Table of Contents

Overview

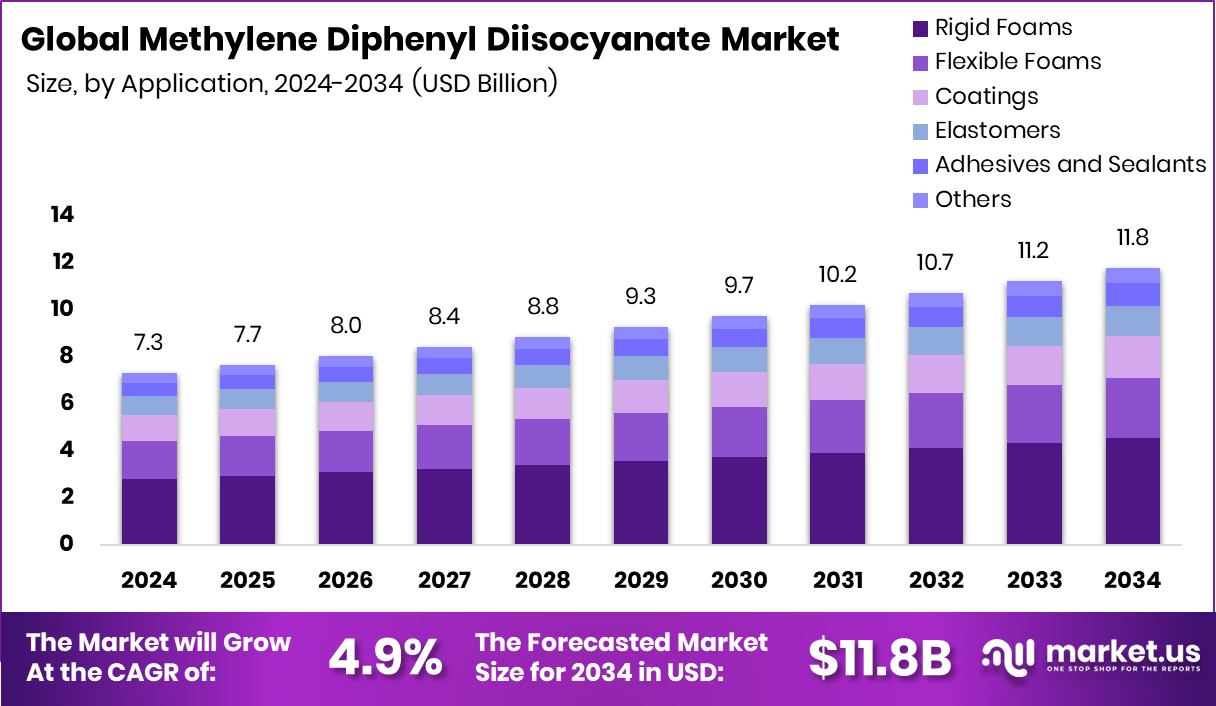

New York, NY – November 7, 2025 – The Global Methylene Diphenyl Diisocyanate (MDI) Market is projected to reach USD 11.8 billion by 2034, growing from USD 7.3 billion in 2024 at a 4.9% CAGR, with the Asia-Pacific region leading at USD 3.3 billion.

MDI, a key precursor for polyurethanes, is vital in insulation foams, coatings, adhesives, sealants, and elastomers. Growth stems from surging demand for energy-efficient construction, refrigeration, insulation, and lightweight materials used in the automotive industry. Industrial coatings are another strong driver, reinforced by recent investments such as a $9.2 million funding round for a coatings manufacturer and Brightplus’s $2.3 million to expand recyclable bio-based textile coatings.

Sustainability-linked funding also supports downstream demand—Ecoat raised €21 million to advance low-carbon paints. Emerging technologies further broaden opportunities: Flō Optics secured $35 million for 3D-printed lens coatings, while Naco Technologies raised €2.5 million for nano-coatings in hydrogen production.

These developments highlight a shift toward bio-based, recycled, and high-performance MDI applications, driven by global sustainability goals and advanced manufacturing needs. Overall, innovation in eco-friendly coatings, functional surfaces, and composite materials is reshaping the MDI market’s growth landscape, creating new avenues across construction, automotive, and industrial manufacturing sectors.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-methylene-diphenyl-diisocyanate-market/request-sample/

Key Takeaways

- The Global Methylene Diphenyl Diisocyanate Market is expected to be worth around USD 11.8 billion by 2034, up from USD 7.3 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, rigid foams dominated the methylene diphenyl diisocyanate market, capturing 38.4% share globally.

- The construction sector led the methylene diphenyl diisocyanate market, securing a 42.7% share during 2024.

