Table of Contents

Overview

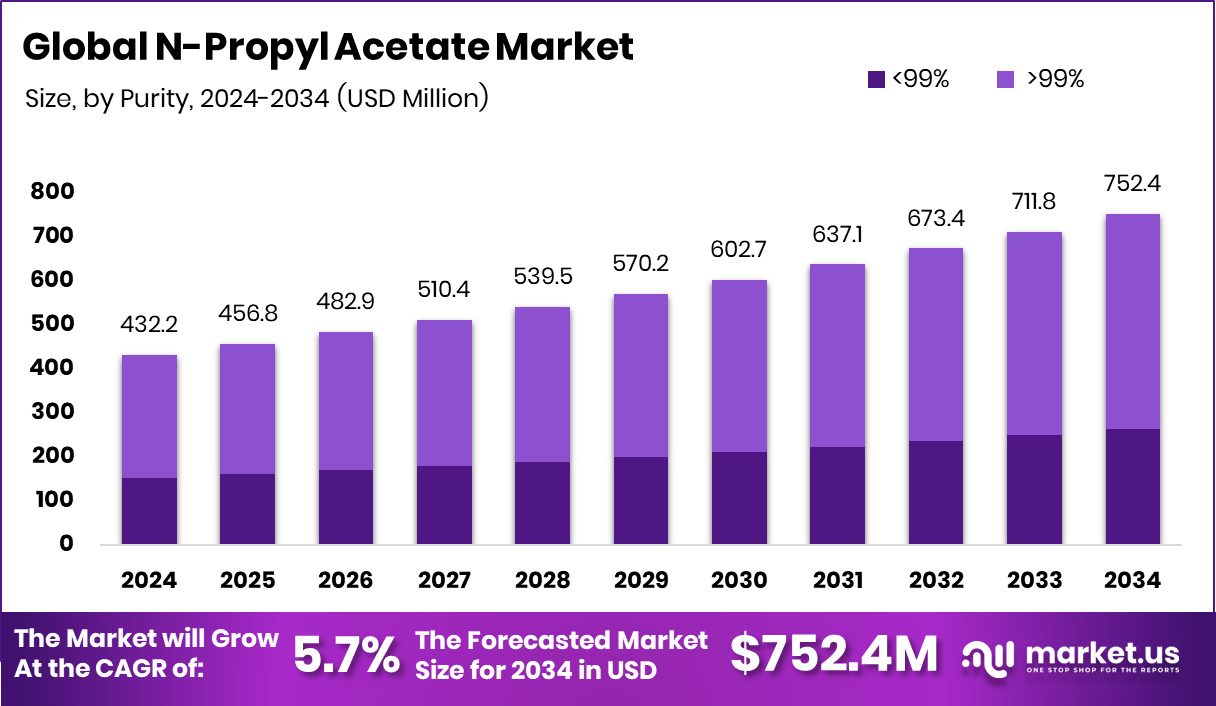

New York, NY – Nov 20, 2025 – The Global N-Propyl Acetate market is set for steady expansion, rising from USD 432.2 million in 2024 to USD 752.4 million by 2034 at a 5.7% CAGR, driven strongly by Asia-Pacific, which accounts for 46.9% of demand.

The solvent’s appeal comes from its clean evaporation, pleasant odour, and low toxicity, making it suitable for coatings, printing inks, adhesives, paints, and fragrances. Its fast-drying behaviour aligns well with the growing push for low-VOC coatings and sustainable printing solutions.

Flexible packaging, offset inks, and industrial paint producers continue to adopt N-Propyl Acetate due to its excellent compatibility with blended solvent systems. Agriculture has also become a major growth vector as agrochemical production expands. Several recent investments signal this momentum: Kotak’s Rs 375 crore into Cropnosys, IFC’s Rs 300 crore into Crystal Crop Protection, and India Agri Business Fund II’s US$15 million support for an agro-chemical firm. These capital flows reflect the rising demand for solvents used in crop protection formulations.

Innovation in the chemical supply chain is also gaining traction. Scimplifi’s $3.67 million seed round aims to modernise speciality-chemical sourcing, while Vive Crop Protection’s CAD 11.2 million funding strengthens precision agri-inputs. Additionally, Arbuda Agrochemicals’ NSE IPO of 64 lakh shares, tied to a ₹120 crore debt repayment and ALP expansion, highlights strong manufacturing activity that further supports market growth for N-Propyl Acetate.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-n-propyl-acetate-market/request-sample/

Key Takeaways

- The Global N-Propyl Acetate Market is expected to be worth around USD 752.4 million by 2034, up from USD 432.2 million in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- N-Propyl Acetate with >99% purity dominates the market, accounting for 65.9% total share.

- As a solvent, N-Propyl Acetate leads demand, contributing 69.2% due to industrial processing needs.

- The paint and coatings sector drives usage, capturing 38.5% share in N-Propyl Acetate consumption.

- The Asia-Pacific market value reached USD 202.7 million, showcasing strong industrial growth.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165319

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 432.2 Million |

| Forecast Revenue (2034) | USD 752.4 Million |

| CAGR (2025-2034) | 5.7% |

| Segments Covered | By Purity (<99%, >99%), By Application (Solvent, Flavoring Agent, Others), By End-Use (Paint and Coatings, Chemical, Pharmaceutical, Printing Ink, Food and Beverages, Agrochemical, Others) |

| Competitive Landscape | OQ Chemicals GmbH, Solvay, BASF SE, Sasol, DOW chemicals, Eastman Chemical company, SHOWA DENKO K.K., Tokyo Chemical Industries, Jiangsu Baichuan High-tech New Materials Co., Ltd., Shiny Chemical Industries Co. Ltd |

Key Market Segments

By Purity Analysis

In 2024, the >99% purity grade led the N-Propyl Acetate Market with a 65.9% share, driven by its essential role in high-precision applications. This grade remained the preferred choice for paints, coatings, inks, and pharmaceutical formulations because its clarity, low moisture content, and consistent evaporation supported clean, uniform finishes. Agrochemical and industrial manufacturers also relied on >99% purity for its strong compatibility with sensitive active ingredients, enabling better solubility and stable product performance.

