering strength, durability, and biodegradability. Their increasing use in automotive, construction, and consumer goods highlights a global commitment to reducing environmental impact.

Continuous innovation, supportive government policies, and industry collaborations are expanding their applications, improving performance, and promoting circular material use. As industries seek greener alternatives to conventional composites, natural fiber composites are gaining strong momentum, symbolizing the future of sustainable manufacturing and responsible material en

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)