Table of Contents

Overview

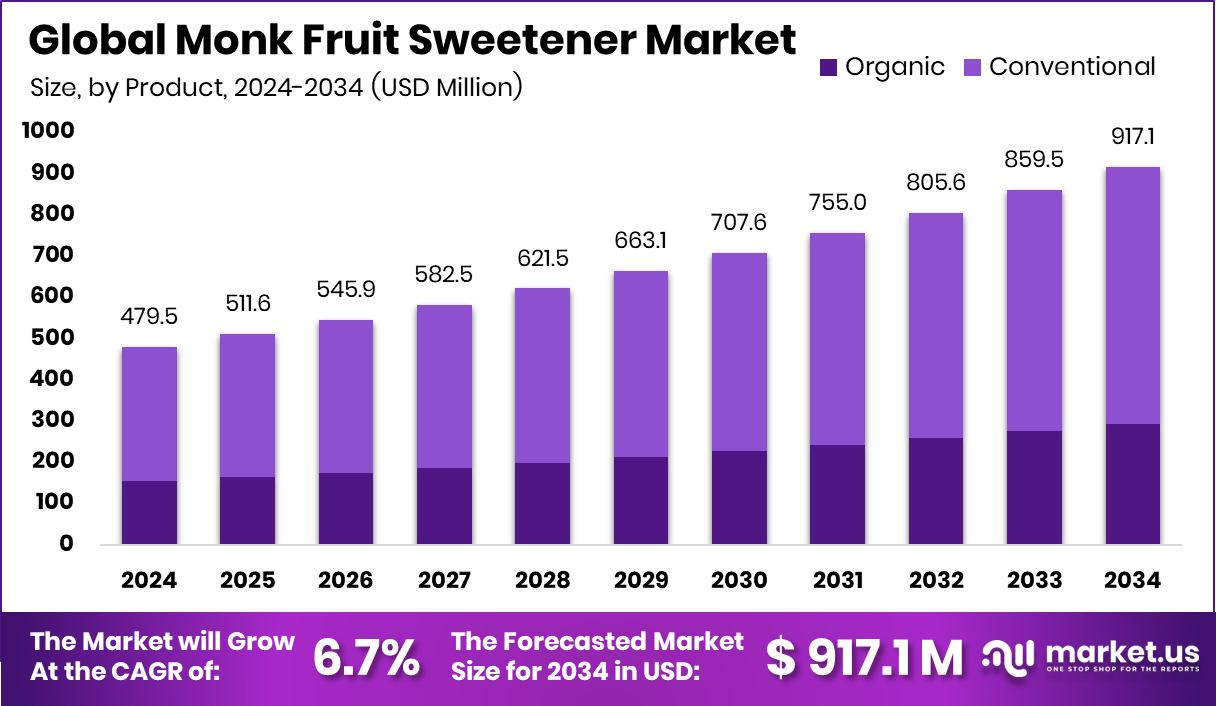

New York, NY – September 15, 2025 – The Global Monk Fruit Sweetener Market is projected to reach USD 917.1 million by 2034, growing from USD 479.5 million in 2024 at a CAGR of 6.7% from 2025 to 2034. North America holds a dominant 45.8% market share, driven by expanded retail availability.

Monk fruit sweetener, a natural, zero-calorie sugar substitute derived from the Southeast Asian monk fruit (luo han guo), contains mogrosides that deliver intense sweetness without spiking blood sugar. It’s widely used in beverages, baked goods, and packaged foods as a healthier alternative to refined sugar, appealing to those managing weight or blood sugar levels. The market encompasses the global trade, production, and consumption of monk fruit-based sweeteners, including fruit cultivation, mogroside extraction, and applications in food and beverage products.

Growth is fueled by rising demand for natural, low-calorie, plant-based sweeteners amid increasing health consciousness and stricter regulations on sugar in processed foods. Elo Life Systems raised USD 20.5 million to fast-track its monk fruit sweetener commercialization, while Good Monk secured ₹7 crore in Pre-Series A funding for expansion. Additionally, Cure Hydration raised USD 5.6 million in Series A funding to scale operations, a new functional tea brand secured USD 6.7 million for launches in Wegmans and Whole Foods, and Super Coffee’s parent company obtained USD 106 million to fuel growth.

Key Takeaways

- The Global Monk Fruit Sweetener Market is expected to be worth around USD 917.1 million by 2034, up from USD 479.5 million in 2024, and is projected to grow at a CAGR of 6.7% from 2025 to 2034.

