Table of Contents

Overview

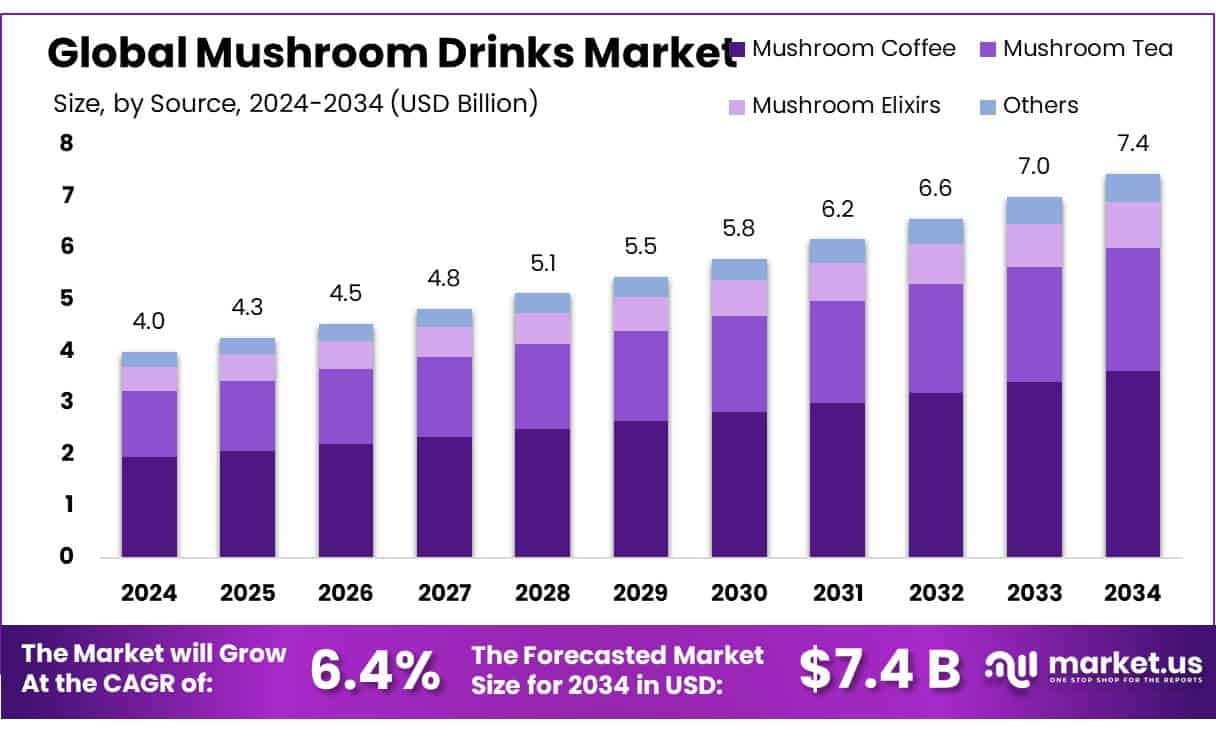

New York, NY – July 30, 2025 – The global Mushroom Drinks Market is projected to grow significantly, with its value estimated to reach around USD 7.4 billion by 2034, up from USD 4.0 billion in 2024. This expansion reflects a compound annual growth rate (CAGR) of 6.4% over the forecast period from 2025 to 2034. In 2024, North America dominated the market, contributing over 46.7% of the global share and generating approximately USD 1.8 billion in revenue. Mushroom drink concentrates infused with functional mushrooms like Reishi, Lion’s Mane, Chaga, and Cordyceps are increasingly used in beverages such as coffee, tea, smoothies, and hot chocolate. These drinks offer perceived health benefits such as enhanced immunity, stress relief, cognitive support, and anti inflammatory properties, aligning well with the modern shift toward holistic and natural wellness solutions.

Market growth is being driven by rising consumer interest in clean label, health oriented beverages, especially among Gen Z and Millennials. In the UK, for example, health drink sales saw a 54% year over year increase, with mushroom coffee becoming a trendy alternative to traditional coffee and even alcohol. Functional mushroom shots are also gaining visibility in retail chains like Marks & Spencer. From a nutritional standpoint, mushrooms are valued for their rich content of vitamins, minerals, and antioxidants like ergothioneine, supported by dietary data from the USDA/NHANES. Meanwhile, mushroom consumption in the U.S. has steadily climbed from 0.69 lb to 3.94 lb per capita signifying strong consumer adoption and supply chain maturity. In Canada, the mushroom industry also demonstrated steady progress in 2023, with production value growing by 2.2% to CAD 710 million.

