Table of Contents

Overview

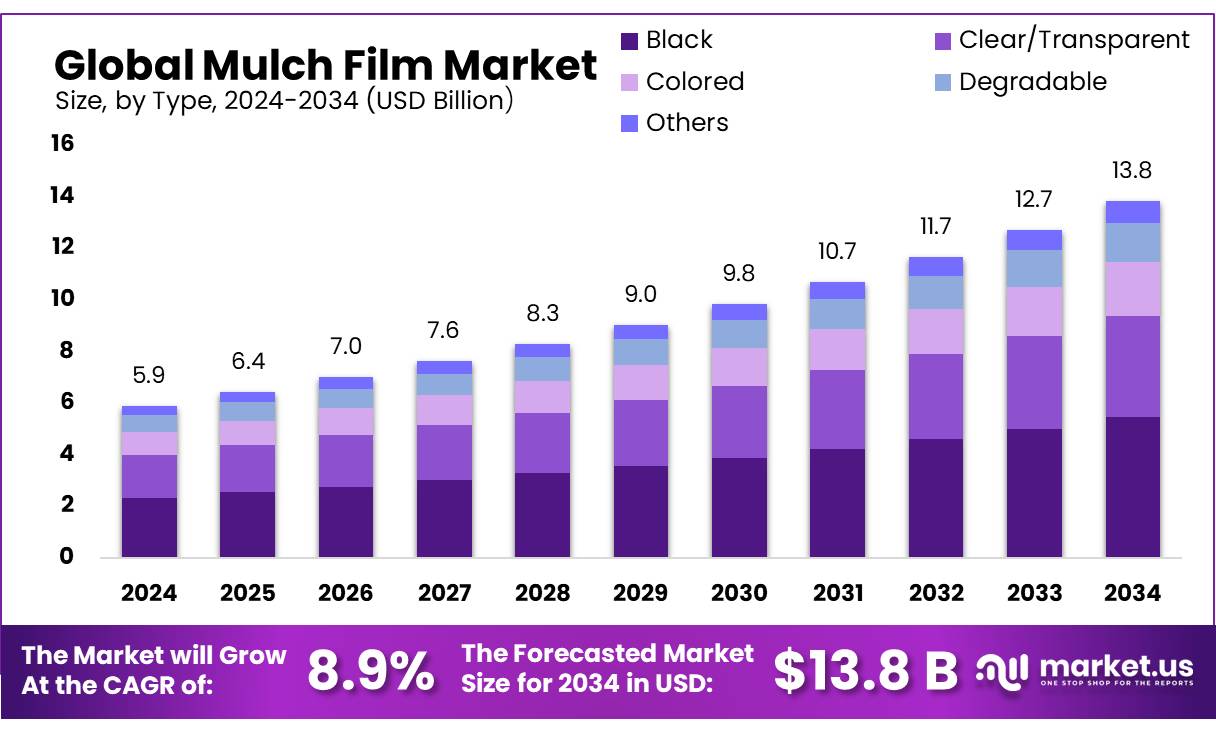

New York, NY – September 16, 2025 – The Global Mulch Film Market is projected to grow from USD 5.9 billion in 2024 to USD 13.8 billion by 2034, achieving a CAGR of 8.9% during the forecast period (2025–2034). In 2024, the Asia-Pacific (APAC) region led the market, holding a 47.8% share with USD 2.8 billion in revenue.

Mulch film concentrates are additive masterbatches, including UV/HALS stabilizers, antioxidants, slip/antiblock agents, and pigments, designed for thin agricultural films. These films suppress weeds, conserve soil moisture, and accelerate crop harvests. Plastic mulch, integral to modern horticulture and row-crop systems, covers tens of millions of hectares globally, driving demand for high-performance concentrates.

