Table of Contents

Introduction

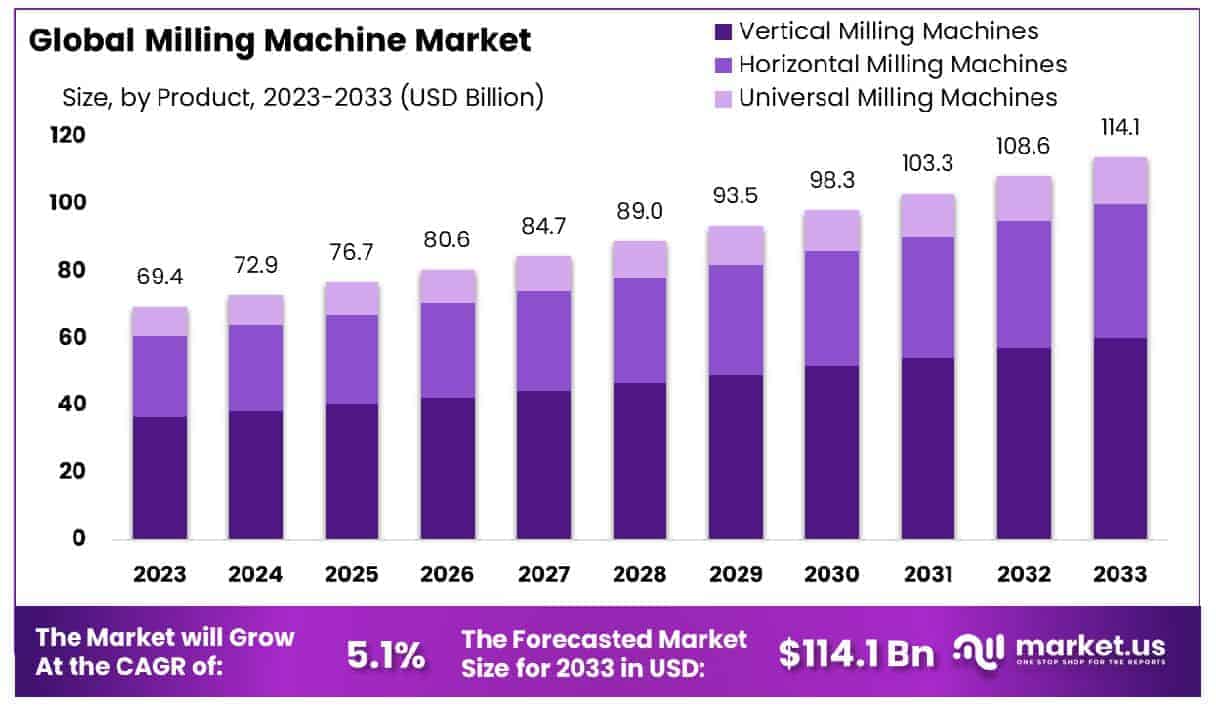

The Global Milling Machine Market is projected to reach a value of USD 114.1 billion by 2033, up from USD 69.4 billion in 2023, growing at a compound annual growth rate (CAGR) of 5.10% during the forecast period from 2024 to 2033.

The milling machine is a versatile tool used in machining processes to shape and cut materials like metal, wood, and plastic. It operates by rotating a cutting tool against a stationary workpiece, allowing for precise removal of material to create various shapes, holes, and grooves. The milling machine market encompasses the production, distribution, and sale of these machines, catering to industries such as automotive, aerospace, metalworking, and electronics.

A key driver of market growth is the increasing demand for precision engineering, driven by advancements in manufacturing technologies and the rising need for custom parts. The expansion of industries like automotive and aerospace, coupled with the adoption of automation and Industry 4.0 technologies, is creating significant opportunities for the milling machine market. Furthermore, the rising trend of reshoring manufacturing operations, particularly in emerging markets, is expected to fuel demand, providing avenues for innovation and market diversification in the coming years.

