Table of Contents

Overview

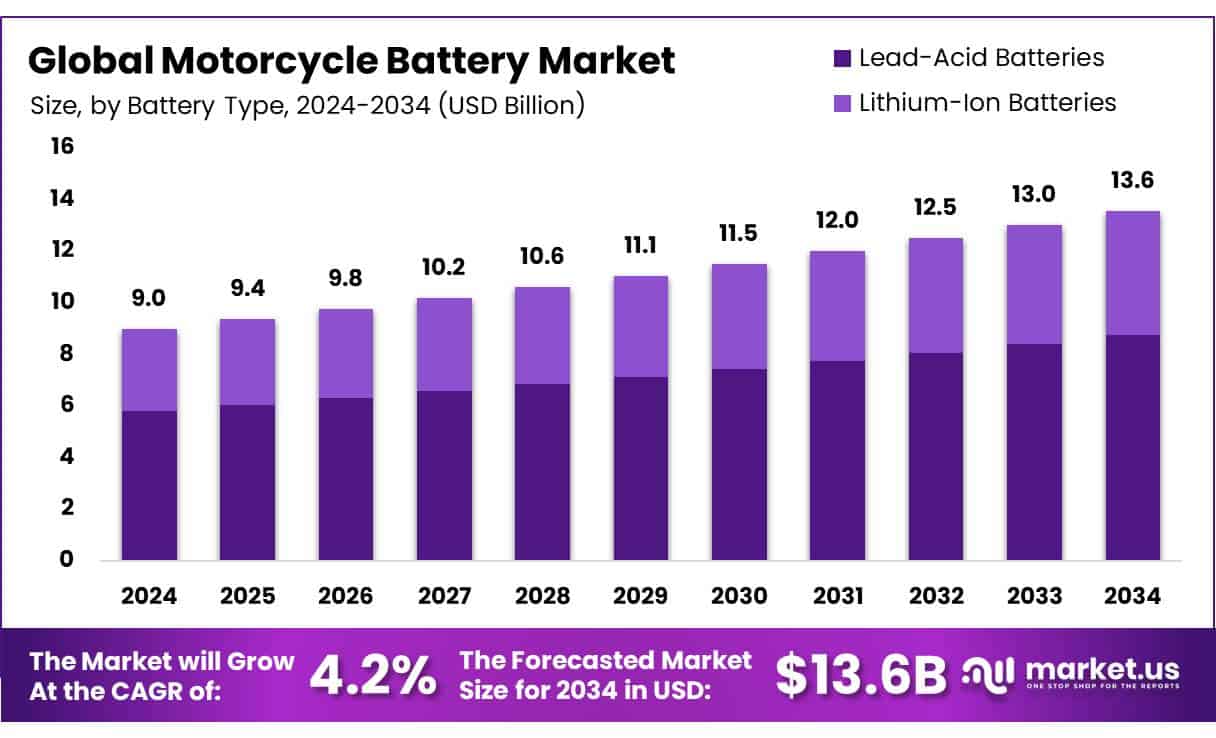

New York, NY – June 20, 2025 – The global motorcycle battery market is projected to reach approximately USD 13.6 billion by 2034, up from an estimated USD 9.0 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 4.2% over the forecast period from 2025 to 2034.

In 2024, the global motorcycle battery market saw Lead Acid batteries dominate with a 64.5% revenue share, driven by their low cost, wide availability, and established use in ICE motorcycles, particularly across Asia-Pacific, Latin America, and Africa. In terms of capacity, batteries in the 50 AH to 10 AH range led the market with a 37.5% share due to their suitability for commuter and mid-range motorcycles, especially in emerging economies.

Internal Combustion Engine (ICE) motorcycles accounted for a dominant 78.3% share by propulsion type, supported by existing infrastructure, affordability, and widespread usage. By application, standard motorcycles held the largest share at 43.3%, fueled by their popularity for everyday commuting in developing regions where cost-efficiency and reliability are key.

How Growth is Impacting the Economy

The growing motorcycle battery market significantly contributes to the global economy, particularly in emerging markets. As urbanization rises and two-wheelers become a preferred mode of transportation for affordability and efficiency, the demand for batteries surges. This growth fuels manufacturing activity, creates employment in production and logistics, and encourages investment in R&D for more efficient battery technologies.

OEM partnerships are expanding, stimulating revenue for both battery producers and motorcycle manufacturers. In regions like Asia Pacific and Latin America, widespread adoption of motorbikes is not only improving mobility but also driving local economies through job creation in retail, maintenance, and supply chains.

Additionally, the increasing focus on electric motorcycles is fostering innovation and supporting the global green energy transition. As the market matures, governments and private sectors are benefiting through increased tax revenues, infrastructure development, and sustainable growth, making the motorcycle battery market a key contributor to economic advancement.

Key Takeaways

- The global motorcycle battery market was valued at USD 9.0 billion in 2024.

- It is expected to grow at a CAGR of 4.2%, reaching approximately USD 13.6 billion by 2034.

- Lead-acid batteries led the battery type segment, holding a dominant 64.5% share of the market.

- In terms of capacity, the 50 AH to 10 AH segment captured the largest share at 37.5%.

- Internal Combustion Engine (ICE) motorcycles accounted for the highest share by propulsion type, at 78.3%.

- Standard motorcycles held the top position in the application segment with a 43.3% market share.

- OEMs were the leading end-users, representing 59.3% of the market share.

