Table of Contents

Overview

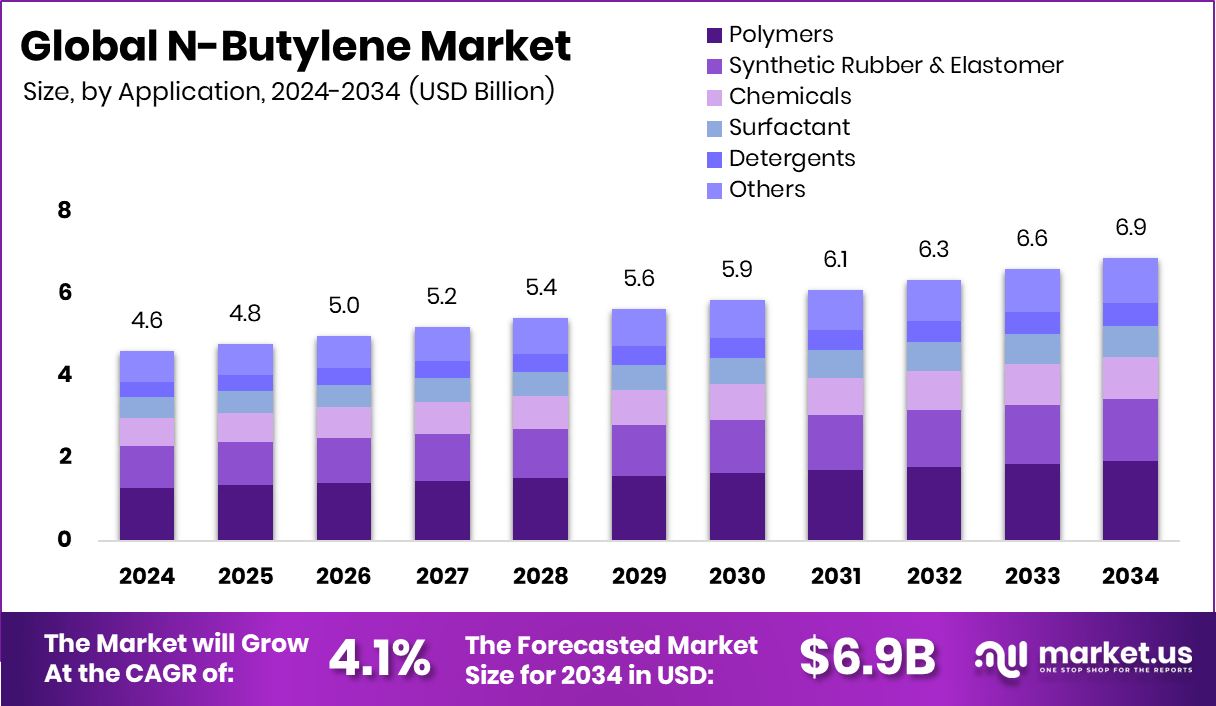

New York, NY – Nov 07, 2025 – The global N-Butylene Market is projected to reach USD 6.9 billion by 2034, growing from USD 4.6 billion in 2024 at a CAGR of 4.1%. Asia-Pacific remains dominant with a 45.30% share, valued at USD 2.08 billion, driven by strong polymer production expansion.

N-Butylene, or 1-butene, is a key hydrocarbon used in polymers, plasticizers, and synthetic lubricants, enhancing flexibility and adhesion in plastics, resins, and fuel additives. Market growth is supported by increasing polymer consumption and infrastructure investments. Significant funding activities highlight industrial optimism—EF Polymer secured USD 6.6 million in Series B financing to scale bio-based materials, while Magpet Polymers raised ₹205 crore to expand sustainable polymer capacity.

Additionally, a USD 3 million federal grant for Akron’s polymer cluster aims to strengthen regional production and innovation. These initiatives underscore a global transition toward environmentally friendly and high-performance petrochemical solutions.

The N-Butylene market’s future trajectory will hinge on sustained demand from the plastics and chemical sectors alongside technological shifts toward green manufacturing pathways, reinforcing its role as a crucial feedstock in next-generation material applications.

➤ Click the sample report link for complete industry insights: https://market.us/report/n-butylene-market/request-sample/

Key Takeaways

- The global N-butylene market is expected to be worth around USD 6.9 billion by 2034, up from USD 4.6 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- In the N-Butylene Market, the Polymers segment accounted for a 39.4% share in 2024.

- The Direct channel dominated the N-Butylene Market with a commanding 72.2% share in 2024.

- In 2024, the Asia-Pacific dominated the N-Butylene market, capturing 45.30% regional share

➤ Directly purchase a copy of the report—https://market.us/purchase-report/?report_id=163960

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.6 Billion |

| Forecast Revenue (2034) | USD 6.9 Billion |

| CAGR (2025-2034) | 4.1% |

| Segments Covered | By Application (Polymers, Synthetic Rubber and Elastomer, Chemicals, Surfactants, Detergents, Others), By Distribution Channel (Direct, Indirect) |

| Competitive Landscape | Chevron Philips Chemical Company, SABIC, Evonik Industries AG, CNOOC and Shell Petrochemicals Company Limited, Shell Chemical LP, Inner Mongolia China Coal Mengda New Energy and Chemical Co., Ltd., Zhonghua Quanzhou Petrochemical Co., Ltd., Qinghai Damei Coal Industry Co., Ltd., Taizhou Donglian Chemical Co., Ltd., PTT Global Chemical Public Company Limited |

Key Market Segments

By Application Analysis

In 2024, the Polymers segment dominated the N-Butylene Market by application, securing a 39.4% share. This strong position stems from N-Butylene’s critical role as an intermediate in producing diverse polymer compounds used in packaging, automotive, and industrial materials. Its growing demand is fueled by the shift toward lightweight, durable, and cost-efficient polymer-based products across global manufacturing.