Key Takeaways

- The milling machine market is projected to grow from USD 69.4 Billion in 2023 to USD 114.1 Billion by 2033, at a CAGR of 5.10% from 2024 to 2033.

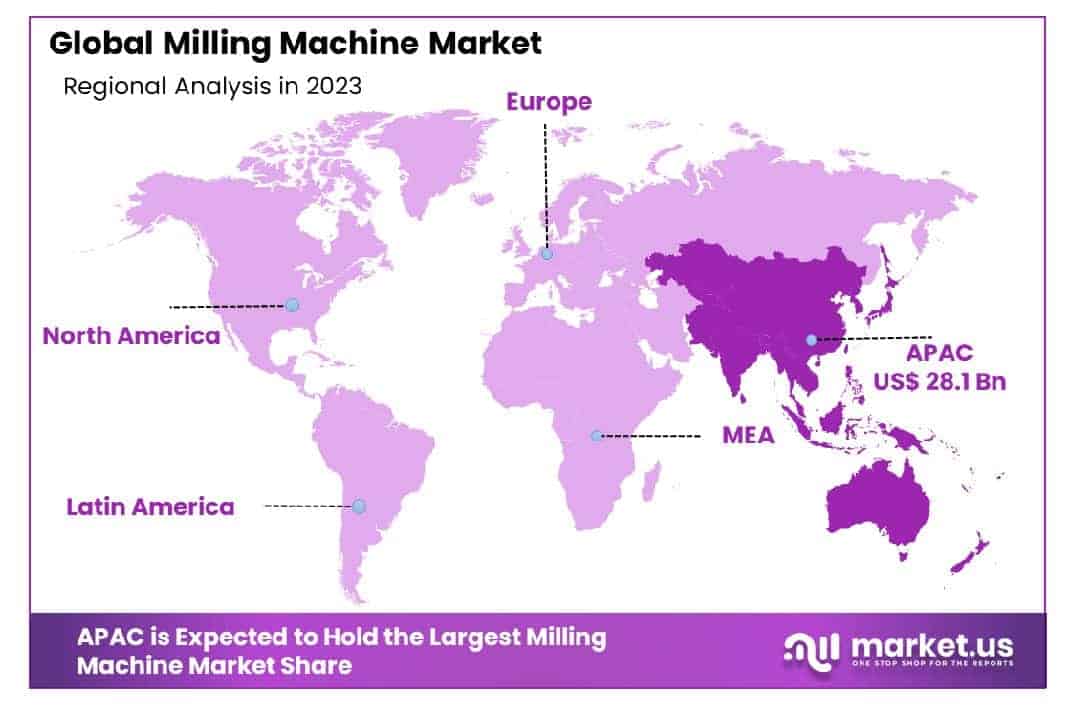

- The Asia-Pacific region holds the largest market share, accounting for 40.6% of the global milling machine market.

- Vertical milling machines dominate the market with a substantial 52.6% share, reflecting their widespread preference and versatility.

- 3-axis milling machines lead the market with a 62.4% share, highlighting their efficiency and adaptability across a variety of applications.

- Precision engineering plays a crucial role, representing 35.4% of the market share and emphasizing its importance in advanced milling applications.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 69.4 Billion |

| Forecast Revenue (2033) | USD 114.1 Billion |

| CAGR (2024-2033) | 5.10% |

| Segments Covered | By Product(Vertical Milling Machines, Horizontal Milling Machines, Universal Milling Machines), By Axis Type(3-Axis, 4-Axis, Others), By Application(Automotive, General Machinery, Precision Engineering, Transport Machinery, Others) |

| Competitive Landscape | DATRON Dynamics, Inc., Haas Automation, Inc., YAMAZAKI MAZAK CORPORATION, Amera-Seiki, FANUC CORPORATION, ANDERSON EUROPE GMBH, Hurco Companies, Inc., Okuma Corporation, KNUTH Werkzeugmaschinen GmbH, EMCO group |

Key Segments Analysis

In 2023, vertical milling machines led the milling machine market with a dominant 52.6% share, driven by their versatility and efficiency across industries like automotive, aerospace, and manufacturing. Horizontal milling machines followed with a 38.9% share, valued for their precision and flexibility in applications requiring intricate cuts, such as electronics and medical device manufacturing. Universal milling machines, holding 8.5% of the market, remain relevant due to their ability to perform both vertical and horizontal operations, offering flexibility for job shops and small-scale manufacturers.