In the United States, vegetable growers use about 0.13 million tonnes of polyethylene mulch annually, relying on concentrates for film durability and opacity. China, the largest mulch film market, enforces a national standard (GB/T 25413-2010) limiting residual mulch in soils to 75 kg/ha, encouraging thicker, longer-lasting films and improved recovery practices, both of which require advanced concentrate formulations.

In India, the Mission for Integrated Development of Horticulture (MIDH) supports plastic mulching adoption with subsidies: 50% up to ₹16,000/ha in FY 2024-25 and ₹20,000/ha with a ₹40,000/ha cap in FY 2025-26. These policies promote quality films and recycling practices. In Europe, EN 17033 (2018) sets standards for biodegradable mulch films, guiding certification and procurement while fostering a premium market for compliant concentrates.

Key Takeaways

- Mulch Film Market size is expected to be worth around USD 13.8 billion by 2034, from USD 5.9 billion in 2024, growing at a CAGR of 8.9%.

- Black held a dominant market position, capturing more than a 39.4% share of the global mulch film market.

- Conventional held a dominant market position, capturing more than 78.9% share in the mulch film market.

- Fruits & Vegetables held a dominant market position, capturing more than a 56.2% share in the mulch film market.

- Asia Pacific (APAC) region held a commanding position in the global mulch film market, accounting for 47.8% of the total market share, valued at approximately USD 2.8 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-mulch-film-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 5.9 Billion |

| Forecast Revenue (2034) | USD 13.8 Billion |

| CAGR (2025-2034) | 8.9% |

| Segments Covered | By Type (Black, Clear/Transparent, Colored, Degradable, Others), By Raw Material (Conventional, Biodegradable), By Crop Type (Fruits and Vegetables, Grains and Oilseeds, Flowers and Plants, Others) |

| Competitive Landscape | BASF SE, Kingfa Sci & Tech Co Ltd, BioBag International AS, Yibiyuan Water-Saving Equipment Technology Co., Ltd., RKW SE, Polystar Plastics Ltd, Armando Alvarez, Novamont S.p.A., Berry Global Inc., Napco National |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155450

Key Market Segments

By Type Analysis

Black mulch film leads the market, holding a 39.4% share in 2024. Its popularity stems from its ability to block sunlight, effectively controlling weeds and retaining soil moisture. The film’s heat-absorbing properties also warm the soil, promoting faster seed germination and early plant growth, particularly in cooler climates. Government initiatives in major agricultural nations like India and China, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and the National Mission on Sustainable Agriculture (NMSA), continue to drive adoption of black mulch films through plasticulture promotion.

By Raw Material Analysis

Conventional materials dominate the mulch film market, capturing a 78.9% share in 2024. Polyethylene-based materials (LDPE, LLDPE) are favored for their affordability, durability, and widespread availability. These plastics resist tearing, UV exposure, and agrochemicals, making them ideal for large-scale farming. Government-backed programs, such as India’s Mission for Integrated Development of Horticulture (MIDH), prioritize conventional mulch films due to their cost-effectiveness and ease of use, particularly for small and medium-scale farmers.

By Crop Type Analysis

Fruits and vegetables account for a 56.2% share of mulch film usage in 2024. Mulch films enhance yield by maintaining soil moisture, suppressing weeds, and shortening harvest cycles, which is critical for crops like tomatoes, strawberries, cucumbers, melons, and peppers. These crops benefit from the stable growing conditions that mulch films provide. Global government support, including India’s MIDH and China’s plasticulture policies, further boosts mulch film use in horticulture through subsidies and technical assistance.

Regional Analysis

The Asia Pacific region commands a 47.8% share of the global mulch film market, valued at USD 2.8 billion in 2024. This dominance is driven by widespread plasticulture adoption in key agricultural economies like China, India, Japan, and South Korea.

China leads globally, with over 20 million hectares of farmland under mulch film in 2024, particularly in arid regions like Xinjiang and Inner Mongolia. In India, government schemes like PMKSY and MIDH, offering up to 50% subsidies, have spurred mulch film use in states such as Maharashtra, Karnataka, and Tamil Nadu, fueled by growing awareness of benefits like moisture retention and improved crop yields.

