Table of Contents

Introduction

The Global Multiwall Bags Market is gaining momentum as industries increasingly shift toward sustainable packaging. With rising concerns about environmental impact and regulations curbing single-use plastics, businesses are embracing durable and recyclable solutions. Multiwall bags, known for their strength and versatility, have emerged as a preferred packaging format across diverse sectors.

Transitioning from conventional options, industries like food, agriculture, and construction are driving adoption of these eco-friendly bags. Supported by regulatory incentives and growing awareness among consumers, the demand trajectory is steadily climbing. Projections indicate a robust market expansion over the coming decade.

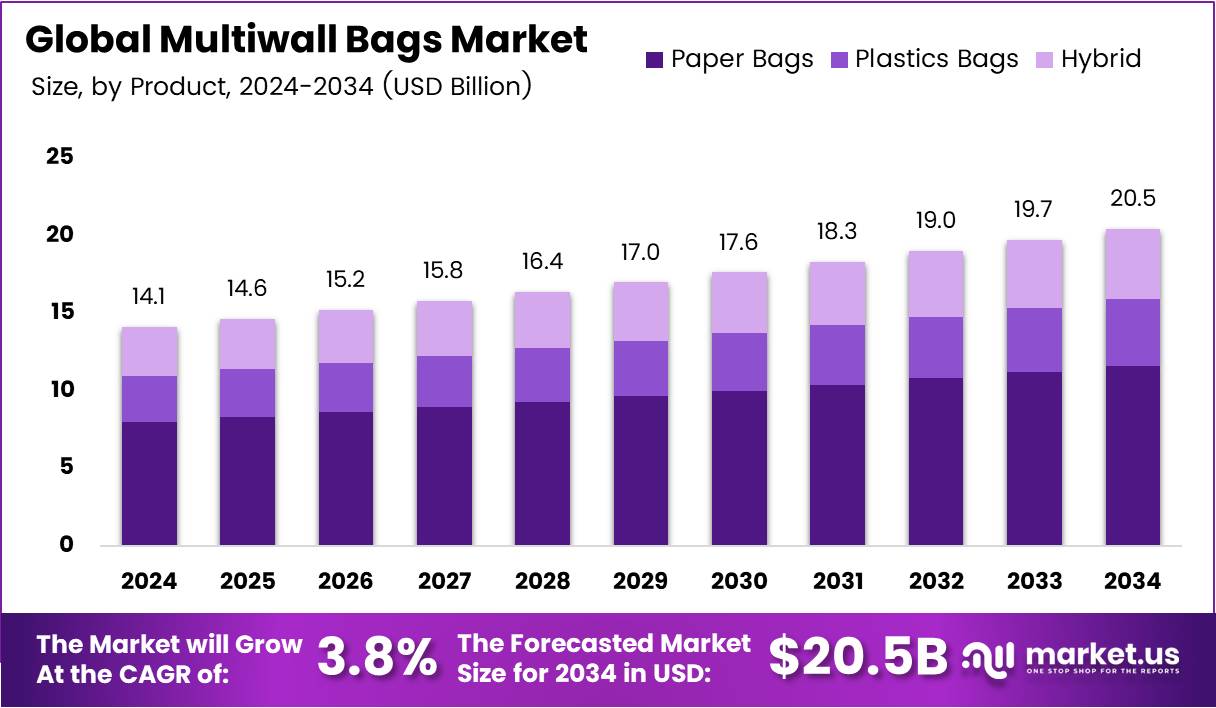

As a result, the market size is projected to grow from USD 14.1 Billion in 2024 to USD 20.5 Billion by 2034, reflecting a CAGR of 3.8%. This shift underscores a packaging revolution rooted in sustainability, customization, and high-performance features.

Key Takeaways

- The Global Multiwall Bags Market is projected to reach USD 20.5 Billion by 2034, growing from USD 14.1 Billion in 2024, at a CAGR of 3.8%.

- Paper Bags lead the market with a 56.8% share in the By Product Analysis segment in 2024.

- The 2-ply configuration dominates the By Layer Analysis segment with a 44.9% share in 2024.

- The 11Kg to 25Kg capacity segment holds a 38.1% share in 2024 in the By Capacity Analysis segment.

- The Food & Beverages sector represents 31.5% of the Multiwall Bags Market in 2024 in the By Application Analysis segment.

- The Asia Pacific region dominates the market with a 43.8% share, valued at USD 6.1 billion in 2024.

Market Segmentation Overview

By Product

In 2024, paper bags accounted for a 56.8% share, driven by their recyclability and eco-friendly appeal. Transitioning away from plastics, industries favored paper-based solutions to align with sustainability goals. Plastic bags retained relevance in moisture-sensitive applications, while hybrid designs gained traction as a balance between performance and sustainability.