- The Asia-Pacific region has a 46.20% share and leads due to strong construction growth and industrial foam demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=163875

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.3 Billion |

| Forecast Revenue (2034) | USD 11.8 Billion |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Application (Rigid Foams, Flexible Foams, Coatings, Elastomers, Adhesives and Sealants, Others), By End-user (Construction, Furniture and Interiors, Electronics and Appliances, Automotive, Footwear, Others) |

| Competitive Landscape | BASF, Covestro AG, Dow, Hexion Inc., Huntsman International LLC, Karoon Petrochemical Company, Kumho Mitsui Chemicals Inc, KURMY CORPORATIONS, Sadara, Tosoh Corporation |

Key Market Segments

By Application Analysis

In 2024, rigid foams dominated the methylene diphenyl diisocyanate (MDI) market by application, holding a 38.4% share. This leadership stems from the increasing global demand for energy-efficient insulation materials used in construction and refrigeration. MDI-based rigid polyurethane foams deliver superior thermal insulation, mechanical strength, and cost efficiency, making them indispensable for building envelopes, cold storage, and logistics infrastructure. The ongoing transition toward sustainable and green building standards further amplifies their use.

Additionally, innovations and funding in low-carbon coatings and advanced insulation technologies—where MDI systems play a crucial role—continue to boost this segment’s relevance. These combined factors position rigid foams as a key contributor to the MDI market’s long-term growth, driven by the dual focus on energy conservation and sustainability across industrial and residential construction sectors worldwide.

By End-user Analysis

In 2024, the construction sector dominated the Methylene Diphenyl Diisocyanate (MDI) Market by End-User, accounting for a 42.7% share. This leadership is driven by the extensive use of MDI-based rigid polyurethane foams in insulation, roofing, and structural applications that enhance building energy efficiency.

The global movement toward sustainable infrastructure and eco-friendly materials strengthens this demand, as MDI foams significantly reduce carbon emissions through superior thermal insulation. Government-backed energy-efficient building programs further boost construction activity, increasing MDI consumption in insulation and coatings.

Additionally, ongoing innovation and funding in low-carbon coatings and advanced building materials are reinforcing MDI’s importance in modern construction practices. Together, these factors position the construction sector as the key growth engine of the MDI market, supported by sustainability mandates and the expanding adoption of high-performance polyurethane systems.

Regional Analysis

In 2024, Asia-Pacific led the Methylene Diphenyl Diisocyanate (MDI) Market, capturing a 46.2% share valued at USD 3.3 billion. This leadership stems from rapid industrialization, strong construction activity, and expanding polyurethane production in China, India, Japan, and South Korea. The region’s growing need for energy-efficient insulation and durable coatings continues to fuel MDI demand.

North America ranks next, driven by applications in building insulation, automotive interiors, and cold-chain infrastructure. Europe maintains consistent growth supported by green building regulations and eco-friendly coating initiatives.

The Middle East & Africa are increasingly adopting MDI-based foams for large-scale construction, especially in the Gulf states, while Latin America records steady growth due to expanding manufacturing and infrastructure projects. Collectively, these trends highlight Asia-Pacific’s pivotal role and the global transition toward energy-efficient polyurethane materials across industrial, automotive, and construction sectors.

Top Use Cases

- Building insulation foam: MDI is widely used to produce rigid polyurethane foam boards and spray-foam panels for insulation in walls, roofs, and cold storage units. These foams help seal gaps, reduce heat loss, and improve energy efficiency in homes and commercial buildings.

- Refrigeration and cold-chain insulation: MDI-based rigid foams insulate refrigerators, walk-in cold rooms, transport vehicles, and pipelines in cold-chain logistics. The strong thermal barrier helps preserve temperature-sensitive food and reduce energy use.

- Adhesives and sealants: MDI serves in polyurethane adhesives and sealants that bond materials (wood, metal, and plastics) and fill gaps in construction, automotive, and furniture applications. These deliver strong initial stick (“green strength”) and long-term durability.

- Coatings for protection: MDI-derived polyurethane coatings protect surfaces like floors, decks, driveways, and industrial equipment from abrasion, moisture, and weathering. The coatings provide a tough, long-lasting finish in demanding environments.

- Automotive interior parts & elastomers: Modified MDI systems are used in vehicle interior components (steering wheels, armrests, and airbag covers) and elastomer parts (mountings and bushings) that require mechanical strength, flexibility, and resistance to wear.

- Composite wood products binder: MDI resins act as binders in engineered wood and composite materials (e.g., medium-density fiberboard, particleboard) used in construction and furniture, offering high strength, moisture resistance, and durability compared with traditional binders.

Recent Developments

- In August 2025, Covestro announced the acquisition of two former Vencorex Holding SAS sites (in Freeport, USA, and Rayong, Thailand) to expand its footprint in specialty isocyanate production (though the sites focus on HDI derivatives, not strictly MDI).

- In January 2024, BASF announced a collaboration with Carlisle Construction Materials to use its “Lupranate® ZERO” MDI (an isocyanate with zero-carbon footprint) in the manufacture of polyisocyanurate insulation boards. This move targets the building insulation market and aligns with BASF’s sustainability roadmap.

Conclusion

The Methylene Diphenyl Diisocyanate (MDI) market is evolving toward sustainability, innovation, and efficiency. Its demand continues to rise across construction, automotive, and industrial applications due to the versatility of polyurethane materials derived from MDI.

Growing focus on green building practices and energy-saving insulation is strengthening its relevance. Manufacturers are increasingly investing in low-carbon and bio-based production technologies to meet environmental goals.

With advancements in coatings, adhesives, and lightweight composites, MDI remains central to modern material development. The industry’s future lies in balancing performance with environmental responsibility, fostering innovation that supports both economic and ecological progress globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)