Table of Contents

Overview

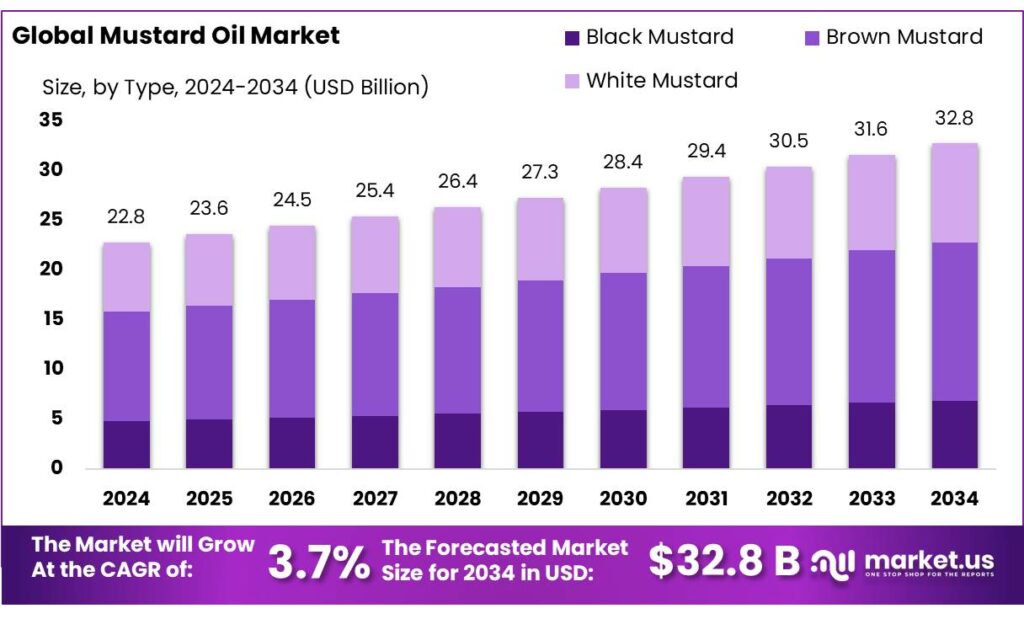

New York, NY – October 13, 2025 – The Global Mustard Oil Market is projected to reach USD 32.8 billion by 2034, up from USD 22.8 billion in 2024, growing at a CAGR of 3.7% from 2025 to 2034. North America held a dominant position in 2024, accounting for 37.9% of the market and generating USD 8.6 billion in revenue.

In India, mustard oil remains a cornerstone of the edible oil sector, supported by strong domestic production and consumption. During FY 2023–2024, India produced a record 12 million metric tonnes of mustard oil, a 13% rise in quantity and a 35% increase in value from the previous year. Despite this, India continues to import around two-thirds of its edible oil demand.

To address this dependency, the Government of India launched a ₹10,100 crore initiative in October 2024 to double edible oil output, emphasizing high-yielding oilseed varieties and advanced technologies like genome editing. The government also sustains farmer profitability through the Minimum Support Price (MSP) scheme for mustard seeds, executed by NAFED.

Furthermore, programs like the National Mission on Edible Oils – Oil Palm (NMEO-OP), with an allocation of ₹11,040 crore, aim to boost domestic oilseed productivity. The Mustard Model Farm Project, initiated by the Solvent Extractors’ Association of India (SEA) and Solidaridad, expanded from 400 to 3,500 farms, improving yield per hectare by 35% compared to traditional practices.

Key Takeaways

- Mustard Oil Market size is expected to be worth around USD 32.8 Billion by 2034, from USD 22.8 Billion in 2024, growing at a CAGR of 3.7%.

- Brown Mustard held a dominant market position, capturing more than a 48.6% share of the mustard oil market.

- Pouches held a dominant position in the mustard oil packaging segment, capturing more than a 34.2% share of the market.