- In the Monk Fruit Sweetener Market, conventional products dominate, holding a strong 69.3% market share globally.

- Solid form leads the Monk Fruit Sweetener Market, capturing 78.4% share due to easy storage and processing advantages.

- Beverages remain the top end-use in the Monk Fruit Sweetener Market, accounting for 41.1% of demand.

- Hypermarkets and supermarkets drive Monk Fruit Sweetener Market sales, representing 45.9% of total distribution channel share.

- North America 45.8% strong health awareness and sugar reduction trends drive monk fruit sweetener demand significantly higher.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/monk-fruit-sweetener-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 479.5 Million |

| Forecast Revenue (2034) | USD 917.1 Million |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Product (Organic, Conventional), By Form (Solid, Liquid), By End Use (Bakery and Confectionery, Beverages, Dairy and Frozen Desserts, Pharmaceuticals, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | Guilin Layn Natural Ingredients Corp., Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Monk Fruit Corp., Cargill, Inc., GLG Life Tech Corp., Steviva Brands, Inc., NOW Foods, Firmenich SA, SweetLeaf, Lakant |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155415

Key Market Segments

By Product Analysis

Conventional monk fruit sweeteners led the market in 2024, commanding a 69.3% share. Their dominance stems from widespread availability, lower production costs compared to organic alternatives, and strong consumer acceptance. A well-established supply chain, supported by large-scale cultivation and processing, ensures a consistent supply and competitive pricing, making conventional sweeteners the go-to choice for bulk buyers like food and beverage manufacturers.

The segment thrives due to its extensive use in packaged foods, bakery items, beverages, and tabletop sweeteners. Scalable production and reliable sourcing help meet growing demand without significant cost volatility. Improved extraction techniques have enhanced taste profiles, broadening appeal to mainstream consumers. Emerging markets further bolster this segment’s growth, as affordable pricing and robust distribution make conventional monk fruit sweeteners widely accessible.

By Form Analysis

In 2024, solid monk fruit sweeteners, such as granules and powders, dominated with a 78.4% market share. Their versatility, extended shelf life, and ease of use in diverse food and beverage applications drive this leadership. Solid forms are favored by both households and commercial food processors for their storage and transport stability.

The segment benefits from growing demand for sugar-free and low-calorie products, particularly in packaged goods. Solid sweeteners blend seamlessly with dry ingredients, ensuring consistent flavor in large-scale production. Advances in granulation and blending technology have improved texture and solubility, enhancing consumer convenience. Retail availability, attractive packaging, and bulk purchase options further boost market penetration.

By End Use Analysis

Beverages accounted for a 41.1% share of the monk fruit sweetener market in 2024. The segment’s strength is driven by consumer demand for low-calorie, sugar-free, and natural drink options, with monk fruit’s zero-calorie, clean-label profile making it a preferred ingredient. It is widely used in flavored water, energy drinks, soft drinks, teas, and functional beverages.

Global sugar reduction initiatives and stricter labeling regulations encourage manufacturers to replace artificial sweeteners with plant-based options like monk fruit. Its heat stability and compatibility with other natural ingredients ensure consistent flavor in both ready-to-drink and powdered beverage mixes. Beverage brands leverage monk fruit’s marketing appeal, promoting products as premium and health-focused.

By Distribution Channel Analysis

Hypermarkets and supermarkets captured a 45.9% share of monk fruit sweetener sales in 2024. Their dominance is driven by extensive product variety, broad geographic presence, and the ability to cater to diverse consumer needs. These retail channels allow consumers to compare brands, sizes, and prices in person, boosting sales of specialty products like monk fruit sweeteners. In-store promotions, discounts, and sampling further drive trial and loyalty.

The rise in health-conscious shopping has led to increased shelf space for natural sweeteners in these stores. Established supply chains ensure fresh, consistent stock, building consumer trust. Strategic product placement in health food and general grocery aisles enhances visibility and impulse purchases. As demand for sugar alternatives grows, hypermarkets and supermarkets are expanding premium and private-label offerings, solidifying their lead in this segment.

Regional Analysis

North America led the monk fruit sweetener market in 2024, holding a 45.8% share valued at USD 219.6 million. High consumer awareness of natural, low-calorie sweeteners, coupled with concerns about obesity and diabetes, drives this dominance. Supportive regulations and a strong presence of health-focused food and beverage manufacturers further fuel growth. Europe follows with steady expansion, driven by clean-label trends and plant-based sweetener adoption.

