Table of Contents

Overview

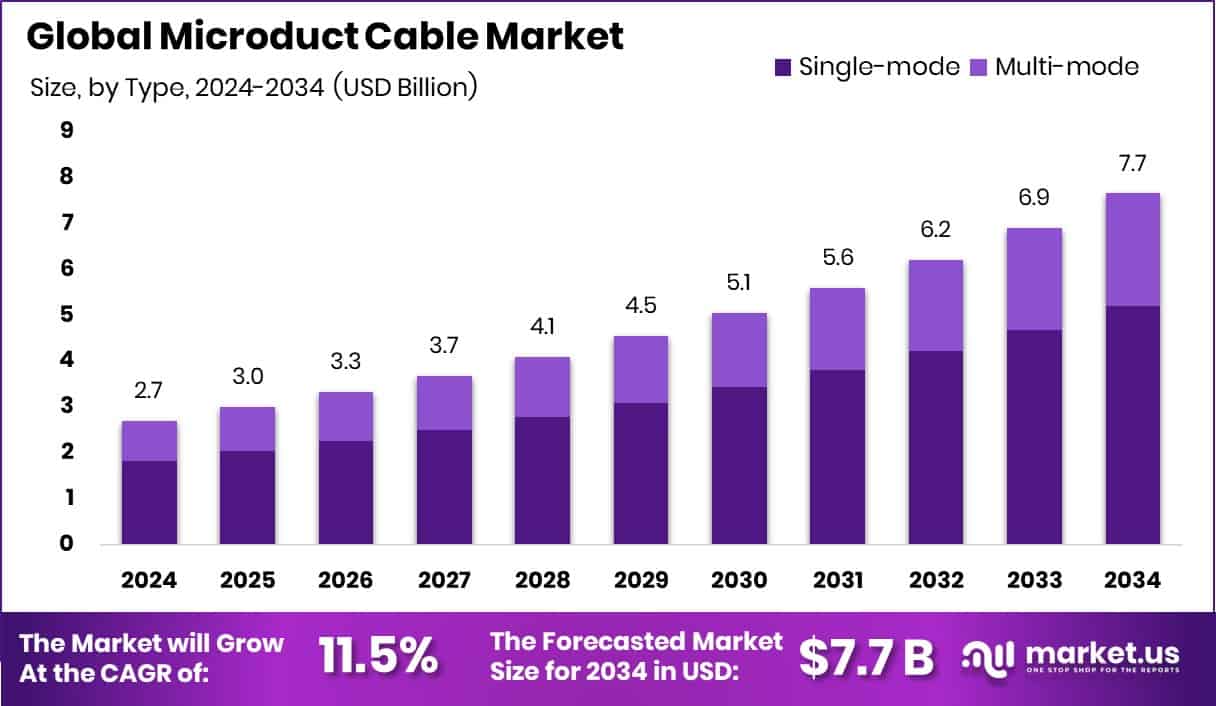

New York, NY – August 08, 2025 – The Global Microduct Cable Market is poised for substantial growth, projected to reach approximately USD 7.7 billion by 2034, up from USD 2.7 billion in 2024, reflecting a robust CAGR of 11.5% between 2025 and 2034. North America currently leads the global market with a 45.3% share, driven by high rates of fiber network upgrades and smart city initiatives.

Microduct cables are compact fiber optic solutions engineered for easy installation into narrow ducts. Their small diameter and high fiber density make them ideal for a variety of deployment scenarios including underground and aerial installations for applications like fiber-to-the-home (FTTH), 5G rollout, and urban connectivity.

The growing need for high-speed internet and scalable network solutions is pushing telecom operators and infrastructure providers to invest in microduct cable systems. These cables are increasingly preferred due to their low installation cost, reduced civil work, and adaptability to different geographic terrains. In India, initiatives like BharatNet, the Smart Cities Mission, and the Production-Linked Incentive (PLI) Scheme valued at INR 12,195 crore are creating favorable market conditions. These government programs are significantly boosting fiber deployment, especially in underserved and remote regions.

Furthermore, national projects such as Digital India, with an outlay of INR 4.5 lakh crore, and PMAY’s housing initiatives, are enhancing demand for digital and electrical infrastructure, further supporting the market. The allocation of ₹53.2 billion for telecom upgrades and the 5G spectrum auction in 2022 also mark critical milestones in expanding connectivity. These developments are expected to accelerate fiber-optic deployment across the country, with microduct cables playing a central role in realizing the vision of a digitally empowered society.

Key Takeaways

- The Global Microduct Cable Market is projected to reach USD 7.7 billion by 2034, rising from USD 2.7 billion in 2024, with a CAGR of 11.5% between 2025 and 2034.

- In 2024, single mode cables led the market, accounting for 68.4% of the global demand.

- Flame retardant ducts emerged as the top choice in duct type, making up 48.7% of total usage.