- The Food and Beverages sector held a dominant position in the mustard oil market, capturing more than a 59.1% share.

- Hypermarkets and supermarkets dominated the mustard oil distribution landscape, capturing more than a 48.9% share of the market.

- North America emerged as the dominant region in the global mustard oil market, capturing a significant 37.9% share, translating to an estimated market size of approximately USD 8.6 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/mustard-oil-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 22.8 Billion |

| Forecast Revenue (2034) | USD 32.8 Billion |

| CAGR (2025-2034) | 3.7% |

| Segments Covered | By Type (Black Mustard, Brown Mustard, White Mustard), By Packaging Type (Pouches, Jars, Cans, Bottles), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Others), By Distribution Channel ( Hypermarkets and Supermarkets, Convenience Stores, E-Commerce, Others) |

| Competitive Landscape | Adani Wilmar Limited, Emami Agro Ltd, Mother Dairy Fruit & Vegetable Pvt. Ltd, B P Oil Mills Limited, Pansari Group, Kriti Nutrients, Manishankar Oils Pvt. Ltd., Ajanta Soya Limited, Medikonda Nutrients, Vigon International, LLC. (Azelis) |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158357

Key Market Segments

By Type Analysis

In 2024, Brown Mustard oil commanded a leading 48.6% share of the Indian mustard oil market, reflecting its strong consumer preference. Its bold flavor and high pungency make it a favorite in North and East Indian households. The oil’s popularity stems from traditional cold-pressing techniques, known as ‘Kachchi Ghani,’ which retain its natural nutrients and distinct aroma. Increasing demand for unrefined, natural products has boosted its appeal, further supported by its rich omega-3 fatty acids and antioxidant content, attracting health-conscious consumers.

By Packaging Type Analysis

Pouches accounted for 34.2% of the mustard oil packaging market in 2024, driven by their affordability, convenience, and versatility. They cater to diverse consumer needs, from small single-use sachets to larger family-sized packs, appealing to both urban and rural households. The growing preference for smaller, budget-friendly packaging reflects changing consumption patterns, making pouches a dominant choice in the market.

By Application Analysis

The Food and Beverages segment led the mustard oil market in 2024 with a 59.1% share, highlighting its essential role in Indian culinary traditions. Its high smoking point and robust flavor make it ideal for frying, sautéing, pickling, and marinades, especially in North and East Indian cuisines. Mustard oil’s versatility extends to its use in traditional pickles and as a marinade base, solidifying its prominence in the food industry.

By Distribution Channel Analysis

In 2024, hypermarkets and supermarkets held a 48.9% share of mustard oil distribution, driven by their wide product range, competitive pricing, and convenience. The growth of organized retail in urban and semi-urban areas, coupled with promotional offers, bulk purchasing options, and services like home delivery and loyalty programs, has made these outlets the top choice for consumers. The availability of diverse brands and packaging sizes empowers consumers to choose products that align with their preferences and budgets.

Regional Analysis

In 2024, North America emerged as the leading region in the global mustard oil market, accounting for a dominant 37.9% share. The region’s market value reached approximately USD 8.6 billion, reflecting its strong consumer base and evolving dietary preferences.

This leadership position highlights a growing shift toward plant-based and heart-healthy cooking oils across the United States and Canada. Consumers are increasingly recognizing mustard oil’s nutritional benefits, such as its omega-3 content and anti-inflammatory properties.

Moreover, rising awareness regarding traditional and cold-pressed oils has encouraged the adoption of mustard oil in both household and commercial cooking segments. The region’s expanding ethnic food culture and the presence of Indian and Asian diaspora communities have also contributed significantly to its market dominance.

Top Use Cases

- Culinary Enhancement: Mustard oil brings a bold, pungent flavor to everyday cooking, especially in South Asian dishes like curries, stir-fries, and pickles. Its high smoke point makes it ideal for deep-frying or tempering spices, adding a unique wasabi-like kick that elevates simple vegetables or meats without overpowering them. Home cooks love how it infuses warmth and aroma into family meals effortlessly.