In 2023, 3-Axis milling machines led the market with a dominant 62.4% share, driven by their versatility, cost-effectiveness, and ability to handle a wide range of machining tasks across industries like automotive, aerospace, and electronics. Their popularity is further bolstered by advancements in technology that enhance precision and efficiency. The 4-Axis segment followed, offering greater flexibility for complex machining tasks, such as contouring and indexing, and is preferred in industries like mold making and prototyping. Meanwhile, the “Others” category, which includes specialized machines like 5-Axis and multi-axis systems, accounted for a smaller share due to their niche applications.

In 2023, Precision Engineering dominated the Milling Machine Market’s By Application segment with a 35.4% share, driven by the demand for high-precision components in sectors like aerospace, defense, and electronics. The adoption of automation and CNC technologies further boosted its position by enhancing production efficiency. Automotive also held a significant share, fueled by advancements in lightweight materials, fuel efficiency, and safety. General Machinery and Transport Machinery segments contributed notably, with General Machinery spanning industries from heavy equipment to consumer goods, while Transport Machinery focused on components for trains, ships, and aircraft. The “Others” category covered niche applications, reflecting specialized machining needs.

Emerging Trends

- Adoption of Automation and CNC Technology: The milling machine industry is increasingly embracing automation and Computer Numerical Control (CNC) technology. This transition allows for higher precision, better repeatability, and reduced labor costs. By integrating advanced software, machines can now operate autonomously, improving production efficiency and reducing human error.

- Integration of IoT for Predictive Maintenance: Milling machines are increasingly equipped with Internet of Things (IoT) sensors. These sensors monitor machine performance in real-time and predict potential failures, allowing for proactive maintenance. By reducing downtime, manufacturers can optimize production schedules and extend the lifespan of machines.

- Growth of 3D Printing Milling: Milling machines are now being used in conjunction with 3D printing technologies. This hybrid manufacturing process enables more complex designs, offering flexibility in producing parts that were previously difficult or impossible to make. The combination of 3D printing and milling is particularly prominent in industries like aerospace and automotive.

- Focus on Energy Efficiency: Energy-efficient milling machines are gaining traction in the market due to rising energy costs and environmental concerns. Newer models are designed to use less power, integrating advanced motors and power-saving technologies, which are beneficial for both cost reduction and sustainability.

- Miniaturization and Micro-Milling: With the growing demand for smaller, more precise components, the miniaturization trend in milling machines is becoming more significant. Micro-milling technology allows for the production of highly detailed, small-scale parts, especially useful in electronics, medical devices, and other industries requiring high precision at a micro level.

Top Use Cases

- Precision Part Manufacturing in Aerospace: Milling machines are crucial in producing precision parts for the aerospace sector. Components such as turbine blades, engine parts, and wing structures require the utmost accuracy and tight tolerances, making CNC milling machines an essential tool in this industry.

- Medical Device Production: Milling machines are widely used in the medical field for manufacturing implants, surgical tools, and prosthetics. The demand for high precision in creating complex and customized medical parts has made milling machines a cornerstone of medical device production.

- Automotive Component Production: In the automotive industry, milling machines are used to create engine blocks, gear parts, transmission housings, and other critical components. The automotive sector relies on these machines for their ability to handle a variety of materials and produce high-precision, reliable parts in high volumes.

- Custom Tooling and Molds: Milling machines are essential in the creation of custom tooling and molds for plastic injection molding and die-casting processes. The accuracy of milling ensures that molds are produced with perfect dimensions, contributing to the overall quality of the final product.

