Table of Contents

Overview

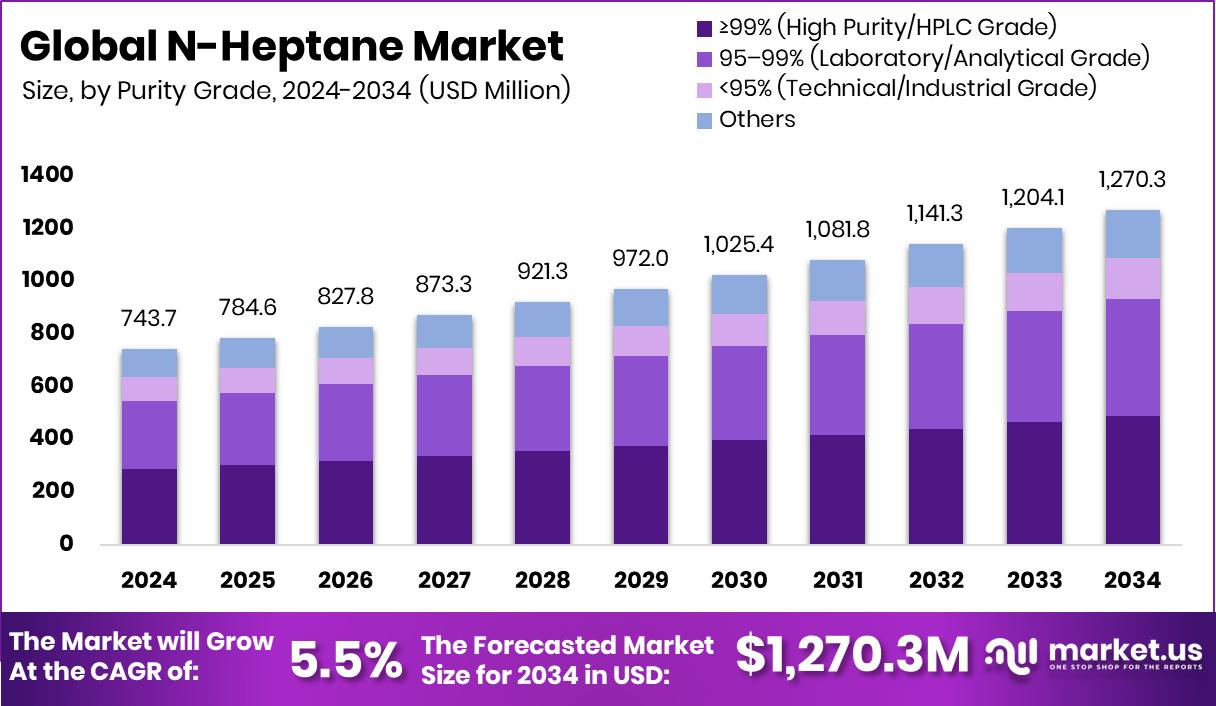

New York, NY – Nov 18, 2025 – The Global N-Heptane Market is estimated to reach USD 1,270.3 million by 2034, rising from USD 743.7 million in 2024, supported by a steady 5.5% CAGR (2025-2034). Asia-Pacific remains the core manufacturing hub due to rapid industrialization, capturing 48.30% share valued at USD 359.2 million, with strong usage across coatings, automotive, printing inks, and flexible packaging operations.

N-Heptane, a C₇H₁₆ straight-chain hydrocarbon, is valued for its high volatility, stable molecular behavior, and consistent solvency performance. These characteristics make it suitable for high-purity testing, extraction, and formulation across pharmaceuticals, electronics, and specialty chemicals, where impurity levels must be extremely low. Industries also favor it as a relatively low-toxicity, non-polar solvent for controlled evaporation environments.

Market progress aligns with rising demand for cleaner formulation ingredients and precision-driven industrial processes. As manufacturers focus on quality-driven adhesives, surface-coating formulations, and environmentally safer laboratory solvents, N-Heptane continues to hold high relevance. Growth is additionally supported by fast-moving flexible packaging and export-driven chemical value chains in emerging economies.