- Skin Nourishment: This versatile oil acts as a natural moisturizer, helping soothe dry skin and heal cracks on heels or elbows when mixed with beeswax. Rich in healthy fats, it fights fine lines and wrinkles by locking in moisture and boosting circulation, making it a go-to for DIY face masks that leave skin glowing and supple.

- Hair Vitality: Applied as a warm scalp treatment, mustard oil stimulates growth and reduces dandruff with its antibacterial properties, turning limp locks into strong, shiny strands. Massaged gently before washing, it nourishes follicles and adds volume, a simple ritual rooted in traditional care that keeps hair healthy and manageable for busy lifestyles.

- Joint Relief: For those with achy muscles or stiff joints, a gentle rub of mustard oil eases discomfort by warming the area and improving blood flow, thanks to its anti-inflammatory compounds. It’s a natural alternative for post-workout recovery or daily aches, promoting flexibility without harsh chemicals, ideal for active folks seeking soothing relief.

- Wellness Massage: In traditional practices, this oil is used for full-body massages to relax tense muscles and enhance skin barrier strength, even for newborns in some cultures. Its warming effect calms nerves and boosts immunity through gentle absorption, offering a holistic way to unwind and support overall vitality in a natural, aromatic routine.

Recent Developments

1. Adani Wilmar Limited

Adani Wilmar continues to aggressively expand its ‘Fortune’ brand in the packaged mustard oil segment. A key recent development is the introduction of innovative, tamper-evident packaging to enhance consumer trust and product safety. The company is heavily investing in supply chain infrastructure and digital marketing campaigns to increase its market penetration in North and East India, where mustard oil is a staple, positioning itself against regional players.

2. Emami Agro Ltd

Emami Agro, under its ‘Emami Healthy & Tasty’ brand, has been focusing on strengthening its distribution network in Eastern India. A significant recent move is the expansion of its modern trade and e-commerce presence, making its mustard oil more accessible to urban consumers. The company emphasizes the purity and traditional kachi ghani method of extraction in its marketing to appeal to health-conscious buyers, competing directly with other national brands.

3. Mother Dairy Fruit & Vegetable Pvt. Ltd

Mother Dairy has leveraged its strong brand equity in dairy to promote its mustard oil. A key recent focus is on assuring quality and authenticity, highlighting its rigorous testing processes. The company has been expanding its product availability through its own Safal outlets and online grocery partners. Their marketing underscores the oil being free from additives, targeting the health and wellness segment to grow its share in the branded mustard oil market.

4. B P Oil Mills Limited

BP Oil Mills, known for its ‘Jivo’ brand, has recently been concentrating on operational efficiency and cost optimization to maintain competitiveness. While quieter on large-scale marketing, their development focus is on consolidating their presence in the wholesale and industrial packaging segments. They are also exploring opportunities to supply to the hospitality sector (HORECA) as it recovers post-pandemic, leveraging their established manufacturing capabilities.

5. Pansari Group

Pansari Group has been actively capitalizing on the trend towards natural and organic products. A recent development is the promotion of their cold-pressed, chemical-free mustard oil through digital platforms and social media influencers. They have expanded their online availability on major e-commerce sites like Amazon and Flipkart, targeting millennials and urban families seeking traditional, healthy cooking oils, effectively carving a niche in the premium segment.

Conclusion

Mustard Oil is emerging as a versatile powerhouse in today’s wellness landscape, bridging age-old traditions with modern health demands. Its natural profile supports everything from flavorful meals to soothing self-care rituals, drawing in consumers who value simplicity and authenticity. With growing interest in clean ingredients, this oil stands poised for broader appeal, empowering households to embrace balanced living through everyday essentials that nourish body and soul alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)