- Electronics Manufacturing: Milling is increasingly utilized in the electronics industry for manufacturing components like connectors, circuit boards, and enclosures. As the demand for smaller and more intricate designs grows, milling machines with high precision capabilities are being employed to meet these complex needs.

Major Challenges

- High Initial Investment Costs: Milling machines, especially advanced CNC and multi-axis machines, come with a high upfront cost. This can be a barrier for small and medium-sized enterprises (SMEs) looking to adopt such technology, limiting access to advanced manufacturing methods.

- Skilled Labor Shortage: The operation of advanced milling machines requires specialized skills, including programming, maintenance, and machine operation. As the industry moves towards more complex machinery, the demand for skilled labor increases, creating a skills gap that many manufacturers struggle to fill.

- Maintenance Complexity: While milling machines are durable, their maintenance can be complex and costly, particularly with the advent of automated systems. Regular maintenance is essential for machine longevity and accuracy, but it requires a high level of technical expertise and access to spare parts.

- Material Limitations: Certain materials, such as titanium or hardened steel, present challenges when milled using traditional techniques. These materials can cause wear on machine tools, reduce cutting efficiency, and increase production time, requiring manufacturers to invest in more specialized equipment.

- Supply Chain Disruptions: Milling machine manufacturers, like many in the machinery sector, are heavily impacted by global supply chain disruptions. Shortages of raw materials, like steel and precision components, can lead to production delays and price fluctuations, which ultimately affect lead times and cost structures.

Top Opportunities

- Increased Demand from Additive Manufacturing: The growth of additive manufacturing is driving the need for more hybrid milling solutions. Combining milling with 3D printing technologies allows manufacturers to produce parts that would be difficult to create with traditional methods alone. This synergy opens up new opportunities in industries such as aerospace and automotive.

- Customization and Tailored Solutions: As industries shift toward more customized products, there is a growing opportunity for milling machine manufacturers to offer tailored solutions. Machines that can be easily reconfigured to meet specific client requirements are in demand, particularly in niche industries such as medical devices and luxury automotive parts.

- Growing Interest in Smart Factories: As smart factories and Industry 4.0 technologies gain traction, there is an opportunity for milling machine manufacturers to integrate their machines into these connected ecosystems. Incorporating IoT sensors, machine learning, and AI can enhance productivity, providing an opportunity for manufacturers to differentiate their products in a competitive market.

- Focus on Sustainability and Green Manufacturing: With the global shift towards sustainability, there is an opportunity for milling machine manufacturers to develop machines that not only improve energy efficiency but also minimize waste and use recyclable materials. This aligns with the growing emphasis on green manufacturing practices in multiple industries.

- Emergence of Low-Cost, High-Efficiency Machines for SMEs: The rise of more affordable, yet highly efficient, milling machines presents a major opportunity for manufacturers targeting small and medium-sized enterprises (SMEs). By offering cost-effective yet advanced solutions, these companies can expand their reach and enable smaller businesses to adopt modern milling technology.

Key Player Analysis

- DATRON Dynamics, Inc. DATRON Dynamics, Inc. is a key player in the milling machine market, known for its precision CNC milling machines. The company focuses on high-speed, high-precision machining systems and has a significant presence in the United States. DATRON’s products are especially popular for applications in the medical, dental, and aerospace industries.

- Haas Automation, Inc. Haas Automation, Inc., based in the United States, is one of the most renowned manufacturers of CNC equipment. The company is widely recognized for offering affordable and high-quality CNC mills, lathes, and rotary tables. It is a dominant force in the global CNC machining industry, offering products for various industries such as automotive, aerospace, and manufacturing.

- YAMAZAKI MAZAK CORPORATION Yamazaki Mazak Corporation, based in Japan, is one of the world’s largest manufacturers of CNC milling machines and machining centers. It offers a wide range of products, including multi-axis and multi-functional machines designed for high precision. Substantial revenue coming from Asia, North America, and Europe. The company has been a leader in innovation, particularly in the development of automation and digital solutions for machine operations.