Demand strengthened as industries shifted toward sustainable, low-VOC, and efficiency-focused solvents. The superior quality of >99% N-Propyl Acetate aligned well with emerging safety standards and environmental expectations. As producers expanded output of eco-compliant coatings and high-grade formulations, the high-purity segment maintained its dominance, underscoring its critical role in modern industrial and chemical processing requirements.

By Application Analysis

In 2024, the Solvent category led the N-Propyl Acetate Market within the “By Application” segment, holding a 69.2% share. Its dominance stemmed from widespread use in coatings, inks, adhesives, and cleaning agents, supported by strong solvency, a balanced evaporation rate, and a mild, pleasant odour. These qualities made N-Propyl Acetate a key ingredient in automotive, industrial, and decorative coating systems, where uniform resin and pigment dissolution is essential for smooth finishes and improved durability.

Its low toxicity and strong compatibility with high-solid, low-VOC formulations further strengthened its position as industries transitioned toward safer, eco-friendly materials. Rising demand for precision cleaning solutions and electronic-grade solvents also expanded its adoption, helping the solvent segment maintain a leading role across multiple high-performance applications.

By End-Use Analysis

In 2024, Paint and Coatings dominated the N-Propyl Acetate Market under the “By End-Use” segment with a 38.5% share, driven by the solvent’s strong dissolving ability, fast drying behaviour, and consistent film-forming performance. Its balanced evaporation rate and effective flow control made it essential in automotive, industrial, and architectural coatings, where smooth finishes, high gloss, and durable film integrity are critical.

Its low odour and compatibility with acrylic, alkyd, and cellulose-based resins reinforced its use in high-quality formulations. Growing demand for low-VOC, environmentally safer coatings further pushed industries toward N-Propyl Acetate. With global construction and infrastructure activity rising, manufacturers increasingly rely on this solvent for its reliability, workability, and alignment with evolving sustainability standards.

Regional Analysis

In 2024, Asia-Pacific led the global N-Propyl Acetate Market with a 46.9% share, valued at USD 202.7 million, supported by its strong manufacturing base and rising demand from paints, coatings, and ink producers across China, India, Japan, and South Korea. Rapid construction growth, expanding automotive coating needs, and increasing adoption of eco-friendly formulations further reinforced this dominance.

North America maintained steady growth, driven by coatings and adhesive applications and a shift toward low-VOC solvent technologies. Europe followed with consistent demand, supported by sustainable chemical production and ongoing innovations in green coating systems.

The Middle East & Africa and Latin America showed gradual expansion as industrialisation and infrastructure development boosted solvent requirements in emerging manufacturing sectors.

Overall, Asia-Pacific’s large-scale production capacity, cost-effective raw materials, and expanding end-use industries positioned it as the primary revenue driver shaping global N-Propyl Acetate demand trends.

Top Use Cases

- Coatings and Paints Solvent: N-Propyl Acetate is widely used to dissolve resins and other components in paints and coatings. Because it mixes well with many resins and evaporates at a moderate rate, it helps form smooth, uniform film surfaces.

- Printing Inks (Flexographic & Special Screen): In the printing industry, this ester is favored in flexographic and specialty screen inks because it helps the ink flow well, dry consistently, and adhere properly.

- Adhesives & Sealants: It is used in adhesives and sealant formulations because it dissolves resins (e.g., nitrocellulose, alkyds, acrylics) and supports good leveling and curing properties

- Fragrances & Flavoring Agent: Beyond industrial uses, N-Propyl Acetate shows up in consumer goods: as a fragrance solvent (it has a mild, “pear-like” odor) and as a flavoring additive in some cases.

- Aerosol & Nail-Care Formulations: Because it evaporates cleanly and has acceptable odor/solvency properties, it is used in aerosol spray products and nail-care (cosmetic) formulations.

- Intermediate / Specialty Chemical Applications: N-Propyl Acetate also serves as a process solvent or intermediate in higher‐end applications such as electronics manufacturing and agrochemical/active-ingredient formulation, where its solvency and volatility are advantageous.

Recent Developments

- In February 2025, Dow Inc. implemented a price increase on its oxygenated solvents (including n-Propyl Acetate) in North America, raising the price by US $0.10 per unit.

- In January 2025, OQ Chemicals announced a price increase for n-Propyl Acetate in North America and Mexico of US $0.04 per lb, and in South America of US $90 per metric ton. The move was driven by tight supply/demand conditions in the oxo-intermediate segment.

Conclusion

The N-Propyl Acetate market is steadily advancing as industries prioritize cleaner, safer, and more efficient solvent options. Its strong solvency, pleasant odor, and balanced evaporation rate make it valuable across coatings, inks, adhesives, and cleaning applications. Growing interest in low-VOC and eco-friendly formulations continues to strengthen its relevance, especially in automotive, packaging, electronics, and agrochemical sectors.

With expanding manufacturing activity, rising environmental standards, and increasing investments in specialty chemicals, N-Propyl Acetate remains an important choice for producers seeking reliable performance and consistent quality. Overall, the market outlook remains positive as industries shift toward sustainable and high-purity solvent solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)