Top Use Cases

- Vegetable & Fruit Farming Productivity Increases: Mulch film is used in growing vegetables and fruits (like tomatoes, peppers, strawberries) to keep soil warmer, retain moisture, and reduce weeds. Because of these, farmers see better germination, fewer losses, and higher yields. Its use helps in improving crop quality and reducing labor in weeding, boosting profit margins.

- Water Conservation in Dry & Semi-Arid Regions: In regions with water scarcity, mulch film acts as a barrier over the soil that slows down water evaporation. This means less frequent irrigation is needed. As water becomes costlier or more limited, mulch films help farmers maintain soil moisture more steadily, saving both water and cost, especially in arid or semi-arid farming zones.

- Weed Suppression & Reduced Herbicide Use: Mulch film prevents sunlight from reaching weed seeds, reducing weed infestation. This lowers dependence on chemical herbicides or manual weeding. Reduced herbicide use cuts input costs and lessens environmental and health risks. It also simplifies management, particularly for small-scale farmers or organic farms.

- Soil Temperature Regulation & Crop Protection: Mulch films help moderate soil temperature—warming the ground early in the growing season, protecting from sudden cold, or buffering heat extremes. This helps in seed germination and early plant growth. Also helpful against frost or heat stress events, ensuring more stable growth and fewer crop failures.

- Support for Sustainable / Biodegradable Agriculture Practices: As environmental concerns grow, biodegradable mulch films are used instead of traditional plastic ones. These films break down naturally, reducing soil plastic residue. Regulations and consumer demand favor sustainable farming. This use case also aligns with organic farming and supports farmers aiming for eco-labels or lower footprint production.

Recent Developments

1. BASF SE

BASF continues to advance its ecovio certified biodegradable mulch films, focusing on agricultural sustainability. Recent developments highlight their use in specialty crops like strawberries and vegetables, demonstrating effective soil biodegradation that eliminates plastic recovery and disposal needs. This supports the transition to a circular economy by reducing plastic pollution in farming.

2. Kingfa Sci & Tech Co Ltd

Kingfa is expanding its global footprint with its biodegradable resin, PBAT, a key material for biodegradable mulch films. Their recent focus is on increasing production capacity to meet rising international demand and developing enhanced formulations that ensure complete biodegradation in soil without leaving microplastic residues, catering to the European and North American markets’ stringent regulations.

3. BioBag International AS

BioBag recently launched a new generation of certified compostable mulch films, BioBag Mulch Film, designed for use with automatic laying machines. Their development emphasizes superior tear resistance and consistent thickness for easier handling and reliable performance. The films are certified to break down into non-toxic components, supporting organic farming practices and soil health.

4. Yibiyuan Water-Saving Equipment Technology Co., Ltd.

Yibiyuan specializes in integrating mulch films with advanced drip irrigation systems. Their recent developments focus on creating synergistic kits where specially designed mulch films work in concert with subsurface and surface drip lines to maximize water conservation, control weeds, and improve crop yield efficiency, primarily for large-scale agricultural applications.

5. RKW SE

RKW’s recent development is the HyJet film, a high-performance, light-blocking black mulch film. It is engineered for exceptional mechanical strength and UV resistance, ensuring durability throughout the growing season. This film is designed to provide optimal soil warming and potent weed suppression, leading to significantly higher crop yields for farmers.

Conclusion

The Mulch Film Market is poised for solid growth globally, driven by the twin pressures of increasing agricultural productivity demand and environmental sustainability. Key advantages like water savings, weed control, soil temperature regulation, and yield improvement make mulch film a valuable tool, especially in water-stressed and intensively farmed regions. However, the rising interest in biodegradable versions and the regulatory and consumer push toward reducing plastic waste indicate that future success will depend not just on performance but also on ecological footprint.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)