Key Takeaways

- The global mushroom drinks market is anticipated to grow from USD 4.0 billion in 2024 to USD 7.4 billion by 2034, registering a CAGR of 6.4% during the forecast period.

- Mushroom coffee emerged as the leading product type, making up more than 48.7% of the worldwide market share.

- In terms of form, powdered mushroom drinks dominated, accounting for over 64.9% of the market.

- Hypermarkets and supermarkets served as the primary distribution channels, contributing more than 36.4% of total global sales.

- North America led all regions, capturing a 46.7% market share and generating close to USD 1.8 billion in value.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/mushroom-drinks-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.0 Billion |

| Forecast Revenue (2034) | USD 7.4 Billion |

| CAGR (2025-2034) | 6.4% |

| Segments Covered | By Product (Mushroom Coffee, Mushroom Tea, Mushroom Elixirs, Others), By Form (Liquid, Powder), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others) |

| Competitive Landscape | Four Sigmatic Foods, Inc., MUD\WTR, Inc., Laird Superfood, Inc., Odyssey Wellness LLC, Peak State Coffee, Inc., Tamim Teas Company, RYZE Superfoods, LLC, Mushroom Cups International, Real Mushrooms, Laird Superfood, Inc., NeuRoast Company, La Republica Superfoods |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153181

Key Market Segments

By Product Analysis:

- Mushroom coffee emerged as the leading product in 2024, accounting for over 48.7% of the global mushroom drinks market. Its popularity continues to rise, particularly among health-conscious consumers seeking functional beverages that provide both flavor and wellness benefits. Infused with mushrooms like lion’s mane, chaga, and cordyceps, these blends are seen as healthier alternatives to regular coffee, offering enhanced focus with fewer side effects like jitters. This trend is especially strong among professionals and wellness enthusiasts, and the segment is expected to expand further in 2025 with the introduction of convenient formats such as instant powders, liquid concentrates, and ready to drink versions.

By Form Analysis:

- Powdered mushroom drinks held a dominant 64.9% share of the market in 2024, driven by their convenience, long shelf life, and versatility. Consumers favor the powder form because it mixes easily into beverages like coffee, tea, and smoothies without altering flavor or texture significantly. The format also allows users to tailor their dosage according to personal wellness needs, making it attractive to a broad range of health-focused consumers. As mushroom drinks become more mainstream, demand for powdered options is expected to stay strong through 2025, particularly among those seeking easy to use, travel friendly wellness solutions.

By Distribution Channel Analysis:

- Hypermarkets and supermarkets led the distribution segment in 2024, capturing over 36.4% of global sales in the mushroom drinks market. Their success is largely attributed to high in-store visibility, broad product availability, and the ability to compare brands directly. Many consumers still prefer purchasing health-focused products like mushroom drinks in physical retail environments where they can evaluate product labels, receive promotions, and ask for recommendations. These outlets increasingly feature mushroom beverages in wellness-focused sections, especially in urban areas, and their influence is expected to grow further in 2025 as more functional beverage brands partner with large retailers.

Regional Analysis

- In 2024, North America led the global mushroom drinks market, capturing a significant 46.7% share and generating approximately USD 1.8 billion in revenue. This strong market position reflects the region’s well-established wellness culture, higher consumer spending power, and widespread access to functional health products across retail channels.

- Several key factors contribute to this dominance. Awareness of adaptogenic mushrooms like reishi, lion’s mane, and cordyceps has steadily increased, thanks to educational initiatives from health authorities and research driven marketing efforts. Additionally, North America’s advanced retail infrastructure including supermarkets, health food chains, and e-commerce platforms has made mushroom drinks easily accessible to a diverse consumer base. In fact, around 47% of mushroom coffee sales in the region came through supermarkets and hypermarkets in 2024.

- The region also benefits from a transparent regulatory framework that supports clear labeling of functional ingredients and health related claims, encouraging product innovation and boosting consumer trust. A rising focus on preventive health and natural immunity solutions has further fueled demand, with many consumers opting for premium, wellness focused beverage options.

Top Use Cases

- Daily Focus & Energy (Mushroom Coffee): Functional mushroom coffees blends with lion’s mane, chaga or cordyceps are used by professionals and students to support sustained mental clarity, mild caffeine boost, and reduced jitters. They serve as daily alternatives to regular coffee for people seeking cognitive balance, steady energy levels, and gentle stimulation through adaptogenic benefits in a familiar format.

- Stress Reduction & Relaxation (Reishi Shots): Reishi based mushroom drinks, often sold in small shot form or elixirs, are used by health conscious consumers to promote calm and stress relief. These formats appeal to those seeking natural support during busy days or winding down. Easy to integrate into daily routines, they deliver adaptogenic mood‑balancing benefits in a travel‑friendly, grab‑and‑go form.