The Asia Pacific region, a key monk fruit cultivation hub, benefits from local demand and robust export markets. The Middle East & Africa and Latin America are emerging markets, driven by urbanization, evolving diets, and improved retail access. Across all regions, innovation in product formats, wider distribution, and the popularity of keto-friendly and diabetic-safe diets propel growth. North America is expected to maintain its lead, while emerging markets offer significant growth potential.

Top Use Cases

- Beverages: People love adding monk fruit sweetener to their daily drinks like coffee, tea, or iced lemonade. It gives a clean, sugar-like taste without calories or spikes in blood sugar. This makes it perfect for those watching their weight or managing diabetes. Just a drop or sprinkle does the trick, keeping your morning routine sweet and healthy without any weird aftertaste.

- Baking and Desserts: Home bakers use monk fruit in cookies, cakes, and muffins as a zero-calorie swap for sugar. It blends well in recipes, helping create low-carb treats that taste just as yummy. Ideal for keto diets, it keeps baked goods fluffy and moist while cutting down on carbs, so you can enjoy desserts guilt-free every day.

- Sugar-Free Candies and Snacks: Candy makers and snack brands mix monk fruit into gums, chocolates, and energy bars for natural sweetness. It avoids the bitterness of other sweeteners, making treats appealing to kids and adults alike. This use case shines in the growing low-sugar snack market, where consumers crave tasty, healthy bites without extra calories.

- Yogurt and Dairy Products: Stir monk fruit into plain yogurt or smoothies for a fruity boost without added sugars. It enhances flavors in dairy like ice cream or cheese spreads, supporting gut health trends. Busy families pick this for quick breakfasts, as it keeps things creamy and sweet while fitting into clean-eating lifestyles effortlessly.

- Sauces and Condiments: Cooks blend monk fruit into salad dressings, BBQ sauces, or marinades to sweeten naturally. It dissolves easily without changing textures, perfect for low-sugar meals. Health-focused home chefs rely on it to make everyday dips and glazes flavorful, helping control portions and support better eating habits overall.

Recent Developments

1. Guilin Layn Natural Ingredients Corp.

Guilin Layn continues to expand its vertically integrated supply chain for monk fruit. Recent developments include significant investments in organic monk fruit cultivation and advanced extraction technologies to improve purity and yield. They are focusing on promoting their high-purity Mogrosides to the global food and beverage industry, emphasizing sustainable and traceable sourcing from their dedicated farming cooperatives in Guangxi, China.

2. Archer Daniels Midland Company (ADM)

ADM is leveraging its broad portfolio by creating more blended sweetener solutions that combine monk fruit with other natural ingredients like stevia and allulose. This approach aims to provide better taste profiles and cost-effectiveness for product developers. Their recent focus is on supporting the sugar reduction trend in beverages, dairy, and bakery products with these tailored blends, meeting consumer demand for cleaner labels and natural origin sweeteners.

3. Tate & Lyle PLC

Tate & Lyle highlights its TASTEVA M Stevia Sweetener, which often incorporates monk fruit in its blends. A key recent development is their collaboration with farmers in China to enhance the sustainable agricultural practices for monk fruit. They are also investing in consumer research to better understand taste preferences, driving innovation in sugar reduction solutions that use monk fruit blends to minimize off-notes and improve flavor in final products.

4. Monk Fruit Corp.

As a dedicated player, Monk Fruit Corp. has been actively pursuing partnerships to increase market penetration. A key recent strategy involves offering high-quality, non-GMO Project Verified and organic certified monk fruit extracts directly to brands. They are focusing on educating manufacturers and consumers about the benefits of pure monk fruit sweetener as a zero-calorie, natural sugar alternative to help combat obesity and diabetes.

5. Cargill, Inc.

Cargill’s recent development is the expansion of its ViaTech portfolio, which includes precise stevia and monk fruit blends. They utilize predictive modeling to optimize these blends for specific applications, ensuring maximum sugar-like taste with minimal off-notes. Their innovation focuses on achieving the right sweetness curve and flavor profile for products like yogurt and protein drinks, making monk fruit a key component in their comprehensive sugar reduction toolkit.

Conclusion

Monk Fruit Sweetener is riding a wave of strong growth in the natural alternatives space. Consumers want zero-calorie options that taste real. North America leads with health-savvy shoppers snapping up blends in beverages and snacks, while organic versions gain traction for clean labels. Brands innovating with easy-to-use powders and drops will capture more shelf space, turning this ancient fruit into a modern must-have for sweeter, smarter living.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)