Table of Contents

Overview

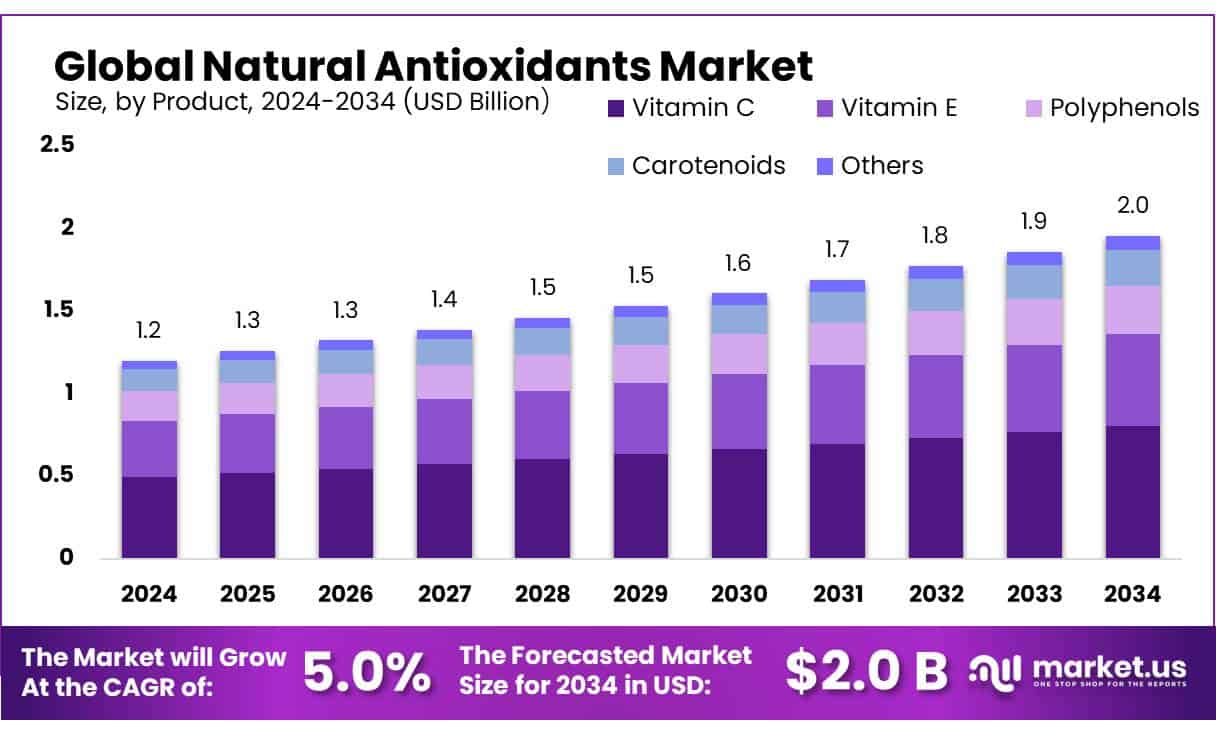

New York, NY – May 14, 2025 – The global Natural Antioxidants Market is growing fast, driven by increasing demand for healthier food and skincare products. In 2024, the market was valued at USD 1.2 billion and is expected to reach USD 2.0 billion by 2034, growing at a steady 5.0% CAGR.

In 2024, Vitamin C commanded a 37.1% share of the global natural antioxidants market, fueled by heightened consumer focus on immune health and preventive care. Plant-Based Antioxidants, including flavonoids, polyphenols, and carotenoids from fruits, vegetables, herbs, and spices, captured a 96.6% market share.

Dry Antioxidants such as powders, granules, and encapsulated forms held a 77.8% share of the natural antioxidants market. The Food and Beverages sector secured a 46.7% share of the natural antioxidants market, reflecting consumer preference for clean-label, preservative-free products.

US Tariff Impact on Market

Approximately 15% of the U.S. food supply is imported, including 32% of fresh vegetables, 55% of fresh fruit, and 94% of seafood, as reported by the Consumer Federation of America, referencing FDA data. Products like coffee and bananas are predominantly sourced abroad. A March study found that 81% of consumers were somewhat aware of tariffs’ impact on grocery prices, with 73% expecting price increases.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-natural-antioxidants-market/request-sample/

This survey occurred during tariff talks focused on Canada and Mexico, before reciprocal tariffs were paused and significant tariffs on China were enacted. Currently, a 25% tariff applies to goods from Mexico and Canada, except for products under the United States-Mexico-Canada Agreement (USMCA). A 10% baseline tariff covers imports from other countries, while goods from China face a 145% tariff.