- Plastic remained the most widely used material type, contributing to 68.9% of the market share.

- The blowing installation method was most preferred, capturing 58.3% of the global market.

- Underground deployment dominated application types, representing 74.6% of global installations.

- The telecommunication industry was the primary end-user segment, driving 61.2% of total demand.

- North America led the regional market with a demand valued at USD 1.2 billion in 2024.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-microduct-cable-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.7 Billion |

| Forecast Revenue (2034) | USD 7.7 Billion |

| CAGR (2025-2034) | 11.5% |

| Segments Covered | By Type (Single-mode, Multi-mode), By Duct Type (Flame Retardant, Direct Install, Direct Burial), By Material Type (Glass, Plastic (HDPE, PVC, LDPE, Others)), By Installation Technique (Blowing, Pulling, Plowing, Directional Drilling), By Deployment (Underground, Underwater, Aerial), By End-use (Telecommunication, Power Utilities, Defense/Military, Industrial, Medical, Others) |

| Competitive Landscape | Corning Incorporated, Nestor Cables, CommScope Holding Company, Inc., Sumitomo Electric Industries Ltd, Prysmian Group, Arabian Fiber Optic Cable Manufacturing LLC, Briticom, Orient Cables India Pvt. Ltd, AFL, Nexans S.A., Fujikura Ltd., SAMM Teknoloji, Polycab Telecom, OFS Fitel, LLC, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146548

Key Market Segments

1. By Type Analysis

- In 2024, single mode cables dominated the Microduct Cable Market with a 68.4% share, driven by the growing demand for high bandwidth and low signal loss in long distance communications. These cables offer a direct light path with minimal reflections, enabling faster and longer data transmission. Their superior performance makes them the preferred choice in large-scale telecom deployments such as city-wide networks and academic campuses. As the telecommunications industry expands and 5G networks roll out, single-mode microduct cables continue to gain traction for their ability to support extensive data transfer with high reliability.

2. By Duct Type Analysis

- Flame retardant ducts led the market in 2024 with a 48.7% share, largely due to stringent safety standards and regulatory guidelines. These ducts are widely used in areas where fire safety is a priority, such as commercial buildings and dense urban environments. Their ability to reduce flame spread and limit toxic smoke emissions enhances safety during fire events. The increasing awareness about fire risks in telecommunication infrastructure and the growing construction activities, especially in emerging economies, are major factors fueling demand for flame-retardant microduct solutions.

3. By Material Type Analysis

- Plastic was the leading material type in 2024, capturing a 68.9% share of the Microduct Cable Market. Its dominance is attributed to the material’s cost-efficiency, durability, and lightweight characteristics, which simplify installation and reduce overall deployment costs. Plastic microducts are resilient to harsh environmental conditions, including moisture and chemicals, making them ideal for both underground and aerial installations. Continuous innovation in plastic materials, such as the development of high-density polyethylene (HDPE), has further improved performance and longevity, reinforcing plastic’s strong position in the market.

4. By Installation Technique Analysis

- The blowing installation technique was the most widely adopted in 2024, holding a 58.3% market share due to its efficiency and low disruption deployment. This method uses compressed air to push cables through microducts, enabling fast and scalable installation, especially over long distances or in difficult terrains. It is particularly beneficial in urban areas where excavation and physical disruption must be minimized. The technique’s flexibility and reduced labor costs make it a preferred choice for network operators aiming to expand or upgrade fiber infrastructure swiftly and economically.

5. By Deployment Analysis

- Underground deployment accounted for a dominant 74.6% of the Microduct Cable Market in 2024, supported by the need for secure and space-efficient infrastructure. This method protects cables from environmental hazards, vandalism, and visual pollution, making it ideal for modern city planning and telecom networks. The rise of smart cities and increased urbanization globally has driven the demand for reliable underground installations that support advanced connectivity solutions. Additionally, the reduced maintenance and long-term cost benefits further solidify the preference for underground cabling systems.

6. By End-use Analysis

The telecommunication sector was the largest end-user in 2024, contributing to 61.2% of total microduct cable demand. This dominance is fueled by the global surge in data consumption and the need for faster, more robust network infrastructure. Microduct cables enable scalable and efficient deployment of fiber networks, essential for supporting broadband expansion and 5G rollout. Their compact design and ease of installation make them ideal for densely populated urban areas, where network upgrades and high speed internet access are in constant demand. The push toward digital inclusion in underserved regions is also driving growth in this segment.

Regional Analysis

- In 2024, North America dominated the global Microduct Cable Market, capturing 45.3% of the total share, with the market valued at approximately USD 1.2 billion. This leadership is largely driven by accelerated digital transformation, widespread adoption of fiber to the home (FTTH) solutions, and significant investments in 5G infrastructure. Government initiatives and substantial funding from telecom companies have further strengthened the region’s position.