Investment momentum across paints and chemicals indirectly boosts N-Heptane consumption. Distil secured USD 7.7 million in Series A funding, JSW promoters pledged stakes to support the INR 9,000-crore AkzoNobel India deal, and Nippon Paint Holdings announced a USD 2.3-billion agreement for AOC, signalling continued confidence across advanced formulation markets.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-n-heptane-market/request-sample/

Key Takeaways

- The Global N-Heptane Market is expected to be worth around USD 1,270.3 million by 2034, up from USD 743.7 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- The N-Heptane Market sees a 38.6% share from ≥99% purity grade, ensuring superior solvent performance globally.

- The N-Heptane Market holds a 39.1% share as a solvent, driving coatings and adhesive production.

- The N-Heptane Market’s 33.2% share in pharmaceuticals highlights its role in drug formulation processes.

- The Asia-Pacific N-Heptane Market was valued at USD 359.2 million in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165024

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 743.7 Million |

| Forecast Revenue (2034) | USD 1,270.3 Million |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Purity Grade (≥99% (High Purity/HPLC Grade), 95–99% (Laboratory/Analytical Grade), <95% (Technical/Industrial Grade), Others), By Application (Solvent, Blending Agent, Cleaning Agent, Reference Fuel, Chromatography Reagent, Chemical Intermediate, Others), By End-Use (Pharmaceuticals, Paints and Coatings, Adhesives and Sealants, Rubber and Plastics, Electronics and Semiconductors, Petrochemicals, Others) |

| Competitive Landscape | ExxonMobil Chemical, Shell Chemicals, Chevron Phillips Chemical, Haltermann Carless, DHC Solvent Chemie GmbH, SK Geo Centric, Triveni Chemicals, Sasol Limited, Loba Chemie Pvt. Ltd., FUJIFILM Wako Pure Chemical Corporation, Avantor, Inc. |

Key Market Segments

By Purity Grade Analysis

In 2024, the ≥99% (High Purity/HPLC Grade) category led the By Purity Grade segment of the N-Heptane Market, securing a 38.6% share due to its suitability for processes requiring exceptional solvent quality and analytical precision. This grade plays a critical role in pharmaceutical synthesis, chromatography, and high-performance coatings, where even minimal impurities can impact accuracy, formulation stability, or product yield.

Its low contaminant profile and consistent chemical composition support reliable laboratory outcomes and repeatable industrial production, making it the preferred choice for regulated and quality-sensitive environments.

Growing adoption of high-purity solvents within R&D, drug formulation, specialty manufacturing, and testing workflows further reinforced its dominance. Additionally, sectors with strict purity benchmarks, such as electronics fabrication and fine chemical processing, are increasingly relying on ≥99% grade N-Heptane, underscoring its essential value in precision-driven and innovation-focused industries.

By Application Analysis

In 2024, the Solvent category dominated the By Application segment of the N-Heptane Market, representing a 39.1% share, driven by its widespread use in paints, coatings, adhesives, and industrial cleaning systems. This leadership is linked to its non-polar solvent characteristics, fast evaporation rate, and strong compatibility with diverse resins and polymer systems, making it a preferred choice for both industrial manufacturing and analytical environments.

The segment’s strength is further reinforced by increasing demand for cleaner, safer, and efficient solvent options, particularly in chemical processing and electronics-oriented applications, where formulation consistency and precision are crucial. Its well-defined composition and reliable purity behavior continue to support its adoption in high-performance production workflows. Consequently, the solvent application segment remains the key value driver, positioning N-Heptane as an indispensable material in process-critical and quality-sensitive industries throughout 2024.