- Immune & Wellness Booster (Chaga, Turkey Tail blends): Products combining mushrooms like chaga or turkey tail with other wellness ingredients such as turmeric, vitamin C or ginger offer consumers a daily immunity support option. They’re used by individuals wanting natural anti‑oxidant and anti‑inflammatory support, often in powder or tea format. These drinks help reinforce holistic wellness routines and preventive health efforts.

- Alternative to Alcohol & Caffeine (Gen Z & Millennials): Geo‑savvy younger consumers substitute alcoholic or overly stimulating beverages with mushroom elixirs, lattes, or kombucha‑style drinks. These products are marketed as clean, functional alternatives that support energy, mood or focus without hangovers or caffeine crashes. Popular in social and lifestyle settings, they meet demand for mindful consumption and balanced functionality.

- Powder Mixes for Dosage Control (Travel‑friendly formats): Powdered mushroom drink mixes cater to users who prefer personalized dose control and convenience. Consumers measure servings into smoothies, teas, or water according to individual health goals. This format offers long shelf life, portability for travel, and flexibility in mixing, making it ideal for wellness routines that require precise adaptogenic ingredient intake.

- Retail & E‑commerce Exposure (Supermarkets & Online Shops): Mushroom drinks are stocked widely in hypermarkets, supermarkets and online health focused stores, making them highly accessible to mass consumers. Brands leverage in store displays, e‑commerce content, and digital influencers to create visibility. This use case highlights how robust retail infrastructure drives market adoption by offering variety, sampling opportunities, and easy purchasing.

Recent Developments

Four Sigmatic Foods, Inc:

- Four Sigmatic is launching 11 new mushroom-infused products by summer 2025, including a medium roast instant organic coffee with lion’s mane and other functional mushrooms. These new offerings expand its product line across formats such as multi serve blends and ground coffees. The company also released a limited edition “The Last of Us” dark roast mushroom coffee (lion’s mane, cordyceps, Vitamin B12) timed with the HBO series.

Laird Superfood, Inc:

- In June 2025, Laird Superfood partnered with Bluestone Lane (US coffee chain) to roll out two functional mushroom infused drinks the Laird Superfood Latte and Mocha featuring chaga, lion’s mane, maitake and cordyceps. Earlier in mid 2025, they also introduced Perform Whole Bean and Perform Decaf Mushroom Coffee, expanding their mushroom coffee portfolio in both caffeinated and decaf versions.

Odyssey Wellness LLC:

- Odyssey Wellness (Odyssey Elixir) raised $6 million in Series A funding in early 2024, backing its ready to drink functional mushroom elixirs formulated with cordyceps and lion’s mane. The brand now offers organic RTD mushroom‑infused energy drinks and secured distribution in 732 7‑Eleven stores in Florida and all 109 Wegmans locations on the US East Coast.

Real Mushrooms:

- Real Mushrooms (parent: Nammex) was recently recognized by Optimal Performance Living as offering the Best Medicinal Mushroom Product for its Turkey Tail extract powder and capsules. The company emphasizes fruiting body only extraction, zero grain fillers, and verified beta glucan potency, maintaining 40 + years of quality expertise.

RYZE Superfoods, LLC:

- RYZE Superfoods continues scaling in early 2025 with its six‑mushroom organic coffee blend (cordyceps, lion’s mane, reishi, shiitake, turkey tail, king trumpet) plus MCT oil. The brand claims smoother energy, immune support, and digestive benefits. According to CB Insights and consumer press, it remains a top selling US mushroom coffee brand with strong subscription growth since its 2020 launch.

Peak State Coffee, Inc:

- Peak State Coffee, founded by a Northeastern grad, markets the world’s first whole bean coffee infused with adaptogenic mushrooms using its proprietary infusion process. While the most recent major funding or product news dates to 2023, the brand remains highlighted in industry releases as a pioneer in infused whole bean mushroom coffee.

Conclusion

The mushroom drinks market is witnessing strong and steady growth, driven by rising demand for natural, functional beverages that offer health benefits beyond hydration. With products like mushroom coffee, elixirs, and powdered blends gaining popularity especially among Gen Z, Millennials, and wellness focused consumers brands such as Four Sigmatic, Laird Superfood, and RYZE Superfoods are innovating rapidly. The growing presence of these products in mainstream retail channels like 7-Eleven, Wegmans, and supermarkets is further expanding consumer access. Government support, clear labeling regulations, and increased interest in immune health and stress relief are also helping the market mature. As the trend toward holistic and preventative health continues, the mushroom drinks sector is poised for significant long term expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)