Technological advancements in polymer processing have further enhanced efficiency and product quality, supporting steady consumption. The 39.4% market share underscores the segment’s significance in maintaining N-Butylene’s global demand, highlighting its deep integration into industrial operations and its central role within the chemical and material value chain.

By Distribution Channel Analysis

In 2024, the Direct segment led the N-Butylene Market by distribution channel, commanding a 72.2% share. This dominance reflects manufacturers’ strong inclination toward direct supply models that provide reliable quality, faster delivery, and greater cost control. By bypassing intermediaries, producers maintain stronger pricing strategies and closer customer relationships.

The 72.2% share underscores the efficiency of direct channels in fulfilling the needs of industrial buyers, particularly those handling large-scale polymer and chemical production. This distribution model enhances supply chain transparency and fosters long-term collaborations, reinforcing its critical role in ensuring stability and trust within the global N-butylene trade network.

Regional Analysis

In 2024, Asia-Pacific dominated the global N-Butylene market with a 45.30% share, valued at approximately USD 2.08 billion. This leadership stems from rapid growth in the petrochemical and polymer sectors across China, India, Japan, and South Korea, supported by strong demand for N-Butylene in plasticizers, resins, and fuel additives.

North America followed, driven by the U.S. shale gas expansion and rising olefin output, while Europe maintained stability through sustainability-focused chemical processing. The Middle East & Africa leveraged abundant hydrocarbons and new export-oriented petrochemical projects, and Latin America, led by Brazil and Mexico, showed steady demand from industrial and automotive applications.

Asia-Pacific’s large-scale manufacturing base and cost-efficient feedstock supply solidified its position as the global growth hub for N-butylene in 2024, with other regions contributing moderately to a well-balanced international market landscape.

Top Use Cases

- Comonomer for Polyethylene Films and Packaging: n-Butylene is widely used as a minor partner (comonomer) with ethylene to make polymers like linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE). This helps the plastic become more flexible, tougher, and thinner—ideal for films, bags, and packaging layers.

- Production of Polybutene-1 for Piping and Hot/Cold Water Systems: By polymerizing n-butylene, you get polybutene‑1 (PB-1), a plastic that combines strength and flexibility. It’s used in pressurized piping systems for hot and cold water, under-floor heating, and other plumbing applications.

- Hot-Melt Adhesives & Sealants: Polymers derived from n-butylene can be processed into hot-melt adhesives and sealants. These are used in packaging (easy-open films) and building materials (sealants for windows/doors) thanks to good flow and adhesion under heat.

- Synthetic Lubricants and High-Performance Oils: n-Butylene is a precursor in making synthetic lubricating oils and gear/hydraulic fluids. Its use helps achieve better viscosity stability, lower volatility, and improved performance in extreme conditions.

- Plasticizer and Polymer Modifier for Elastomers: The compound finds use in plasticizers and modifiers for rubber and elastomer compounds—improving flexibility, durability, and performance. For example, when modifying natural rubber or butyl rubber for tires or industrial seals.

- Feedstock for Surfactants, Resins, and Specialty Chemicals: n-Butylene serves as a building block (feedstock) to make other chemicals such as surfactants (used in detergents), resins, adhesives, and even specialty intermediates. Its chemical reactivity makes it valuable beyond just plastics.

Recent Developments

- In August 2025, SABIC, via its joint-venture with Plastic Energy in Geleen, Netherlands, achieved first production of “TACOIL™” — a pyrolysis oil derived from post-consumer plastic waste, intended to serve as replacement feed-stock for petrochemical plants. The announcement emphasises the chemical recycling-to-feedstock pathway, enabling SABIC to recycle waste plastics into high-quality input streams for new plastics.

- In May 2025, CPChem announced that shareholders of its affiliate Chevron Phillips Singapore Chemicals Pte Ltd (CPSC) agreed to sell 100% of their shares to Aster Chemicals and Energy (via its affiliate). CPSC owns and operates a 400,000 t/yr high-density polyethylene (HDPE) plant on Jurong Island, Singapore. The move aligns with CPChem’s asset portfolio optimisation in the Asia-Pacific region.

Conclusion

The N-Butylene market is positioned for steady advancement, supported by rising demand in polymer, chemical, and industrial sectors. Its critical role as a building block for plastics, resins, and synthetic lubricants ensures continued industrial reliance. Growing focus on sustainable and high-performance materials is driving innovation across production processes.

Strategic investments, technology integration, and expanding petrochemical infrastructure further strengthen its outlook. With increasing applications in packaging, automotive, and specialty chemicals, N-Butylene remains central to modern material development. The market’s long-term trajectory is defined by efficiency improvements, global industrial growth, and the transition toward cleaner, more sustainable chemical manufacturing pathways.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)