By End-Use Analysis

In 2024, the pharmaceuticals segment led the By End-Use category of the N-Heptane Market, achieving a 33.2% share, mainly due to its essential role as a high-purity solvent in drug formulation, extraction, and purification workflows. Its low toxicity, high stability, and strong capability to dissolve non-polar compounds make it suitable for producing APIs, intermediates, and fine-grade formulations where regulatory precision is required.

The segment also benefits from expanding global pharmaceutical R&D, continuous modernization of formulation facilities, and improved quality control standards that prioritize solvent consistency. Growing emphasis on safer and cleaner production environments has further increased N-Heptane usage, helping pharmaceutical manufacturers maintain compliance, repeatability, and purity benchmarks.

Regional Analysis

In 2024, Asia-Pacific led the N-Heptane Market with a 48.30% share, valued at USD 359.2 million, supported by expanding activity in pharmaceuticals, specialty chemicals, and coatings. Strong industrialization, manufacturing-driven policies, and the presence of large-scale production clusters in China, India, and Japan reinforced its regional leadership and solvent-focused demand growth.

North America ranked next due to progress in chemical formulation technologies, rising laboratory use, and increased focus on high-purity research solvents. Europe recorded steady momentum, influenced by stringent quality and regulatory standards, especially within the pharmaceutical and analytical sectors.

In contrast, the Middle East & Africa displayed gradual advancement through emerging industrial capacity, while Latin America benefited from expanding export-oriented chemical manufacturing.

Overall, global demand remains well distributed, but Asia-Pacific’s manufacturing scale, export capability, and preference for cleaner, precision solvents continue to define its long-term leadership in N-Heptane production and consumption.

Top Use Cases

- High-purity lab solvent: N-Heptane serves as a non-polar, low-reactivity solvent in laboratories for chromatography, extraction, and purification of sensitive compounds. Because it has minimal impurities and doesn’t interfere much with reactions, it’s used where precision is required.

- Extraction of natural oils & botanicals: The compound is used in botanical extraction to pull non-polar compounds (like essential oils, waxes) from plant materials, replacing less-desirable solvents in certain clean-label applications.

- Paints, coatings and adhesives solvent: Its good solvency for resins and quick evaporation rate make n-heptane useful as a carrier or diluent in the formulation of paints, varnishes, adhesives and sealants, contributing to flow and drying performance.

- Rubber & synthetic elastomer processing: In rubber manufacturing, n-heptane is applied as a solvent to remove impurities, help mixing of rubber compounds and facilitate processing of both natural and synthetic elastomers.

- Fuel component & octane reference: While not a major commercial fuel on its own, n-heptane is used in gasoline blending and in octane-rating tests as a reference hydrocarbon (“zero” octane number) to benchmark other fuels.

- Electronics cleaning & degreasing: Because it dissolves oils, greases, and non-polar residues without interfering with sensitive surfaces, n-heptane is used in electronics manufacturing and precision cleaning processes for components and assemblies.

Recent Developments

- In May 2025, CPChem agreed to sell 100% of its shares in its Singapore polyethylene manufacturing joint venture (Chevron Phillips Singapore Chemicals) to Aster Chemicals and Energy (via its affiliate). This plant had a capacity of ~400,000 t/yr and was located on Jurong Island. CPChem retained its Asia regional headquarters in Singapore.

- In March 2025, Shell confirmed it is conducting a strategic review of its chemicals assets in the U.S. and Europe, with the help of Morgan Stanley, as it considers possible sales of some facilities to focus on high-margin operations.

Conclusion

The N-Heptane market is positioned for steady long-term relevance due to its role as a high-purity, non-polar solvent used across critical industrial and laboratory applications. Its demand is influenced by sectors such as pharmaceuticals, coatings, flexible packaging, electronics cleaning, and analytical testing, where consistency, stability, and low impurity levels are essential.

Continued advancements in formulation chemistry, cleaner production standards, and precision-based manufacturing keep N-Heptane valuable for modern processes. As industries shift toward safer, more controlled solvents, its usage is expected to remain strong, supported by innovation in purification technology and expanding applications within regulated, quality-driven environments worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)