- Europe ranked next, propelled by growing demand for high-speed internet across both metropolitan and rural regions. The region’s focus on smart city development and increased industrial automation continues to support market expansion. Asia Pacific also emerged as a key market, fueled by its large population base and rapid rollout of fiber optic networks, especially in emerging economies.

- Meanwhile, the Middle East & Africa are gradually scaling up their digital infrastructure, aiming to bridge connectivity gaps in underserved communities. Latin America showed steady progress, with moderate growth driven by initiatives to upgrade telecom networks and extend coverage in urban centers.

Top Use Cases

- FTTH Rollout: Microduct cables enable fast, flexible fiber to the-home installations. Utilities or providers can pre‑install empty ducts in neighborhoods, then blow in fibers later as subscriptions rise. This reduces upfront cost, minimizes disruption, and allows scalable deployment over time, making it cost‑effective for large residential rollouts while managing investment risk effectively.

- 5G Small Cell Backhaul: Microduct systems support high‑capacity backhaul links for 5G small cell deployment. These mini‑ducts allow fiber cables to be blown quickly, enabling service providers to connect base stations with minimal civil works. Their adaptability and easy upgrade path make them ideal for dense urban 5G infrastructure where speed, reliability, and low latency are essential.

- Data Center Interconnections: Within and between data centers, microduct networks offer dense, clean cable routing with room to upgrade fiber count as needed. They simplify cable management inside tight trays, enabling high‑speed data transfers across racks and facilities. As data volumes grow, operators can add or replace fibers without major construction, preserving uptime and flexibility.

- Enterprise or Campus Network Upgrades: Businesses, campuses, or large office complexes use microduct cables for flexible renovation of data networks e.g. moving from 10 G to 40 G Ethernet. Ducts carry fibers across buildings or floors, allowing easy incremental upgrades. This ensures future scalability and reduces labor and downtime when network requirements change over time.

- Industrial or Factory Environments: In large factories or production facilities, microducts are installed alongside cable trays or ceilings during construction. When new fiber links are needed over months or years, technicians simply blow in new fiber without disturbing machinery. This approach reduces installation complexity and ensures reliable connections even in harsh, dynamic industrial settings.

- Urban Smart City Applications: Smart street lighting, traffic sensors, surveillance cameras, and IoT nodes all depend on fiber backhaul. Microduct networks laid in urban ducts or aerial routes support these smart city applications by offering expandable infrastructure. As municipal systems evolve, additional fibers can be added to support new services without new excavation or disruption.

Recent Developments

1. Corning Incorporated:

- Corning continues innovating in microduct cable solutions with its MiniXtend family. The MiniXtend HD and Binderless FastAccess versions offer industry-leading fiber density up to 432 fibers in a compact form designed for jetting into microducts. The reduced diameter and faster cable access cut installation time and improve efficiency. These products comply with IEC 60794‑5‑10 standards and are suitable for outdoor microduct applications. Corning’s strong focus on scalable and efficient fiber deployment reinforces its leadership in the microduct cable market

2. Nestor Cables (acquired by Clearfield Inc.):

- Nestor, a Finnish specialist in microduct networks, recently introduced its ultra‑thin FRMU 1.8 mm microduct cable, which fits subscriber ducts of 7/3.5 mm and 7/4 mm. With high tensile strength (~150 N) and improved resistance to cold‑weather issues, it enhances blowing performance in harsh climates. Its Nestor Optimus product family includes complete microduct systems and accessories.

3. Prysmian Group:

- In March 2024, Prysmian launched the Sirocco Extreme 864f microduct cable, featuring 864 optical fibers within a 9.8 mm diameter, achieving record fiber density for installations. It reduces environmental impact and installation cost. More recently, the innovative SiroccoXT range has been recognized at ISE Expo 2025, earning a Gold Innovators’ Award for combining high density with long-term reliability. Prysmian has partnered with Dow using AXELERON™ materials to further advance Sirocco production. These developments reinforce Prysmian’s leadership in space-efficient, high-performance microduct cables.

4. CommScope Holding Company, Inc.:

- At present, specific microduct cable product launches from CommScope were not found on public websites. However, CommScope continues leveraging its extensive broadband, fiber, and enterprise connectivity portfolio to support microduct installations, particularly for 5G backhaul and smart city infrastructure, focusing on modular and scalable cabling systems to meet high-speed deployment needs in urban networks.

Conclusion

the Microduct Cable Market is experiencing strong growth, driven by rising demand for high-speed internet, 5G network expansion, and scalable fiber optic infrastructure. North America currently leads the market, supported by large-scale FTTH and telecom projects. Products like miniaturized, high density cables are enabling more flexible and cost effective installations, especially in urban areas. Companies like Corning, Prysmian, and Nestor Cables are investing in innovative microduct solutions to support future-ready networks. With continued government investments in digital infrastructure and smart cities, the market is expected to grow steadily, offering long-term opportunities across regions.