- Amera-Seiki Amera-Seiki is an American-based manufacturer of CNC machine tools, including vertical and horizontal milling machines. The company focuses on providing machines that combine precision with affordable pricing, making them accessible to small and medium-sized manufacturers. Amera-Seiki’s machines are widely used in industries like metalworking, aerospace, and automotive. The company has been expanding its global presence and continues to focus on providing cost-effective solutions in the competitive milling market.

- FANUC CORPORATION FANUC Corporation, headquartered in Japan, is one of the world’s leading companies in CNC systems, robotics, and automation technology. FANUC’s CNC milling machines are highly regarded for their reliability, precision, and automation capabilities. The company holds a strong position in the milling market with an annual revenue of over $6 billion, thanks to its innovation in automation and robotics. FANUC serves multiple industries, including automotive, electronics, and aerospace.

Regional Analysis

Asia-Pacific Milling Machine Market with Largest Market Share (40.6%) in 2023

The Asia-Pacific region holds the largest share of the global milling machine market, accounting for 40.6% in 2023, valued at USD 28.1 billion. This dominance is driven by strong manufacturing growth in key countries such as China, Japan, South Korea, and India, where advancements in automation, industrial infrastructure, and precision engineering are fueling demand for milling machines.

China leads as the world’s largest manufacturing hub, while Japan and South Korea contribute significantly through their high-tech industries and precision manufacturing capabilities. India’s expanding industrial base also adds to the region’s growth. The rising adoption of automation technologies and the emphasis on cost-effective, sustainable manufacturing solutions further support the increasing demand for milling machines, reinforcing Asia-Pacific’s leadership in this market.

Recent Developments

- In 2024, FANUC America, a leader in industrial automation, introduces the ROBODRILL α-D28LiB5ADV Plus Y500. This advanced vertical machining center boasts a larger table, shorter cycle times for drilling and tapping, and faster tool changes, making it a valuable addition to production shops. FANUC will present this new model at the International Manufacturing Technology Show in Chicago, from September 9-14, 2024.

- In 2024, Nidec Corporation announces its decision to acquire Makino Milling Machine Co., Ltd., a leading manufacturer listed on the Tokyo Stock Exchange. The acquisition will be conducted through a tender offer, following the board’s approval, aiming to make Makino a fully-owned subsidiary.

- In 2024, Caterpillar introduces VisionLink® Productivity for its PM600 and PM800 Series Cold Planers. This online platform provides contractors with near real-time jobsite and machine data, helping them optimize productivity by tracking activities like fuel burn, machine location, and cutting performance.

- In February 2024, Trimble unveils its Trimble® Roadworks Paving Control Platform for Mills and Cold Planers. This new system, running on an Android™ operating system, offers precise control over cutting depth, allowing operators to follow project specifications more accurately on the jobsite.

- In April 2023, Okuma America Corporation launches a new division focused on recommending and supporting manufacturing production line systems. This segment, based at Okuma’s headquarters in Charlotte, North Carolina, will integrate CNC machine tools and automation technologies to enhance production efficiency.

- In 2024, ModuleWorks announces a strategic partnership with DN Solutions. The two companies will collaborate on developing software for CNC machine tools, driving the digital transformation of the manufacturing sector through integrated technological solutions.

Conclusion

The global milling machine market is poised for substantial growth, driven by technological advancements, increased demand for precision engineering, and the rising need for custom manufacturing solutions across various industries. The integration of automation, CNC technology, and IoT is enhancing production efficiency and precision, while trends such as energy efficiency and the growing use of hybrid manufacturing systems are shaping the market’s future. Despite challenges like high initial costs and skilled labor shortages, the ongoing innovations and expanding industrial needs present significant opportunities for market players. As industries like aerospace, automotive, and medical devices continue to evolve, milling machines will remain a critical component of advanced manufacturing processes worldwide.