- The Asia Pacific region emerged as the largest regional market, contributing 43.3% to the overall market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-motorcycle-battery-market/

Experts Review

Experts highlight the motorcycle battery market as resilient and growth oriented. Presently, demand is fueled by economic two wheeler usage in urban and semi-urban settings, especially in Asia and Latin America. Analysts see stable short term growth led by ICE motorcycles and standard commuter models.

Looking ahead, there is a positive outlook for lithium-ion battery adoption, driven by global EV transitions and government incentives. Experts recommend a phased investment in lithium battery R&D while maintaining a strong foothold in the lead acid segment. As electrification expands, the market is expected to benefit from innovation, policy support, and infrastructure upgrades.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=150931

Key Market Segments

By Battery Type

- Lead-Acid Batteries

- Wet Cell

- Maintenance-Free

- Absorbent Glass Mat (AGM)

- Gel Cell

- Others

- Lithium-Ion Batteries

By Capacity

- Upto 50 AH

- 50 AH to 10 AH

- 10 AH to 15 AH

- Above 15 AH

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

By Application

- Standard

- Cruiser

- Moped

- Sports

- Adventure

- Others

By End-user

- OEMs

- Aftermarket

Regional Analysis

In 2024, the Asia Pacific region led the global motorcycle battery market with a commanding 43.3% share, driven by surging two wheeler adoption and the rapid shift to electric mobility. Major countries like India, China, Indonesia, Vietnam, and Thailand are fueling this momentum through large urban populations, government-backed incentives, and rising consumer interest in affordable, eco friendly transport. The rise in electric two-wheelers, particularly in densely populated urban areas, is accelerating demand for lithium-ion batteries.

According to the International Energy Association, China, India, and Southeast Asia collectively accounted for nearly 80% of global motorcycle battery sales in 2024. In India, the electrification wave is strong, with electric three-wheeler sales hitting 700,000 units and growing at nearly 20% annually. In May 2025 alone, India registered over 179,000 electric vehicles, with high-speed electric two-wheelers making up more than 50%. Meanwhile, Indonesia aims for 2.5 million electric motorcycles by 2025 and 13 million by 2030.

Top Use Cases

Battery‐Swapping for Electric Motorcycles: Developers are introducing battery‑swap stations that let riders quickly exchange depleted batteries for charged ones. This model reduces range anxiety, lowers upfront costs, and supports lighter, more affordable electric bikes. It’s gaining traction in Asia and Europe through consortiums of OEMs and energy service providers.

Starter vs. Auxiliary Batteries: Traditional starter batteries power ignition, lights, and indicators, while auxiliary batteries support GPS, infotainment, and security systems. Demand is rising for high‑performance auxiliary units as motorcycles become tech‑rich, leading to diversified battery portfolios for aftermarket retailers and OEMs.

Capacity-Based Use in Commuter vs. High‑Performance Bikes: Batteries in the 10–20 Ah range serve daily commuter motorcycles, balancing cost and power. Meanwhile, >20 Ah batteries are increasingly needed for adventure or electric bikes equipped with accessories and higher energy demands, driving capacity segment innovation.

Aftermarket Customization: Users are customizing motorcycles with LED lighting, alarms, USB chargers, and more. This trend boosts demand for rugged lead‑acid VRLA batteries capable of high discharge bursts. Online sales channels are growing to meet customization and replacement needs.

Battery-as-a-Service (BaaS) Models: Companies are offering subscription‑based battery services especially for electric two‑wheelers where users lease batteries and swap them at stations. This model reduces vehicle cost, simplifies maintenance, and accelerates adoption among urban commuters and delivery fleets.

Recent Developments

GS Yuasa International Ltd

GS Yuasa and Honda signed a basic agreement in January 2023 to form “Honda・GS Yuasa EV Battery R&D Co., Ltd.” for joint development of high-capacity, high-output lithium-ion batteries targeting EVs, with operations planned to commence by the end of 2023. in May 2024, GS Yuasa’s lithium-ion energy storage systems won the New Energy Award for pioneering battery control and management innovation.

Exide Group

On March 13, 2025, Exide Technologies expanded its Motorbike & Sport AGM Ready range by adding seven new batteries compliant with EU Regulation 1148/2019, enabling acid-free, ready-to-use AGM batteries for motorcycles. In May 2025, Exide announced advanced partnership discussions with major 2‑wheeler and 3‑wheeler OEMs for electric vehicle battery production, including auxiliary battery supply for e‑2Ws and EVP systems

Clarios

Between 2022 and 2026, Clarios is investing roughly EUR 200 million to expand its European production of AGM (Absorbent Glass Mat) vehicle batteries aiming for 50% more output by 2026. On January 31, 2025, Clarios also celebrated production of its one-millionth 12 V lithium-ion battery, marking a significant milestone in its advanced energy storage portfolio.

Samsung SDI

At the Daegu International Future Auto & Mobility Expo (DIFA) in October 2024, Samsung SDI unveiled a full mobility battery line-up including all-solid-state, 46‑φ cylindrical, LFP+, and 21700 format batteries with mass production of cylindrical batteries set for early 2025. In February 2024, it partnered with Vietnam’s Selex Motors to provide battery cells for electric motorcycles targeting the Southeast Asia market

Conclusion

This growth is supported by increasing two‑wheeler usage in emerging economies, continuous innovation in lead‑acid and lithium‑ion technologies, and rising electrification trends. As urbanization and demand for affordable transport rise, both OEMs and aftermarket players benefit from consistent battery demand. Overall, the market is poised for balanced, sustainable growth anchored in traditional segments while gradually integrating advanced battery technologies for future mobility needs.