Key Takeaways

- Natural Antioxidants Market size is expected to be worth around USD 2.0 billion by 2034, from USD 1.2 billion in 2024, growing at a CAGR of 5.0%.

- Vitamin C held a dominant market position, capturing more than a 37.1% share in the global natural antioxidants market.

- Plants held a dominant market position, capturing more than a 96.6% share in the natural antioxidants market.

- Dry held a dominant market position, capturing more than a 77.8% share in the natural antioxidants market.

- Food and Beverages held a dominant market position, capturing more than a 46.7% share in the natural antioxidants market.

- North America stands as the dominant region in the global natural antioxidants market, commanding a substantial share of approximately 39.6%, equivalent to USD 0.4 billion in 2025.

Analyst Viewpoint

The natural antioxidants market is a compelling opportunity, driven by a global shift toward health-conscious living. The market is dominated by Vitamin C and sources from plants, and consumer demand for clean-label products fuels growth, particularly in food and beverages. Investors can tap into the rising popularity of functional foods and nutraceuticals, where natural antioxidants enhance shelf life and appeal.

However, risks loom of US tariffs on imports, especially from China, that inflate costs for food manufacturers, potentially squeezing margins. Smaller firms may struggle with compliance costs in a stringent regulatory landscape, but larger players with R&D capabilities are well-positioned to innovate and capture market share.

Consumers, increasingly wary of synthetic additives, prioritize transparency, pushing brands to adopt plant-based antioxidants like rosemary extract. Regulatory environments, particularly in North America and Europe, favor natural ingredients, but navigating diverse global standards can be costly. The key is balancing cost pressures with consumer-driven demand for natural, health-focused products.

Report Scope

| Market Value (2024) | USD 1.2 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 5.0% |

| Segments Covered | By Product Type (Vitamin C, Vitamin E, Polyphenols, Carotenoids, Others), By Source (Plant, Petroleum), By Form (Dry, Liquid) |

| Competitive Landscape | A & B Ingredients Inc, ADEKA CORPORATION, Ajinomoto OmniChem Natural Specialties, Archer Daniels Midland Company, BASF SE, Cargill, DSM, DuPont-Danisco, Novonesis Group, Indena S.P.A, Koninklijke DSM N.V, Natural Products Co. Ltd. (JF Naturals), Naturex S.A,, Prinova Group LLC, Inc., Royal DSM N.V., SI Group, Tianjin Jianfeng |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147665

Key Market Segments

By Product Type

- In 2024, Vitamin C commanded a 37.1% share of the global natural antioxidants market, fueled by heightened consumer focus on immune health and preventive care. Its popularity as a potent antioxidant spans the food and pharmaceutical sectors, with increased demand in 2024 tied to the preference for natural, immunity-boosting ingredients. In food, Vitamin C extends shelf life and preserves freshness without synthetic additives, while pharmaceutical and nutraceutical firms integrate it into supplements, multivitamins, and energy products.

By Source

- In 2024, Plant-Based Antioxidants, including flavonoids, polyphenols, and carotenoids from fruits, vegetables, herbs, and spices, captured a 96.6% market share. The surge in consumer preference for plant-based and clean-label products has driven their use in food, beverages, and personal care. These natural extracts align with sustainability and organic trends, meeting the demand for chemical-free formulations. In 2024, plant-based antioxidants solidified their dominance, and this trend is expected to continue into 2025, supported by growth in functional foods, nutraceuticals, and clean skincare.

By Form

- In 2024, Dry Antioxidants such as powders, granules, and encapsulated forms held a 77.8% share of the natural antioxidants market. Their long shelf life, processing stability, and ease of storage and transport make them ideal for the food and supplement industries. Dry forms integrate seamlessly into tablets, capsules, protein powders, and fortified snacks, supporting manufacturers’ goals of extended shelf life and reduced preservative use. Demand for dry antioxidants grew in 2024, particularly in functional foods and nutraceuticals, and is expected to remain strong in 2025 due to cost-effective production and supply chain efficiency.

By Application

- In 2024, The Food and Beverages sector secured a 46.7% share of the natural antioxidants market, reflecting consumer preference for clean-label, preservative-free products. Natural antioxidants like rosemary extract, green tea polyphenols, and ascorbic acid are widely used in snacks, baked goods, dairy, and beverages to enhance freshness and shelf life. Functional beverage brands, in particular, leverage antioxidants to boost nutritional appeal. With rising awareness of food safety and natural ingredients, this segment is expected to maintain its lead into 2025, driving growth across mainstream and niche markets.