By Layer

The 2-ply segment dominated with 44.9% share in 2024, offering an optimal mix of cost-effectiveness and durability. Transitioning industries adopted this configuration for mainstream applications. Meanwhile, 3-ply solutions catered to heavy-duty packaging, and niche multi-layer variations addressed specialized industrial demands.

By Capacity

Multiwall bags in the 11Kg to 25Kg range led with 38.1% share in 2024. Transitioning across industries, this mid-capacity segment served food, cement, and fertilizer sectors effectively. Smaller capacities gained traction in retail packaging, while heavier bags above 25Kg were preferred in large-scale industrial processing.

By Application

The Food & Beverages sector held a 31.5% share in 2024, reflecting growing reliance on multiwall bags for bulk items like flour, sugar, and grains. Transitioning into agriculture, chemicals, pharmaceuticals, and construction also fueled steady demand, highlighting the versatility of these packaging solutions across multiple industries.

Drivers

Growing Demand for Sustainable Packaging Solutions

Rising environmental concerns and regulatory measures are driving industries to transition toward eco-friendly packaging. Multiwall bags, being recyclable and biodegradable, align with global sustainability goals. Their ability to reduce environmental impact makes them a preferred solution among industries seeking compliance and brand reputation enhancement.

Expanding E-commerce and Retail Sector

The surge in e-commerce has created demand for reliable, durable, and cost-efficient packaging. Multiwall bags provide strength and versatility for transporting diverse goods while ensuring product integrity. Retailers and logistics providers increasingly favor these solutions to meet efficiency and sustainability standards.

Use Cases

Food & Agriculture

Multiwall bags are extensively used for bulk packaging of flour, rice, sugar, fertilizers, and seeds. Their moisture resistance and durability ensure product safety during storage and transport. Transitioning food supply chains rely on these solutions to meet regulatory standards and consumer expectations for hygienic packaging.

Construction & Chemicals

Industries handling cement, chemicals, and other hazardous goods prefer multiwall bags due to their strength and barrier properties. Transitioning to multiwall solutions allows these sectors to maintain compliance with stringent safety regulations while ensuring durability in demanding environments.

Major Challenges

Environmental Concerns on Plastic Use

Although multiwall bags are eco-friendly when paper-based, the inclusion of plastic laminates raises environmental concerns. Transitioning away from plastic-heavy designs is challenging for manufacturers needing moisture-resistant options. Stricter regulations intensify compliance costs, creating hurdles for traditional plastic-based multiwall bag producers.

Competition from Alternative Packaging Solutions

Reusable containers, biodegradable films, and advanced paper solutions are competing with multiwall bags. These alternatives attract eco-conscious consumers, pressuring traditional multiwall packaging providers. Transitioning consumer preferences may shift further if manufacturers fail to adapt innovative, sustainable solutions.

Business Opportunities

Customized & Specialized Packaging Solutions

Growing demand for tailored packaging creates opportunities for manufacturers to design application-specific bags. Transitioning into niche markets like pharmaceuticals and chemicals offers potential for higher margins and differentiation. Customized barrier properties, moisture resistance, and branding open avenues for innovation.

Development of Biodegradable & Smart Multiwall Bags

Transitioning into sustainable materials, biodegradable multiwall bags offer immense growth prospects. Additionally, integrating smart packaging features such as freshness indicators or supply chain trackers enhances product value. These innovations position companies strongly in a competitive market.

Regional Analysis

Asia Pacific Leads with 43.8% Share

In 2024, Asia Pacific accounted for 43.8% of the global market, valued at USD 6.1 billion. Rapid industrialization in China and India, coupled with robust construction and agriculture demand, drives growth. Transitioning focus on sustainable packaging further strengthens the region’s leadership.

North America and Europe Drive Sustainability Adoption

North America demonstrates steady growth through strong demand in food & beverage packaging and eco-friendly solutions. Europe’s strict regulations against plastic waste fuel rising adoption of paper-based multiwall bags. Transitioning toward recyclable materials positions both regions as innovation hubs for sustainable packaging.

Recent Developments

- June 2024: MASTERGRAIN acquired Fibercraft Door Company, strengthening its presence in specialty paper packaging.

- March 2024: ProAmpac acquired Gelpac, expanding capabilities in flexible and sustainable packaging.

- March 2025: Cordovan Capital acquired Ireland’s only paper sack producer, enhancing its position in European paper packaging.

Conclusion

The Global Multiwall Bags Market is transitioning toward sustainable, innovative, and high-performance packaging solutions. With USD 20.5 Billion projected by 2034 and steady growth driven by eco-conscious trends, the industry offers opportunities across food, construction, chemicals, and agriculture. Manufacturers investing in biodegradable, customized, and smart bag solutions will secure long-term leadership in this evolving landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)