Regional Analysis

- North America leads the global natural antioxidants market, holding a commanding 39.6% share, valued at approximately USD 0.4 billion in 2025. This dominance stems from strong consumer demand for health-focused, clean-label products, supportive regulations, and ongoing industry innovation.

- Key factors driving this market include a growing preference for plant-based ingredients, increased awareness of antioxidants’ health benefits, and their use in natural food, beverage, and supplement additives. Regulatory support, such as the U.S. Dietary Guidelines promoting antioxidant-rich diets, further fuels growth.

- The market thrives across diverse applications, with food and beverages, pharmaceuticals, and animal feed leading. Natural antioxidants like vitamin C, vitamin E, carotenoids, and polyphenols are widely used to boost product shelf life, nutrition, and consumer appeal.

Top Use Cases

- Food Preservation: Natural antioxidants like vitamin C and rosemary extract extend shelf life in snacks, baked goods, and beverages. They prevent spoilage by neutralizing free radicals, maintaining freshness without synthetic preservatives. This meets consumer demand for clean-label products, boosting appeal in health-conscious markets and reducing food waste.

- Nutraceutical Supplements: Vitamin C, vitamin E, and polyphenols are key in dietary supplements for immune support and anti-aging. They combat oxidative stress, promoting heart and skin health. Their natural sourcing appeals to wellness-focused consumers, driving growth in the nutraceutical sector with rising demand for preventive healthcare.

- Cosmetic Formulations: Antioxidants such as vitamin C and carotenoids are used in skincare to reduce wrinkles and improve skin tone. They protect against free radical damage, enhancing anti-aging products. The trend for natural, organic cosmetics fuels their adoption, appealing to consumers seeking safe, effective beauty solutions.

- Animal Feed Additives: Vitamin E and carotenoids in animal feed improve livestock health and milk yield. They reduce oxidative stress, enhancing growth and disease resistance. This supports the demand for high-quality, natural feed ingredients, aligning with sustainable farming practices and consumer preference for natural animal products.

- Functional Beverages: Polyphenols and vitamin C are added to functional drinks for health benefits like immune support and energy enhancement. They appeal to health-conscious consumers seeking natural, nutrient-rich beverages. This growing segment drives innovation in clean-label, antioxidant-infused drinks, boosting market share in premium beverage categories.

Recent Developments

1. A & B Ingredients Inc

- A & B Ingredients has expanded its portfolio of natural antioxidants, focusing on plant-based extracts like rosemary and green tea. Their latest product, Herbalox, is a clean-label antioxidant for meat and poultry applications, extending shelf life without synthetic additives. The company emphasizes sustainable sourcing and non-GMO ingredients.

2. ADEKA CORPORATION

- ADEKA has developed Adekantol, a natural antioxidant derived from tocopherols and rosemary extracts, targeting the food and cosmetic industries. Their research highlights improved oxidative stability in oils and fats. ADEKA is also exploring synergistic blends with other plant extracts for enhanced efficacy.

3. Ajinomoto OmniChem Natural Specialties

- Ajinomoto has introduced AminoMax, a range of amino acid-based antioxidants that improve food preservation. Their recent studies focus on combining plant polyphenols with amino acids for better stability in processed foods. The company is also investing in fermentation-derived antioxidants.

4. Archer Daniels Midland Company (ADM)

- ADM launched Novasol, a sunflower lecithin-based antioxidant for clean-label applications. They’ve also partnered with PlantPlus Foods to develop antioxidant-rich plant proteins. ADM’s research highlights the role of natural antioxidants in reducing food waste.

5. BASF SE

- BASF has enhanced its Naturesse line with lipid-soluble rosemary extracts for snack and bakery products. Their recent innovation includes microencapsulated antioxidants for improved heat stability. BASF is also collaborating with universities to explore novel antioxidant sources from algae.

Conclusion

The Natural Antioxidants Market is experiencing significant growth, driven by increasing consumer awareness of health and wellness. The demand for natural antioxidants is fueled by a shift towards plant-based diets, clean-label products, and the rising prevalence of chronic diseases. Consumers are increasingly seeking products that offer health benefits, such as fortified foods and beverages, as well as natural and organic personal care items. The aging global population further contributes to this demand, as individuals look for ways to maintain health and vitality.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)